It’s the most wonderful time of the year!

In the market’s case, it already surpassed its record highs and proven analysts’ predictions to be way off roughly a year and a half ago so by now, investors couldn’t be more eager to close out the year.

December is a time investors have the most pent-up demand partly due to exhaustion and frothiness from the year, a year like no other, or shall I say, another unprecedented one.

Exactly a year ago, the first person on the planet got their covid vaccine and markets started to get exuberant and a bit out of control. Frothiness and speculation were in the record books. Too much naughtiness for Santa.

At the start of January, a retail trading bonanza took off between retail trading platform, Robinhood plus its Reddit day trading gang versus the hedge fund, Melvin Capital shorting unprofitable ‘meme stocks’. Although GameStop reached a valuation of over a billion dollars and RoaringKitty cashed in a couple million, like many events in the market, this was another pointless brawl.

A few months later, craze revolved around crypto and NFTs. I’m sure many of you, including myself haven’t heard of half of these investments or shall I say, things prior to 2020. In my case, I didn’t even know what investing was as a 19 year old at the time. I had only started this writing gig circa June 2020 due to lockdown and I’ve learned a heck of a lot since! It couldn’t have been a more thrilling time to be immersed and get started in the markets. The only downside to starting today is that you lost time not starting yesterday and there are no deep discounts with these lofty valuations these days.

Fast forward to the summer months, a record number of IPOs and SPACs came into existence. Most were unprofitable and hit a record high of listings since the 1980s. DeFi and FinTechs were taking the charge, AI and the metaverse were being explored.

Since Americans had been flushed with fiscal (3 stimis) and monetary stimulus (low interest rates/mortgage rates) since the pandemic began, we witnessed the fastest recovery out of any recession in history. Revenge spending took its course which drew inflation to become hyper.

Thankfully wages rose 4.5% last month and employers are expected to increase them as competition is fierce for top talent and the cost of living ain’t cheap. But the main indicator on how to chart inflation’s course is through the Fed’s actions. FYI. Never fight the Fed.

Now finally to close out the year, a new variant has emerged. Black Friday, coincidentally what would seem like the best day for the markets with record amounts of consumer spending and deals after Thanksgiving, the market ended up having its worst day since October 2020 with concern over the transmissibility of Omicron. As data has been rolling in since it was first detected in South Africa, the transmissibility of the variant is fierce, potentially faster than Delta but there are no signs it is deadlier which has allowed the markets to rally pre the scheduled Santa Clause rally which is known to cap off the year on a high note.

After that reassuring news, the market seems more concerned about the Fed’s rate hikes than the variant. It’s hard to choose which one is more worrisome but nonetheless, the markets have been oblivious to the news ever since.

Santa Who?

A bull market is common during the last few weeks of the year. What could possibly go wrong on December 31?

Well, just because this year is nearing a close, doesn’t mean everything will turn into a market surge and assets will record above-average returns. Keeping your ego in check and never confusing skills with a bull market is prudent to make sure you realize anything can happen anytime in the markets and it is usually not based on technical analysis.

What’s certain is uncertainty but this year with the excess froth, speculation, retail training bonanza, and millions of accounts opened on brokerage platforms due to fiscal and monetary stimulus, there are more investors than ever before. This excess liquidity brought frothiness, speculation, gambling, alternative unheard of investments, and expensiveness.

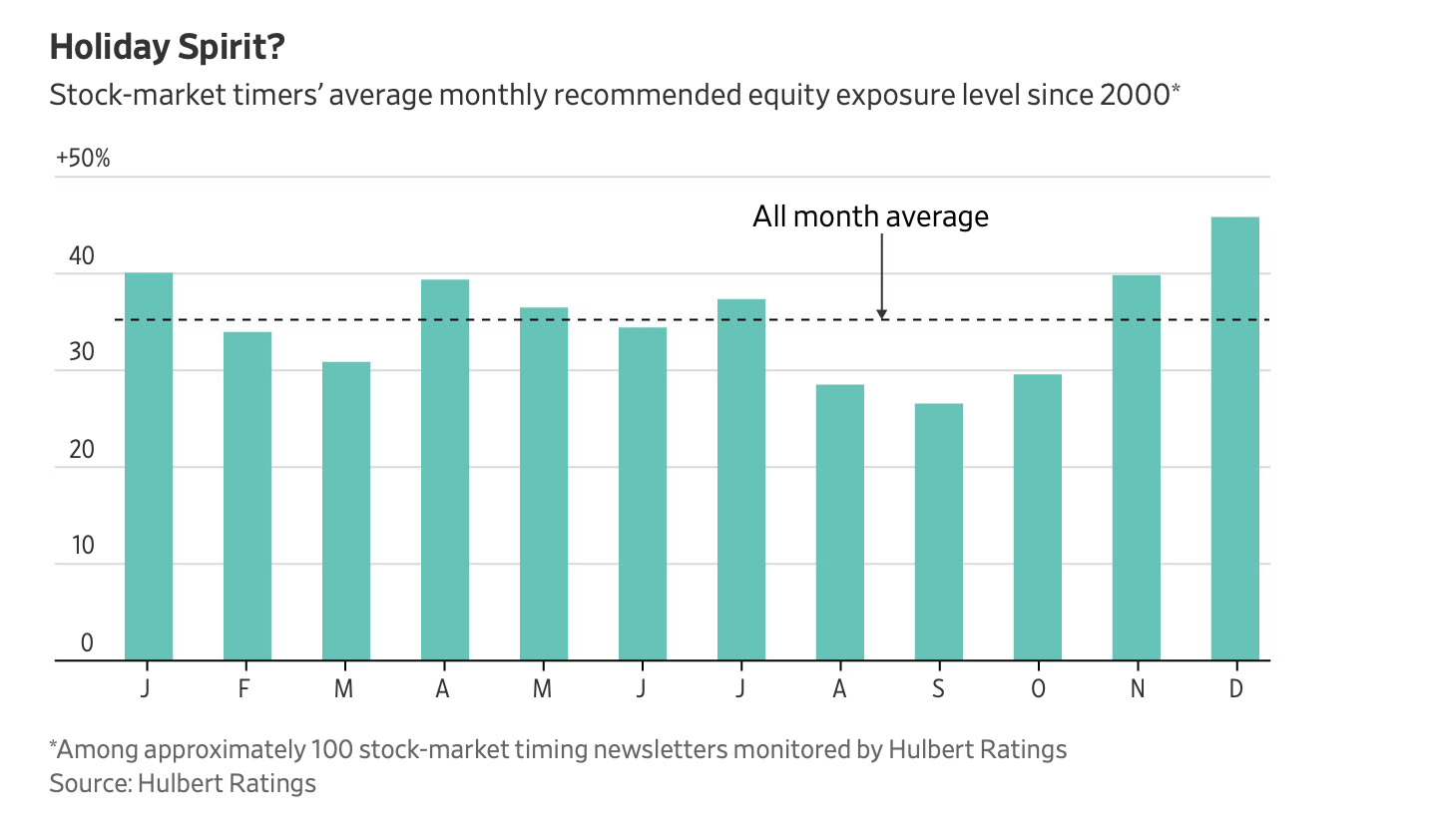

December confidence tends to be unbeatable and in the past, 43.9%, investors have leaned on the more bullish side, higher than in any other month according to the American Association of Individual Investors. Compared to September, the most volatile and choppy month as investors come back from their Hampton’s vacations and a new quarter is near, in December, everyone is ready for a fresh year, not a school year.

Naughty or Nice

Speaking of the new year, there seems to be more uncertainty on the horizon. With supply-chain constraints turning into a political agenda as ports are required to be open 24/7 now with a shortage of shipping containers and holiday demand, inflation on the rise and will continue to be hyper until pent-up savings diminish and spending resumes to normal levels, most likely after the holidays.

With the record number of IPOs and SPACs this year, profitability has not seemed to be cool and most likely won’t hold on till next year. Compared to the 1980s when over three quarters of companies were profitable relying on fundamentals not long-term prospects, in 2021, only one third of them had positive cash flow!

With venture capital, angel investing, private equity buyouts, M&A activity, investment banking, sales and trading overload, the financial sector had another record year and so did retail and institutional investors but will this eventually normalize again? I have a feeling it must otherwise we will become priced out of another market alongside the housing bubble which is on fire.

Santa Clause Rally

Analysts and those on the trading floor are predicting the Santa Clause rally will be muted this year. They aren’t Grinch. They may be right. Any variant can come about anytime and ruin future prospects.

Due to loft valuations and excess liquidity in the markets, the markets have already reversed course and reached their record highs a few months past the pandemic’s start so it is unlikely that we will see anything monumental.

Whatever happens, happens. All we can do is hope that the market end the year strong and our communities get vaccinated, especially lower-income families who don’t have as much access and or time-off to get inoculated. The vaccination rate is the best predictor to normal life, a predictor pandemic ravaged industries from airlines to hotels, cruise lines and Las Vegas are eying.

If you aren’t exhausted yet and still scouring for opportunity in the market, buying low, selling high is always your friend. In addition, if you are wanting to sell your losses to offset you capital gains tax burden before the end of the year, tax loss harvesting is a common approach. Just make sure to obey the wash-sale period, by waiting 30 days to repurchase the security if you must. I will write a post in a few days about this tax advantageous strategy since harvesting doesn’t make sense in the winter. JK.

In this overheated expensive market, there may be no discounts in sight so the best approach is to passively invest. The buy and hold strategy never disappoints. It’s a foolproof way towards diversification and a piece of mind. The year will end whether we want it or not. The markets are made to be volatile but our portfolio allocation doesn’t have to be.