When you think of the most ideal tax-advantageous strategies to legally pay the least amount in taxes, without spending hundreds of thousands of hours and trust money on lawyers, accountants, tax attorneys, etc., owning any kind of business will forever be a top contender and make your life easier when it comes to tax season.

And for the rest of the year, with a business, expect to endure massive growing pains that will be well worth it in the end. For tax savings of course.

Once you have some type of intellectual property that can add value to someone, anywhere, profitable or not, Uncle Sam will no longer chase after you.

Since more than 60% of Americans did not pay income tax last year, you shouldn’t feel bad about living the American Dream, reinvesting the earnings back into your business(s), and declaring a lower annual income for yourself.

A basic rule of U.S. income tax is that individuals pay tax on their entire gross income and businesses pay tax on their entire net income after expenses are tax deducted and income flows directly into owners’ pockets. For W2 income, expenses are sadly not deductible.

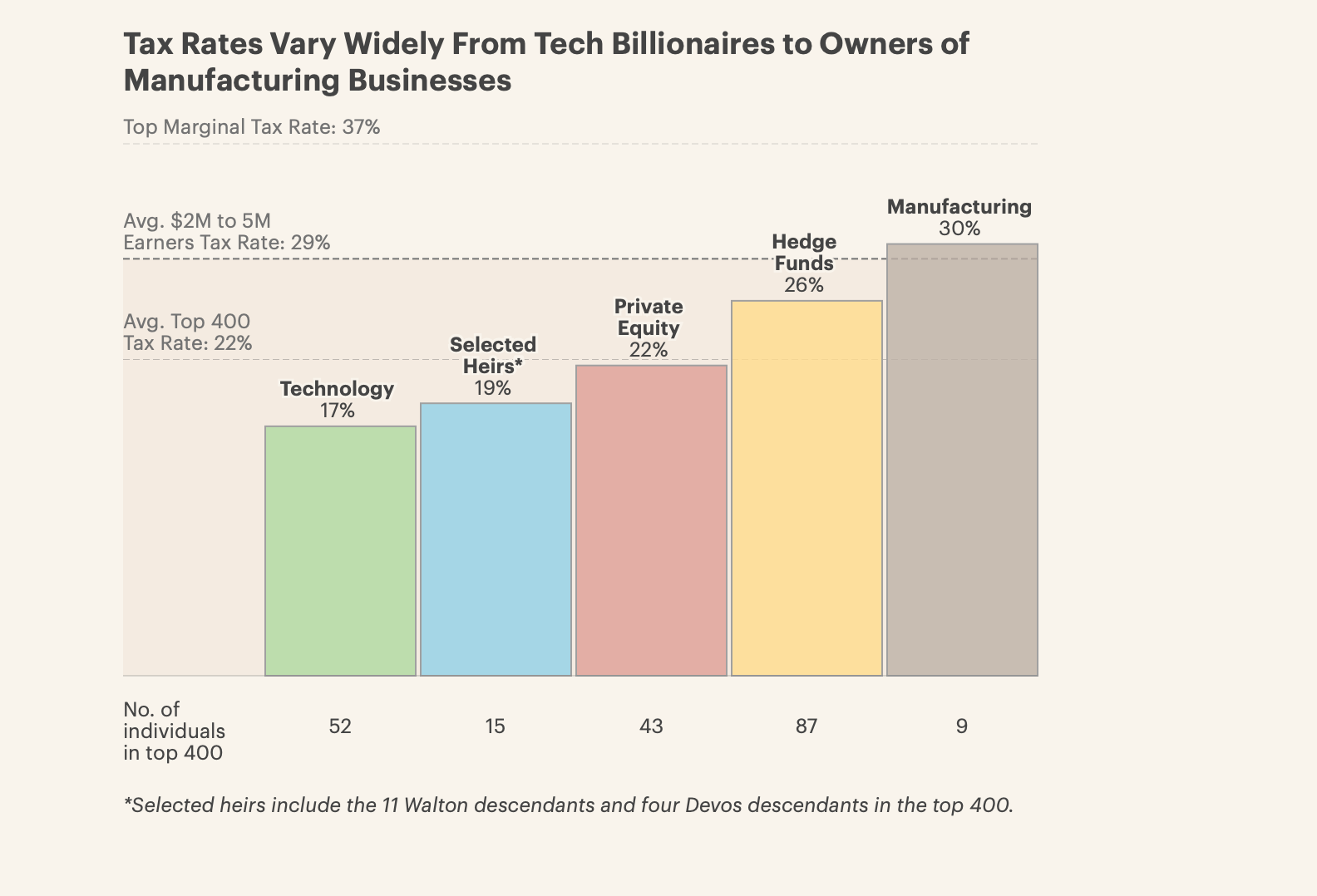

The top .001% and counting who earn 9 to 10 figures per year who mainly make up the industries of tech, real estate, investments-hedge funds + private equity, and industrials + manufacturing use the same kind of tax write-off system we business owners, freelancers, retail traders, influencers, and every day stealth wealth millionaires with multiple streams of passive income can follow as well.

Instead of relying on their income to pay for basic everyday goods such as food and gas, they have much more bargaining power and oftentimes declare their assets as collateral when borrowing money if they want to own a $43bn social media company or something of that nature.

They use borrowed money to fund their lifestyles, not their paycheck especially since many wealthy founders are cash poor. Although cash got a bad wrap during the rock bottom interest rate period we experienced these past few years, it is finally becoming king again and should always stay that way since what’s certain is uncertainty.

Rollercoaster Ride

In the U.S. there is a progressive and regressive tax system. Progressive, as the name entails, means the more income you make, the higher your tax rate is. Through a regressive tax, a.k.a., consumption tax, standard goods have a base tax rate that everyone pays regardless of income. This includes state and local taxes.

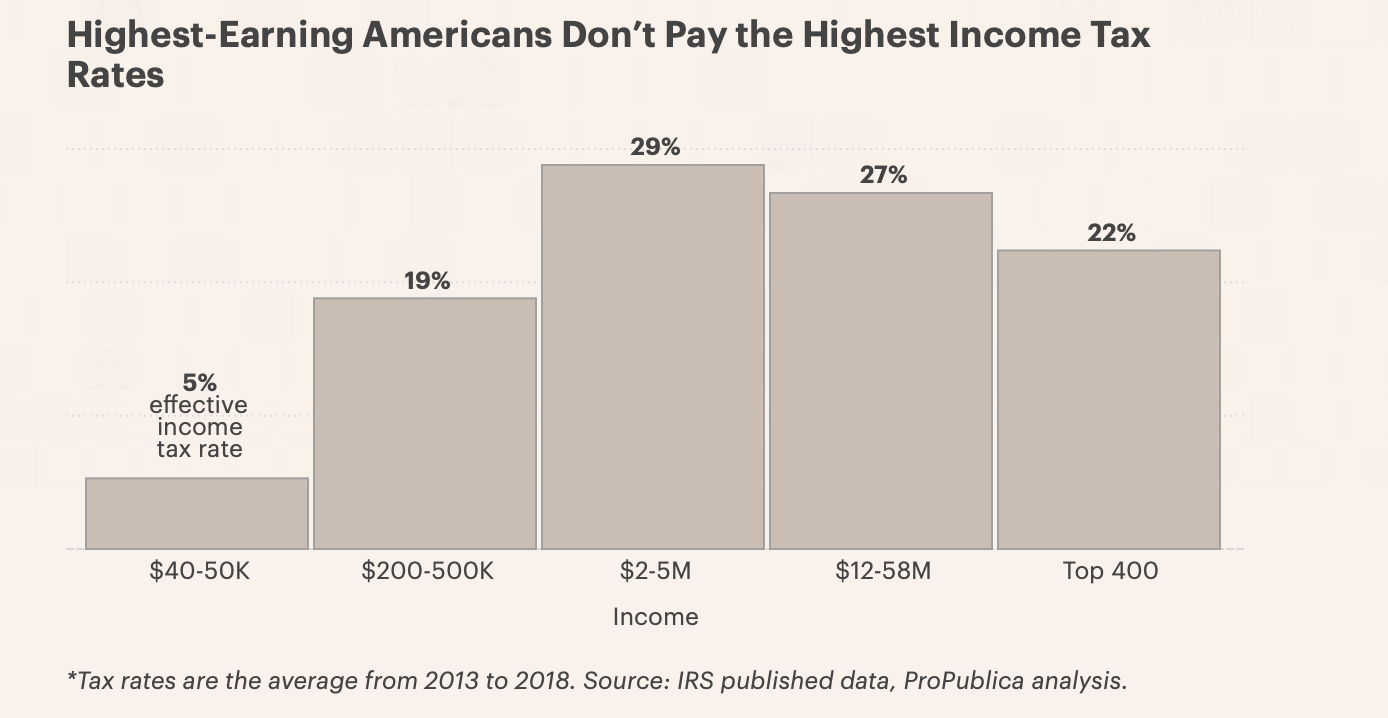

Although the progressive rate should be progressive, it clearly isn’t and cannot be relied on. If the top 1% on average paid an income tax rate of 29% from 2013 to 2018, this progress is clearly inversed due to the way wages and investments are taxed.

I’m sure you can guess which one is taxed at a lower rate based on which class triples their wealth per year. Even the top 25% paid a conventional income tax rate of 16% and the gap is only rising due to the pandemic’s meteoric inflated gains, new asset creation, record businesses, and tight labor market and housing bubble.

Before we jump into the 3 step plan, how do the richest Americans actually get away with paying lower personal federal taxes than lower-wage earners?

Aren’t they highly scrutinized and watched over like a hawk? In the opposite way.

The richest Americans’ earnings don’t get eaten up by Socal Security or Medicare, a large part of the majority of workers’ income tax and they instead pay less in taxes for these programs that are run by the government.

Payroll taxes are deducted from W2 earners’ paychecks since wages take up a bulk of their total income while through the inverse progressive tax system, the highest-earning Americans pay little to none of these taxes becuase they amount to such a small percentage of total earnings.

Borrow or Bust

Just like happiness, up to a certain annual income, your time versus effort for a paycheck that puts you in a 37% tax bracket may not be worth it since you can keep majority of those earnings owning a business. Plus, with those types of checking balances, inflated lifestyle is most likely to kick in and your tax rate will be through the roof before you know it.

For many, it would be better for their morale, health, family situation, and overall wellness if they weren’t sabotaged by the allure of their high paycheck. At least hide it from yourself if you can, continuously live below your means and have real economic security through other means as well. As long as you are aware, that is most important.

Similarly with the rate of income tax, on average, once one gets into the pay range of ~$2–5 million, the rate of income tax people pay does not climb and ascend with their income.

The trend actually plateaus for the top 1% who paid an average income tax rate of only 29% and this only drops further the more one makes. The wealthiest Top 400 richest attempt to hit the sweet spot of where their income will come from stock sales taxed at a lower rate around a long-term capital gains rate of 20%, half of the ordinary income they really should pay of 37%.

Not to mention the tax rates differ greatly depending on the type of business they structure and own. The way a business is structured can change the the types of taxes they pay on earnings.

For example, income from public companies is taxed at a C-corp level but once passed to large shareholders, founders, usually through the dual-class structure, comes in the form of dividends which are taxed at lower rates than ordinary income. Compared to hedge funds and remanufacturing companies, the income flows directly to the owners who pay higher tax rates on the income not paid out in dividends.

Compared to W2 income, business owners take their revenue, subtract the expenses, and pay tax on the difference. Since most expenses are tax-deductible, no matter how large the venture grows, one will still be paying the same or base federal income tax.

Once you can get to this point, you have no pay ceiling and tax hikes.

Here’s how this simple 3 step process millionaires and beyond follow to protect their hard-earned earnings:

Step 1: Buy

Do It.

Buy an asset, inherit a fortune, renovate rental properties, or build a company ON THE SIDE FIRST.

As long as you don’t sell an asset, you don’t owe any capital gains tax (>1 yr) or income tax (<1 yr) so you can keep your income as low as possible.

Step 2: Borrow

Borrow against your holdings (collateral) and the bank will give you a good deal.

“I’ll loan you $50m with only 2% interest”

They are loaned money to afford their lifestyle all while paying little to no taxable income only interest on their borrowings.

Step 3: Die

The wealthy use complicated trusts and philanthropic foundations to avoid estate tax so their heirs can easily inherit their assets tax-free.

This allows a new generation of ultra-wealthy new money to flow through.

With more dependants, having your estate plan in order is a must in order for a smooth transition of your trust’s assets.

Saving on federal income tax is more than possible when you have the guts to create something of your own and take the hardest step of starting.

The “Buy, Borrow, Die” method isn’t rocket science. It is a way for the ultra-wealthy borrow against their holdings to avoid taxes.

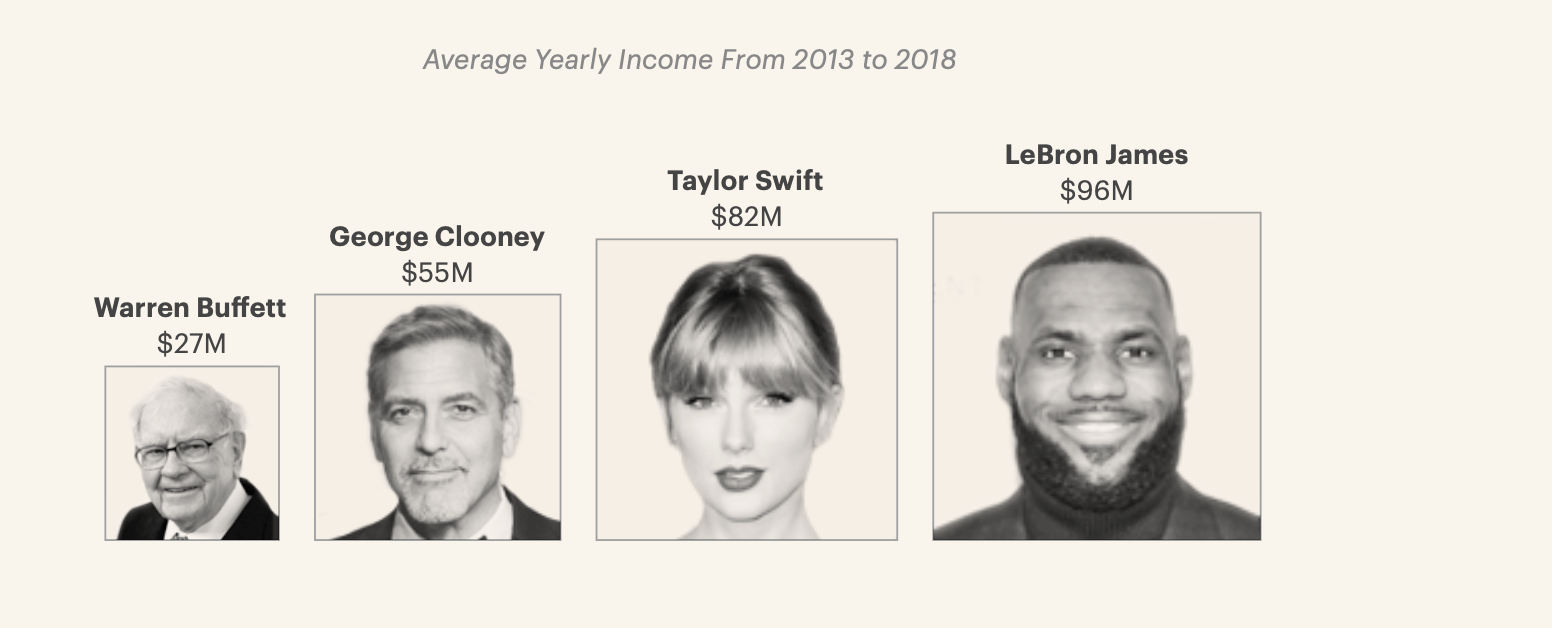

Legendary investor, Warren Buffett only earns an estimated $27M per year because he decides to earn that much and reinvest it instead.

Sadly, the federal tax system favors blue-collar middle-class Americans who usually live off of one W2 paycheck and have the majority of their net worth in their home or car. Although your primary residence is a terrific way to compound wealth in your home in a stable inflationary proof way, without investments, a side hustle, or uncorrelated asset(s) which are major components and drivers of sustainable wealth, you can only reach so far.

Ultimately, if you want to rise up the socioeconomic ladder and still help your fellow Americans, donating to charitable organizations anonymously is a great way to support those in need. If you donate $1m+ to a plaque on your children’s college library or a wing of a building for legacy giving purposes, you are clearly helping yourself more.

As the tax system slowly gets repaired while members of Congress apparently engage in insider trading, it’s never too early to start focusing on increasing your allocation into the market and capitalize on your skills in multiple areas, or else the tax system will always go against you. You can work harder or smarter. Chose the latter.