The ideal investments offer sizable adjustable return and scalable impact.

Only caveat: They rarely exist.

These days investors are pouring more money into ESG (environmentally social governance) funds striving to leave a mark on their investments believing in funds that eliminate fossil fuels, combat climate change and promote diversity yet these managers selfishly expect a lot more in return as well.

Their money isn’t always headed where their mouth is. They crave juicy returns taking on risk, something institutional investment funds and conservative managers are skeptical about.

ESG criteria is attractive as a niche investment sector. It has risen in popularity in recent years as activists such as Greta Thunberg have come into the spotlight highlighting how our planet is populating while getting hotter, more polluted and dangerous killing wildlife and endangering our future.

The Covid pandemic has inadvertently sent signals about our warming planet. We discovered phenomenons such as how much cleaner the air could be without traffic jams and abound flights, the beauty and preservation of endangered species and most vividly our relationship with the earth and why it’s vital to take care of it on our own through monitoring our gardens and recycling efforts.

Yet when it comes to investing and practicing what we preach, it isn’t always synonymous considering businesses aren’t always designed to be economically efficient and preservative. Their number one intention isn’t to take care of the earth, it’s their clients and they’ll do anything for them since money always comes first.

If they need to fly, they will get the most luxurious jet and if they buy excess food for a client meeting, they can afford to dump it.

Now A Days

Companies and economists estimate business travel to slowly come back to the same levels as in pre-pandemic in the next few months due to unprecedented pent-up demand. Many are also adopting an in-person remote hybrid landscape while the largest companies, mostly bulge bracket investment banks in high cost cities of New York and Los Angeles, are requiring all employees to be vaccinated, commute polluting the world, spend more on fast fashion to look appropriate for the office again, travel to shack hands and leave and eat take out.

Regardless of the costs, they need to keep business flowing and these companies believe the best way to do so is when a team is all back together packed like sardines on the trading floor. Personally I don’t mind commuting again and spending more on experiences than sitting home via Zoom.

Down the road, a true test for companies will be profitability. If they notice the in-person workflow lag, then they might reconsider implementing work from home again although for junior bankers and fresh grads, that isn’t always preferable considering they tend to work more, their mental health suffers and they need to do everything in their power to be seen and get noticed for those bonuses and extra brownies points.

As of now, countless businesses from a variety of industries, except for IT, are getting back to the less-economically Earth friendly way but with good intentions for teams to nourish their headspace and get back to a real foundation.

ESG Who?

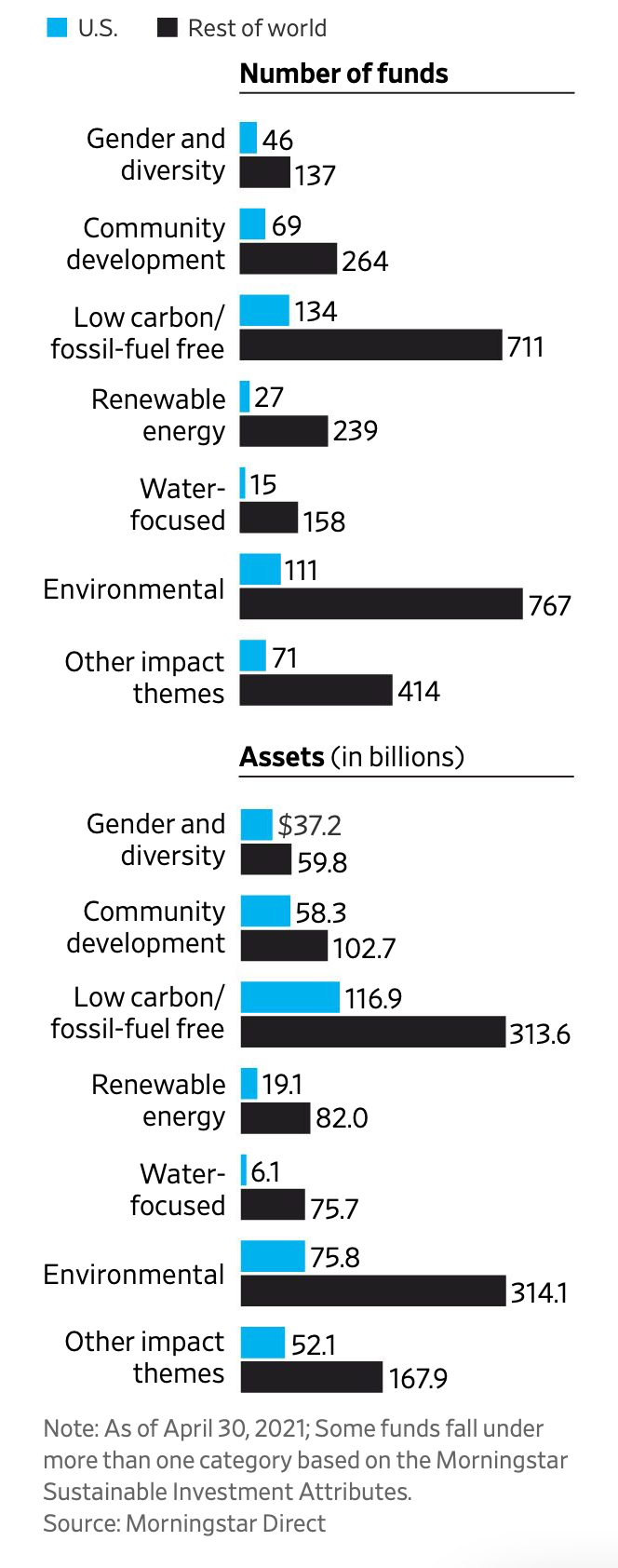

There are various approaches to sustainable investing. There’s no ‘buy the dip’ phenomena here. It’s all passive investing designed for long-term impact. Just like Rome wasn’t built in a day, the Earth can’t get 10% cooler overnight. It is intentional impact investing aimed to promote the health of the environment, the well-being of society and workplace diversity.

In the most recent years, clean eating and beauty, exercising, mental health, and dieting such as Keto to intermittent fasting have all been popular areas younger consumers, Millennials in particular, are spending their hard earned minimum wage paychecks and time in, valuing their mental sanity and considering their future, something previous generations wouldn’t consider given that social media, influencers and prioritizing “you” weren’t so chic.

ESG means different things to different people. To Millennials it could mean spending less on brand name clothing and buying thrift reusable second-hand clothing and to their grandma it could mean cleaning up the streets of New York.

There’s a fund for all of that!

At the end of 2019, about $17.1 trillion-roughly 1/3rd of all assets under professional management in the U.S. were managed using some form of sustainable-investment strategy according to the most recent data from US SIF Foundation, a sustainable-investing trade group. That was a 42% increase from two years earlier. This year, a net $21.5 billion flowed into mutual funds and ETFs that use ESG screens which is double the he net inflows the prior year as well according to MorningStar Inc.

So what does this data mean?

Individual investors believe that their money can actually work for greater society and address challenges the world is concerned with. It’s relieving to hear that investors aren’t so self centered and maybe that’s in part due to the market’s extended rally. It’s looking a bit opaque, on the edge of a possible correction, leading investors to dive into somewhere else besides the classic post-pandemic trades.

I’m guessing a bit part of this interest in ESG and #cleanearth is coming from a brand image perspective and allure. BlackRock, the largest asset management investment firm is known to publicly emphasize their code of business conduct and ethics in capital markets to evaluate corporate behavior and predict the future financial performance of companies.

They are recognized for their ESG leadership in corporate social responsibility, sustainability, investment stewardship, transparency, and inclusion and diversity. They believe meaningful sustainability for stakeholders is key.

Worth It?

If BlackRock is doing it, while it may or may not be a publicity stunt, then it must be working!

More investors and companies from finance to healthcare are getting on board as material ESG issues focus drive better financial performance and diversification. Not only does ESG add diversification and impact one’s portfolio in a long-term way, it allows investors to have a say in how they are contributing to the world, something Millennials and younger generations are a big fan of.

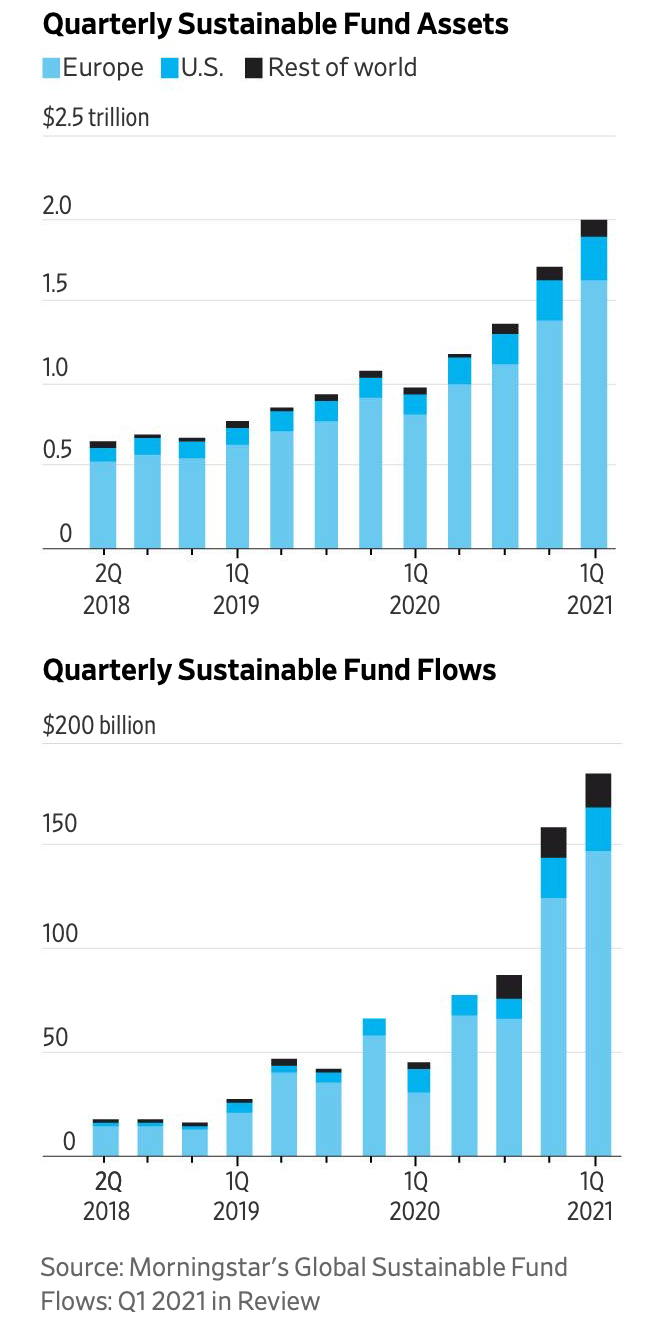

Most recent outside factors such as climate change and the racial and social unrest along with the global pandemic have illustrated how rapidly these factors spiral into the economy. At this point, there is continuing interest in ESG issues driving assets to hit nearly $2 trillion globally at the end of the first quarter of 2021.

Too Big To Fail?

Impact implies higher expectations and institutions have a promise and expectation to deliver exceptional results to clients.

The values-based investing pay off is a grueling debate. Last year, U.S. sustainable equity funds outperformed their traditional peer funds by a median total return of 4.3 percentage points while U.S. sustainable bond funds outperformed their traditional peer funds by a median total return of 0.9 percentage point, according to a report from the Morgan Stanley Institute for Sustainable Investing.

“Short-run realized returns are noisy because of luck or other circumstances, sometimes favoring ESG investors and sometimes favoring non-ESG ones,” Dr. Statman says. “Each tends to crow when returns favor them. The logic of fees, however, suggests that, in the long run, ESG investors are likely to earn lower after-fee returns than non-ESG investors,” he says.

Only time will tell if companies will be committed to diversity and improving the only planet earth we have. Companies are sure to be scrutinized, just like the monopolistic FAANGs on their climate policies as the Biden admin pledges to substantially slash U.S. emissions of greenhouse gasses by 2030. Sustainability ratings are a way for companies to compete and get down on the issue to advocate how well they incorporate ESG factors into their investment processes.

As of now, is it worth it for me and you to invest in ESG?

Consider your values. Are you ethically minded within your investments or couldn’t care less about earning a juicy return from spilling oil over the Gulf of Mexico or promoting fracking?

Pick your poison but overtime, it may sting.