What will forever be certain is that we always need a place to live.

Most of us choose the places we live not for the weather, food, culture, or people that are there but because we need to work nearby.

The closer we are to work, the easier our lives are and as a result, we have more time with family, less time commuting.

This leads us to work to live instead of living to work, which can be a good thing but it most importantly means finding a shelter in place is the most important and costly financial decision we will ever make.

The average cost of a home in the US is now at $227,700 according to data from Zillow. Along with housing, education and healthcare are the top expenses behind that you will make.

Since we take pride in saving and budgeting to presumably start a family and finance a home ourselves, it has become increasingly more difficult on where to get reliable and simply truthful, up to date information on if it’s the right time to sell or buy becuase it seems like it never is!

Just like with a company, it is never the right time to start.

With homes, except during the 2008 Housing Crisis which in fact lowered prices for homes and a deal for those who could pay, when the economy is booming and people are congested in cities, prices skyrocket and there is not enough supply.

Today it’s the opposite.

The only places where there is not enough supply are the places people never stay for more than a long weekend such as the Hamptons and beach homes in Tampa unless you are retired and in that case, you are there all year round.

It has been more than a decade since the Great Recession of 2008 and we can attest that the housing market has rebounded nicely.

Since a recession is known as a decline in economic activity, the job market, lending standards shrank and housing prices went free fall.

Compared to this once in a century pandemic where economists are bickering over considering it a recession or not since in-demand businesses are booming and the rest are falling which is very rare, overall activity and spending have declined and hence no inflation which is a recipe for a recession.

In 2008, since the recession led to a loss in jobs and income, Americans were unable to afford long-term investments such as home purchases and as a result, the prices shrank.

So becuase we have a recession today, does that mean the median sale prices of existing homes will fall 25% soon?

Many economists are saying this is unlikely because big banks have learned to not give away horribly rated loans to homeowners who will default on them, also known as the balloon or default payment mortgages. They have stronger procedures and have learned from the poor underwriting standards that lead to the Great Recession.

PROS

As we’ve heard over and over, this year is certainly unprecedented and truly today, we have no president insight.

The pandemic is a once in a lifetime episode and has changed our lives around, especially the housing market.

The wealthy are relocating to their vacation or second homes out of the crowded city because they are able to work from home while those who cannot afford another home are staying put, which may not be such a bad thing after all with finally enjoying peace.

In March at the start of the pandemic when Times Square looked like a ghost town and subways were empty, yes NYC might have been considered dead but today, it is truly booming becuase rent and homes for sale are plummeting, in a good way, except for those trying to relocate and sell them. If that is your case, try not to move. Wait out the recession which will end next year once we get a vaccine and NYC will have demand again.

Those who always dreamed of moving to the Big Apple now can afford to do so while enjoying a one of a kind, quiet, and more spacious city that will not last long.

There is no reason why buying a house during a recession is a bad thing.

The first obvious pro is because housing prices and mortgage rates are lower so buyers get the benefit of low-interest rates and lower prices.

Especially with very low mortgage rates, currently 2.9% for a 30-year fixed loan, versus 4.6% two years ago.

According to CNBC, the most relocated areas that people have settled down during the pandemic include New York, Tampa, and Arizona.

Except for Tampa and Arizona, NYC has one of the highest income taxes behind California, the leader but with reduced housing costs, Millennials, in particular, believe it is worth taking advantage of.

In addition, buyers during a recession are able to ask for things that sellers were too pushy and wouldn’t budge on during a competitive market such as giving up the furniture, lower prices because homes sit longer on the market and are willing to negotiate or even free deep cleaning before moving in.

As with everything there are cons so let’s dive into them.

CONS

Depending on your employment situation, the biggest con to buying a home during a recession is believing you should move when you really don’t have the savings for it.

Even though it is typical to only put 20% cash down on a home and the rest set in a 3-10 yr fixed mortgage, you need to make sure you aren’t overly confident that you will have no problem paying off the mortgage.

If your job relies on your physical presence and manual labor, first off, try to get out of that job as soon as possible because that will kill you, but of course, we need laborers in this space and cannot afford or have the capacity for people to only work remotely in an office.

But if you have to clock into your job, get paid on how many hours you are physically working or work in a cyclical job that is struggling during the pandemic, then it is more likely there will be less stability for you during a recession or economic downturn.

As a result, banks are less likely to lend money to you based on how likely you are able to pay down the mortgage, and in general, banks have to be more reserved with their money since spending is put on hold.

At the same time, banks, institutions, and the government are providing hefty loans to small businesses who really need it becuase of its bang or bust for them.

Individuals can wait for a home loan in this case.

As a refresh, in order to apply for a loan you must:

-Show proof of savings equal to several months’ of mortgage payments

-Credit history

-Job in order to prove credibility that you will pay off the loan

After the Great Recession, the federal mortgage regulations were fixed so as a result, banks will not allow you to purchase a home with no money down, which is what caused the 2008 recession in the first place.

Besides not having a stable job and looming uncertainly in the future for example, needing to relocate, if you are able to afford it, this is your best opportunity to get the lowest price for a home in NYC!

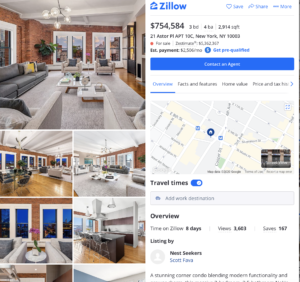

For example, check out this amazing price for a 3b 4 bath listed for only $754,584 near NYU.

21 Astor Pl APT 10C for reference.

My family is highly considering it especially since we would make a nice profit when NYC gets back to being, NYC. My mom and I wouldn’t have to commute 20 hours total per week to school and be closer to the city.

The sellers today purchased it exactly last year for 5x at 5.5 m and have lost more than half of their money plus I’m sure they did renovations.

Pre-pandemic we had been searching for months for a place under 1 m for a 2 bed and now our patience has been rewarded.

Manhattan property sales dropped 56% in July and rose 44% in nearby suburbs, with a slim selection of the population, who wanted and could afford to move to areas with more space, comfort, and nature, typically found in the suburbs or on Fisher Island, the most expensive Zip Code in the US.

There is no doubt that buying a house during a recession is a good thing.

There is absolutely nothing wrong with doing so and you will be able to score a great value on your home.

But before you do so, it is always important to not rush the gun.

Just becuase it’s a great price, doesn’t mean it is a great building, area or move-in ready that all add to the fees and can make it harder to make a profit when sold.

Buying a home isn’t an investment unless you take those things into account. Renting can be as a good investment since you are saving much, much more unless its Justin Beiber’s Air BNB for 15k a night.

If your apartment is a great price but the location is a ghost town, take that into consideration.

If it’s a dump, you will have to put quite a bit of money down to make sure the price is higher than what you bought it for.

Along with the paperwork and broker fees which are typically around 6% so if you’re selling or purchasing a $300,00 house, that’s already $18,000 profit for the broker, it all adds up.

It’s not just a one-time expense.

The upfront purchase comes with ongoing taxes, insurance, HOA, maintenance, insurance, renovation costs that all reduce the price, except for renovation in the long run if the sale is timed correctly.

Depending on the state, you could be paying half of your estate just in property taxes, and don’t forget state or country taxes.

Lastly, don’t undermine furniture!

It is an expense that adds up quickly.

Appliances are getting more expensive since they are more innovative with built-in tech that frankly breaks easily.

I would advise making sure you can check off at least 3 out of the 4 of these requirements to confirm you are on the right track to purchasing your home:

-Stable Employment

-Understand this is not a rushing game or that fun.

It is hard not to be excited but remember that making a quick decision on a house that isn’t financially realistic is worse off than buying another home that is not your first choice but the better financial choice at the end.

-REMEMBER: no home will be perfect and what is “too good to be true.”

Renovations will always be necessary, eventually.

Buying a home is not like buying a meal.

You need to maintain it in order to make a profit.

-If you are planning on living in that place for less than 3 years, renting is better. Buying is a long term investment.

-Do your research and be patient to be able to research a broker or do the postings to search for the right seller, neighborhood, past price history, and all of the little details.

Time=Money and weigh opportunity cost.

If you want a broker to do this for you, you have to pay the price

-6-8 months of leeway of cash as an emergency and at least 20% cash put down on the estate

ROI Before And Today

Since our home is our single largest asset, a few of us actually calculate the return on our investment after selling since we always need to have a palace to live. We assume it will be an investment to grow a family and live happily, but besides that, we don’t check up on our payments.

First off, if you can make your home an investment, that will help you become more confident in selling it for a profit and be able to buy a better home with that ROI (Return on Investment).

SO what is ROI?

ROI is not price appreciation (how much less you sold it compared to paid for it) and doesn’t take into account the expenses while owning the home, buying the home, and preparing to sell it.

How to really calculate your ROI:

-Add acquisition costs-costs incurred when you purchased home-down payment attorney fees, closing costs, etc.

-Principles interest, raxes, insurance, repairers and maintenance, HOA dues and condo fees

-Selling costs-real estate agent fees-roughly 5%, closing costs-even if a sale is exempt from federal capital gains tax may need to pay state and local tax

-Loan payoff amount. Did you skip or be late for payments? Add all of those fees and calculate your mortgage!

Compared to previous generations, it is hard to compare if this is the best cycle to buy or not because the economy fluctuates and has its highs and lows the same way it did in the past.

The only change is that since the economy grows, the US accumulates more debt due to a rise in spending.

Inflation occurs and there is a price uptick with everything.

Since our salaries increase due to this demand for more expensive things, it evens out.

I’m not a financial expert, just a 19-year-old who is planning on purchasing an apartment near NYU soon when I go back eventually.

I took on this responsibility to do the research for my family on the best decision to make for our future and have evaluated that there is really no bad time to buy.

It all depends on where you are relocating to, the conditions of the property, and how long you will keep it to sell it for a higher price.

Recession or not, prices will fluctuate.

It is up to you to make the best decisions based on what you need, not want.