In the short-run, grossing a high net-income per year would be preferred.

More deposited in one’s pocket per year, the easier it is for them to use it to their liking. The only problem is, net-income from an employer isn’t guaranteed to last or be as grand in subsequent years.

Most people don’t even pay attention to their net-worth compared to their AGI, take-home pay. If I asked random people their net-worth versus net-income, I’m sure most would nail down to the penny their yearly income but place their net-worth in a ballpark.

Earners become too obsessed with the yearly salary that what goes in and out becomes harder to track and assess over their lifetime. Plus you’re more likely to overspend with that immediate cash than having to tap into resources or sell your investments.

More friction = less compulsion.

A high-income looks terrific on paper and is the best Christmas gift but is quite deceiving overtime since it’s rare one will spend, borrow, and bet less the more they earn.

These are the main problems with earning a higher W2 income:

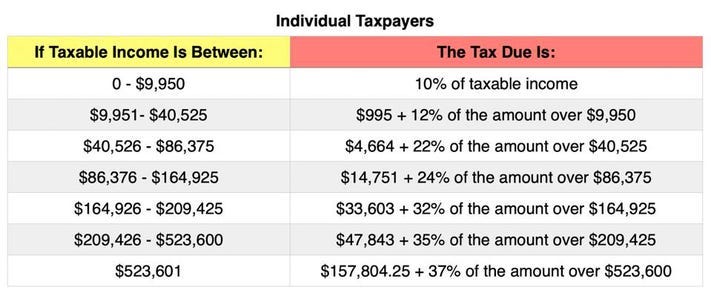

-Mo Money= Mo Taxes paid out to Uncle Sam, up to the 37% marginal tax bracket, it may not be worth it to keep earning at that high-level

Here’s the 2021 marginal tax bracket breakdown per income level:

-Lifestyle inflation creep

-Safety concerns

-Pressure and fake allure

-Health, work-life balance concerns

-Titles, prestige mixed with an inflated ego

-Not a true indication on overall balance sheet

-Not guaranteed

Clearly the more you earn, the more you keep at the end of the day but with the overall lack of financial literacy, impulse control, and excess pleasure people receive from cashing a thick paycheck into their account, they are more likely to spend more due to the number’s enticing allure.

There’s nothing wrong with spending more. You rightfully earned it, usually, and can make your life better because of it. But it’s better to live with a little more than a little less. The most common first large purchase a high-earner makes is upgrading to a larger home. A home they don’t really need but say, “why not?” to because they are earning more!

Top management and higher-paid positions are less replaceable since you are a crucial part of the company but the most important part is what not to focus on which is the income, bonuses, equity compensation, performance pay, etc. and instead your overall net-worth once you reach this level.

It takes time to build a solid foundation, a.k.a your net-worth. The average net-worth for a 21-year-old is -$50k so if you’re above that, you are technically above-average. Wouldn’t recommend striving for $0 in the bank, but with looming student loan debt rising faster than inflation, along with inflation on staples good in itself, spending on costly fancy gadgets we need to survive these days, and the cost of being a student in itself isn’t cheap. I wouldn’t be surprised if ~90% of teens were in debt, but hopefully for a helpful cause to pay for college and possibly get a mortgage, all while working a minimum wage job or part of the gig economy.

As every successful person on earth says, “where you are now, is not where you will be.” The past does not determine the future. Everyone had to start somewhere and eventually that debt will reduce as long as you stick to your plan, not the pay-check amount, especially when starting out.

One of the biggest mistakes I see students make is that they take advantage of the word, ‘no’. They don’t capitalize on enough opportunities and are picky about pay! This is not the time to be picky and negotiate pay folks, I mean students. You are a student and made to learn. The earnings will come once the learnings are found. To grow your net-worth, obtain the skills to be irreplaceable in this knowledge based economy. Don’t work for your time. Instead strive to reduce your tax-income threshold, shelter your income from taxes and be your own boss by focusing on alternative ways to make a living outside of W2 income to truly be free.

Net-Worth, You-Worth

Your net-worth is an indication of your entire balance sheet. Assets — liabilities = net-worth. Asset and wealth managers can help assess your risk tolerance, portfolio split, tax threshold, estate tax plan, build your legacy, and tailor your investment thesis to help fund your investment goals through assessing your net-worth. Your net-worth is the only thing you got to really prove how financially secure and stable you are. Your net-income could go down the drain tomorrow, especially during a recessionary environment in a cyclical industry.

You can be comfortable in your net-worth but not with your net-income. It is much more volatile and can unfortunately change anytime. Clearly if you owe more than you own, you’re in the red zone and to reverse this it requires diligence, not overextending yourself, not believing you are smarter than the market, having an appropriate budget, and not putting all you eggs in 1 basket through diversification.

Some would argue a net-worth isn’t a great indication on how large of a mortgage payment or any loan you can take out but the truth is, it’s better than any other indicator. The higher your net-worth, the likelier you will hear back and be approved by a lender for a mortgage. Plus you can take out collateral against your home just like against a stock if you need to raise funding. CEOs, most notably billionaires place collateral bets against their stock many times in order to fund their lifestyle and get a loan. Your net-worth is the most powerful indicator on how healthy your financial situation is.

Surprise and Downfall

Getting caught up in your AGI (adjusted gross income) amount is a dangerous move since it can fluctuate each year and most importantly, isn’t guaranteed forever. Unlike investing in the market where majority of your net-worth should be allocated and grown from, if its invested in diversified low-cost ETFs or index-funds that track the broader markets, these are fool-proof easy, passive hands-off ways to stay afloat and secure. On the other hand, managing a lofty net-income budget is much tougher especially when higher earners tend to want to prove they have cashed it.

Managing your net-worth on the other hand takes more time and diligence. Yes it can be as simple as managing a fancy budget and profit/loss statement but the higher your income, the more homeownership costs go up, liabilities, expenses of various kinds, scams, gifts, donations, subscriptions, pleas, come your way and if you don’t look at your overall balance sheet, you can become toast.

The most important rule to follow when earning money is to never become too reliant on it. The best way to combat this fear is by setting up uncorrelated income streams. Investments, a business (blog or rental), side-gig/side-hustle, etc. The world is your oyster! Earners who solely rely on W2 income never become financially free and flexible, no matter how high since taxes and the comparison treadmill chase them down.

The 50/30/20 budget rule tends to fall out the window once one’s income exceeds $100k which is concerning especially since we don’t usually need more earning $20k even $200k more. We know it won’t make us happy so we can’t get too complacent. There are far too many cases where top 10% and above earners simply buy a mega-mansion because they can. They couldn’t before and they want to seize and prove that they can now providing no extra value and only more hassle to them later. Don’t fall into the trap of extending your lifestyle so much that one day it might end and you’ll have to move in with 3 roommates again.

Loss Aversion

Debt is a key component and tailwind in helping people grow their net-worth. It can act as fuel especially since majority of homeowners put less than 20% down on their homes, even during the pandemic when they were flushed with stimulus and low-interest rates. There are two kinds of debt: good debt which includes a mortgage and student loans that are investments into your future and bad debt, such as credit card and luxury good debt which compound overtime and erode your savings. Having a balance of being able to manage debt starts with diving into your portfolio and overall net-worth. Decoding your income streams and what you owe versus own. There’s no reason to obsess over your net-worth and you probably won’t notice once you cross the 6,7, 8 figure mark since it is irrelevant when you are earning money and letting it grow passively for you in ways that enrich your life and allow you to bring value back into the economy. Earning money in your sleep is a game-changer. Earning money as a byproduct of success is a blessing.

The Ultimate Income

W2 income is certainly helpful but not ideal in growing wealth passively and securely. Through aggressively saving and investing as much back from your AGI as you can into your investment and retirement accounts, you can easily become a millionaire under 45 with a 8% annual compound growth rate. It is a great catalyst to propelling your wealth overtime and should certainly still be a part of your income sources, just never the only one.

Since you are beholden to Uncle Sam, owning a business, enterprise, intellectual property, rental property or any kind of business whether it generates passive income or not is more ideal for tax-purposes and longevity. It’s bizarre how the IRS goes after high-earners while lower-earners in the lowest income brackets can easily make more than 8 figures per year with their business ventures! No wonder the billionaires paid $0 in income-tax. Their net-worth is tied up to their company’s stock price and they never sell their gains! That’s the American Dream!

Since you can deduct your expenses on a business, it is tax-deductible. This means you can charge whatever you need to grow the business and reinvest it back into it and the tax liability will be minimized. The more you spend on it with proof, the bigger break you get.

No wonder 80%+ of Americans don’t pay taxes! This is the real reason why owning a business of some sorts provides true freedom to build generational passive wealth and enormous wealth holdings overtime. It must be invested into the market and yourself!

Never undermine the power of other income sources. Your net-worth is your stabilizer. Check it frequently, but not too frequently that it becomes obsessive. You should know how it’s risen YOY. There are more opportunities than ever to boost your net-worth and the time is now before the Fed starts to taper, markets get extra frothy and wild, housing prices plummet, and interest rates rise.