The number one goal for parents is to have their kids become more successful than they are and make an impact on the world so they can brag about it for the rest of their lives.

That’s what they are for.

If you ask parents with more than 1 child why they wanted more kids, they likely won’t say they were bored or wanted company, rather the more you have, the likelier you are convinced one will grow up extremely successful and possibly be able to support the rest.

Unfortunately, there is a 99.9% chance each child will have to work for themselves and not depend on their siblings once becoming an adult. Unless you grew up in the Kardashian or Gronkowski family where all members of the family are part of the same business or do the same thing, it’s very rare that it’s LESS expensive to have more children. Don’t believe something that hasn’t come true yet. It’s nice to dream but being realistic is safer and usually becomes the truth.

After all, the rising costs of having children have only skyrocketed in the past few decades due to inflation, higher costs of tuition, food, you name it! Especially during this pandemic as kids have been bored out of their minds and dealing with cabin fever, keeping them occupied, feeding them and buying all the gadgets they can get to distract them is more than a part-time job, especially on the wallet.

Raising a family and adding more kiddos to a clan is a rewarding feeling yet everything comes down to cost. Don’t let it bother you, just trust and understand the process so you don’t have to let go of anyone.

Income Split

True sincere parents would do anything for their children. They would work double shifts in order to afford the best education, live in the nicest and safest neighborhood and raise them with humility and teach them the most precious life lessons. Yet with all of this comes downsides which includes inequality.

The world isn’t fair. Women have to fight more to still get less than men and blacks and Hispanics are marginalized for their skin and ethicity.

Income inequality is a prevalailing issue that has only gotten worse as the pandemic began.

It is at the central theme of capitalism, a social construct that creates all sorts of problems for people who don’t deserve it.

The key to successful capitalism has been the middle class. At the turn of the century, America was the largest superpower and had the most prosperous middle class in the world.

Although we are still a strong, resilient and the richest country in the world, in the past 20 years, China has been stealing the spotlight, dominating all types of industries and been the leader with innovation.

From trade to infrastructure, manufacturing chips for our computers to combating the virus, China’s rise to ultimate reign has been mainly due to the fact that it has transferred its wealth throughout its system and believe it or not, is rather equal.

Compared to the US where the top 1% have earned more during the pandemic due to working in staple defensive industries and relying on the stock market to keep them afloat than the bottom 99% is completely unfair. The rich not only pay less in taxes for their businesses and on personal income, they get to sabotage the rest of America. You can learn about the tactics they use here. Some are legal, most aren’t but no one seems to care.

While China has added several hundred million people to its middle class as they took strict measures to restrict the virus’ spread, the US has subtracted people leading millions to become evicted, into poverty, homelessness and rely on stimulus for a year.

For the past 50 years in America, the transfer of wealth has gone form the middle class to the shareholder class. This doesn’t mean the lower and middle classes have done worse or better, it has just lead GenZers and Millennials to take risks that they cannot afford to loose.

For example, as teens were bored at home twiddling their thumbs on Zoom University, they attempted to learn how to deal with their finances, a skill that unfortunately isn’t taught in school and instead had to teach themselves the wrong way on retail trading platforms. This not only led them to go into debt by participating in the GameStop mania frenzy, but neglect investing in themselves the right way.

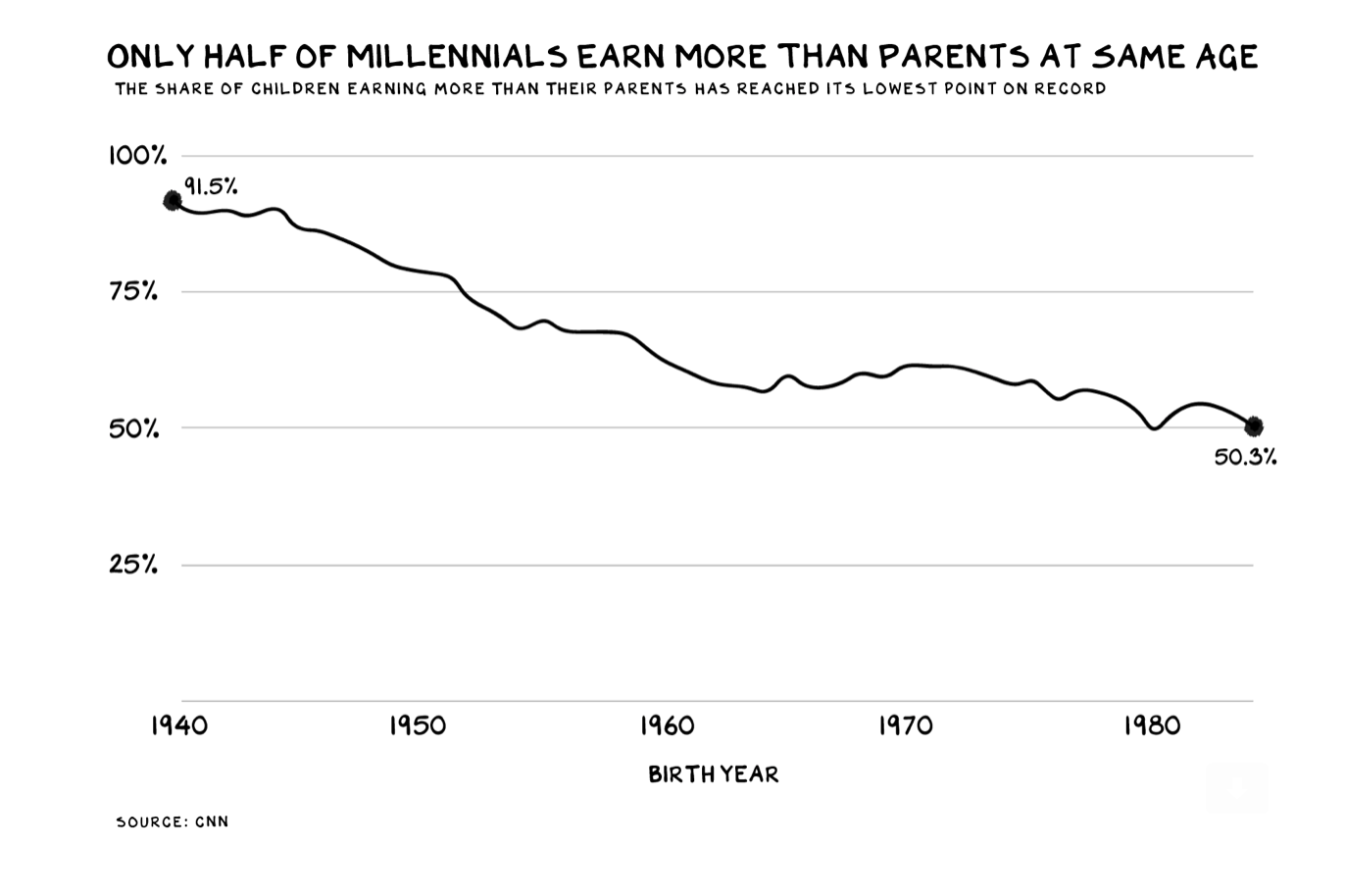

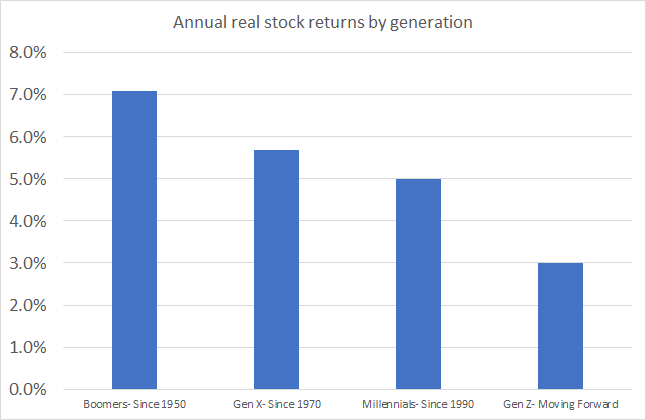

It is staggering to hear that my generation will have a harder time to double our money than our parents did.

What a disappointment but luckily there are ways you can tread ahead.

This shouldn’t be seen as a competition rather just a fact that needs to be considered.

Luckily as a passive long-term investor (read here), volatility and Robinhood isn’t my jam but for most of my peers who could care less about spending their parents money on retail trading apps and not bothering with educating themselves properly treating the stock market like a game, they are setting themselves up for a tough hill ahead.

In the past few months, there has been a record number of newly opened brokerage accounts and retail traders coming onto the market taking up quite a large percentage of overall traders.

Charles Swab, an institutional brokerage recently announced it opened roughly 3 million new brokerage accounts in the last month and Robinhood has over 10 million with a couple million joining after the January meme frenzy.

What appeals to this generation isn’t finance or business fundamentals from the markets to social media, it’s potential and upside that could come from winning big and overstimulation that makes them go crazy!

Although historical analysis proves passive investors consistently beat out active investors, they still have false hope they will win big like Roaring Kitty, 1 out of a million for no reason betting GameStop, an unprofitable stock for a few decades would surge.

Plus with all brokerages now instituting free commission trading, Robinhood has no competitive advantage anymore besides seeming ‘cool’ and ‘trendy’ amongst youngsters which is even more dangerous because as you should know, trading shouldn’t be fun.

The share of wealth has crashed and people want to get into this game for the wrong reason making it harder for their future that they designed.

Splurgeee

The reason Millennials have less than half of the economy security (ratio of wealth to income) than their parents had at the same age isn’t due to inflation or lifestyle inflation, rather due to the risk, over-confidence, double recessions under their belt, sky high valuations of stocks they’re trading and most importantly, lack of focus on education.

When you take risks with no proof or financial education under your belt, you are setting yourself up for a pitfall. Investing in yourself is by far the best investment because you then know what you are doing.

If not, trading turns into gambling, getting a full-time job turns into working for your time and taking more chances in the market with no education means loosing it all.

This is leading to massive shame in households across America as 40 year olds have moved back in with their parents all due to the lack of education and responsibility. At least if you have 1 child, you don’t have to be as disappointed or worried what will happen to the rest.

How Is This Possible?

According to Credit Suisse’s 2021 report on global investment returns, they stated: “young investors today can expect to earn less than half the annual return that baby boomers enjoyed during their careers.”

Yet with low-interest and mortgage rates, a gig economy, booming valuations for BitCoin and Tesla, sky high earnings in the market and the vaccine rollout in place, how can there not be anticipation for massive growth?

Don’t all these factors make it easy for my generation to get ahead and make mommy and daddy proud?

The problem with high valuations, insurmountable amounts of stimulus and hope pushed into the economy is that fundamentals are out of the picture.

Although major indexes are at all time highs, this doesn’t mean each generation in the future will take a share of it and are doing well now.

Hype and the exuberance around retail trading and the SPAC frenzy have also lead to massive confusion amongst teens who’ve felt compelled to be a part of this new finance era with no fundamental backing.

Although inflation isn’t a concern, it is when it comes down to the record retail sales and spending done by youngsters. The pandemic has been challenging in many ways stuck at home, not able to live life like a teenager which has now lead many to impulse buy as stores and venues are slowly reopening ruining all their savings they’ve built up this past year.

Gig Economy Challenges

Working for yourself is a relaxing yet unrealistic way to live sometimes. Especially when starting your career, you want stability not necessarily freedom. You have the most time, energy and determination so might as well work as hard as you can to build up that nest egg, pay down excess student loan or credit card debt, set up a 401(k) match for match (dollar for dollar account) and build up your cash cushion within a job.

No job is perfect and won’t last forever. It’s not a marriage. Having my generation understand that earlier is better to steer them on the path for financial success.

In the meantime, while you are still fully employed, set up a few passive income streams to keep yourself afloat. Don’t quit immediately; that would be silly and erase all your hard earned work!

Some of my passive income streams include capital gains to dividends, affiliate marketing, investments, real estate, royalties, intellectual property and many more outlets will all help you earn as much or easily more as in a job without needing to necessarily work another job.

Once you’ve established these sources and see them helping you boost your net worth and portfolio amount, if they take up a substantial amount of your earnings per month aside from your main job, then you can decide to possibly quit and take out a severance in the meantime. Quitting anything is scary mentally and financially so make sure you are fully supported.

Yet, it usually doesn’t work out that way. In my parents and grandparents age, there was no choice than to go to college and then find and keep a job forever. Now with the rise of social media, online influencing, freelancing and independent contracting, everyone wants to be their own boss, not have a set schedule and work on their own time for themselves yet not only this is dangerous, it is leading many GenZers and Millennials into debt fast.

The Boomers and Gen Xers have taught us a keen lesson to not spread ourselves too thin. Working harder won’t cut it anymore. We need to work smarter and potentially longer to enjoy the fruits of what our parents did on the safest path. This is guaranteed, side hustles aren’t.

Now don’t get me wrong, working at the same job for 40+ years isn’t going to get you that far compared to bringing your company public. Yes you can rise up to the ranks, earn new positions and titles, but after a while, your fulfillment will slowly fade. You need more purpose and drive especially if you want to retire earlier than normal and that starts with taking advantage of your time today.

There are pros and cons to both lifestyles. Our parents took the conventional 1 job path at the same time with little risk = little reward besides stable income and investments on the side but this generation is doing the complete opposite along with having no investment in themselves while taking massive positions in companies based on their social media feed which leads to worse outcomes.

Balance out both scenarios and make sure to plan for the worst hope for the best. You have more control than you think and it starts with you.

Steps to Deal With The Upcoming Storm

It’s natural and healthy for the economy to have a downturn every 5–10 years. It’s a way for companies to be stress-tested, give investors a better idea on where the market is frothy, help the Fed do all it can to grow America and a tell-tale sign on how the economy is doing since the last recession.

Regardless if you are 70 or 7, there are some practical strategies that you can follow to not only impress yourself, but the generations before you because let’s be honest, there’s no better feeling than impressing our family.

The Best Investment Is In Yourself

You are the CEO of your life and must represent yourself well. If you don’t, then there is no way to get ahead of the competition and be employable. Although most of us are more similar than different, you can easily stand out by starting early and doing things others don’t do on weekends for instance.

It’s also key to remember that getting a 9–5 job shouldn’t be an embarrassment.

Entrepreneurship isn’t for everyone and shouldn’t be glamorized. Companies teach us how to be resilient, work with difficult people and menial tasks and learn about an industry through a difference lens.

If you love structure, consistency and working within a set time frame with a team, then its best to do what works for you. After all, it’s your life your living, no one else’s.

If you want to get ahead of the crowd, invest in yourself by trying new things, experimenting, failing, meeting new people, designing and planning out different courses, taking programs and bootcamps online, reading intellectually stimulating books, etc.

The more you try, the more you will learn because mistakes are your best friend. If you don’t try, you never know. The younger you are, the more mistakes you are able to take because you have minimal responsibilities and dependents such as those kiddos.

It’s Not How Much You Earn/Make, It’s How Much You Keep

You could be the highest paid IB banker in America but if you spend it all on drugs, girls, yachts and who knows what, then you will be as poor as the poorest. The more you make, the less you keep and pay more in taxes.

Lifestyle inflation creeps up since money fools our minds.

Unless you live in 0 tax states such as Florida, Alaska, Nevada or New Hampshire, you won’t have to pay income tax, but most of the in-demand lucrative jobs are in coastal cities anyway.

Earning income should never be your sole income that you should rely on. We learned that from our parents. Saving is much easier than spending or earning and can easily be done through investing and lowering your living expenses.

Most kids (GenZers) and or Millennials focus on what others have, yet that is a dangerous way to live. Be appreciative of what you have, value less = more and stay prudent by becoming a frugal minimalist. You don’t need to impress anyone, no goods or amount of clothing will make you a better person and being frugal isn’t cheap it means you are grateful for what you have. Invest in appreciating assets not depreciating goods by earning income that will last.

Balance Your Risk

More risk = more reward but it could also mean you loose everything you started out with. Risk everything you are willing to loose. The more you educate yourself, the more risk you should take. The less you know, the less you should try, except when starting a venture or project because in that case, you learn more of it on the job while performing the task.

The younger you are, the more risk you can take in the market but not much until you loose it and go into debt. Surprisingly the average net worth for a 20 year old is $0 so if you aren’t in debt, you are technically above average. Not necessarily something you should be proud of or want by itself, but a number just to keep in mind when realizing how easy it is to loose money.

Ways to manage your risk appetite:

Diversifying: Invest in ETFs or index funds (basket of diversified stocks tracking an index as a whole) instead of individual stock picking which will make you go insane and be wrong most of the time

Holding: Don’t try and time the market-instead look long term and do less work for more consistent gains without the crazy intra-day volatility

Have tax-advantageous accounts: Set up a pre-tax (IRA and 401(k)) and post-tax (Roth IRA) where you pay taxes before you deposit the funds to grow via compound interest. Don’t look at your salary or bonus, set up automatic transfer so it doesn’t fool you into spending

The money pulled from your take-home pay and put into a 401(k) offered by your employer by a match benefit lowers your taxable income so you pay less income tax when you withdraw the funds after age 59.

Minimize Fees: when you are young, you don’t need a money manager or broker. You have the most time to invest a portion of your savings and do the work to learn about the market. Even if you don’t major in business or become a trader, it’s vital you understand how to minimize those pesky fees and take control of your portfolio yourself. Don’t go overboard or end up paying a broker expense or transaction fees for something that you can easily do. It doesn’t require work or turn into a full-time job. They have no secret sauce or crystal ball. Banks simply have traders monitoring the markets just like you.

Never Underestimate Cash

Cash is truly king but as with everything, too much of anything is a bad thing. I would advise to have no more than 20% of your net worth in cash. This is a prudent and strategic way to live in order to not spread yourself too thin and put all eggs in 1 basket.

If we’ve learned 1 thing during this pandemic, it’s to plan for the worst, hope for the best.

Understand how much you spend each month and double that by 6 months. Always plan for it to take longer than it seems to get a job and back on your feet.

Pretend you loose all of your income streams tonight, will the cash amount keep you stable?

6–12 months will put you on the right track. Prioritizing risk management and making sure you come up with all worst case scenarios will put you on the right path to avoid bankruptcy, eviction, homelessness, etc. It never hurts to over plan and prepare.

Although your parents of course want to see you live a fruitful, enjoyable and the most successful life possible, remember, it isn’t there’s. We have a lot to learn from their generation and grandma’s so acknowledge it but remember to focus on what you can control as well. The world is innovating at a rapid expansive pace faster than any other generation in the past which requires you to know what you are worth, diversify, try different opportunities and have a set plan.

Nothing beats a well thought out plan.