Most people would choose a high paying temporary job that kills you over one that pays lower dividends over time but allows you to live your life and get a higher promotion down the road. As much as you believe and read this all the time, rich is really not a mindset and rather what you thought it was since you met Abraham or Lincoln or Hamilton. How much value you have provided to people. The meaning of rich also has misconceptions and stereotypes that most don’t take the time to think about. The biggest of all? More is usually never better especially with money as it never lands in your favor.

Right off the bat, if you have to sacrifice your time to make money, you are in trouble. Having a physical, labor-intensive job will get you nowhere let alone a regular job. Regardless if you are an MD at Goldman or an asset manager at Citi, it is impossible to be wealthy off of a job. A job will rob you of money becuase you pay taxes, allocate your salary towards your pension/401K benefits, food, commute, and can get replaced at any moment. That’s why millionaires are not born from these hustles, they are born from side passive income streams such as a business, intellectual property (books, podcasts, articles, YouTube video), investments in the stock market, real estate, dividends, and compound interest, to name the top.

If you allocate a few hundred bucks and about 2 hours each week educating yourself on financial literacy, you will be well on your way to being above 97% of Americans who have little to no financial literacy. And by this, I mean not knowing the difference between a debit vs credit card or that cars depreciate the moment you drive them off the lot.

It is sad to know that more Americans know all the songs to the Superbowl Commercials a year later than the difference between good and bad debt, which 80% and counting of our country is in. Increasing by the minute. Check out the Union Square debt calculator for more information.

So right off the bat, to answer this question, there is no such thing as the richest most insecure financial jobs because they are all insecure and provide you a temporary lavish lifestyle until you get that unexpected phone call at 8:34 am or pm on a Friday asking to pop on a WebEx meeting.

I don’t want to sound like a Debby Downer but the reality is that no job in this world is stable. Obviously a blue-chip, defensive stock such as Amazon or Publix will always have more demand and be bullish than AMC or Delta simply because we all need to eat, but our jobs are always replaceable but our mindset doesn’t have to be. The scary truth about life.

In school, we are taught that in order to get a good job, decent grades with a nice GPA, and extracurriculars will back you up. But in reality, which means, right after graduating with half a million in student loans like the majority of graduates, no one cares what you lied about to get to this stage in your life or how much you ‘faked it itll you made it’ to get accepted into USC. Recruiters, managers, bosses, companies, you name it, they just care that you will help them succeed and grow more dough. Of course, all companies need to instill community and values to show reliability and personality, but at the end of the day, business usually lies and not as friendly as you think. I learned that first lesson from a job fair last fall on campus. I was speaking to alumni from NYU at a firm that they work for. Their bosses were babysitting them making sure that they were only saying good things about them and of course, their job. No wonder it is hard to find where to work or the truth!

Not just in finance but in industrials, healthcare, beauty, fashion, they are just concerned about bringing in profits to hopefully lead to monopolistic success. Sustainability, inclusion, mental health and ESG promotions/investments always help push the mission as well and drive attention but the real work behind it is still unknown because no profits up front. Just like with starting a business. There is a lot of unknowns, time, effort, commitment, success that you are sacrificing upfront for no guarantee in the long term. That is what mental health and sustainability is doing to companies.

Our world is egocentric and no matter how much you think businesses are here for you, they hired you because they believe you will make them better, not necessarily you a better and happy person. I guess our Kindergarten days are over.

Whenever someone hires someone, they are taking a chance on an individual. If they aren’t exceeding sales or producing the same quality work or the manager is just having a bad day, its as easy as that Friday night meeting to let you go.

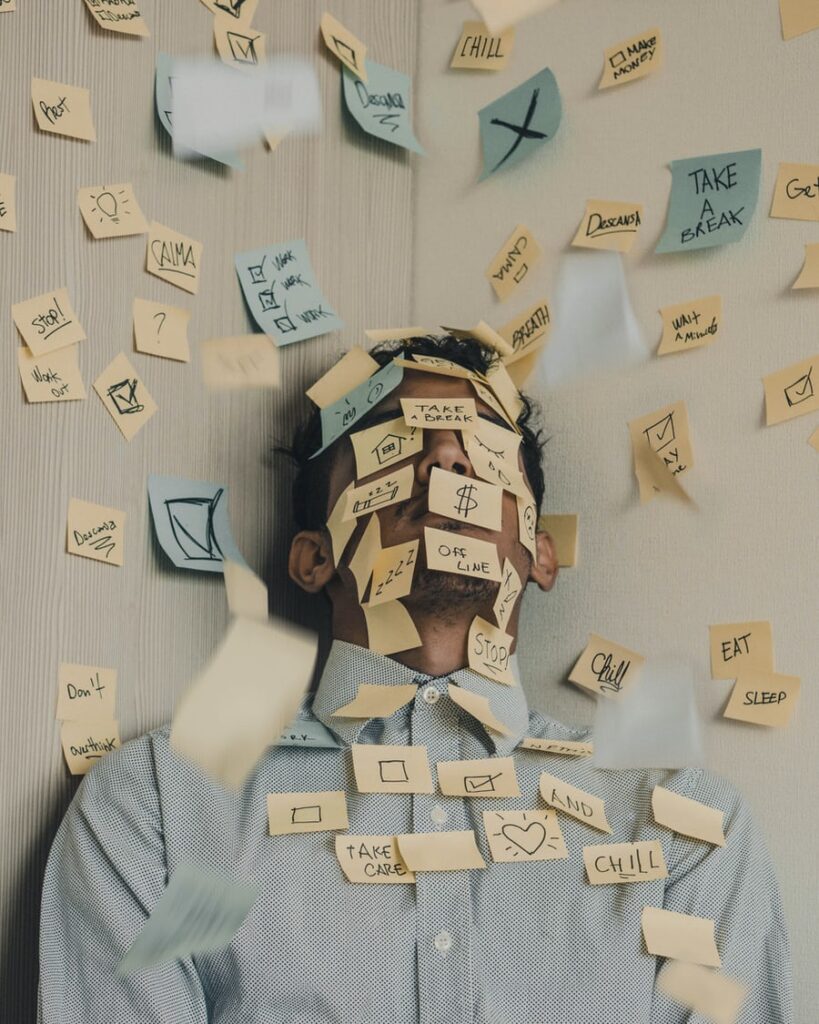

So how can we avoid this because the truth is, this can be intimidating and play a detrimental effect on the quality of our work.

Before you have any job and it could be the most in-demand one that you will have for the rest of your life or none at all, it is crucial to set up a few musts to have eggs in your basket:

-An emergency savings account

-Investment portfolio

-2–3 additional income streams

-Pay off debt ASAP

-Pay yourself first

-Best investment = yourself + financial education

-Spend less than you earn

-Build up credit score

It is easy to believe that someone who is making a great salary doesn’t have to worry about these things. The truth is, salaries are extremely misleading because they have nothing to do with your financial situation, just how much you can possible spend or save at the moment. Making a million might seem like a lot per year but when you take into account Uncle Sam’s paycheck and inflation, managing your money is the hardest part. Just look at uneducated college drop out athletes or movie stars, the rich and famous of them all until they blow it up and are broke back to square one.

There are 2 types of people, those who are good at saving or spending. It’s rare to find someone in between.

As we’ve witnessed during the pandemic, crises favor the rich and limit the poor on their options to building and preserving wealth. While interest rates and mortgage rates are low which means borrowing and investing are up, lower to middle income families are focused upon food, job, and rent security instead.

The Basic Necessities

Of course, we feel bad for these folks but it doens’t mean that the rich haven’t worked hard for their money either.

I find so many haters online who criticize those who are more well off than them and they seem to not be able to move the needle in their own life, only on social media accusing people of working hard. Especially with the recent announcement of the Forbes 500 list last week, people were saying on LinkedIn especially there is no diversity and only white privilege San Francisco men once again at the top. Yes, that is true but that doesn’t’ mean they all were born as a trust fund baby on a yacht. Nothing is stopping women anymore.

The reason women don’t get paid as much as men are not that we don’t’ work as hard or aren’t good enough, etc. but rather because sports, the movies is all entertainment and more people watch men play sports and act than women. Money can never be an excuse. As someone who has 2 startups, finding money is the easy part while convincing investors and building a brand is what 99% of why startups fail. No one has patience anymore!

But there are industries that pay extremely well and always offer volatility.

Business

Yes, the money-making industry. Especially with the rise of electronic trading and robo-advisors, this means that traders on the floor are vanishing because computers are not only smarter but creepy accurate in their calculations, all that we need to make more deals = firms happy. If no communication with clients such as making deals or partnerships are in the mix, people are out of the picture and hello cheap robotos.

Automation Overload

Warehousing clerks, manufacturing floor workers, cashiers, bus conductors, travel agents, tour guides are the most popular industries that are getting an innovative and not so pretty makeover. This is all changing due to tech and innovation since new skills are required all the time.

Social Media

I still don’t know what influencer means. Most of them online don’t influence me to do anything. They just make me more frustrated that they call themselves influencers promoting a product that they’ve never heard of just to make a referral commission. Due to the antitrust allegations against Facebook and Twitter as they grow and topple over smaller companies and conglomerates, they are becoming bigger monopolies which means more problems. Who knows what the future will be like? As someone who always attempts to plan for future becuase it isn’t a bad thing to do even if you know you have a 50/50 chance you will be wrong, I bet that social media will die. It is causing too much mental health strain and it is oversaturated. Suicides, comparisons between teenage girls, and scams are skyrocketing. It isn’t social anymore. For those that call themselves, ‘influencers’, I would advise planning a smooth exit route. If you quit college to do this posting sponsor gig full time, beware.

Niche Specific

Jobs that are niche to a specific company are also always under threat. If the company goes under those jobs and skills become useless. Whether it’s a specific kind of technology or operational skill, these are very volatile as well since technology is becoming more ubiquitous.

So is there a way to recession-proof your career?

If your best bet is not to work for a company, that only leaves you with two more contenders. Self-employed or early retirement? Honestly, retirement does sound nice for a week but not only it can get crazy expensive, but it is also extremely boring. Take on a job you want becuase you look forward to seeing people, communicating, solving problems, fixing stuff, and feeling embarrassed. Acknowledge these things occur in any position, even more, when you are an influencer (not recommended in that case). Obviously working on your own is more volatile becuase there will be on and off days. In the office, there will always be work for you and you will get paid no matter if you are sitting and going out for lunch. It is more structured and you are not in control of your every move. That doesn’t mean you have a helicopter parent, just obligated to get work done or off with your head!

I want to mention that the salary isn’t something you should be looking at. Obviously, for most of us, our main source of income is our job but why? You would be much less stressed, probably happier, have more time if you weren’t obligated to produce work at a certain time frame for someone. Find a balance that works for you but make sure you have many options to choose from that can come your way depending on how much work you put into it. It’s always an equal opportunity these days. The more you make, the more you will be inclined to spend more and live an inflationary lifestyle. That means you will have to work more to keep up with demand, leading to a less rich lifestyle.

Being rich provides you freedom, privilege, security, and peace (if you aren’t a celebrity). Rich has no value or number, it is dependant on what makes you financially free. Looks truly don’t matter and the less you feel the need to show off, usually the richer you are. Impossible to find out about it unless you know everything about that person’s finances. #StealthWealthRevolution

Gov’t Jobs

As we heard yesterday after the Electoral College vote, instead of Rudy Guilliani waiting for Trump to tweet firing him to his 100 million-plus followers, he decided to resign. Smart move. Probably the smartest thing someone in the Trump cabinet did in the last 4 years. Govt jobs are also doing well sometimes, but as we see every 4 or 8 years dependant on when we get a new president, cabinets will always be replaced by the Republican or Democrat party meaning that new roles will be filled and adios to the rest.

To find a job that is in demand, look towards companies that have a long historical profitable record that are always in demand that you use yourself. Understand the brand so you can enjoy it and that will make your job easier. Don’t call it a job, because there is no such thing as a work-life balance. If you look forward to work, it should be called a passion or activity for the day.

As long as you test out different industries, explore the earlier the better and hone your soft and hard skills, that will help start rooting your potential for more success down the road in whatever industry you choose or in yourself.

There is no such thing as a perfect job unless you’ve tested it out and tried it yourself for more than a year. Don’t set your expectations too high becuase you will naturally be disappointed. It is up to you to find joy and calm amidst the storm. There is always something you can be grateful for, just the fact you have a roof over your head and food in the fridge. People are begging for that this holiday season.

Don’t rush with it. People will get that top tier internship at age 16 but then be burnout by 30 when you are just getting started not rushed, enjoyed college and in it for the long haul to end up earning more. Learning is a gradual, lifelong process. There is no destination and it has to continue when you work. Don’t ever think you are the smartest in the room.

To answer the question. No job is insecure. Just people.