Eventually at one point, none of us will be here anymore.

It’s hard to imagine and wrap our heads around, but what if I told you the most important step towards financial freedom, security and mental sanity is to prepare for death?

What if you get hit by a bus tomorrow? Not a question you want to be asked, but those who answer and have a plan always come out alive.

If we’ve learned one thing during this pandemic, it’s to plan for the worst hope for the best. Those who relied on one earned income source (their main job that robs money out of their pockets due to taxes and time), assuming that it will always be stable and never leave them in financial jeopardy if their company goes bankrupt, went into the most trouble.

The less you rely on, the more you have to worry about.

Just think about it.

The more income sources you have, the less frightful you should be that you’ll get evicted, not be able to support your family, cannot afford necessities such as food and shelter because there are other alternative sources you can rely on to back you up in case one pit falls.

Same thing with death. From a financial standpoint this is crucial to take into consideration, especially the more assets you own. The more you’ve worked for, the more you own, which means more is in your name and as a result, when one passes, the government is after you.

This article isn’t’ a philosophical one about what happens after death. We all have our own beliefs. Instead, we will discuss the importance of planning for death, how to deal with it and how to put the least amount of pressure on yourself and loved ones when it happens from a financial standpoint.

As with everything, money controls our lives and it is one of the biggest factors to helping us mourn easier and allow the death to be a little less strenuous.

Prepping for Death

This isn’t something we want to do but need to do in order to prevent it. The scary thing about death is that for most of the time it’s uncontrollable, unless you commit suicide.

If you have a balanced, healthy diet, exercise regularly, have a passion, care about your mental and physical health, live a fruitful healthy life with a support system, stay safe and take calculated risks then you immediately lower you chances of death and also countless medical and insurance payment down the road.

But no matter how much you try to be safe, sometimes you don’t look both ways. What is certain is that death will unfortunately happen, we just don’t know when.

There are 2 things you need to do to be best prepared for a loved one’s passing:

-Talk openly and honestly about all issues related to locating finances, health concerns, medical bills, asset allocation, wills, trusts, etc.

-Make sure you are aware where everything is located and who owns what

The first step to financial preparedness is setting up at least 1 of the 2 most vital documents of our lives.

Yes, more important than a birth certificate.

Trusts and Wills

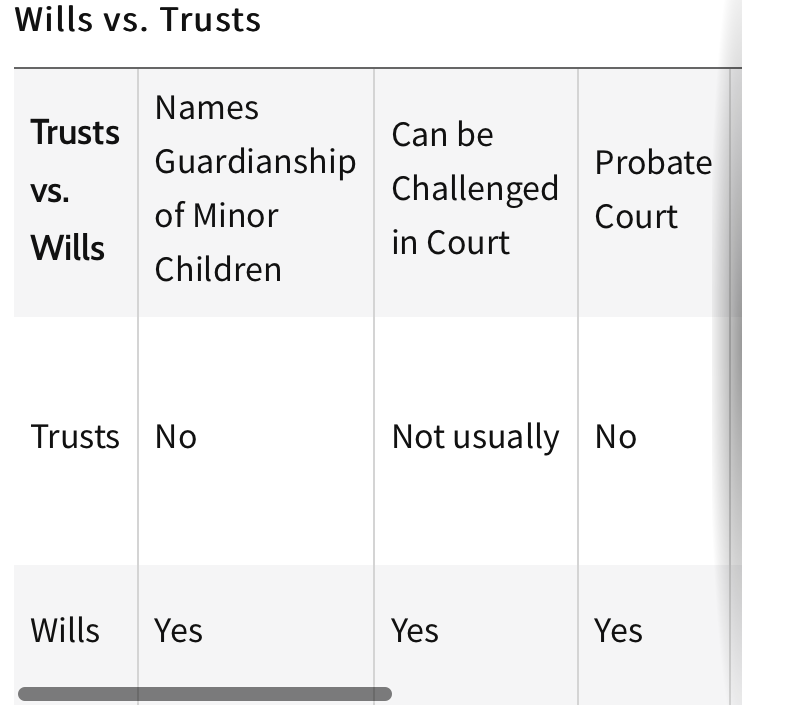

Both are estate planning tools that can help ensure your assets are protected so when your loved one passes, you don’t have to go through probate (court) and split up the assets and deal with ongoing fees.

Will (Always recommended for every citizen)

Written legal document expressing a deceased person’s wishes. This includes naming guardians of minor children on what they own and who inherits the cash and assets. How you want the assets distributed is the main goal.

The will becomes active after one’s death.

Trust (Optional)

A trust becomes active the day you create it. This is a fiduciary relationship in which a trustor gives a trustee the right to hold your assets and title their property(s).

They offer more control of assets. Irrevocable trusts are created for tax purposes especially if you own more than a couple million in assets and earn money in various places. Hence, they are more expensive and tedious having to hire a lawyer to set up but necessary especially if you have a substantial net worth that you don’t want court to investigate into, have many income streams and or a large family, I would suggest getting this put together.

Whether you need to choose a will or trust is up to you but wills are highly recommended and should be mandatory.

Especially if you are a guardian for minor children as a dependent, if you pass, they need to be appointed to have a new guardian. If a guardian is not appointed at the time of death, your surviving family will have to seek help in a probate court to have a guardian appointed for your children. The person appointed may not be one whom you would have wanted to be entrusted with your kids, so choose wisely through the will.

In addition, you ideally want your kids to inherit your assets and estate, not necessarily your partner, especially if you’re divorced.

Die Without A Will

This is called intestate, where the state gets involved and distributes your assets. The state will direct a guardian to minor children and the court follows a set formal on how to divide assets that could negatively impact a surviving spouse or child.

Wills are simple and easy. They cost less than $100 and are necessary for protection. No question. Ask your parent and yourself if you have one today.

Don’t wait unless you want the government or your mean uncle to inherit all your hard earned money once you pass.

Types of Trusts

Trusts are just another more complicated method of estate transfer.

#1: Living Trust

It is called living because it is created while the property owner or truster is still alive. It is revocable as it may be changed during the life of the trustor but unlike a will, a living trust is passed outside of probate so no court or attorney fees but it is still expensive to set up.

Since I’m a single child with only one dependent, my mother set up a revocable living trust when my father passed a few years ago to ensure that I wouldn’t have to go through trouble later on. It gives you a peace of mind and in my opinion, worth the work and cost.

#2: Testamentary Trust

These trusts are more expensive and help declare which estate is whose and is an effective way to control the passing of your estate beyond the grave.

Sum It Up

Wills and trusts are important in order to make sure your family knows who inherits what and who you would like to carry on your legacy.

They are important estate planning tools that cannot be forgotten especially when it’s too late. No one wants to go through court when mourning.

Which One Is Better?

A trust will streamline the process of transferring an estate after you die while avoiding a lengthy and potentially costly period of probate.

Deciding between a will or a trust is a personal choice, and some experts recommend having both.

A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

Do You Need Both a Trust and a Will?

Nearly everyone should have a will, but not everyone most likely needs a living or irrevocable trust. If you have property and assets to place in a trust and have minor children, having both estate-planning vehicles might make sense.

Other Necessities to Think About

Along with establishing who owns what and what tiles are put into place with your property to assets, understanding the logistics of long term care, insurance, funeral costs and arrangements, are crucial to take into consideration. They aren’t just a drop in the bucket. They all add up quick.

Life Insurance 101

Although a majority of readers are students, it is still imperative that you know what insurance is and if your parents have it. I’m sure you’ve heard of car or home insurance through providers such as AllState and Geico but what about life insurance?

Life insurance is an expense that robs Americans if not planned for. Medical debt is the number one reason Americans get into debt and life insurance falls into that category one way or another.

Purchasing life insurance is certainly a personal decision just like investing and getting a trust. With a will, as stated above, there’s no choice. It’s mandatory.

There are a variety of price ranges and different types of life insurance to consider which can get overwhelming considering one’s finances.

The top 5 reasons life insurance is crucial for one to have:

-Dependant care

-Unpaid debts

-Living expenses

-Asset protection

-Replacement of lost income

In simple terms, life insurance is insurance, similar for the car and home which are assets that pay out a sum of money either on the death of the insured period or at the end of the period.

You designate beneficiaries, similar to when you assign a trustee to your trust.

The main purpose of insurance is to hep replace your income when you pass away meaning that your beneficiaries would use the money to help cover essential expenses such as paying the mortgage or college tuition.

Instead of paying out of pocket expenses for an emergency, you have insurance that you pay each month or year, depending on the plan to keep you covered. This comes in a premium as a lump sum (large amount of money paid) known as a death benefit to your beneficiaries after your death. You get paid once they pass.

Essentially you are paying the insurance company for protection in case of your death or an accident. You don’t get that money back until you pass, crash, etc.

For example, funeral insurance is a type of insurance that can be used to cover funeral expenses when you die.

Yet overall, term life insurance offers a much better value because it can be used to cover end of life expenses and much more.

Personally, my mother has hybrid insurance and this is a quick way to provide the beneficiaries (myself) with the funds necessary to continue life and settle her accounts stress-free.

This plan is a policy that is 6 to 10 times your annual salary. It isn’t cheap but is a lump sum once you pass

Circumstances

When you pass away, loosing a primary wage earner of the household is scary.

That’s why I advocate for females never to rely on the male of the household to only work.

I was very fortunate both of my parents have always worked but if not, we would’ve been in trouble.

If you pass away as the sole provider, the loss of your income for your family could be devastating and they would have to live a lower quality of life and move, etc. so having insurance allows you to earn money from your provider.

This insurance provides the financial protection for your beneficiaries so they don’t have to worry about how to afford the bills and can maintain normalcy once a loved one passes.

A life insurance death benefit gives them flexibility to keep the assets you worked so hard to attain or sell them at a future date if they wish.

End of Life Expense

Most people like to take charge of things when they happen yet as we’ve witnessed during this deadly recession, it doesn’t work out that way.

No one likes to plan for death and hence those who don’t are the most stuck and dazed when something doesn’t go as planned needing to pay out of pocket with no financial support from insurance.

Planning a funeral, coming up with a plan for insurance and letting your family know your wishes is vital to ensuring a financially stable recovery.

Most people don’t realize how expensive funeral expenses can get. Based on where you live to the products and services used most burials cost about $10-$12k bust can easily surpass $50k.

Any outstanding debt, medical bills when you die will be passed on to your co-signer as well so make sure they are aware of what they will be inheriting.

Levels of Life Insurance Needs

When you are financially independent without debt or dependents, life insurance is unnecessary. When you die your estate goes to whomever you indicate on your will or revocable trust. Since you presumedly carry no debt, there’s no liability to settle.

Debt or no debt, once you have dependents, life insurance is encouraged especially if your children are minors, under age 18. This is an optimal time to set up a revocable living trust and have your financial security and all financial matters settled by your trustee, spouse, your parents or siblings.

People who are financially independent with debt and dependents have more risk and more to deal with taking care of children.

Their net worth composition is more complex and hence they will need to settle estate affairs, asset distribution and titles for their properties. If you have many financial accounts, it will take a long time for your parents, kids, etc. to go through them so advising them now not later where you keep your private information is key since you cannot ask the police to open up or investigate what’s not yours if you cannot unlock a safe or Excel file with key information to keep you financially afloat.

As a result, gaining access to all financial accounts takes a long time so having estate planning documents with detailed instructions is key.

End of the Day

Setting up a will and or trust buys time for trustees to execute their wishes and life insurance enables your family to go through the least amount of hassle when your assets are being passed on.

When you die unexpectedly your trustee needs to gain immediate access to your financial accounts, from passwords to properties.

Make it easier on your loved ones and get your life insurance benefits, trust and will in order so all they have to do is arrange the funeral and deal with any outstanding debt. This will put less weight on their shoulders not having to go through probate and deal with unexpected bills.

Live gently.