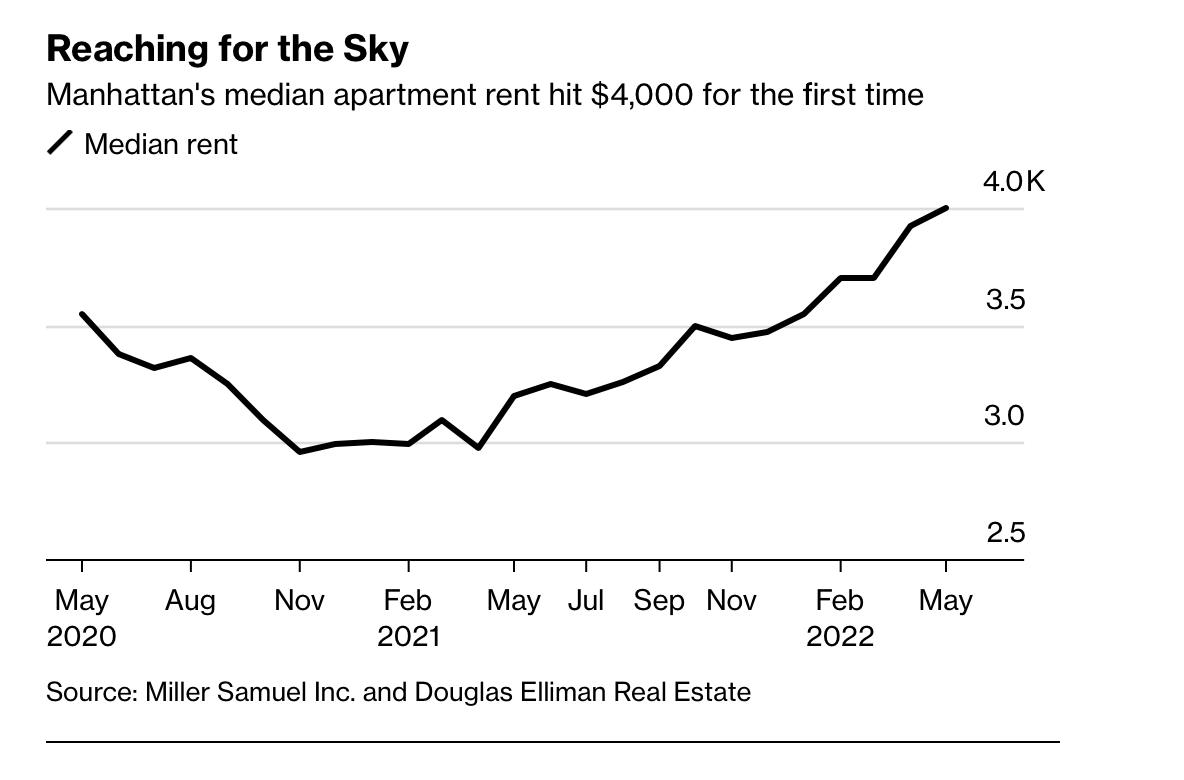

Although high-end luxury sales in the Hamptons to Beverly Hills have started to plateau for the first time since the pandemic began as eager buyers scooped in early to capture outdoor space and room for a WFH set-up, rents are soaring in 24 and 18-hour cities across the nation.

Vacancy rates are lower than pre-pandemic levels in many cities including here in NYC and the labor, housing market, and weather couldn’t be hotter.

Homeowners in 24/7 cities such as NYC, San Francisco, and Atlanta and 18-hour cities including San Antonio, Los Angeles, and Miami are profiting the most off of this news!

This is one of the main reasons real estate is one of the most defensible inflationary proof asset classes of all time. Not only you can depreciate expenses as it appreciates as a fully-functioning business, but it is also usable too! Owning 30 shares of Tesla won’t make you feel nearly as cozy.

As a physical tangible illiquid asset, real estate not only incentivizes owners to take better care of others and be able to manage responsibilities — their tenants’ needs, but also how to save enough to invest for the long-term to provide utility and a safe haven.

With the inflation report coming in hot at 8.6% for the month of May and gas hitting $5 across the nation for the first time this morning on June 11th, although the markets may be jittery, real estate has continued to soar. Another set of good news is that inventory is easing up as well.

Many may see this as an opportunity to price gauge as inflation is a prominent concern. That can defiantly be the case given the immense pent-up demand for cities however compared to the big oil giants and our favorite grocery stores, they are in more serious waters, directly accused of profiteering, taking advantage of soaring commodity prices amidst Russia’s invasion of Ukraine.

Surprisingly, Americans’ cash balances and savings rates seem to be too resilient given inflation is raging and New Yorkers are partying like never before. Industries ravaged by the pandemic, excluding urban real estate have practically recovered as well. Airlines recorded booking levels higher than in 2019 and leases across the country are being scooped up in only a few hours.

Although the national savings rate plummeted to ~5% from a high of almost 20% at the height of the pandemic, thankfully inflation is a self-correcting mechanism that will eventually cool down demand and bring down inflation itself. It’s only a matter of time until you must hold off on that cruise.

If you’re looking for an accessible, cost-efficient way to double your savings rate, start by paying attention to what you earn vs. keep. With over a quarter of earners who rake in more than $250k+ live pay-check-to-pay-check, there’s no surprise most don’t max out their retirement contributions nor have enough to contribute to their kids’ 529s, Roth IRAs, or side hustles after adjusting for tax.

As a life-long New Yorker, in such a competitive fierce city with an abundance of opportunities, I’m not surprised rents would reach these historic levels and plan to get higher; however, I am skeptical about my fellow city dwellers’ spending habits and priorities. I thought they would be more stealth wealth given true wealthy New Yorkers try to blend in not stand out like Mark in his thousand-day-old hoodie. I’m curious how long rents will stay at a median of $4k per month. I’m projecting a decline in the fall once families settle into the new school year and foreign buyers venture out.

The Typical $4k Per Month Tenant in A Coastal City

Women tend to be more conservative by nature than men. Fortunately, being more risk-averse doesn’t have to mean giving up on returns, especially with renting!

When it comes to housing, it’s personal. It’s not black or white — renting or owning. It is up to your personal circumstances, priorities, and cash flow needs to assess. Of course, if you are looking to stash and invest a little more per month and grow a more stable financial buffer for a future family, you know which one is more prudent long term.

Just like with investments, my rule of thumb is if you don’t plan on staying or investing in that fund for more than 5 years, it’s better to rent or not invest as a result.

By the time you add up your short-term capital gains taxes due, moving costs, broker fees, closing costs, etc., spending a little more now than later will turn out to be the better choice.

After all, if you choose cheap today, most things will become very expensive later on, especially with housing.

Rearview Renting Rules

When it comes to renting, we are a strong enough country to say we have more homeowners (close to 60%) than renters (30%) according to Census.gov. Hopefully, that won’t change anytime soon and continue to rise. The pandemic has certainly been a big boost as millions have become wealthier as a result. As long as there are enough developments for all income classes around and inside big cities, that will be ideal to add more affordable housing for all.

Although I’ve never been a fan of renting, even though it sometimes makes perfect sense in-between seasons and I am a landlord I could see myself dealing with, following this renting rule is a helpful benchmark I use to assess if a property is worth six figures in rent per year or not.

For any property, you must take into account your current incoming cash flow needs, not your net worth. Although net worth is arguably more important, especially the older you are to make sure your assets > liabilities and you pay everything off as fast as you can in retirement when living on a fixed income, as a renter, income matters a great deal in order to stay credible and actually find a place.

#1 — Being eligible to rent out the property. Oftentimes the board whether it be in a co-op or via the background check with the property manager will access if you are a creditworthy borrower and reliable spender + earner. They could care less if your net worth is in the negatives but if you earn bank at a top Fortune 100/500 firm, you are seen as more favorable than someone working at a volatile startup in the top .001%.

Investors of all kinds crave consistency and reliability. Be that person in work to life and you will get what you want.

#2 — Emergency Expenses — Things come up all the time and that’s why everyone needs a buffer. No one is immune from mistakes.

As a renter, you are dependent on your income to provide you a living outside of real estate. Not being able to own a tangible asset doesn’t feel as safe so make sure you have a minimum of 5+ income sources on deck. Nothing will be passive about it at first.

Even though you may be a tenant and a landlord of other properties, the majority of your income is still going to your rent for your primary residence so keep it flowing and prioritize it the most while you’re there.

Income isn’t everything but it is the basis of how renters survive since a HELOC or tapping into your primary residence’s equity aren’t options. Not owning something tangible hurts so your passive and active income streams become your lifeline.

For properties that charge more than $4k in rent per month for a total of ~$50k per year with additional expenses included such as insurance, maintenance, HOA, etc., it is recommended to earn around 2–5x your annual rent to stay comfortable here for a few years.

Of course, the more one earns, the more incentive they have to rent given that they donated to depend on a slow investment (real estate) that needs constant attention. Once one’s rent goes over six figures per year (~8–9k) per month, they must be earning at least 7 figures to keep up.

Buying Utility vs Renting Luxury

One last note I’ll make about the surge in city living and massive pent-up demand for “living like it’s 1999 again” is this common trend many New Yorkers and Californians follow when deciding between splurging on rent or taking the aching and time-consuming investment to buy real estate.

When it comes to your lifestyle and mode of living, it’s a royal pain to move around and test out options every few years, but the truth is, we are curious creatures and eager to explore which means we need to plan for the worst and hope for the best.

Buying utility reminds me of buying value stocks. Currently, this is an opportune time to do so when tech and growth stocks are getting hammered echoing the dot-com bubble when investors poured their money into Internet stocks that soon tanked 80% on the Nasdaq Composite from March 2000 — October 2002.

All in all, if we’ve learned one thing, it’s that markets do go up over time and thankfully all losses become erased! We just endure cyclical bearish times every 3–5 years! You know that rent increase and or possible recession is looming, so plan for it earlier than later!

There’s a price to pay for everything, even value stocks when they’re discounted and don’t go anywhere but the general rule to stay safe but smart is to buy utility (value) and rent luxury (growth) temporarily.

Remember, rent is not purely money down the drain if it improves your life. Real estate certainly isn’t a bad investment to own these days and in fact, one of the best but also comes with costs that you may not have to sacrifice and deal with if you’re able to control your spending, cash flow sources, and lifestyle inflation creep!

Let’s see how long city dwellers can take this price hike! At least they are very vocal and demand the best!