There are certain stigmas that are holding people back from building the life they’ve always dreamed of.

Whether you like it or not, money is involved in almost every part of your life. It dictates what you do, who you are with, where you live, how you behave, what you own and parts of your character that you might not have so much control over because money is a stimulus or barrier.

Yet the best time to build wealth is as early as possible because compound interest, also known as the 8th wonder of the world, works in your favor during this time.

When you’re young, life is on your side because:

-You have more time to recover from your losses whether its in the stock market or with a venture

-No one cares if you’ve failed 100 or 1 time

-You can make the most mistakes as a student

-No dependents

-You aren’t beholden to making money to support your family yet

-You can act foolish to get you somewhere you never dreamed of

As you get older, there is more pressure to work towards something in order to keep yourself and family afloat which leads people to believe certain things about money that have nothing to do with wealth creation.

They believe these lies because they’ve never been exposed to money and associate being rich with glamour and shiny objects.

The stigmas that people associate with wealth include:

-They believe income and possessions = wealth

-The more you own, the wealthier you are

-Working hard is only temporary at the start

-Mindset has nothing to do with wealth creation

-They have a fixed/scarcity instead of abundance mindset about the availability of money in the world

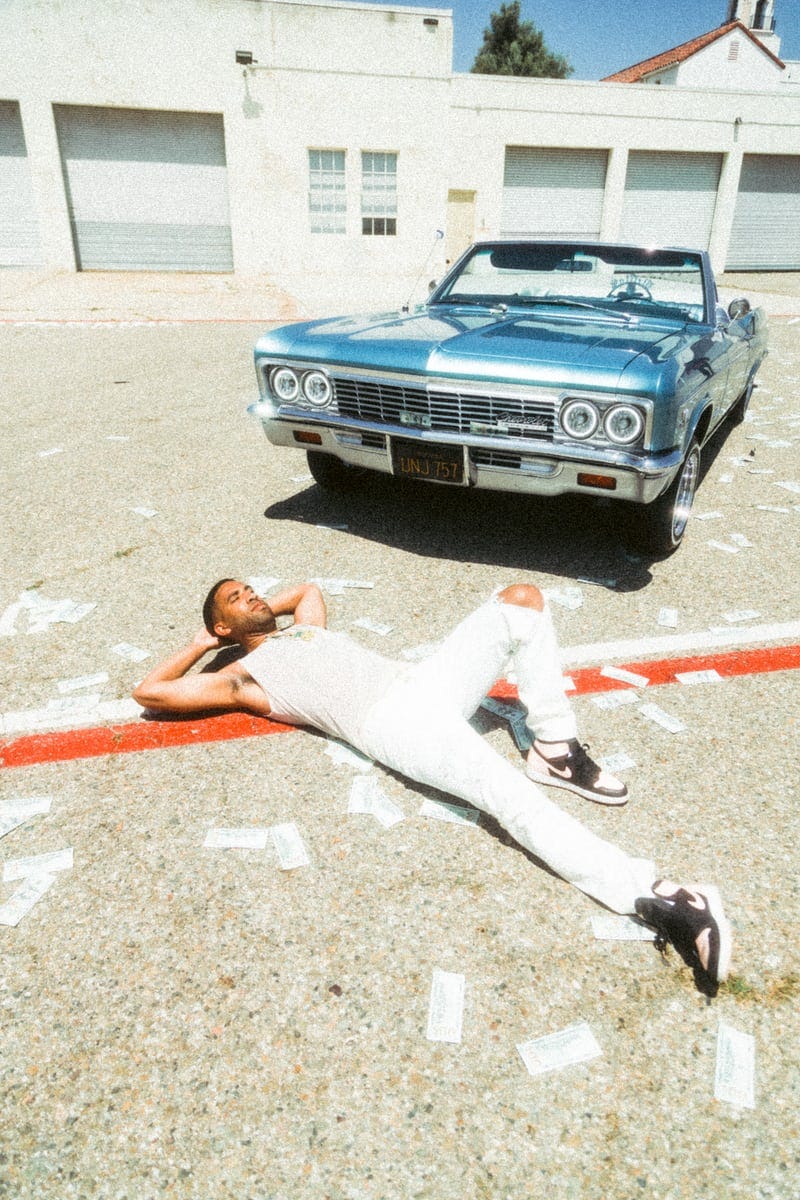

Looks are the Devil

All of these statements are the most popular perceptions the lower to middle class have about millionaires.

The lower to middle class range from people making anywhere from $9k a year to up to $90k a year.

While it’s hard to deny that a lavish lifestyle with a high-cost of cars and homes means someone is rich, more often than not, it’s usually never the case if you really identify what’s a part of their portfolio.

Why?

For one, looks are very deceiving. Especially with real estate or investments, you can purchase almost all of your property through a mortgage or stocks on margin.

Margin means going into debt, having the bank or government loan you money in hopes of the lender paying it down or replenishing it through your gains.

You can check out why real estate is less risky but offers a better return at the same time here.

Two, there’s a difference between good and bad debt.

Good Debt: Investments in appreciating assets such as student loans, business or in yourself through education in hopes of repaying the debt sooner in the future

Bad Debt: Adds no benefit, simply money down the drain not intending to get the money back after it’s spent. Credit card debt behind medical debt is the second most common reason why people get into debt by purchasing junk such as luxury gods, cars, clothes, etc. to simply impress others.

So the next time you see someone with that $50k watch and Lambo, think about how much debt they took out to pay for those things.

Never judge a book by its cover. You have no idea what they are dealing with.

It’s not about how much you earn/make, rather how much you keep.

Trap

We all have fallen into the trap of wanting to become rich quick. Yet, according to consistent historical research, passive investing always beats out active investing because day trading is always unpredictable, no matter how much experience you have.

As opposed to investing long term in the S&P 500, throughout the corrections and crises, the major indexes, not just S&P always go up.

Anyway, with active investing, you never see all the losses behind that 1 gain. A few weeks back during the profitable Robinhood trading frenzy, RoaringKitty, a Reddit investor lost a majority of his money, couple thousand before making 7 figures with GameStop.

Investing FOMO is the worst kind of emotion because you never get over it.

We weigh our losses far more than our gains and believe we must skip the long line to earn real wealth.

That’s the problem. With our short attention spans, we don’t bother educating ourselves, instead we try picking up every cheap gig we can get which ends up costing more of our time.

Rich isn’t about skipping the line.

It’s all in the mindset and what you envision in the future.

Author and researcher Thomas J. Stanley conducted research for several years on millionaires to learn their habits.

In their research according to INSIDER magazine, they found that many people who have achieved millionaire status don’t follow the popular perceptions.

It’s all in the wealth-building habits that lead to achieve millionaire status.

So let’s dissect the three misconceptions that is limiting your potential:

Myth #1: Millionaires Are Born Wealthy

According to Thomas J. Stanley’s book, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, only 20% of millionaires inherited their riches. Most were not trust fund babies and 67.4% of ultra high-net worth individuals in 2017 were self made.

Excuses lead you nowhere. Most millionaires had to work for everything they wanted.

Most had to work 9–5 jobs, take on several passive income streams, baby sit, take on minimum jobs on the weekends to make ends meet and utilize the most powerful source of investing to reach their status.

But keeping status is harder than it looks. No wonder why 90%+ of athletes and lottery winners go bankrupt within a year of earning a lump sum they cannot control.

Saving is in fact harder than earning since there are a plethora of places to earn these days online.

Although gender and racial wealth gaps, along with rising healthcare costs coupled with stagnant wages have held people back even more during this economically challenging time of the pandemic, those who have a positive, mindset with a game plan and a safety cushion made it through the best and in fact saw their net worths skyrocket during this time.

Don’t follow your economic professor who always tells you that there’s scarcity. There’s always an abundance of wealth. That’s why fait money exists. The government prints trillions of dollars each year for someone who deserves it.

Myth #2: Possessions Define Wealth

Although it’s hard to believe, material possessions that depreciate in value such as designer items, cars, and status symbols do not present someone as wealthy because more often than not, the poor clamor to those things.

The rich know better. They invest in themselves, don’t try to impress anyone except themselves, don’t feel the need to waste their money to look good and don’t care about looking homeless through their stealth wealth image because they are the most confident in themselves.

The average millionaire doesn’t drive a car more than $35k. The middle class do when they cannot afford it.

No wonder one of the richest people on Earth: Warren Buffet still lives in his Omaha, Nebraska home he bought for $31,500 in 1958 and in today’s dollars adjusted for inflation it is worth $652,618. He lives in a modest home even worth an estimated $84.6 billion because he is happy and focused on other important things such as education and giving back.

What is even more shocking is that many car dealers state, “Many drivers of luxury cars have neither the levels of income nor net worth which would qualify them as high economic achievers,”

The more cars or stuff you have doesn’t qualify you as a millionaire, it only impedes you from becoming one.

Focus on experiences, yourself and those that cannot be replaced.

Myth #3: Income Is A Majority of One’s Wealth

Most millionaires started building up their wealth portfolio by attaining a standard 9–5 job along with investing on the side.

The key isn’t the type of job, role, company brand or title, it’s what you do outside of it, the tax advantages you take advantage of and the alternative sources of income you build up to keep yourself afloat and let money work for you.

Income isn’t wealth becuase it doesn’t matter how much you earn if you spend all of it. If you live in a high tax state, that leads you into lifestyle inflation which drains you from keeping your income.

A farmer who saves up to 60% of their income paying little to none in federal or state taxes living a comfortable life in the middle of heartland America can easily be wealthier than a banker with those monogrammed vests on Wall Street spending all day and night.

Looks are deceiving and salary is even worse to focus upon. You have no idea how much debt is looming over someone’s bank account and what type of spending addiction they may have.

It’s easier to spend and save and the more you make, you are tempted to buy yourself more without it making your life any better.

Don’t fool yourself. Making money is hard because of these stereotypes you believe.

Break out of this vicious cycle and pave the path you want to be a part of.

What’s stopping you is yourself. Get after it.