We can’t stop talking about inflation since we can’t run away from it.

The only good thing is that it’s better than deflation and is erasing debt.

Until the Fed begins pulling back their QE stimulus and increases interest rates which is reported to roll out later this year, toilet paper will continue to be as high as Chipotle guacamole.

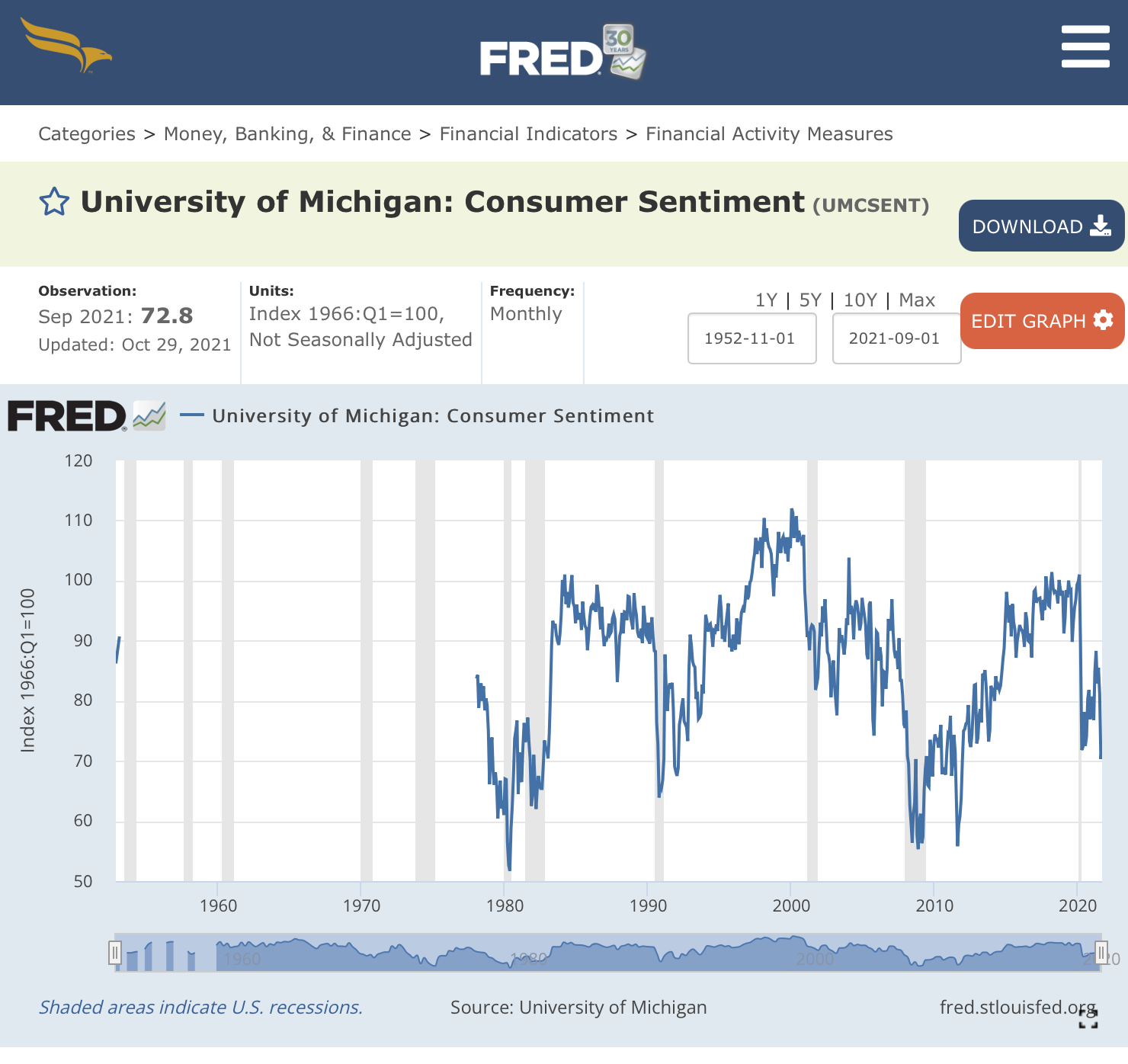

Surprisingly, despite higher prices, consumers aren’t backing away. According to the National Index of Consumer Sentiment, hovering at around 72.8% in September, consumers have never felt better about their economic health!

Who would have thought after a deadly pandemic people are in better shape? Maybe not mentally or physically but financially which helps in some regard.

Granted this number is certainly not as high as back in April 2021 at 88.3%. Back then there was more hope in the air which came about from soon-to-be warmer months, pent-up demand to start living life again, the vaccine rollout already a few months underway, and the tourism, hospitality, and airline industries let out a big sigh of relief recording a major comeback in their Q1 earnings at the time which all lead to higher optimism and more partying. The sentiment recorded last month wasn’t as bad as economists expected after a global recession and deadly pandemic.

Currently there are an abundance of indicators, factors, metrics, you name it at play that indicate the stock market boom has just passed. With increased inflationary pressures, supply chain shortages, concern for harsher weather and brutal winter, a possible new covid variant, tax hikes, and regulation around BigTech all play into the concern investors have for the months ahead yet this still hasn’t stopped consumers from spending.

Since the start of 2021, airlines have consistently reported a record number of passenger screenings through TSA and retailers are anticipating massive crowds for Black Friday and gift giving for the holidays. Xmas trees will be pricier and travel will be a mess. It already is.

Although travel and experiences are considered discretionary purchases, millions have found themselves better off with their finances today compared to pre-covid as the year and a half made them revaluate their circumstances. Sadly, we don’t change until we have to and covid has forced procrastinators to tackle their finances head on.

A variety of involuntary and external factors have contributed to Americans’ financial success. Consumers’ pent-up savings from being sheltered at home for a year allowed them more time to manage paying off their debt with bottom low interest rates. Plus with the ability to move to a lower cost of living area, and or possibly receive a signing bonus from their employer or from joining a new firm were also enticing packages that gave employees a leg up. Last but not least, there’s a Great Resignation labor shortage going on. Now workers are in demand and demand to live a more balanced life.

Why High Prices Aren’t Bothersome

As much as we all wish to pay less for everything, average earners don’t mind as much these days. Considering they don’t always have a choice and believe inflation is a transitory not permanent stage in the economy, they are hopeful it won’t last too long.

But if we can get more bang for our buck and not have to spend more for less, we will all go for that option instead. Although there aren’t a whole lot of options besides clipping coupons and comparing Walmart vs. Amazon’s prices for a few quarters in savings, we can make our portfolio more defensive against the lack of purchasing power instead resulting in larger gains.

Inflationary Strike

There’s nothing more that investors despise than inflation. Surging to around 5.5% yoy in Sept, this has been fueled by record low interest rates and trillions of dollars of gov’t spending. Inflation is unavoidable for the most part but able to be erased and avoided if we put our long-term thinking caps on.

Inflation erodes purchases power requiring investors to perform their least favorite task: rebalance out of their favorite bluechip stocks and into more defensive, stable investments such as U.S. government debt or small caps.

The reason why investors fear inflation is due to uncertainty. Although everything in the market is uncertain, history does reveal juicy lessons that end up repeating. For example every 8–10 years the economy is known to go through a recession. As much as we hope one doesn’t happen again, recessions are in fact healthy so stocks don’t inflate to the point they become too expensive and trade at 200x earnings as some of our big techies are valued at currently.

For the most part, analysts, forecasters, and economists have been bad at predicting inflation. They attempt to avoid it by adding more risk to their portfolio as more risk = more return but in hindsight, it leads to lower returns.

According to the WSJ, “Federal Reserve Alan Greenspan noted in 1999, estimates of future inflation — including those by the Fed itself — “have been generally off,” and even changes in inflation that were “doggedly forecast” never occurred.”

Even highly skilled investors certainly don’t know everything, especially inflation. That’s why they fear it the most.

How To Hedge Against Inflation

Quick Foolish Answer: Rebalance and reposition everything into options, commodities, forwards, derivates and more risky assets.

Most investors tend to follow this quick strategy as they want to get away from inflation by speculating and hedging against it. That’s the purpose of options, put, calls and derivates. They derive their assets from another investment or asset, interest rate, index/benchmark or even current event in hopes of earning a juicy quick profit.

Yet overhauling your portfolio into your favorite cyclical growth stock is a poor educated move.

Weigh these assets instead:

Gold vs. Crypto

Many asset classes, most evidently gold, known as the classic best inflation hedge has failed to keep up with asset prices and the cost of living for decades end. In response to this, investors should be resorting to alternatives assets such as but not limited to cryptocurrency, farmland, art, and fiat currency since gold has been down almost 5% this year alone not doing its intended job of keeping its investors secure! Don’t be a gold digger anymore.

Investors who dig into gold fail to see how it has performed recently and instead simply believe gold and other precious metals will make a sweeping comeback when they realistically haven’t in a long time. When comparing it to bitcoin, with a supply cut off limited to mining only 21 million coins, this digital currency has safeguarded holders from inflation yet at the same time with its erratic volatility, it isn’t known to be a fool-proof safeguard asset so I wouldn’t suggest having it more than 1–2% in your portfolio at any time.

Value vs. Growth

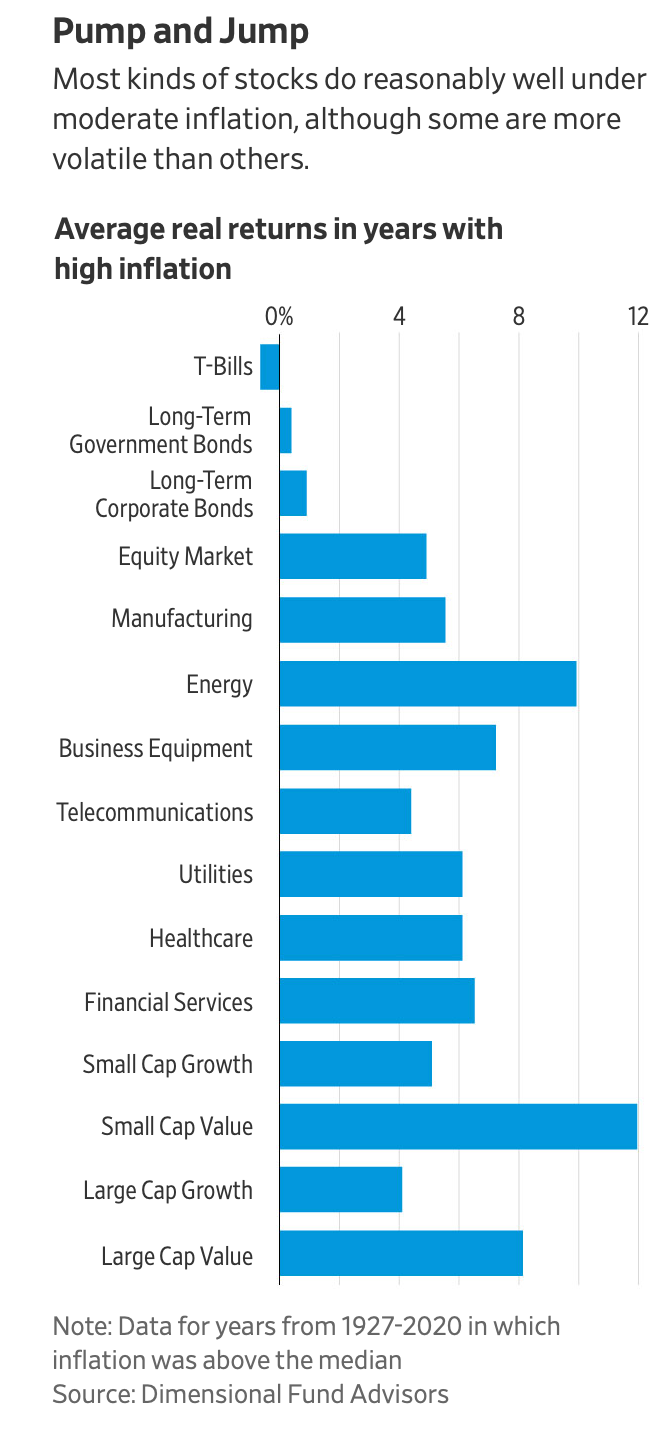

Value stocks that have lower PE ratios and that trade at low prices and valuations relative to their earnings have been performing incredibly well this past year. Don’t rule out small caps just because they are small. They are small yet mighty in their future outlook.

This was not expected as growth stocks tend to take full advantage of low interest rates as they are less cash heavy and dependent on the short term relying on future expectations in the future.

For the most part, in periods of rising consumer prices, value stocks have outperformed growth since they rise price as prices rise. They are traditionally found in industries such as retail, consumer staples and discretionary for everyday goods. The customer has less purchasing power in this industry. Compared to the tech world, it is harder to rise prices as their products aren’t everyday staples, although hard to believe, and there is a cap on how much one is willing to pay for social media. Plus a majority of their products are free making it harder for them to increase prices. Their valuation increases through network effects. The more users they have, the more money they make and in sum, irreplaceable.

These value stocks in the consumer staples, discretionary, materials, real estate, and even healthcare pharmaceutical space are not only defensible but have provided a ton of insulation against inflation this past year.

Tangibles

In addition to value stocks, tangible physical assets are always great stabilizers during an inflationary environment as their value goes up as prices rise. Plus you can depreciate it as it appreciates. No other investment does so! These include but are not limited to equipment, machinery, factories, and real estate. These operate in sectors such as financials, energy, materials, and industrials.

Energy vs. Commodities

Both traditionally known to be inflation hedgers as they are stable and less prone to foreign and business risk, in recent years they haven’t been a foolproof tool. Since commodities are basic staples such as corn, wheat, coal, etc., they are highly dependent on the weather and economic conditions. As consumer prices rose in 1998, 2001, 2008, 2014, 2015, 2018 and 2020, commodities have lost money as well since they are too risky and uncertain in inflationary environments.

U.S. Government Debt

This is the safest investment in the world and acts as a risk-free asset. It is a form of fixed-income and comes in the form of a bond, note or bill with differentiated maturity dates depending on how long you want to continue earning interest from your loan given to the gov’t.

If you want more return, investing in TIPS (Treasury Inflated Protected Securities) can offer you protection against volatility in consumer prices securing you with the highest interest rate adjusted to the real rate of inflation.

Ultimately to beat inflation, you need to own assets that generate higher yields than the rate of inflation. These usually come about in scarcer assets that are harder to replicate such as crypto or gold but as we’ve seen, this isn’t always the case either so keep an eye out for how inflation is panning out every time.

Overall, staying diversified, not over-leveraging yourself by putting all your eggs in 1 basket, and not going all in in one asset class or unicorn is always your bet bet. If you’re invested in a ETF that tracks a broader benchmark for example the S&P 500 which consists of 500 of the largest U.S. companies, that choice alone would have allowed you to outpace moderate rises in the costs of living already. U.S. stocks as a whole have outperformed inflation by an average of 4.9 percentage points according to Dimensional.

By simply investing and not solely earning W2 income, you are paving a path against inflation. Buy what you need, not what you want and inflation will eventually pass. The rest is up to you to control inside that portfolio.