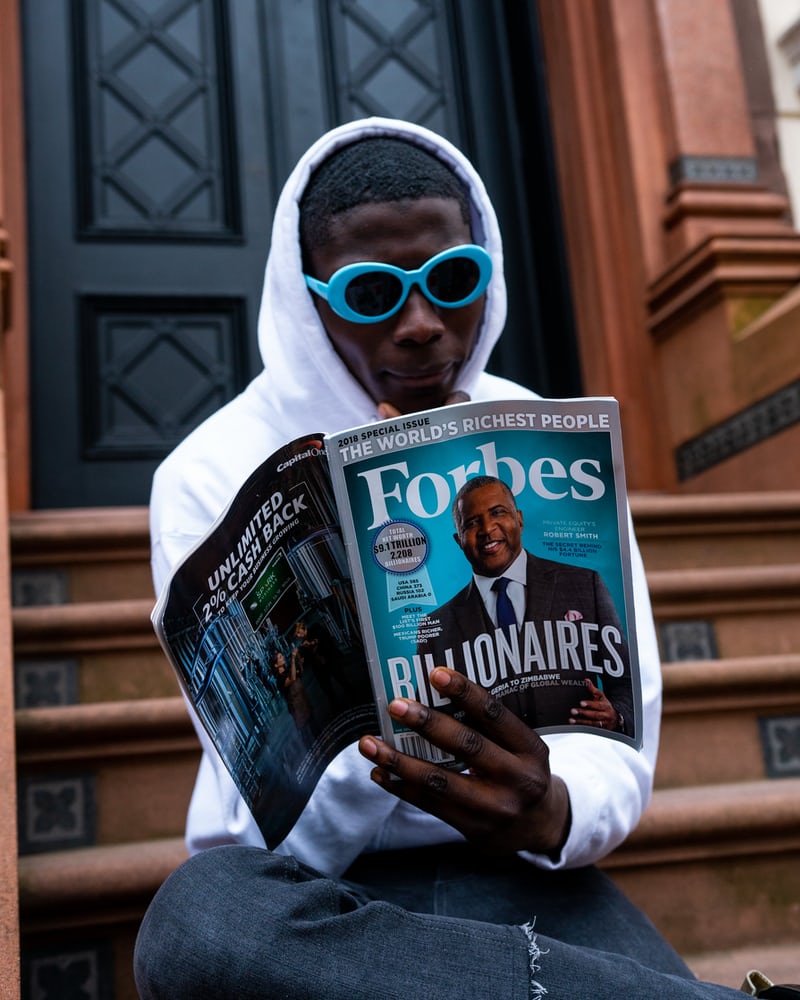

There’s no doubt everyone wishes they could be worth more but majority have no idea why.

What is stopping you is yourself. Having the right money rich money mindset will get you there.

But unfortunately not everyone’s chances are equal especially in this divided era we live in where the rich get richer and the poorer get poorer.

As we’ve witnessed during the pandemic, the wealth divide grew by a staggering 30% meaning that the top 1% grew their wealth by roughly 3.1 trillion dollars while 8 million + Americans slipped into poverty.

The U.S. poverty rate jumped the most in 60 years and plunged millions of Americans into starvation mode while the top half were struggling needing to find an alternative vacation home and a new way to workout.

We all have our own set of challenges but no problem is worse or better than the other.

What is universally true is that we all wish we had more.

Realism

Having a net worth of at least one million dollars for any American is a nice milestone to achieve by age 30 and I believe it can happen if one follows the steps below.

Unfortunately, the average net worth for an American still isn’t there, roughly $692,100, although it varies dramatically by age and race.

White Americans have an average net worth of $933,700 while the average net worth of Blacks and Hispanics is $138,200 and $191,200.

You can read more about what goes into your net worth here.

According to Spendmenot.com, a new survey has found that there are 11.8 million households which have a net worth of $1 million. That is equal to 3% of the United States entire population and about 40% of the global millionaire population.

To be considered, ‘wealthy’ in the US according to Charles Schwab is to have at least $2.3 million in personal wealth not counting inflation.

Americans’ Net Worth

Soaring prices for stocks, real estate, borrowing, WFH craze, and massive savings have erased losses inflated by the pandemic allowing Americans who previously couldn’t find time and the capacity to pay off lingering debt and take out a mortgage at a record low interest rates now can during the pandemic.

The net worth of US housheolds finished 2020 at the highest level on record despite the economic downturn.

Household net worth — the difference between assets and liabilities — ended the fourth quarter at $130.2 trillion, stated by the Federal Reserve.

That was up 5.6% from the third quarter and 10% from the end of 2019.

Breakdown

These gains mainly came from 2 places:

1) Real Estate

2) Stock Market

This is as expected especially since these are the main classic sources the wealthy generate their money from. These are two places that offer positive cash flow, no brutal time schedule and money that works for you not against you.

Stocks

Particularly in financial assets, corporate equities and mutual-fund shares rose steadily after the sharp drop in the first quarter of 2020 at the heat of the pandemic.

The S&P 500 index rose 12% in the fourth quarter and ending the year in the green shy of all time highs. This was propped by positive investor sentiment, extraordinary stimulus actions from the Fed and Congress, vaccine rollout and ultra low-interest rates for the foreseeable future announced by Fed chairman, Jerome Powell until inflation and employment get to respectable levels.

Real Estate Palooza

The median existing home price rose to about $310k in December as WFH accelerated the boom to relocate to the heartland of America with the option for lower costs of living and more demand for space along with the influx of borrowing with ultra low interest rates for a 15 and 30 year fixed rate mortgage.

Causes

Rising net worth is an increasingly positive outlook for the economy as spending accounts for more than 2/3rd of US gross domestic product (GDP) and people are sheltering more of their money away as they’ve learned the dramatic economic effects that a recession has on one’s finances without cash.

The $1.9 trillion dollar relief package helped propel the economy to its fastest annual growth in nearly 4 decades as well.

Debt Levels

With lower interest rates means a borrowing spree. Total debt in the household sector, which consists mostly of mortgages rose 4% in 2020 to $16.64 trillion, compared with 3.2% growth in 2019.

Consumer credit finished the year little changed, as some households used stimulus checks and jobless benefits to pay down debt.

The Juicy Part

Your Chances of Becoming A Millionaire

As education becomes more expensive, so do student loan rates.

This leads families to consider the pros and cons of education more aggressively these days especially since entrepreneurship and working for yourself on your own schedule is becoming more popular.

But can it last or be guaranteed?

Education is the only thing that people (Americans) since it’s free for the rest of the globe, that you would pay extraordinary amounts and go into debt for for no guaranteed result.

Education doesn’t start working for you ASAP and just because you have a degree doesn’t mean you will get a higher paying job.

What you put in is what you put out.

Yet high-paying jobs historically and often require, except for Tesla and funky cool new startups, require higher levels of education to be considered. The more education you receive, the likelier you will be better compensated.

Yet due to the expansion of the internet and content creators, we’re giving education second thoughts, especially after Zoom fatigue has kicked in.

Net Worth Debunked

Although net worth = assets — liabilities like on a company’s balance sheet, it’s more than just that.

Your assets include everything from the cash in your bank accounts, to the value of your stock portfolios and the market value of anything tangible that you own such as a house or a car.

It also includes valuables like art or jewelry.

Yet it is important to remember that the more you own, doesn’t necessarily mean the more you are worth.

Owning 6 depreciating cars versus 6 Picasso antique pieces is a big difference.

Reach Your Goals

Regardless of what age, demographic, race, background, ethnicity, gender, etc., there are certain guidelines that all millionaires have stayed true to to reach their net worth and retirement goals, myself and family included.

Budget

The most common is the 50/30/20 rule. Essentially, 50% of your income should go towards essentials, like housing and food, while 30% should go towards your wants, like shopping and travel, and 20% should go towards savings.

Pay off debt/liabilities

Save money for emergencies, cash cushion = become recession proof

Qualified

Between race, age, ethnicity and gender, lots of opportunity is also based on luck. Most of our success are based on people we meet, skills we’ve acquired, being a genuine person and the experiences we’ve simply gotten lucky with.

The best way to boost your luck is to simply try more.

Something I’ve gotten into the habit of asking myself daily, what if I weren’t scared?

Would I be somewhere different?

If you were able to join Robinhood 5 years ago when they first started raising money as a startup on the board as one of the first early founders, you probably would be a millionaire by now.

Or if you worked in the highest paying industries, finance and tech you would most likely earn six-figures by 30 as well.

Chances of becoming a millionaire with levels of degrees attained by race:

HS Degree:

Asians 6%

White 5%

Hispanic 2%

Black 1%

Associates Degree:

Asians 3%

White 7%

Hispanic 2%

Black 1%

Bachelor’s Degree:

Asians 16%

White 18%

Hispanic 4%

Black 3%

Master’s Degree:

Asians 27%

White 38%

Hispanic 11%

Black 6%

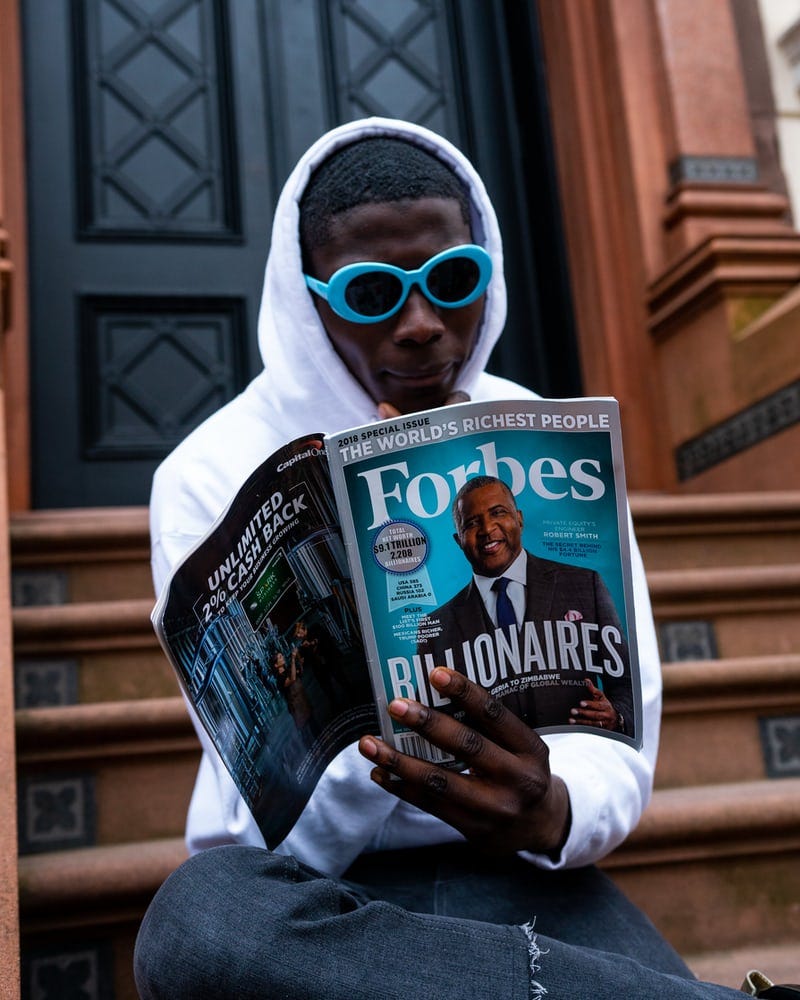

Your odds of becoming a millionaire by race:

Asian 22.3%

White 21.5%

Hispanic 6.8%

Black 6.4%

(According to the Federal Reserve Board’s Survey of Consumer Finances)

By the time someone has a Master’s degree, chances of becoming a millionaire is 10x higher yet the differences between White (38%) and Black (6%) are shocking.

Asians and Whites have significantly higher chances of becoming millionaires as they age because they are higher represented in top industries such as tech and business.

As You Age

The older you get, the greater your chances are of accumulating more wealth and becoming a millionaire due to the rewards of compounding returns.

Strangely up until age 61, your chances of becoming a millionaire diminish significantly most likely due to a lack of motivation, retirement and stubbornness.

The Likelihood of You Becoming A Millionaire

The odds are relatively slim for an average American with an average net worth.

Their chances are between 6.4% to 22.3% according to the Federal Reserve’s Board’s Survey of Consumer Finances yet compared to any other country, becoming a millionaire in Singapore or South Africa is less than .5% as their GDP per capita, overall consumption and industries are less expensive and innovative.

What You Can Do To Increase Your Chances

First off, you are in the right place.

I believe if you continue to read my articles and keep up with the daily trends in the market, your portfolio, stay invested, take advantage of compound interest especially while you are young, you will become a millionaire in no time, as long as you make sure you spend less than you earn or it will all crumble!

Top Bonus Tips On What I Follow And Recommend Religiously:

-The more you educate yourself, the more you will get because no one can take knowledge away from you

-Optimism, the right mindset and personality are key. The nicer you are, naturally more opportunities will be presented your way. Soft skills must be valued!

-Max out your 401(k) and earn roughly 7% per year in internet, you will become a millionaire in 40 ish years and invest another $2k in after-tax proceeds a month to get there in 20 years

-Invest in what you know not Reddit WallStreetBet forum addiction trades

-Know how much you earn, take in every month-put away roughly $500 per month and earn 3% each year you will become a millionaire if you start at 20 and get there by 50.

-Track your net worth but don’t be too addicted to it

-Work harder than the average person, see if your income increases by working longer hours, if not, work smarter not harder

-Create and generate multiple income streams of income-properties, intellectual property, blog, YouTube channel, side e-commerce business, baby-sitting, you name it, it’s available

-Money Mindset: You deserve what you earn

-One to always look for opportunities, never satisfied

-Abundance never scarcity

-Tax optimization especially with properties

-Don’t care about looks, rather invest in oneself

-Don’t ONLY rely on college to keep you afloat or teach you everything

-Renting = -100% return-renters have a 46x less net worth than homeowners

-Try individual stocks if your index funds are lagging but a balance of passive investing is key as well to not go overboard like Melvin Capital!

-Network-people are everything-first class: referral for a job

-Cancel any subscriptions that keep recurring that you don’t NEED

-Work in highest paying industries if you want to work for someone: finance, tech, law, consulting, entrepreneurship (risky and not right away rewarding) and the medical field

-Understand your net worth asset allocation

-Get half of your day done by the time people wake up-work during your flow states don’t just try to cram in all hours until 5 pm-become a morning person. Healthy mind = healthy life

Remember, it’s not about how much you earn/make, it’s all about how much you keep that counts.

There are thousands of ways to make money, it’s just a matter of sustaining it for most, cough, cough superstar athletic players and lottery winners who go bankrupt within the first month.

Once you do reach that millionaire status, always keep shooting for the stars, don’t become an arrogant looser especially since $5 million is the new $2 million due to inflation.

Don’t grind till death because then you’ll be burnt out and get nothing done. Without health you have nothing. If you feel anxious and hate your job, achieving that milestone will be 100x harder.