Since the start of the recession back in March 2020, lots of financial jargon has been floating around and you could say, that’s a good sign. Obviously, the current state of our economy (excluding the exceptional bullish run for the stock market), politics, and all things COVID from deaths to the slow vaccine rollout aren’t circumstances we want to witness but the growing number of Americans that are finally curious about preserving wealth, expending their financial literacy vocabulary and taking their financial matters into their own hands seemed to never be something that would come true.

GenZers and Millenials, the most popular age groups to use ‘hot’ retail investor apps such as Robinhood and Webull accounted for 20% of the trading volume in the stock market last year. That is a percentage that has never been recorded before and although might be seen as a great way to promote the adoption of financial education we can never expect from schools, it doesn’t seem like it’s all a good sign.

How retail investing platforms work is more for the company’s benefit than for the customers/traders. Customers aren’t even considered clients since most are taking enormous risk through options trading, hedging, and the buying and selling of single shares that have only downsides to their future. As you’ve probably heard, Robinhood was under fire a few weeks ago for selling customer’s behavior to 3rd parties that help Robinhood make their platform intuitive to trade quickly on and make the transaction process as seamless as possible. Robinhood’s hopes of an IPO have slowly faded now. The 3rd party monitor how users engage with the platform and promote the trades that profit Robinhood more than the users. That’s why I’m a sell on these trendy Las Vegas gambling platforms. In the long run, unless you are a superior day trader that enjoys, and who does, timing the market, has a reason backed behind every ‘strategic’ bet, has proof from experience that this will profit and can predict the future, then it should be a no go for anyone especially the young investor who’s best friend is sports betting. Might as well read “Rich Dad Poor Dad” and you’ll get your money back guaranteed.

But not all of it is bad. Since we are all cooked up at home, at least some of us are who understand that we are essentially still in the same situation as in March, have taken advantage of all this time off at home. Everything from books, pianos, yarn, and even extra Google searches are on teh rise. People are curious and I like it! That also means there’s a higher chance someone will read your article or watch your TikTok. The more content you produce, whether it’s on social media to your blog, it will always be in demand unless you are still debating if that optical illusion dress is black or blue and in that case, you can drop that by now, it’s blue for most non-color blind people.

We’ve also witnessed during this time the staggering wealth inequality that American has faced. As in every crisis and war, there is always a loser and winner. In the dot-com crash and today, the rich get richer and the poor get poorer.

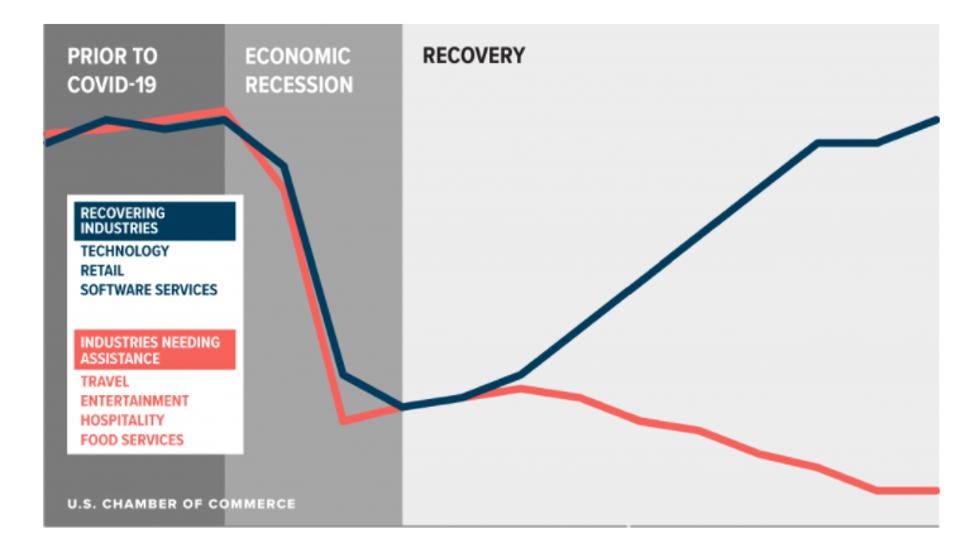

So how does that K-shaped recovery thing everyone is talking about play in here? Well, without trying to explain it in words like a textbook attempts to when there is no room for a picture, I will save you some mental headspace and provide a diagram here:

V to W to What?

Before we dissect this graph, let’s discuss the various types of recovery scenarios that go about in almost every recession that has happened in American history. A V-shape curve would be one where it recovers very quickly with no one left behind.

This rarely happens since 40% of Americans are paid $15 per hour. A U-shape would take the economy a longer time but everyone would recover, this is something that America should hope for but especially with COVID, faster is always better. A Square Root recovery is when the latter portion of the recovery is higher than what was occurring before the downturn meaning that it is to portray a quick rebound but flat to no growth after the fast upturn, which we don’t want, especially Main Street and Wall Street, rarely a combo. A W-shaped recovery is where the economy largely recovers but is back down before it regains momentum and gets back to where it as before the downturn. And lastly, an L-shaped recovery is the longest of all of these since it means the economy doesn’t get back to its trend line and is permanently damaged. As a heads up, never happened in modern history or to a developed 1st world nation. There’s always more imaginary stimulus that the government can push out.

We only witnessed a U shaped recovery during 08 and the dot-com crash. Going back into ancient history with Prohibition and WWII, it was more like a W-shaped recovery since the economy was lagging for a while especially after the 87 Black Monday crash. History for sure repeats itself, but in different ways.

It it’s hard to picture how the economy is different from the stock market since the market should rely on everything that is going on in America from a political, economic, financial, and physical standpoint, but it seems to differ since only 60% of Americans are financial literate and by financial literate that means knowing what credit versus debit is, so in actuality, more like 30% are seriously literate in finance.

Since the stock market doesn’t trade in real-time, it is even more difficult to discern where the world is headed. In the March sell-off, since the uncertainty of the future loomed over the world, investors were warry to hold on to pre-COVID stocks in the hospitality and leisure space in particular, but now since we have a glimpse of hope with the vaccine and defiantly in the new administration coming into office tomorrow, the stock market is back in full throttle looking 5–10 months into the future.

Maybe that’s the reason why investors are so bad with looking into the future. Hiring a genie wouldn’t be such a bad idea especially since finance is all about diversity anyway right? Banks are willing to hire anyone with any quirky major these days to find fresh ideas and propel creativity and of course, add to the metrics of how many art majors and minorities they’ve hired to show off at the quarterly investor relations meetings.

K-Shape Kurve

A K-shaped recovery is where America is headed. There is a large wealth gap in this country, larger than any other developed nation and let alone being the wealthiest nation, it makes sense, but this brings on immense challenges for more equality because it just cannot happen due to more money.

Even the rich take advantage of stimulus payments and are presented more opportunities to pay less in taxes than someone who is living below the poverty line. What it comes down to is when you have money, you have more opportunities to take advantage of. Everything from tax shelters/havens to hiring accountants and lawyers to get you out of trouble and pay less than needed. Everything is in your power and you get it your way simply because your bank account allows you to.

When you have no power a.k.a money to hire an accountant to help you find the best tax-advantageous strategies for your family or be able to afford a rental property and charge all of your expenses towards it to count as a depreciating expense (loss) instead of gain, life gets very hard and expensive quick. The rich and poor pay the same amount of sales tax on a Coke but on a property, although the rich would tend to live in a more expensive area owning more land and junk, it is easily possibly they could be charged less in a 100% legal way simply through having more money.

Hence, there is no doubt money provides freedom in terms of helping one attain more wealth, fewer headaches, and more privilege to get what they want as stubborn folks. America is one for all. It may be united in terms of land and states, but when it comes to money, we’re all fending for ourselves.

You and I

Given the impact of COVID and the effects, it’s had on the leisure, travel, retail, hospitality, restaurant industries, it isn’t hard to realize that this is the recovery we are going through. These are the industries where most blue-collar workers make their living and the majority only count on 1 income source since they either don’t have the education or have the means to risk their money and investment it into the stock market. When stimulus arrived, they immediately used it to pay off rent and feed themselves.

When stimulus came as a present or generous gift to the rest of Americans that are working from home and feeling bored, after they resort to their beach house or the next room, they stash that money into the stock market where the rest of the wealthy Americans have made gains and not affected, creating this more unequal divide into where our money is headed. Almost 40% of the middle to upper class did not spend any money received they either saved it or paid down debt. The other extreme almost 30% spent the entire amount on durables, food, medical supplies, and other consumer products. The remaining 30% plus had a mixture of spending and saving.

So what does this mean for the future?

With Biden’s New Tax Plan, since most Fortune 500 company CEOs are Republican, it would be expected that they are upset about the tax increase on those making more than $400k or more per year, yet a tax increase will always correlate to higher corporate earnings and a stock market run. Taxes will provide for the economy and help alleviate the uncertainty. Plus if Uncle Sam’s paycheck a.k.a taxes run out, the government could also just buy treasury bonds which will bring about more stimulus into American’s pockets and alas allowing the stock market to grow higher into a possible dot-com boom. It’s both a win-win situation, of course for the wealth. The lower class, still in the same boat.

Unfortunately, once again, there is always a personal incentive to everything, we just hear what we don’t want to hear.

When it comes to the industries such as technology, consumer staples, restaurant, small businesses, and banking these are the industries, except for the always-in-demand staples: food that the middle to upper class are a part of. What is also interesting to notice is that most small businesses are operated by minorities. That also leads to wealth inequality as they are hammered now.

The companies that lie in at home stocks and beyond are companies that include everything from Microsoft to Peloton and even Chewy that are mainly based on the coasts of the US where living expenses and are the highest in the whole country, and as a result, higher salaries to employees who are part of the upper class.

Yet as we’ve encountered with Tesla and Dell, Texas, a low-cost state is getting the spotlight as WFH is seen as an alternative that never seemed possible pre-pandemic but still has no effect on the lower class, those who really need the assistance.

Each Level

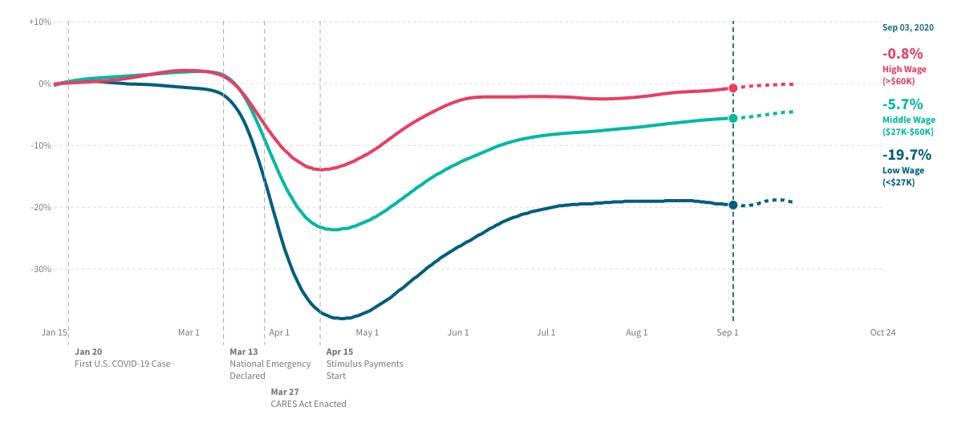

According to Harvard University, unemployment has impacted people of color in the bottom quartile who make below $27k per year more than any other demographic. They have seen their employment drop by almost 20% while less than 1% of those making over $60k per year have lost jobs.

What Does This Mean For You?

I’m presuming if you are reading this now, you are pretty well off and just found this article somewhat educational. You have taken 5–10 minutes to conquer more knowledge that some folks cough cough teens or lower-income people don’t have the priorities or time for. But whatever situation you are in, the best way to guarantee if you will get out of it, is through education. It will forever be the best investment for your future. Ditch that short attention span immediate result dopamine type brain and be patient. Rich quick doesn’t exist, unless you made huge bets for Tesla and BitCoin. The majority of the time, you want to play it safe, be in the long term and trust yourself will always pay off since the indexes always outperform and go up in the long term.

The K-shaped recovery suggested systemic inequities in the economy and society. It is important to note that this is quite unusual because when the economy dips, it’s felt by every industry and demographic, except in the early 18th century with the Spanish flu. This gap has only widened since the pandemic began and those who are doing well are doing even better and those who are not are the same or worse.

We’ve encountered a lot for first in this pandemic. First time I wore a tie-die sweatsuit that stained my white coach, binged watch tv, baked burnt banana bread, Bitcoin crossed the 30k mark, Elon Musk reached the richest person status and the K-shaped recovery first emerged in 2020.

Not all of these are fun and games, especially when most Americans are hurting. But what is certain is that after a recession there will be certain parts of the economy that will resume growth and other that will still lag behind indefinitely, yet in a few years to come, everything will stable out as the quarantine bound folks for the past year are desperate for any Disney vacation or cruise and these industries will for sure see immense demand. Get ready for 50 min wait times to get into a restaurant again.

Since we do have something to blame, COVID and possibly China, although they won’t pay, the K-shaped recovery didn’t cause these inequalities, they just exposed them. As the richest 1% of Americans own more wealth than most Americans combined, at least there is some glimmer of hope from donors and philanthropists such as Mackenzie Scott, Jeff Bezo’s ex-wife that has donated over a billion to various charities and schools in need. In addition, thankfully the Federal Reserve and other governmental entities have taken action to calm this financial crisis and heal the desperation for the retail and hospitality sector. The only thing we can rely on now is just time and our optimism to get us through this pandemic. Vaccines are the main gateway along with our responsibility to just wear that mask. Don’t become that stubborn person who doesn’t obey anything becuase at the end of the day, it only hurts you. As with everything in history, it has all passed. We might be fighting our own battles but you sure aren’t alone.