Half-way through the pandemic, I was a bit bored. I was dealing with cabin fever, Zoom University and as my pet peeve is procrastinating and wasting time, I needed something else on my plate.

So I randomly merged my interests of self-help and personal finance into this blog in July of 2020 not expecting it to go anywhere.

8 months in I can confidently say it is certainly one of the most fulfilling and rewarding activities I’ve ever taken on. Getting to speak to hundreds of you per week via email and help GenZers to Millennials, grandparents to teachers pay off debt, learn about goal setting and make finance fun is extremely satisfying.

Yet it wasn’t so easy as buying a domain and marketing to all of you 11k readers especially by word of mouth. As a non-social media user, except for on LinkedIn, I relied on all my colleagues I could find in the Zoom meeting and close friends to spread the word.

It took a lot of optimism, determination, late nights dealing with pesky WordPresses plugins, it’s poor and horrible infrastructure system, customer service from MailChimp, and dealing with the anxiety writing in front of thousands, my worst fear.

Yes, even worse than death.

The problem with writing as a student is that I’m so used to being asked what to write. For the longest time until late HS, I never enjoyed reading and certainly not writing because school told me to only read Shakespeare and write in poetic script dictionary language that I couldn’t understand.

Complicated is overrated.

Simple is cool.

Back to the Basics

I’ve always been a simple, basic gal who has 7 pairs of white shirts, a routine exercise health food junkie and values my time to the second but it’s taken me a while to cut down on writing.

I’ve always struggled with it until I started writing about what I want to learn. As someone who reads the NY Times, WSJ and Medium daily for roughly 3 hours, I still couldn’t find what I was looking for and decided to write about what’s important to me: financial literacy, mental health and my struggles because I know what I’m dealing with, someone else is as well.

And that led me to start something during quarantine.

I call it a blessing in disguise because through all this time spent at home, I could finally embark on solving my problems and work towards my passion projects of building a startup and blog.

Without all this free time, I would still be a student not a true learner. Plus by the time I graduated from HS I was so tired of taking on all these extra activities just to put on my college application and 5 page resume, I needed a real purpose.

I can’t imagine the pressure for HS junior and seniors at this moment as most in-person clubs and sports are canceled and feeling the need to take them simply to get into college.

Yet, tbh, we all felt that way.

Who would run Model UN for 6 hrs a week for fun?

There’s always another reason for everything.

Starting Over

Whenever starting something, there’s never a right time and that’s what trips most people up so they end up never doing it. We wait until we earn x amount of dollars, get into x school or assume when we turn 30 we will have the toolkit to succeed yet the truth is there’s always free information online to learn.

We consume too much and produce too little that we never get to where we want to go.

Cycles

During a pandemic, there are cyclical businesses (those that boom during a downturn).

We’ve witnessed that the leisure, hospitality and tourism space got crushed due to social distancing and lockdowns and e-commerce, finance, energy and technology all got boosted in this remote environment.

A major part of success is luck. The best thing you can do to prevent financial collapse or turmoil is to build a defensive business.

In our personal life that translates to having a cash cushion to support 6–12 months of any emergency expenses-in case you get evicted and don’t have enough to pay rent due to losing your job, get into an accident, etc.

What’s certain is uncertainty so you must plan for the worst hope for the best.

Why Recessions and Downturns Are the Best Time To Start Something New

-Low interest rates to borrow but borrow smartly

-Take less irsk with more risk in market-able to start an in-demand business such as mask making at the start fo teh pandemic

-People take it easy on you

-Stimulus from the gov’t-boost in economy, lower unemployment

-The stock market isn’t corerlated ot main street so invesmtnets tend ot do well this is mainly due ot the increase wealth gap-rich get richer, poorer get poorer

-Businesses and consumer look for cheaper alternatives-prioritize lower operating costs (the thing not to do is increase costs because not all goods and inelastic(always in demand)

The one thing that is guarantee during any recession is that your intellectual property will always be safe.

From investments to real estate, they aren’t always guaranteed to last. Yes people need a place to live but who knows what the next recession will bring. Maybe people will realize that living in their cars is better than homes or the stock market is so rigged that investors start pooling their money out of it and rely on retail trading platforms instead!

Who knows! The world changes rapidly and most things don’t make sense but what does make sense is to own an asset that appreciates and is always in demand which includes a domain licensed under your name because the World Wide Web cannot shutdown.

The best example is owning a website domain like Boiled Not Fried. Compared to owning a YouTube channel or podcast, those are hosted by a separate domain, ex. YouTube or Spotify, etc. and can be taken down or demonetized anytime by billion dollar C-suite corporations.

With a blog, you own a domain on the website by a provider that will always exist and they have no control over your content. Creating free content is the best way to promote new users and readers. Then you can eventually convert them into paying customers if interested in creating a paid newsletter similarly to what Morning Brew does with its million dollar sponsors.

Class Structure Divide

The pandemic was a pretty great year and a half for the rich hence why the wealth gap grew even larger and the battle between Main and Wall Street thickened. All the 10%+ had to worry about was to not get sick in their 6th beach home and ponder when they’ll be able to be back in their pilates studio.

For the rest of Americans (roughly 63%) who live paycheck to paycheck, these folks struggled to pay rent and most likely got exposed to Covid as WFH is not an option at an Amazon facility. As a result, they had to work harder during this pandemic and didn’t have time to start something new as the upper class did.

Luckily, everything eventually ends and we are getting closer and closer every day to the light at the end of the tunnel.

Whether you had extra time on your hands and were lucky enough to boost your net worth during the pandemic, good for you but if you didn’t as an essential worker, luckily you still have the after affect to take advantage of.

Lagggg

Surprisingly, post-crisis periods are amongst history’s most productive eras.

Let’s examine global historical events ranging in Europe to the US to compare:

-London was swiftly rebuilt after the Great Fire with new infrastructure and construction planning

-After the 1918 Spanish flu, the US revitalized the economy and the Roaring Twenties came about

-The Marshall Plan turned enemies into allies and new leaders came about from war

In this case the war is the pandemic and the leaders are IPOS and SPACS in today’s world.

So why is this so?

The phase of the economic cycle is unpredictable but all we know is that it will end eventually. Since a recession/economic downturn happens every 5–10 years as the economy goes through waves, the first one was globalization, second innovation and technology and now the influx in the health care and e-commerce space is booming, this is a healthy way for the world to show it has growing pains.

Let’s examine why this pandemic in particular is a great time to start something new. Currently we see more of a K-shaped recovery happening with inflation coming about in the next coming months as the vaccine rollout picks up.

The factors that are helping entrepreneurs to newcomers into this risky field is:

-$1.9 trillion dollar stimulus package to boost consumer spending, saving and unfortunately Reddit retail gambling (hopefully not everyone will get enticed)

-Open to a new wave of home delivery, e-comerce markets, eating healthier and valuing WFH and work life balance better-people would rather take up less pay for more quality time

-Remote Work: Massive Opportunities-Commercial real estate is a $16T asset class-real estate is a hedge against inflation a great asset to invest in as interest rates rise and the demand for office space declines by a third-crowdsourcing is also a smart move

-Comeback of cities-will be cheaper, younger and more diverse perfect for startups

-SPAC frenzy and new fields such as health care-Amazon Pharmacy-healthtech-largest consumer industry in US and AI, robotics, blockchain and cryptocurrency

-Free and non-free education online-way to upward mobility- tuition rises each year pandemic moved 1.6 billion people into online education and most notably retail trading-online brokerage spur

-Crypto-$1.7T asset class- Advantages: limits intermediaries, no regulation and volatile-game keeps people hyped as opposed to classic gold-

Ride the Waves

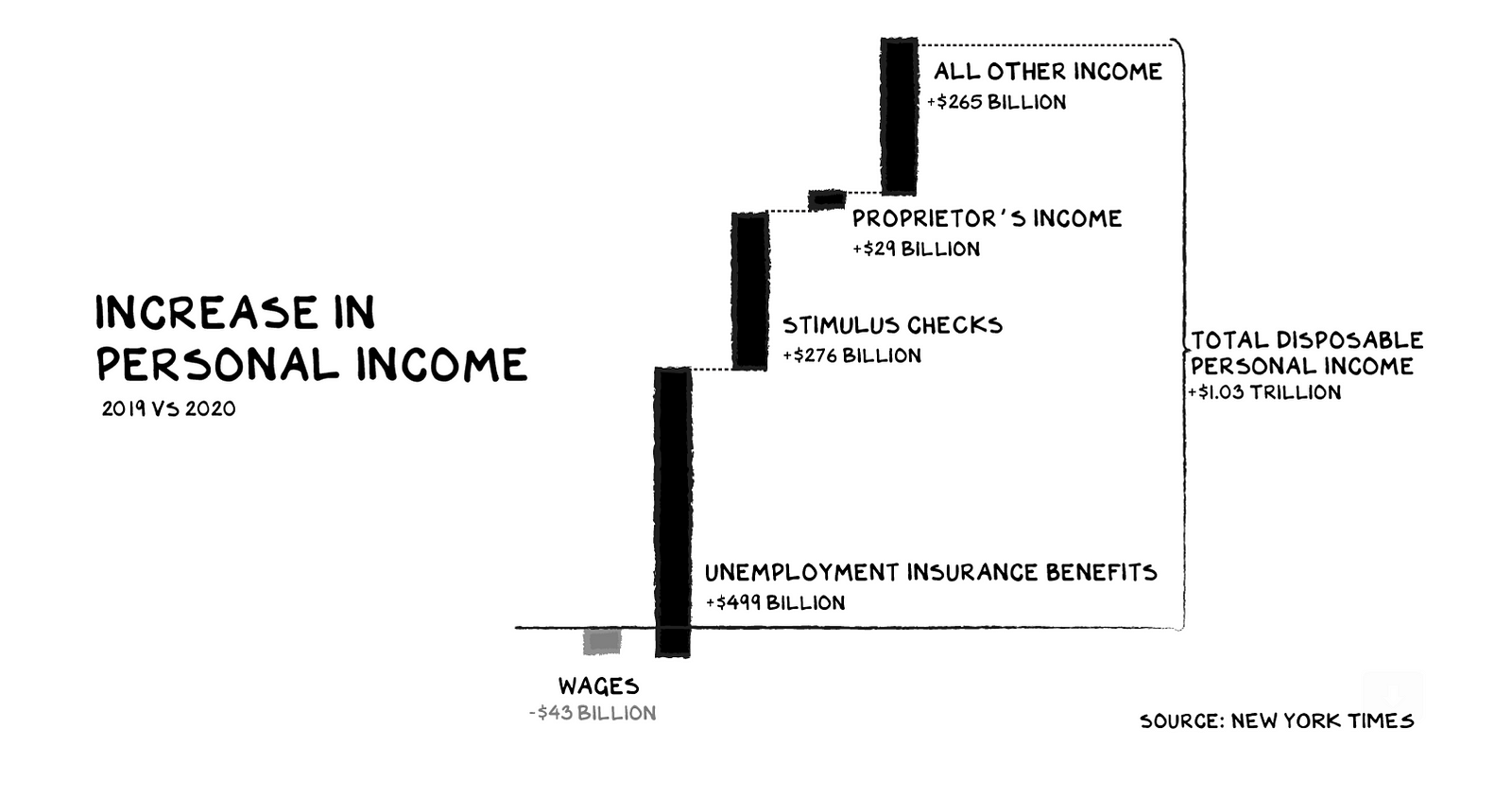

As the wealth gap has widened, we’ve at least seen an increase in personal income since the height of the pandemic (March 2020) when the stock market lost roughly 23% of its value in a few days.

Thanks to stimulus and sheltering in place, this has been an ideal time for people to prioritize their cash cushions and also focus on others things besides vacations, eating out and going out every weekend night.

Yet as with everything, there are also downsides, especially during a rough time.

Downsides to Starting Something New During A Pandemic

-Big Tech getting bigger

-New admin-higher taxes in states where people try to migrate WFH

-Feels lonely to start something new at home

-Starutps and SPACs loosing steam-no quality companies in the last few months

Lastly, if you don’t want to hop on any pandemic or post-pandemic entrepreneurship train and never take any risk, well then expect to be comfortable.

But if I would advice a few things here they are:

The Best Thing To Do AnyTime:

-Invest in early-stage seed startups/high growth companies the younger you are and when interest rates are low=when tech does best

-Be bullish on Crypto and invest in non-depreciating assets/hedges such as real estate, crowdsourcing, REITs, etc.

-Invest in yourself

-Set up an emergency savings account

-Have at least 2–3 passive income sources (check out here for examples)

There’s a lot out there to explore. Be wary, cautious and just start because there’s no good time to start anything anyway!

We typically regret the things we didn’t do not the things we did do.

Regret regret, nothing else.