The shocking truth about becoming wealthy in the stock market is that it takes little to no effort.

There’s no stock picking or day trading involved.

It’s letting your money sit in a fund that tracks a diverse variety of stocks from different industries to lower your exposure to risk, save money on management fees, work for you and increase wealth over time.

Yet most people (Reddit and Robinhood traders) still oppose.

Why?

In this day in age of short attention spans and instant gratification, most novice retail traders would rather waste their time to see their money disappear than deal with investing FOMO (missing out on a trade), the worst type of fear outlined here.

Allocating your funds in an index fund is simple and you can earn a decent return if you play it safe.

More risk = more reward, but regardless of your age, you never want more than 70% of your holdings to be in individual stocks, or else you would go bankrupt when a recession hits, unless you have a stable job and other means to keep you afloat, which most don’t.

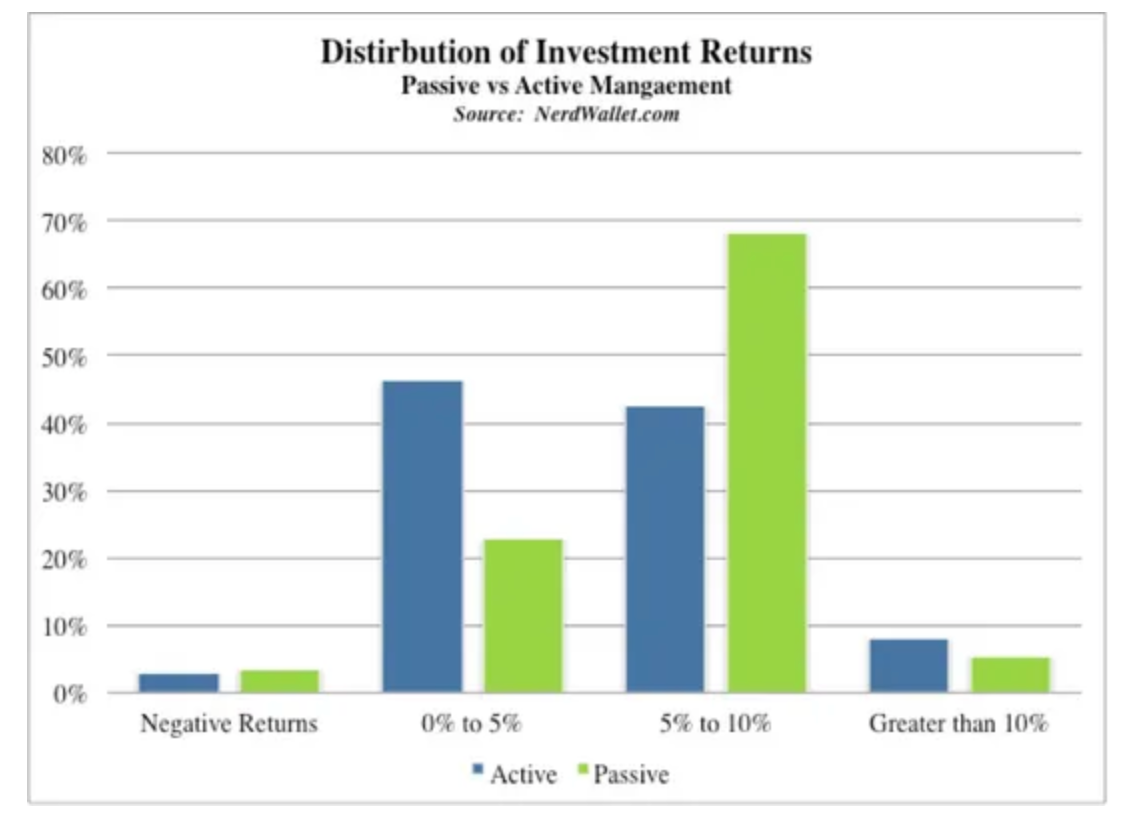

Active vs Passive Index Investing

It makes sense that actively managed funds would provide a higher return because there are managers who are qualified and skilled with tons of experience to deal with each transaction yet as with everyone, no one can predict the future nor has a crystal ball.

Even among the highly skilled fund managers, past performance is not easily repeatable when it comes to the stock market. When the market takes an unexpected turn, the fund manager could use his logic but still cannot predict a safe comeback.

Who knew 2 decades later BlackBerry would be successful again?

In addition, within actively traded mutual funds there are ongoing fees which include:

-Higher expense ratios: average 0.67%-cover salaries of fund’s employees, operation such as computers, building lease, office supplies

-Higher barrier to entry (minimum withdraw $3k)

-Trading Costs

-Sales Commissions

-12B1 Fees-marketing expenses-online ads, television commercials, etc.

In 2019, 70% of actively-managed funds trailed behind the S&P 1500 Composite Index as per Forbes.

As per The Balance.com:

“For the twenty years ending 12/31/2015, the S&P 500 Index averaged 9.85% a year. A pretty attractive historical return. The average equity fund investor earned a market return of only 5.19%.”

Emotional Rollercoaster

Ultimately, active investing is the perfect game to match your emotions to the stock market which is dangerous. When the market is up, you want to sell and when it’s low you want to buy ASAP.

Strategies Towards Index Funds

Investing in these funds is a slow process but quite rewarding especially considering the lack of time and effort you must put in to make a juicy return.

What is always certain about indexes is that they always go up in the long term. Short term no guarantee.

Before jumping right into picking an ETF or index fund from participating brokerages such as Vanguard, Fidelity, Atticus, Charles Swab, etc. make sure to understand how to get the most bang for your buck.

Pesky Costs

Focusing on cost should be first priority since they take a hefty chunk of profits and all brokerages make money off of your gains and losses.

Nothing in this world is free.

Managers take ownership and those fund costs slowly eat into your returns. It is staggering how decreasing your expense ratio by 0.10% can increase your financial balance by almost 10% after a few decades.

So, what type of fees should I look out for?

Ongoing charge (service fee) + Transaction costs = Total Expense Ratio

Ongoing charge: a yearly or quarterly fee you pay the fund manager to cover the ongoing costs of running the fund.

Transaction costs: the fees you pay each time the fund manager buys and sells shares within the fund (this is why active funds are so expensive since their managers are paid to do this all day long).

Let’s identify 4 other areas of index funds to look out for:

#1: Diversification and Appropriate Allocation

Dependent on several factors, most notably your age, net worth, short/long term goals and risk tolerance, you will be matched with an appropriate index that fits your needs either by a fund manager or on your own through these participating brokerages.

To understand your appropriate risk tolerance and passive/active investment split per age, check out here.

Asset allocation is crucial to not fall into debt and let the market take advantage of you.

Equities are most volatile and bonds are more conservative (loans to banks/gov’ts-safe haven investments).

Cash is king so make sure to allocate roughly 20% of your net worth into it just in case a pandemic hits or an unexpected recession occurs which historically happens every 5–10 years.

Since I’m 20, I have a balance of 60% passive, 40% active investments due to my long time horizon to recover from any losses that may occur.

Keeping a decent amount of your portfolio in low-cost bonds, ETFs and index funds is crucial.

Going all in with 1 isn’t strategic so make sure to have an appropriate split.

Allocation:

You risk appetite is directly correlated to how much risk you can take on. Before you jump into choosing which stocks you want to track, you must understand the 5 asset classes that are a part of the market:

Shares in companies listed in the stock market.

Bonds issued by institutions and governments.

Commodities, such as oil and gold.

Real estate, either directly investing in property or buying shares in investment trusts.

Cash for any short-term purchases or as a safety pot for rainy days.

Dependent on when you plan on withdrawing the money, make sure you remember the fees associated with it.

If you sell your gains under a year, you must pay income tax on top of it.

If you keep your investments for more than a year and plan on selling them, eventually you must pay capital gains tax.

To avoid any taxes, take advantage of tax-differed retirement plans (Roth IRA, IRA, 529 which are tax deductible), invest long term and possibly reinvest the proceeds to avoid capital gains.

#2: Dollar Cost Averaging (DCA)

To be consistent with your returns, you have to be consistent with your allocation split and investments.

Surprisingly, you will earn more in a few years by contributing a few thousand per month than a lump sum (large amount of money) once every few months. Since index funds allow you to buy more shares when the index is cheaper and fewer shares when the index is more expensive, it allows you to optimize your growth strategy better to take advantage of price drops instead of putting money in at any time.

#3: Sector Breakdown

Simply put, there are 3 main ways you can diversify your investments.

Asset diversification: you can spread your money across multiple assets, such as owning 50% in stocks, 10% in bonds, and the remaining 40% in commodities.

Sectoral diversification: you can choose funds that are focused on certain sectors (such as Consumer Goods, Healthcare, or Industrials).

Geographic diversification: funds let you invest your money in a range of companies operating across the globe.

#4: Just Don’t Touch

As legend Warren Buffet declares when describing his investment strategies at his quarterly shareholder meetings:

“Our favorite stock holding period is forever.”

Index It Up

In 1976 when John Bogle created the first index investing fund: the Vanguard 500 that tracked the 500 companies of the S&P500 it was a swift and affordable way for everyday people to become investors and take profit in the stock market.

Valuing index funds is a key strategy to growth and since then, passive funds have held more money and have pulled higher gains than active funds.

This approach to building wealth is no secret and has lead millions out of debt and into financial freedom.

-Understand the pesky costs and fees towards active investing

-Spread your bets and allocation within your risk tolerance

-Diversify

-Stay off and limit emotions

Are you ready for the market to work for you?