Everyone likes to spend money. It provides us temporary satisfaction and unfortunately most people will forever believe that money brings happiness. 🎭

Sorry folks.

That is completely false even though it is hard to believe.

To prove it, look at the countless experiments that were done on this subject or just take The Science of Happiness course at NYU, I had to reveal my college eventually.

Believe it or not, over a certain amount of income, $75,000 per year to be exact, your happiness starts to plateau and although you think that more money will be an easier lifestyle, it doesn’t. Why?

You have more responsibilities.

STORY TIME 👩👩👧👧

Once upon a time, You were the biggest billionaire in the world, owned dozens of properties, slept in a new city every day, and had all you want, no needs left.

You are sitting on a beach in a lounge chair with champagne and maids around you.

PROBLEM: You take a sip of that champagne and swallow. You feel you have a sore throat.

MEANING: No matter how much you have, none of that will help you if you are sick. I always prioritize my health because it is your baby. It is more important than ANYTHING in life and without it, you cannot achieve anything.

Tip for my fellow teenagers: If you want to live a fulfilling life, don’t attempt any risks to your health. It might seem cool in the present, but long term get ready for suffering.

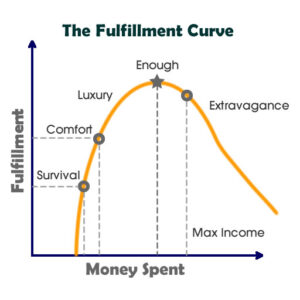

As I’ve learned how to budget, save, invest, and plan for the future, I’ve learned that I really DON’T need much in my life to be happy. 🥳

I’ve quickly turned into a minimalist, thanks to Marie Kondo: Tidy Expert who has CALMLY made me rethink everything I own.

No stress added. 🛀

Honestly, rethinking what I own and as someone who doesn’t like clutter, especially any cluttering show on TLC, it can make me anxious.

I can be considered a maximizer, one who evaluates every possible decision through tediously comparing prices, sales, and attempts to find the best bargain. That can be draining and that is maybe one of the reasons why you can call me crazy.

Yet, it makes me appreciate and be grateful for the money my family has earned. They didn’t inherit extraordinary amounts of wealth living in this country for centuries. They were immigrants from Poland and my parents found their way to an affluent town in NY coming from Europe. Compared to the other residents who’ve usually inherited their wealth.

Enough about me. This is the JUST ENOUGH section after all.

Let’s cut to the chase and discuss briefly why these few things will hurt you financially.

INTRODUCING: THINGS I NEVER AND WILL NEVER BUY:

1. Coffee and other drinks. I only drink the cheapest and healthiest: Water

I don’t even drink coffee but if you do, just invest in a one time purchase of an Nespresso or whatever coffee machine you can find! Grab it to go in your reusable coffee mug to work and don’t waste money + time waiting for Starbucks to write your name wrong. This is how much it will approximately save you per year:

2. Hold Off On The Concerts and Coachella thing.

I get it. It’s the experience. I love the experience. Traveling, exploration and quality time with friends and family are why we exist. But events that will ruin your ears the next day and something you can stream from home personally is not worth it to me. Check out this thing YouTube for it!

3. Those Dangerous Teen Gatherings

Parties do not end up going smoothly, especially for youngsters who like to “experiment.” People make bad mistakes that sometimes ruin the rest of their lives during these types of sketchy, dangerous parties. I’ve never been to one and don’t plan on it. Plus, I’m not going to waste a full day afterward recovering. Other parties with professional adults are acceptable. Yes, I’m starting to act like your mom. Yes, I’m an only child, I’ve been once since I was five. 🤷♀️

4. A Bunch Of Those Pop Sockets and Cases

LifeProof Cases look too bulky even though they work. Casetify: Is The Same, Maybe Even Better Quality For Half of the Price You don’t need to mix and match them depending on your mood. The chances of you breaking your phone by the time your new case gets delivered through these delayed times are higher.

5. High-End Jewelry (or any) and Designer Clothing

I cannot. I’ve dressed like those billionaire tech guys since I can remember and it saves me time. Unless it is an investment and you wear it, it is not worth your money.

It’s not worth your time to impress others because, at the end of the day, those who you try to impress will not care how much debt you are in. When I think of those who buy markup clothing, I believe it is the worst financial mistake they could make, besides owning a designer car.

That’s it. There is no reason it is a good decision.

6. High-End Car To Just Be Flashy

Don’t get me started. You better know that the moment you drive it off that stubborn lot, it is already depreciated in value.

7. Eating out

I buy Trader Joes every weekend and pack my own lunch. You can call me a baby but I prefer eating my own food that I portion out and know what’s inside. I’m healthier and richer that way.

You don’t have to be as crazy as me, but I like to eat the same thing every day. I enjoy consistency and routine. I have never found myself bored with it as well!

If you want something healthy that can be delivered and in the budget?

I heard this from my grandma and she has tried all of the delivery meal kits before. This is the only one that she and I enjoy as well:

Sun Basket: Healthiest Delivered Meals

For now, I have bombarded you with all the main things I can think of that I have never and will never spend on.

With not getting stuck into these millennial or Gen Z, Baby Boomer traps, this is why I have achieved financial success.

Now, of course, my favorite part:

INVEST IN:

1. A Water Bottle (Non-Plastic)

I use S’well: S’well Water Bottle

2. Airpods Pro (You know where to get these. Might as well scroll their site)

If you commute as I do for 2 plus hours on the Subway and Train, investing in noise cancellation earbuds is a lifesaver.

3. Exercise Equipment at Home-SKIP THE MEMBERSHIP

Ever since quarantine started and I’ve had to force myself to stop going to workout classes before they were closed, I’ve become a big fan of working from home. It might not be for all of you but for someone who is motivated to make no excuses and get shredding, it is a great time and money saver!

I’ve done everything from SoulCycle, Equinox, Pure Barre, to countless other gym memberships. They made me feel I was obligated to use them daily or I felt I would be wasting money.

Equipment that I have in my apartment:

Any Nordic Track Elliptical. On Fleek?

4. Weighted Blanket

Baloo Blankets for Anxiety and Stressed Out Folks

As someone who takes 3 hours to fall asleep and has always had my mind raising while being sleepy, this has been the only product that has truly worked for me.

I’m a stubborn cookie as my mom likes to call me.

I refuse to take drugs or any drinks to calm my mind down, earplugs, a white noise machine, or blackout shades.

Baloo Works. That’s it.

5. Mac, Please No Cheap Laptops With A Life Expectancy

As a student, I’m pretty impressed to see that the laptop that I’m currently using to type this amazing piece of art is almost half my age=11 years.

Apple delivers quality at an unaffordable price for some.

But, it is WORTH IT.

As you can tell, I still spend money! The goal is to evaluate your NEEDS vs. WANTS in life.

I can’t tell you what you should get or not. I don’t know your circumstance and what you need, but all I do know is that you have clothes in your closet that you haven’t worn in months, food in your pantry that is feeding the ants, and randomness that you don’t even remember buying.

We are all guilty of this and IT IS OK, as Suzzie Orman puts it.

Now For the Tools:

There are a few things that I’ve implemented into my brain for a while now. Once, again, as with everything I do, it takes motivation, daily habitual practice, and MINDFULNESS.

No, not meditating on a rock in Tibet, being present, and evaluating decisions.

Now, for the tools. The gateway to success?

Some of the tools I use every day that help me become more mindful have helped my family never own a single piece of debt and be financially successful.

I know, ugh.

This is a boring topic for you all teens who could care less and just want to make another Tik Tok video now.

Well, eventually you have to know and warning:

COLLEGES DO NOT PREPARE YOU ENOUGH FOR THE SUDDEN TRANSITION FROM THE CLASSROOM TO CUBICLE (IF YOUR LUCKY, PING PONG TABLE AT SOME FIN-TECH SPACES 👌)

Now, the holy grail. The tools you should know that unfortunately, we are not taught in college (unless you strictly major in finance):

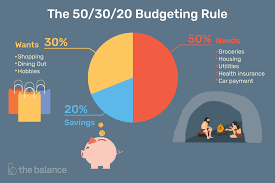

- The 50/30/20 Budget Rule:

- Getting a credit card to start building credit at an early age

- Whenever making a purchase, I always check WireCutter for reviews

- Understanding what a will and trust are. I know this is hard topic. No one likes talking about death, but if you plan for it, it will save your family a WHOLE LOT OF HASSLE. TRUST ME, I’ve been through it with my own parent.

- Revocable Trust to avoid probate

- Understanding that debt is not always bad! There are different types.

- A tool to manage finances from multiple accounts and is not advertised enough: Personal Capital

- Diversifying and investing in your portfolio

- ROTH IRA-Let your money work for you 24/7 and take it out penalty and tax-free!

- 529 C plan for College

- Savings for retirement. 401K. Yes, it can be intimidating to think about this now. But the key to personal financial success is PLANNING. Add a little now, that’s all that it takes

Last But Not Least, These Are the Digital Tools I Use Daily To Educate Myself For Free:

- YouTube: Graham Stephan

Graham Stephan’s Youtube Channel

- Podcasts: Something you Should Know, Suzzie Orman

Best Podcast to Get Smarter, Faster: Something You Should Know

- Blogs: Financial Samurai. And no, we are not in competition.