Getting rich is arguably the easy part.

Keeping it is the challenge.

You only have 3 options with your money.

Save, invest or everyone’s favorite, spend it!

Unfortunately in a world where we must fend for ourselves, spending cannot go on 24/7 although it seems like it is.

Although these obvious restrictions have to be in place to be able to properly survive, that certainly shouldn’t imply you cannot enjoy life. It simply means you need to put your thinking cap on and buy what’s necessary not what the Joneses own. In a sense, since we all have limits, we are naturally happier this way. If we could buy everything, we would be miserable.

All of us would be retired and there would major stagflation like Japan has been dealing with for the past few decades. They have an increasingly older population and it is hurting the economy with no young workforce to take care of their elders. Stagflation occurs when there is high unemployment and inflation. Thankfully it isn’t happening in this current economy but could if we spent left and right and didn’t know what to do with ourselves.

Having limits is safe. Our life is made by the choices we make and teaching ourselves to spend until it hurts is good practice for life. If you eat too many donuts, you feel groggy, have digestive issues and can’t focus plus it’s simply a burden on your health. If you continue at this pace, you will eventually suffer various consequences and even worse possibly kill yourself with an excess in donuts. You don’t want to get to that point. The same thing goes with our finances.

Since we have limits, we don’t appreciate what we need and idolize what we don’t have. Once some of us get to our prized position, we soon realize Jim Carry was right all along in stating that everyone wants to be filthy rich until they don’t. The grass will always be greener on the other side until you step on it and smell it.

In essence, too much of anything is bad.

Too much exercise to food = bad. Checking your finances daily is dangerous as well. Moderation is key in everything in addition to your job.

How To Become Wealthy In the Most Average Way Possible

I’ll never say it’s easy because that would be a lie but I will say this is common practice.

Any reward takes effort.

There are millions of millionaires in this world that don’t look like it because they have average jobs and just save and invest aggressively. It’s not magic. It requires seemingly simple yet painful skills of patience, stoicism, constant effort, good timing, and a constant go-getter mindset to produce luck.

I think it’s absolutely fascinating and for the better that our brains cannot decipher between reality and our future selves. We can become the person we want to be if our interal selves will believe it. You can manifest anything you want. I sometimes believe it and sometimes don’t buy it, but quickly realize if my mind’s not in the right zone, everything else falls out of place.

Whatever your definition of being wealthy is, good for you. It’s completely relative and personal. Someone earning $300k is considered middle-class in San Francisco while living in Nebraska and any non-coastal city like NYC or LA, they are classified as being in the top 10%.

I appreciate that the 18.6 million millionaires in the world, the highest number located right here in the U.S. don’t all look like it. Way to go! More folks are adopting the frugal minimalist stealth wealth lifestyle. For the most part… until we start comparing ourselves to each other and move outside of expensive cities where residents haven’t been trained to only buy what they need since things are cheaper. That is one of the joys about living in NYC. No one has time to impress you — for the most part. And those who try to impress others aren’t usually the ones who should. Adopting these minimalistic appreciative habits are by far the greatest propellant towards your budget and lifestyle.

In an expensive area, people are more likely to use their money better since they have to compensate for a higher cost of living and for the most part these millionaires are earning money in traditional, typical ways. There are more ways than ever these days thanks to the expansion of the internet.

No-Ceiling

Once your compensation breaks free from being based on how many hours you work, it is limitless. Majority of CEO compensation is based on vetting stock options and only 3–7% of it is based on performance pay. The stock market will always be your best friend if it’s tied to your paycheck. No wonder CEOs make 1,000x more than their average employee. Their pay is based on an overvalued stock price. Read here how compensation works.

You install your own wealth ceiling or cap if you don’t invest. The best way to do this is to start as early as possible. Time is your best advantage. Save what you can and invest the rest. Contribute to your Roth IRA when you’re in a lower tax bracket since it’s a post-tax account. At work match your benefits to the max for your 401(k), 403(b), 457, etc. pension, IRA, and overall spend less than you earn until your investment income is generating more than your active income from your job but even then I wouldn’t make any drastic moves right away. Anything can slip and bounce, especially the stock market.

Majority of people who’ve built their wealth and reached their goals will say it is a slow process that many aren’t used to. Patience is a virtue and delaying instant gratification is your best tool, similarly to abandoning emotions when making investment decisions.

If you have extra time on your hands which for the most of us is on the weekends or when you are a student with less responsibilities and the most freedom to test, fail, and absorb everything like a sponge, you can afford to take bets and dabble into Reddit and Robinhood but beware that passive investing historically beats out active investing anyway. Rebalancing and monitoring trades doesn’t mean better performance. Sometimes you have to let your favorite cyclical company do its thing and it will grow for you. Otherwise, growing wealth for 90% of us is slow and painful yet always more rewarding in the end.

It’s painful because it’s slow. We’ve been trained to not think that way. We want to see our wealth grow in real time and touch and play with it. That’s what money is for. We want to spend it ASAP just like our wages and bonuses we deposit at the bank.

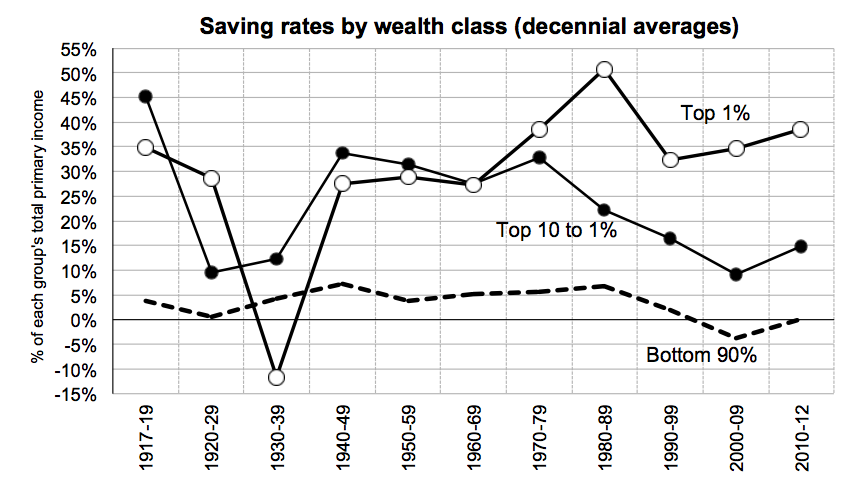

But the trick isn’t to just stop spending. It is to save as well which the wealthy have mastered the most saving up to 70% of their income! Just look at the savings rates by income class. Since regressive tax, consumption tax on everyday goods eats into lower to middle class earner’s budgets the most, spending restricts them from saving.

The more one makes, the more they can save since necessities end up costing little to nothing. The rich also want to save as much from taxes as possible since the progressive tax system (pay more tax the higher income tax bracket you are in) persuades the rich to just reinvest all their money into the market to keep earning more, never cash out or pay taxes on top. The buy and hold strategy is powerful especially when your living expenses are low.

The Enemy

Building generational wealth and a comfortable lifestyle for yourself starts from knowing how to take control of life’s 2 certainties: death and taxes. We can only truly control the latter and the wealthiest individuals have taken advantage of the system to pay little to nothing of their dues while a middle-wage worker trying to support themselves with 3 jobs gives up more to the IRS per year.

Eared income is the main victim towards the tax system and the IRS’ best friend. Since U.S. federal government income tax is based on a progressive system, the more one earns, the more they give up. Up to a certain point, it may not be worth it to earn and be a slave to your time especially if you don’t enjoy it and it robs your health.

Top-earners come to this realization eventually after they’ve worked in the industry long-enough and start to reassess how much they’ve given up to the government versus kept.

Why let the IRS take 37% of your income when you could keep it all by managing a rental property on your own schedule as your own boss?

Even when Trump installed the Trump Tax Cuts and Jobs Act favored by investors and high-earners to incentivize them to continue working due to lower income taxes, there was job hesitancy and a high job turnover rate since they knew this wouldn’t go on forever. This is comparable to the environment today with the labor shortage and Great Resignation as people reconsider their lifestyles and wealth opportunities beyond the 9–5.

The only way to break free from any income ceiling is by staring any kind of business and investing in the market.

Whether it’s through real estate, a blog like this one, an LLC or some cool unprofitable startup, you can deduct the expenses towards the busines as a tax-write off. You supply yourself a Tesla and charge it towards the business if you prove you use it towards helping drive around customers or finding new clients. If you have a purpose towards your expenses no matter if the business is a boom or bust, it counts.

For some reason, even when one can easily make more through a business than any kind of job and it is the most obvious way to build generational wealth since the the wealthiest people on earth all have multiple businesses, the IRS still goes after W2 income workers that make up the bulk of this country. At least taxes for the middle class aren’t going up. The country relies on the middle class more than any other demographic and are raising taxes to those earning more than $400k, not $130k.

There’s no doubt that luck, connections, and timing plays a critical role in one’s success. I firmly believe that when preparation meets opportunity that is true success. You need to know how to play your cards right and when to say no. You can only do so much.

A network is an insurance policy money cannot buy. Get to know as many people as possible since anyone, anywhere can help you and teach you something. The world is a small place. Be close with your friends and closest with your enemies. Never believe you are the smartest in the room either to actually learn. Staying humble is a powerful trait in all of business.

Building a supportive nest egg and crushing your financial goals aren’t reserved for the elite. It is made for everyone and I hope these basic principles surrounding taxes, types of compensation, costs of living, and the premise of savings have made you more confident in taking control of your future. At the end of the day, where you are now is where you’ve chosen to be. Our life is based on the decisions and choices we make. If you aren’t happy or satisfied, there’s always another way out.

Every field and industry can be argued as overly saturated but what cannot be replaced is your unwavering spirit, dedication, commitment, and unique personality. No one can take that away from you. There are millions of Youtubers to bloggers but I still decided to get into this space because I am worthy and have something to teach to my audience.

Never assume that your idols have some unique genes or inherited a lump sum. You are as capable as them and whether or not it’s your ultimate dream to hit 7 figures in the bank, which I personally wouldn’t only strive for, realize that everyone is following the same path in one way or another. Yes there are thousands of outlets that allow for endless opportunity but we’re all in this together and it isn’t as complicated as it seems if you know what you deserve.

Spend less, keep more. Buy less, invest more.