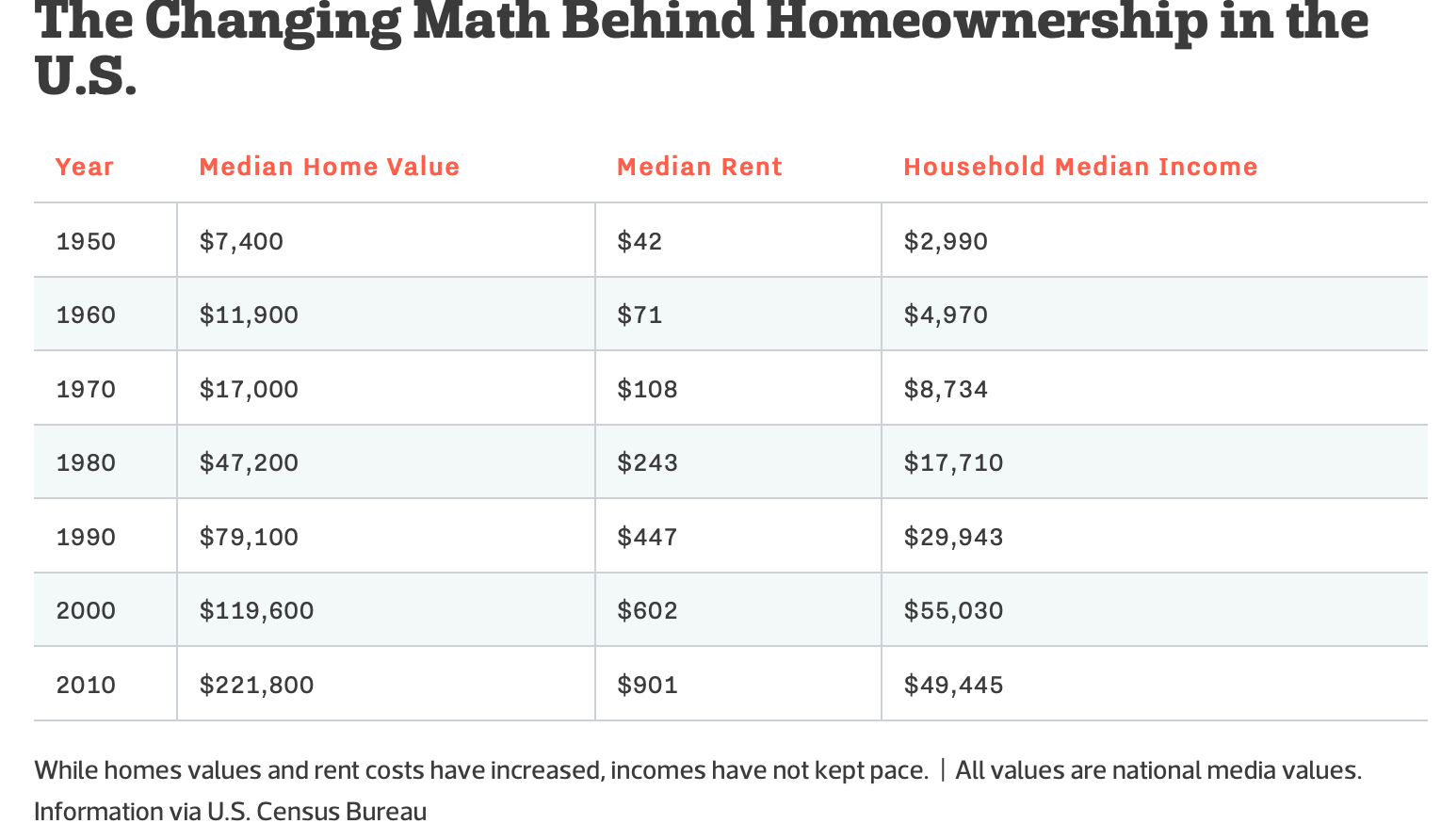

As a 21 yr old, it’s hard to imagine that the average home price when I was born in 2000 was close to $100k and the median income was slightly above $50k. Today, these figures have now jumped by almost 2 fold to $88,300 in estimated annual income needed to purchase a home. This is $40k more than in 2019 when less froth, speculation and overall bidding wars were around.

The extraordinary bump in home prices isn’t directly correlated with rising incomes either, especially during a time of rampant inflation when wages aren’t keeping up with rising costs. This is frightening to realize, particularly for future homeowners who thought they could easily purchase their dream home after securing a cushy paycheck or two and paying down all student loans.

Unfortunately, the markets have a mind of their own, and record-high mortgage rates surpassing 7% at this point continue to push first-time home buyers out of the market and their dreams. Luckily, rates won’t stay this elevated forever, especially as potential homebuyers are having a tough time justifying paying an extra couple thousand to their monthly housing payment when they could simply wait for supply to elevate.

Buying a home in the U.S. is the definition of the American dream. Being able to purchase something, even if it’s only putting down ~20%, and then eventually in 10–15 years paying it all off and finally owning it all, not owing anything to the bank is real financial freedom and security.

Putting down roots works best with real assets such as real estate, collectibles, farmland, artwork, and anything that is non-fungible and cannot be replaced or tank in value overnight like crypto!

No wonder billionaires store their cash in 5+ bedroom empty mansions overseas and buy yachts, toys, and useless gadgets they don’t need! The more real hard assets owned, the less likely the value will vanish by a bad trade, wrong bet, or seized by the government!

No one needs to live in an empty 97th-floor 7+ room penthouse on Billionaires Row. 80% are empty throughout the year after all! The reason owners swoop them up anyways is to convert as much money into real hard cash as possible to not lose it overnight or have it vanish by the government, a concern foreign officials and investors have. This makes perfect sense when you look at the owners of these luxury properties. They are mostly foreign investors, heiresses, or lucky entrepreneurs! Money is stored more securely in the U.S. than anywhere else in the world and so is the value of non-fungible real estate.

Median Income Hike Overtime

Although real estate across the heartland, sunbelt, and coastal cities continue to surge in price post the remote-work boom due to rising rents, higher inflation, higher borrowing costs, rates, and lower inventory all induced by the Fed’s hawkish plans, American real estate will continue to be the most defensible, tangible, inflationary-proof real estate market in the world for its attractive buying power, appreciation factors, utility, income levels coupled with, of course, opportunities, too many to even count!

Especially for interest-rate-sensitive sectors such as real estate which is directly influenced by the direction of mortgage rates, higher incomes also induce higher prices which are mainly influenced by location and demand. In order to afford a property, you must be able to pay a certain price or at least be qualified to own it and pay off a mortgage for as many years as you need to finally call it yours. If there’s a major influx of wealthier individuals from NYC parking into Florida to save on income tax as witnessed in 2020–2021, this will naturally drive up prices and cost of living, squeezing out local residents.

Although housing inventory has completely inverted and standing at all-time lows compared to during the Great Financial Crisis of ’08 when millions lost their homes due to foreclosure, complicated packaged MBS derivates, and dangerous engineering by the banks, believe it or not, finding a deal nowadays as inventory has eased is tricky although can be much easier, especially depending on the time of year you’re searching.

Listings during the late fall winter months tend to be a sign eager sellers want to move out ASAP. Due to this rushed feeling, they are more likely to chop the price every few weeks until they get rid of the property.

Although prices may seem unbearable, Americans are sitting on a collective $2.1 trillion on their balance sheets with pent-up savings from aggressive DCA investing from the lockdown day of the pandemic. Plus for the most part, wages across most sectors have also kept up with inflation, a strong sign the labor maket isn’t letting up, consumers are fierce, and unemployment is at record lows. Only time will tell when the Fed’s higher borrowing costs will signal consumers to pull back and it may not even happen on Black Friday.

In sum, if you’re looking to buy a home for the first time, although you may be frustrated with the lack of inventory, poor deals, and are squeezed by higher borrowing costs, evaluating when you can look around is most opportune long-term since more often than not, the season and time of year in which you search makes all the difference, especially if you live in the coastal states where weather plays a major factor in consumer sentiment! Emotions are a major distraction in investing but can be used to your benefit when hunting for open house deals.

Real Forecast

For the past few weeks, the notable macro/micro indicators released have signaled the Fed may be able to engineer a soft landing and avoid a recession after all! With October’s inflationary report coming in lower than expected along with PPI, a vital indicator and bellwether for producers in the supply chain, and with a sharp decline in I Savings Bonds, these are bullish signs inflation has likely peaked and the Fed’s hawkish moves are working!

As inflation officially starts to cool on track to reach the Fed’s proposed target of 2% by EOY 2023, mortgage rates are also bound to plateau along with a rise in inventory until rates start dropping.

The Fed isn’t expected to cut rates anytime soon since it kept them low for too long sleeping behind the wheel.

No matter where the macro climate environment is headed, what’s for sure is that with real estate as a lagging indicator and real asset, being able to assess where it’s headed may be easier than with any other investment since what’s for sure is that it will not tank overnight!

When it comes to home buying, it’s important to assess if you’re having an income or price-tag problem. If you’re unable to put down roots of at least 20% in cash on a fixer-upper or dream home, this is usually rooted in not diversifying your income sources. It’s never advised to tap into your 6–12 months of emergency savings cash pile or let alone retirement fund to purchase a home. Those funds have their own goals and shouldn’t be touched.

Nowadays with the boom of the side-hustle gig economy, it’s easier than ever before to create passive income streams for yourself! Securing that 20% deposit won’t happen overnight but it can add up over time when planning out the largest purchase of your life.

If you forecast your risk tolerance and asset allocation carefully enough, tap into risk-free assets, and save till it hurts, that deal will be waiting for you one day at the front door.