These days, financial burdens and mental health are usually the key suspects when examing the skyrocketing rise in suicide rates during the pandemic. Although these do account for a hefty percentage of the cause of these deaths, there are unexpected platforms that don’t seem to do damage because everyone hides their true selves here. I’m talking about the platform we’ve all been exposed to for quite some time now, our frenemy: social media.

But if you thought social media was bad, take a look at the booming business world with the trading platform: Robinhood. Following the suicide of Alex Kearns, a 20-year-old student who went into ‘massive trading debt’ in the late summer sparked controversy over Robinhood’s gambling practices and the way they teach young consumers invest and trade.

Now, Robinhood vows platform changes to enhance ‘good thinking’ and ‘practices’, even though as an occasional user myself, haven’t seen any since this incident.

Robinhood also donated $250k to suicide prevention. Very generous but I doubt that really solves the problem since their main goal as a company is to make trading fun, less expensive and of course, make money, not necessarily to fix a mental health crisis.

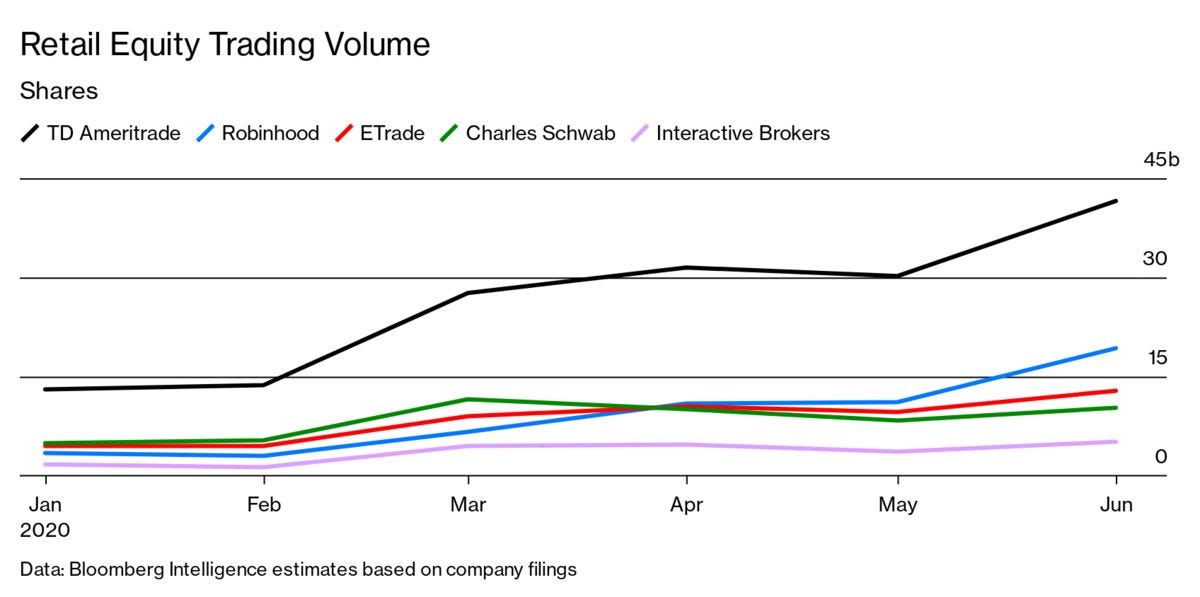

Robinhood has had a tremendous year with more than 13 million customers and 5.8 million retail accounts at the end of June 2020 with 4 million active daily trades, blowing past the brokerage rivals such as Charles Swab and T.D. Ameritrade out of the park.

It is certainly known as a pandemic pastime. It is one of COVID’s economy’s breakout success stories because people feel convinced that although they are using real money, it doesn’t feel like it since it is all digital. This is a bad thing becuase we spend double the amount if we paid with physical cash in a store. But since this is trading, it is all electronic, and exposing youngsters to the stock market is risky in itself. At least there is some education built-in as opposed ot binge-watching Netflix and shopping on Amazon Prime.

Pic

If you’ve ever been on Robinhood, it offers free commission trading and can seem quite complex at first.

It is simply to introduce you to the stock market instead of going through an individual broker that charges hefty fees.

As a 19-year-old personal finance guru and someone who quit social media now 7 years ago, as soon as I see a place for possible addiction, I avoid it.

Robinhood in itself can be seen as a game because the stock market is like gambling. You are trying to time the market and bet your money. It can easily get addicting and with the younger generation such as Alex, who was only 20 losing over $730,165.72, it is certainly a reflection of day trading gone wrong.

I know, I’m wondering the same thing. How did he get that much money?

So how do we strike this balance and learn trading not lose our savings?

It seems like we always need to leave the dinner plate shiny clean and not be okay just trading a few dollars.

Robinhood does teach GenZers and Millenials, the highest concentration of users, useful lessons that the broken down education system does not which includes financial literacy, the only real and only skill you need in your life.

But is there ever a way we can learn to control our behaviors?

I find that it is great to teach youngsters the earlier the better about investing, compound interest, and taking risk because we have a longer time horizon so it is acceptable but in reality, these platforms are designed to make us spend, ‘play’ more time on there and become addicted.

Facebook shows you ads designed to your liking.

If you are a Republican, they will keep showing you Trump ads, no Biden insight.

More scrolling = more revenue for them and the same thing for Robinhood.

Solution

In order to fix this, it is best to understand what you are capable of controlling.

I know for a fact that social media was the worst outlet for my self-esteem and productivity, so I simply abandoned it and haven’t felt FOMO since.

At 19 you really don’t need to set up the bad behavior of learning like a day trader.

Learning from YouTube or how your parents manage their portfolios respectively and hopefully, they do it in somewhat of a more calm, intuitive manner, then they are great leaders.

Plus, when you are younger, you don’t have time to watch the price trends, keep up with daily reports.

That takes a lot of work and maybe paying a broker will give you a peace of mind instead of wasting your time and money.

Opportunity cost needs to be evaluated everywhere.

I doubt that Robinhood will implement eligibility requirements for users to be 21 or older to use the platform now after 3 suicides have already taken place since June.

1 is far too many.

As we all know, Robinhood as a business seems to only be concerned about making the platform as yada yada ‘user-friendly’, interactive, addictive, and they heavily emphasize the customer buying power and returns to be shown front and center.

We’ll see where it goes from there but all I know is that learning from experience, especially when handling money is not always your best bet.

You could have all the money in the world but if you don’t know how to manage it, it’s pointless.