If there is one example that you should never follow when it comes to managing your money to help you achieve your goals and live out your dream of becoming financially free, it should be the US government.

At the end of fiscal year 2019, the total federal debt was $22.8 trillion dollars. Taking the first and final fiscal stimulus package into account, that number is now at around $27 as of October 1st, 2020, and only increases by the second. If you want to check it out, head down to Union Square and the debt calculator will be staring back at you with embarrassment.

Compared to Americans who actually need to pay off their student, car, business loans, etc. off in full, there is no need for the government to rush the process.

So how does the wealthiest nation also owe the most debt?

Taking into account foreign exporters, selfish wants, and preservation, the United States owes the most to China, the largest foreign owner. But besides our frenemy as the culprit, the Social Security Trust Fund which houses all our retirement money owns most of the national debt. This is through the military retirement fund, the fed disability insurance trust fund, and cash on hand to name a few resources that fund the federal government.

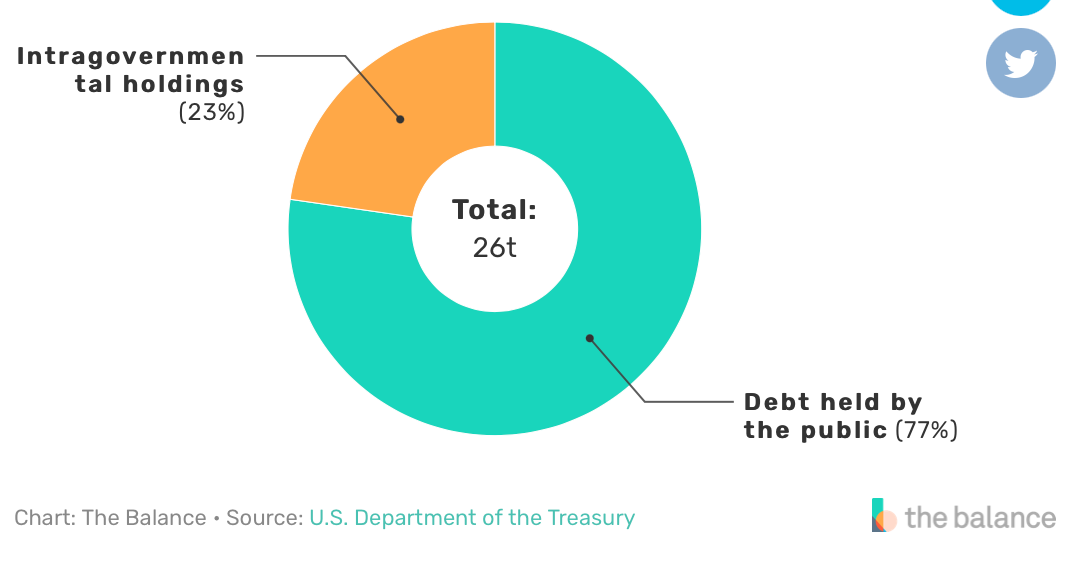

Through the debt that is held by the U.S. Treasury(intra-governmental holdings) and debt held by the public, the public holds about 77% of the total debt compared to 23% by the Bureau of the Public Debt.

So let’s just get down to the crucks of it.

There are 4 ways the US government can actually pay off its debt. With no obligation or time frame, compared to us individuals with harsher restrictions.

Off with your head!

Until the sovereign debt (nation’s debt) cuts into more than 77% of GDP then that will affect annual economic growth and we citizens will have to abide by these methods:

-Cut government spending

-Raise Taxes

-Drive economic growth at a faster rate

-Shift spending to areas that create the most jobs

As a result, we aren’t able to initiate any of those rules ourselves.

The best tips for paying off debt in full at a consistent rate for us Americans includes:

-Budgeting

-Allocating savings/emergency savings

-Earn passive income

-Sell investments/assets

-Learn to live frugally

-Spend less, make more

That is easier said than done but requires no additional money or skills upfront.

When we want to learn about money, it usually entails wanting to learn how to make as much as possible through get rich quick schemes or understand what is the best way to outperform the market in gambling with RobinHood.

All of these methods lure readers because they seem easy and effective long term.

That leads me to my first point:

Passive Income Isn’t For Everyone

Everyone would love to earn a few extra bucks a month here and there and we have this inclination to want to do it so bad so we end up reading inspirational cheezy articles to get us hyped. We follow the rules, whatever they may be, and get started investing or dropshipping until we discover that it takes distinct characteristics to start something that might never be successful.

You have to put yourslef in an entrepreneur’s shoes. Passive income requires a lot of additional effort, patience, and grit upfront for possible returns in the future that aren’t guaranteed. Most Americans, 62% to be exact don’t have that grit because that is the percentage of the population not invested in the stock market. I understand some people don’t invest because they don’t have enough or the education but those are all just excuses. You only need a $1 invested in teh stock market to grow. Open up a Vanguard, Fidelity, Charles Swab, etc. account to get started and see results but you must be patient becuase there will always be volatility but those who will really miss out will sell during the lows and not wait out until the market has a correction, which always happens.

You Already Have What You Need

If you are safe, healthy, sheltered, loved, educated to some capacity, you are set. It is fascinating to me how the more you earn the less you are appreciative of what you have until you buy it and realize it was a waste of money.

I was walking on 5th Ave the other day and saw 2 types of people. One guy with sweatpants and a Zara hoodie getting his Honda parking himself in the underground parking and the other dude wearing flashy Loui Vuitton and Gucci slides made to impress and showoff with his Lambo worrying if it will get scratched trying to park himself.

I know, looks are deceiving but if you have time to snag that outfit, you have time to waste your time on what other people think. Hence, the less energy and time you put into your outfit, food, and things that don’t help you succeed educationally are followed by the ones who are really wealthy, not fake wealthy just for the store appearance.

These days the idea of stealth wealth is becoming more and more popular and I couldn’t love it more. When you are rich, you feel it. There is no need to show it off and make people jealous of you. Similarly to a conversation. When you are weak in your arguments, then you refuse to listen to others because you are easily swayed as opposed to a strong confident leader who is open to listening to both sides.

Less is more at this age. If you can be appreciative and grateful, you will stay grounded and value what the universe has provided you. Whatever you have, someone wants. Keep in that in mind.

2 Types of People: Those Who Find It Hard To Save & Find It Hard To Spend

Believe it or not, it is rare to find an individual who will be able to equally master both. Even the richest or the rich will lean towards one or the other. We live in the age of consumerism where the bigger home with the backyard is more special than a homemade meal or saving means living a shoebox. For some reason, we assume we cannot find moderation and balance in 2 hard things.

If you are looking to earn more without finding a new job or living a dreadful minimalistic life, then maximize your savings. Evaluating what you do and don’t need will allow you to have more money saved up for the things you want to have and do. As always make sure to have 2 years of emergency savings saved up in case you lose your job and need to support yourself during that time. If you are a big saver, decide if this is working for you or not. If it isn’t, then get a remote side hustle online such as copywriting or social media marketing.

Everyone is online these days. Use it to your advantage!

Realistic Pessimism

In order to thrive during the worst times, you need to be prepared for the worst. This pandemic has tested how families and Millennials in particular who are the most risk-averse and apparently hate cash, how to survive. As much as you want your money to grow for you through tax-smart investing and allocation in the stock market, real estate, and side hustles, cash is there for a reason. It isn’t uncommon or not possible that something may happen. That is why car, life, health insurance exists so you won’t have to pay double out of pocket costs when it happens. Being prepared and financially secure during a recession is a badge of honor because they are bound to come. You just don’t know when. Isn’t that the thrill of life we always talk about? Post-pandemic we will experience it more because we will be taking those risks so be prepared.

You Won’t Change

The first things college drop out athletes purchase with their first and usually only million-dollar paycheck is luxury cars, goods, or gold teeth. Yes, gold teeth. Not to make themselves a better person but to let others know that they work hard and deserve this garbage.

There is a difference between someone who really deserves to be wealthy or not.

Working hard at a job will be a lot more challenging than being unique and different and making your wealth that way. It’ll be a lot more fun as well.

No matter how much you own, you have the ability to change every aspect of yourself except your mind which is addicted to this negative lifestyle that you’ve displayed about yourself.

But have you ever seen Warren Buffet or Bezos wear luxury clothing and have their ears pierced? You don’t because they don’t spend their precious money, even though they have more than anyone on cheap liabilities because it doesn’t make them feel better.

The lucky rich buy depreciating assets (liabilities) that take money out of their pockets.

The true sustainable and long term rich buy appreciating assets (gains/returns) that put money in their pocket when they are sleeping and traveling.

As much as $1 million might seem like a lot when you take into consideration the various property, capital gains state tax, and solely leave it to spend, you are poor.

Investing your hard-earned money to make you more through compound interest such as a ROTH IRA, index, or mutual fund, contribute to your retirement account, and pay off all high-interest debt such as car and credit card loans as soon as possible to not be beholden to the movement or your bank.

That’s why if you play the lottery, the most important part is to learn how to manage it if you win. Losing it all is easier than keeping it.

Money Is Dangerous

The more you make, the more you spend. This is called living an inflationary lifestyle and only those who haven’t managed their money before such as college athletes or lottery winners fall into this trap and eventually go bankrupt. When you make more, there aren’t only more problems in relation to your security and reputation with a ton of assets under your name that you need to manage, but also the diligence you must take to coordinate it correctly and pay almost half in taxes depending what you make and where you live. As hard as this is to do, it is best to live the way you would live without that money, pre-earnings. It is tempting to buy a home and more gadgets when you achieved that paycheck. Go for it if it is really going to make you happy, but I suggest waiting at least 72 hours for every purchase. Remember, the best investment is in yourself because no one can take it away from you and there is no tax on it, the most expensive fee we ever need to pay.

A Farmer Can Easily Be Wealthier Than A Business Man With No Extra Work

It’s not about how much you earn, it’s how much you keep in the bank. You will hear this over and over and until you hone into your brain that what someone drives or wears has nothing to do with their worth, then I will shut up.

Don’t be careless about these basic money principles that can separate you from the rich and poor. It is all mindset and following your own path, no one else’s. You can let other’s assumptions and opinions lead you to debt or follow what you need and right for you to lead a financially free happy existence.