In order to accumulate wealth, you must develop a set of habits that won’t just come to your advantage for the next few years, they must help you grow your wealth, assets, financial position and hopefully character for decades to come.

Being rich is all a mindset. A farmer who makes $80k per year but saves 90% of it is wealthier than an investment banker who makes $400k per year who flaunts his wealth due to his inflationary lifestyle ending up in debt.

It’s not about how much you make, instead what you keep.

Let’s face it, if you asked a random person on the street how they feel about their financial situation, 9 times out of 10, any stranger would not so hot like the tumulus market we are in now. We were raised not to discuss money since it is a taboo subject even thought it controls everything we do in life, where we go and what we do so all our relationships to money are broken and told never to talk about our salaries because then unfair treatment comes up.

But not to worry, although financial literacy may seem complicated simply because the internet makes it so, it really isn’t. If you follow certain strategies that have made millions successful, get out of debt and alleviate all burdens behind them and start from scratch, you can too. And the best part? You need little to no money to start, just a courageous and hopeful mindset.

#1: Real Estate

Housing is the number one expense for Americans and because of that, it makes or breaks a lot of first time homebuyer’s financial decision. There’a huge emotional component that goes into the decision of where we live, attempting to plan for the next half decade and family plans. Some people prefer to be near their work, others want that separation. Others enjoy living in a cramped, cockroach infested studio in NYC to enjoy the pleasures of the city instead.

To build wealth, you must own something. The more that asset appreciates, the more you will take in, can reinvest and grow your wealth piece by piece. But most of the time, this habit takes years of patience, research and practice to see what location is strong to outperform in the next decade when deciding to sell or lease out.

There’s no turning back once you sign the deal. Only regret.

If you want to build wealth, quick, owning is better but that doesn’t mean you will make your return fast, especially since there are many fees ranging from the property to brokerage that take advantage of upwards of 10% of the listing price of what you paid for which you can learn about more here.

Buying vs. Renting

Owning isn’t always better for everyone, especially if you are someone who isn’t settled on a decision on where to live in the next few years yet. Most of us don’t know what will happen and no job is stable.

All financial decision are risky, but that’s where the reward kicks in.

The rule of thumb for buying a property is confirming that you will live there for the next 5–7 years and ultimately when you do plan to move out, end up renting it to grow a passive income strategy.

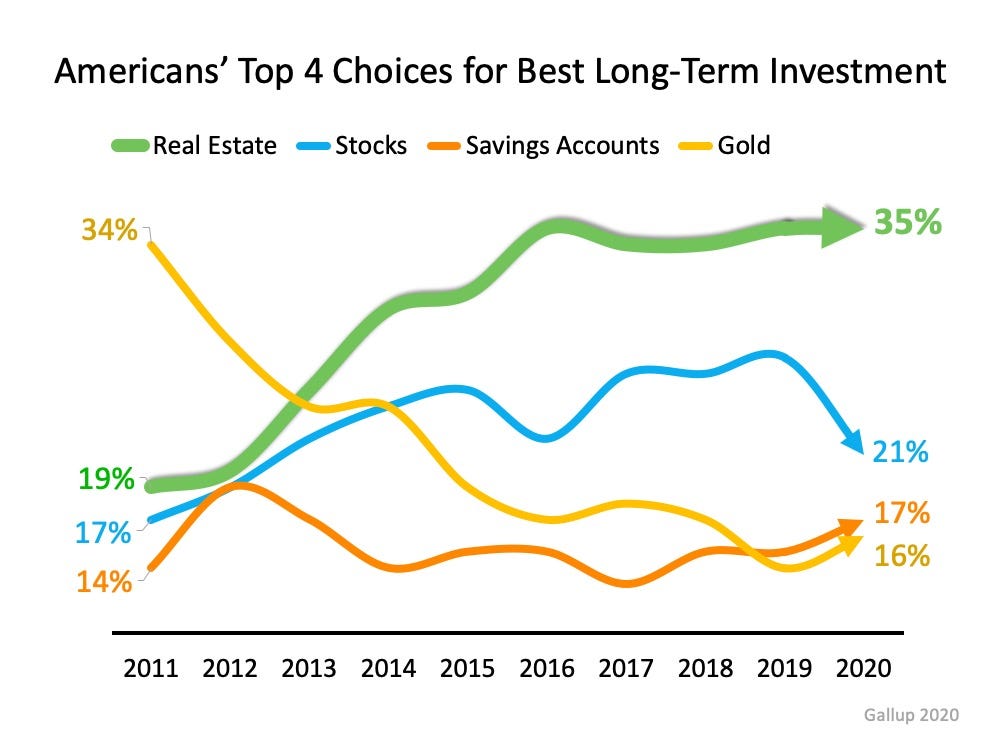

Real estate provides income in lieu of dividend stocks. Real estate also offers asset class diversification. During stock market downturns, real estate can outperform, as we saw during the March 2020 meltdown.

According to Bloomberg Wealth, “Perhaps no part of the U.S. economy has been buoyed by the Federal Reserve’s easy-money policies more than housing, and with cities now joining the suburbs and exurbs in the boom, the impact on growth appears to be broadening. In some regions, urban areas are now substantially outperforming.”

The costs of owning a home are mostly upfront and reoccurring dependent on how much renovation is needed and damage is done.

The main pillars in homeownership costs include:

Property tax: roughly 1% value of the home

Maintannce costs: roughly 1% value of the home as well

Cost of capital: roughly 3% of the value of the home

Debt = mortgage

Equity = down=payment, typically 20% in cash, finance 80% of the rest in a mortgage

Cost of capital = cost of debt + cost of equity

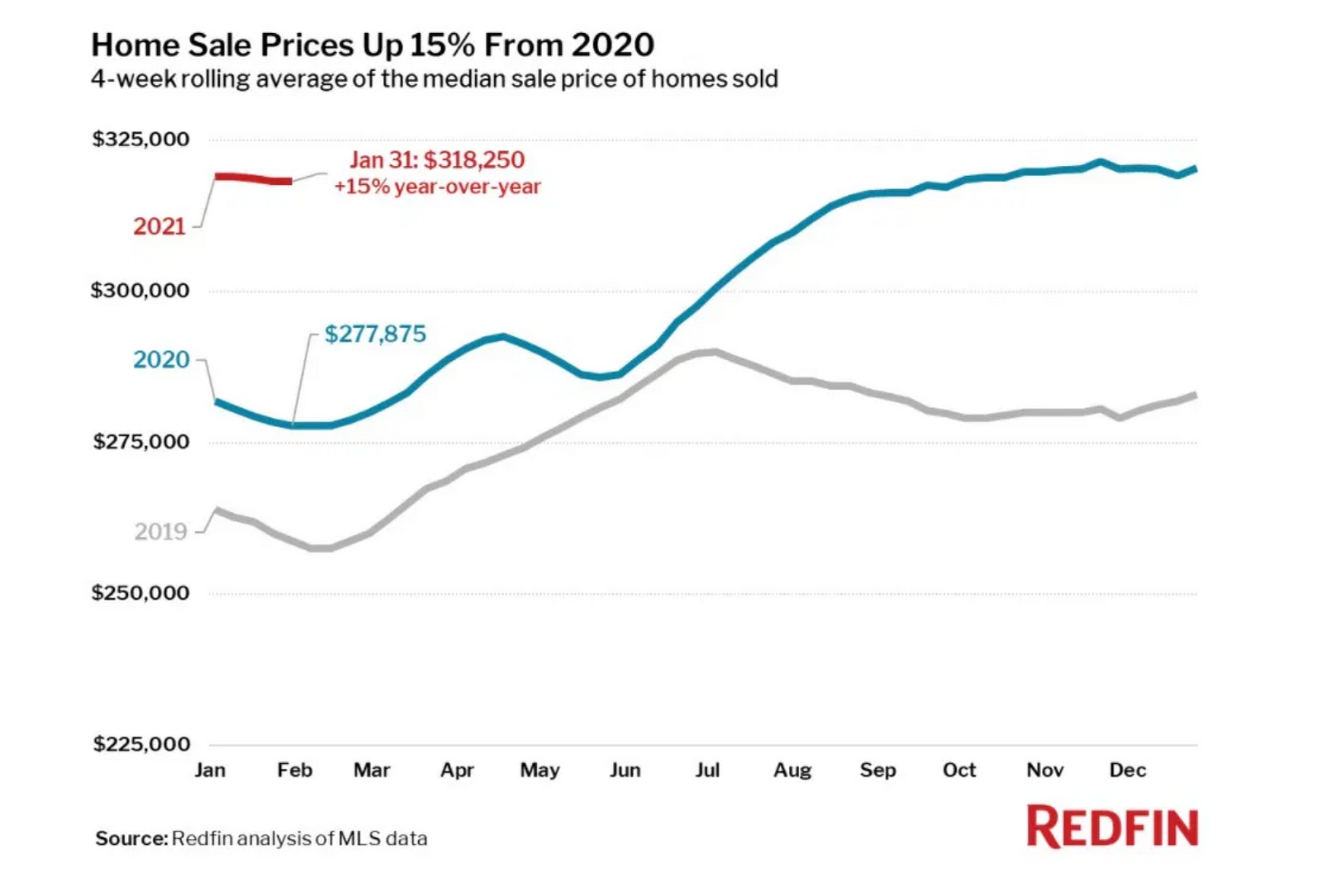

As we’ve seen throughout the pandemic with offices turned into bedrooms and our living space meaning more to us than a place to sleep, the national real estate market continued to rally and was extremely strong in the new year, especially January 2021. According to Redfin and MLS data, home sale prices are up 15% YoY.

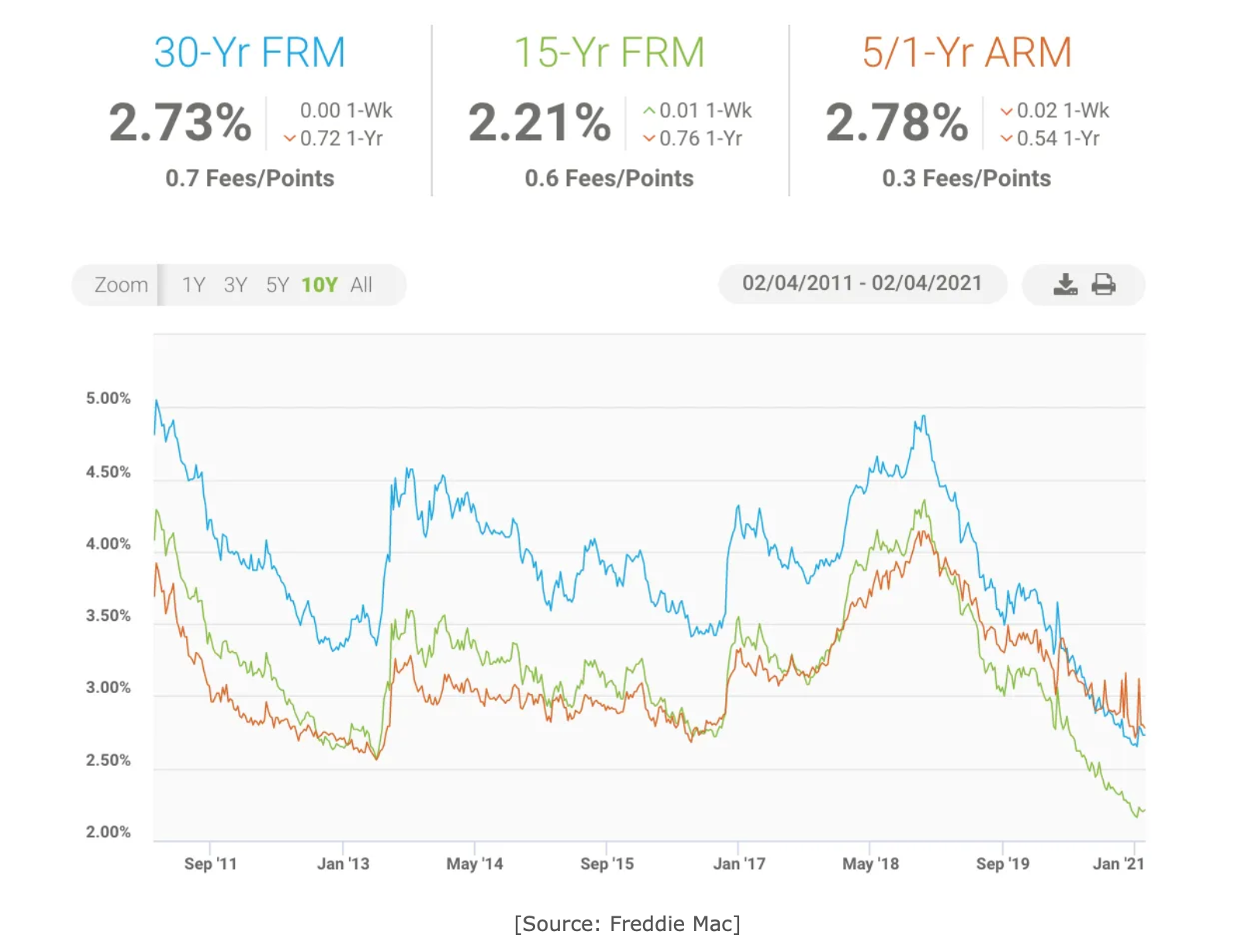

Economic Standpoint

For a mortgage, the 15-year fixed, followed by the 30-year fixed mortgage offer the best value at the moment. Mortgage rates follow the 10-year yield and although it looks like its creeping up to around 1.5% at the moment, this may be the right sign to refinance your mortgage before interest rates keep going up.

Yet, as the Fed continues to buy bonds and mortgage backed securities to keep interest rates low, there’s no better time to take out a loan but of course, only if it makes sense.

Just because it’s on sale, doesn’t mean it’s right. It’s not free after all.

Buying a home is a big move, expense and huge, huge project. You will save more renting if you are strategic only staying in the poprety for less than a few years, otherwise you are giving away your money for free to the landowner.

Real estate historically has had a high risk-adjusted rate of return relative to stocks and bonds. It has consistently outperformed the market with a positive correlation even during high inflationary times, as it provides a hedge against inflation.

#2: Wills and Trusts

Now this is something majority of people, middle to lower class typically don’t factor in when thinking about building wealth, hence that’s why they aren’t prepared.

Most millionaires are self-made. They haven’t inherited much through trust funds and instead grew their wealth from the ground up through sweat and tears. I believe that is the best way to find fulfillment and purpose in life because without hard work, why be grateful or proud?

This is a topic that most people dread because no human or matter of fact, animal enjoys planning their death. Yet, let me tell you, to live a better safer existence, it is necessary.

Think of a will like insurance. If you do pass, you don’t have to go through probate, court, pay exorbitant fees with lawyers and family members, bickering over who should own what from your deceased loved one. It is all taken care of. Dealing with divining one’s assets and lawyers is the last thing you want to do when mourning.

Wills cost virtually nothing, max $100 in some states if you have a lot of assets and specific rules on what siblings should take what or if you own 100 rental properties and an immense amount of intellectual property you receive royalties from that must be split. Otherwise, the average America pays $20–50 for a will. No renewal, one time fee.

To save you hassle, extra fees and provide a peace of mind, set aside an hour or two with an executor or simply go online and fill out a will yourself, diving up your assets based on their value and make sure the inheritance is equal and fair for every sister, brother, aunt, niece, spouse, everyone close to the loved one to approve of.

Similarly to umbrella insurance on your home, car and life, if you don’t have it, then you have to pay out of pocket fees that could cost you the value of your home if a fire breaks or small leak. You can never buy it when you need it. Spend that extra money so if something does happen, you are cared for, protected and also reimbursed by the insurance company.

Better be safe than sorry.

I get it. This is a daunting task but as we’ve learneed through any recession, economic crisis, you name it, those who plan for the worst and hope for the best are in the best hands.

Preparing for the future is similar to setting aside cash for any emergency. Yes, we all wish our cash didn’t deflate in value due to inflation and not making us money, but wouldn’t you rather have some cash left over instead of needing to sell your investments and pay capital gains, etc. if your house blew away during a storm for instance or your spouse who was the sole bread winner for the family passed?

Thinking about hypotheticals is always smart. You don’t need to be a freak. Be realistic and smart about possibilities and a game plan. Being joyous that the future will only be rainbows and unicorns doesn’t help anyone, especially your wallet and sanity.

Trusts

Trusts are the bumped up, expensive and complicated version of wills. These are for individuals who own and manage a lot of assets and have certain types of capital and benefits tied to their name. My mother and I set this up when my father passed to keep a safe heaven for anything she owns would go directly to me, past the court or my cousins.

Wills are strongly recommend for any individual, but trusts have higher fees since you must have your own lawyer, accountant and several managers that will go through your assets with you and sign booklets of paperwork. You also must create an ILLIT account to store some funds.

Once agin this all as prep in case something may happen to one of us. As a single child with only one parent, this is vital for me to have so the assets don’t end up going to my cousins or ruled by the judge, instead everything she’s built and owned goes straight to me no hassle, only payments and preparation up front for the unknown.

Compared to the max $100 will, a trust is around $50k. It isn’t something we want to do, it’s something we need to do. Ff you have a net worth of a certain amount and own a lot of assets, it is recommended, especially if you have a large family.

Don’t be foolish and instead plan your life. There’s no better way to preserve wealth and pass it down than through a trust. The worst thing you can do is have a judge take all your partner’s, parent’s, family members’ etc. assets away from you and give it to the government! Let the monopolies pay their fair share in taxes instead.

#3: Growth Stocks > Dividend Stocks

“Dividend growth stock” is an oxymoron. The larger a company’s dividend grows the more it means its management cannot find a better use of its cash. It’s not actually growing!

Don’t get me wrong, dividend stocks are a great passive income strategy. In fact, it is one of mine because it is stable, reliable but the only downside is, with dividend yields relatively low at 1–3% for most companies, you need a lot of capital to generate any sort of meaningful income. Also there’s no way to improve the dividend payout ratio.

If you have a $1,000,000 dividend stock portfolio yielding 1% that’s only $10,000 a year in dividend income.

For young investors, I highly recommend staying invested in dividends but more relying on growth stocks in companies such as Tesla, Google, Facebook that provide more capital appreciation while you are working.

Earning dividend income is not as vital since you have recurring income from your job. This would be best for someone who is close to retiring or retired already since you rely on dividend stocks for your income and they are less volatile given their strong, reliable balance sheets similarly to bonds, they never fault as reputable, long lasting investments.

My problem with dividend-paying companies:

Companies pay dividends because they cannot find better growth opportunities within their own company to reinvest its retained earnings. They return excess earnings to shareholders in the form of dividends or share buybacks, faking us shareholders into thinking they are growing and giving us a gift when in reality, they are staying stagnant.

When you look at companies that don’t pay dividends such as Google, they would rather invest and beat a return on their capital for shareholders. Google raises debt and reinvests cash flow back into the company which has made growth stocks flourish even higher.

To build wealth quick, which is usually not the formula since rich quick doesn’t exist unless you are a social media sensation over night, growth stocks are key.

Misconception:

Dividends are not free money. Paying a dividend lowers the amount of cash on a company’s balance sheet, which in turn, lowers the enterprise value of a company.

In a low interest rate we are living in now, as the Fed promised to not see inflation go higher than 2% for a prolonger period of time, in a rising interest rate environment, dividend-yielding stocks, REITs, and bonds tend to underperform the broader market while growth stocks flourish.

Why?

When interest rates are low, companies can borrow more debt more cheaply. Cheap money can be borrowed to reinvest in more opportunities.

#4: Passive vs. Active Investing Allocation

The split between passive and active investing is always something early investors have trouble identifying because they don’t know if it should be based on age or risk tolerance.

My answer is yes for both.

If you are only a passive investor, you won’t be able to outperform the market. You will only save on fees and grow with it together. But if you are an active investor, well, you can guess what happens. The opposite!

Being an active investor means you are fully fledged into becoming a day trader. This is something I highly do not recommend especially since there are massive downsides, headaches, waste of time, money and most importantly, one usually get know where no matter how much experience they have.

Active investing is for those who believe they can time the market and are true gamblers. You have to keep up on your daily trades throughout the day and it is very taxing on the body, wallet and mind.

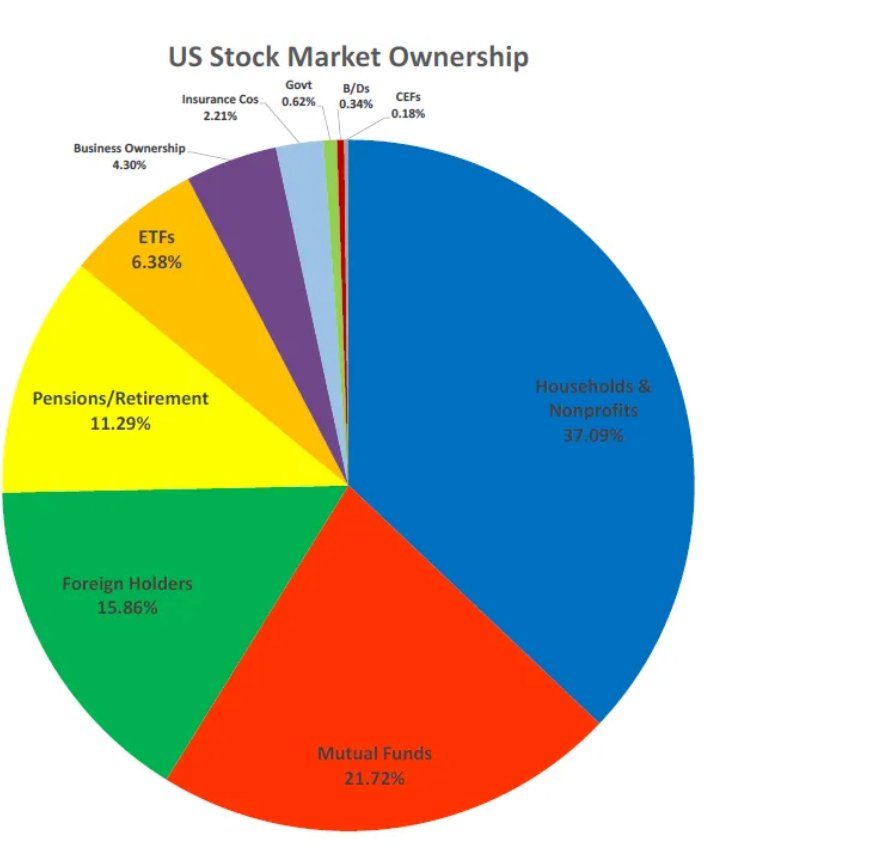

For an average investor, I would recommend have a stock investment split of 90% passive and 10% active for ages 50 plus. At this age, you care about recurring passive income through ETFs and index funds and don’t want to take the hit with mutual funds and individual stock picking.

As a 20 year old, I have a split between 75% passive and 25% active because I have a lower risk tolerance and care about the long term, focusing on mostly ETFs and growth stocks.

Passive index investments have low costs and it’s very hard to outperform the indexes this way.

As you get more experienced with investing, you can gradually increase your active investing percentage but greater than a 50% towards active investing isn’t smart.

Building wealth is achievable for all. All you need is a set plan, structure and focus on unique strategies that only a true investor takes advantage of. From managing risk in your portfolio to planning for emergencies, part of being rich is knowing that you have a safe haven and something to fall back on in case there’s a hiccup. It’s not just how much money you earn or make, but rather how safe you are for the future.