Believe it or not, the number one way to earn $1m isn’t through stocks.

It’s through alternative investments in and out of the market.

But before we get into the weeds of what these investments entail, let’s understand why stocks are the most common and easiest choices amongst new and old investors.

Since 1926, stocks have returned roughly 10% a year so that brings up the question, what percent of Americans own stocks?

Well, according to the Federal Reserve and lack of financial literacy in the education system, the rate is low as expected.

Roughly 10% of families with the highest income, 92% owned stocks as of 2020, 70–80% of the market are institutional investors and American’s top 10% holds 84% of stock ownership.

Stock Market Concentration

The top 10% of Americans owned an average of $969,00 in stocks, the next tier (upper middle class) 40% owned $132,000 on average and the bottom half of families, considered the lower to middle class owned just under $54,000.

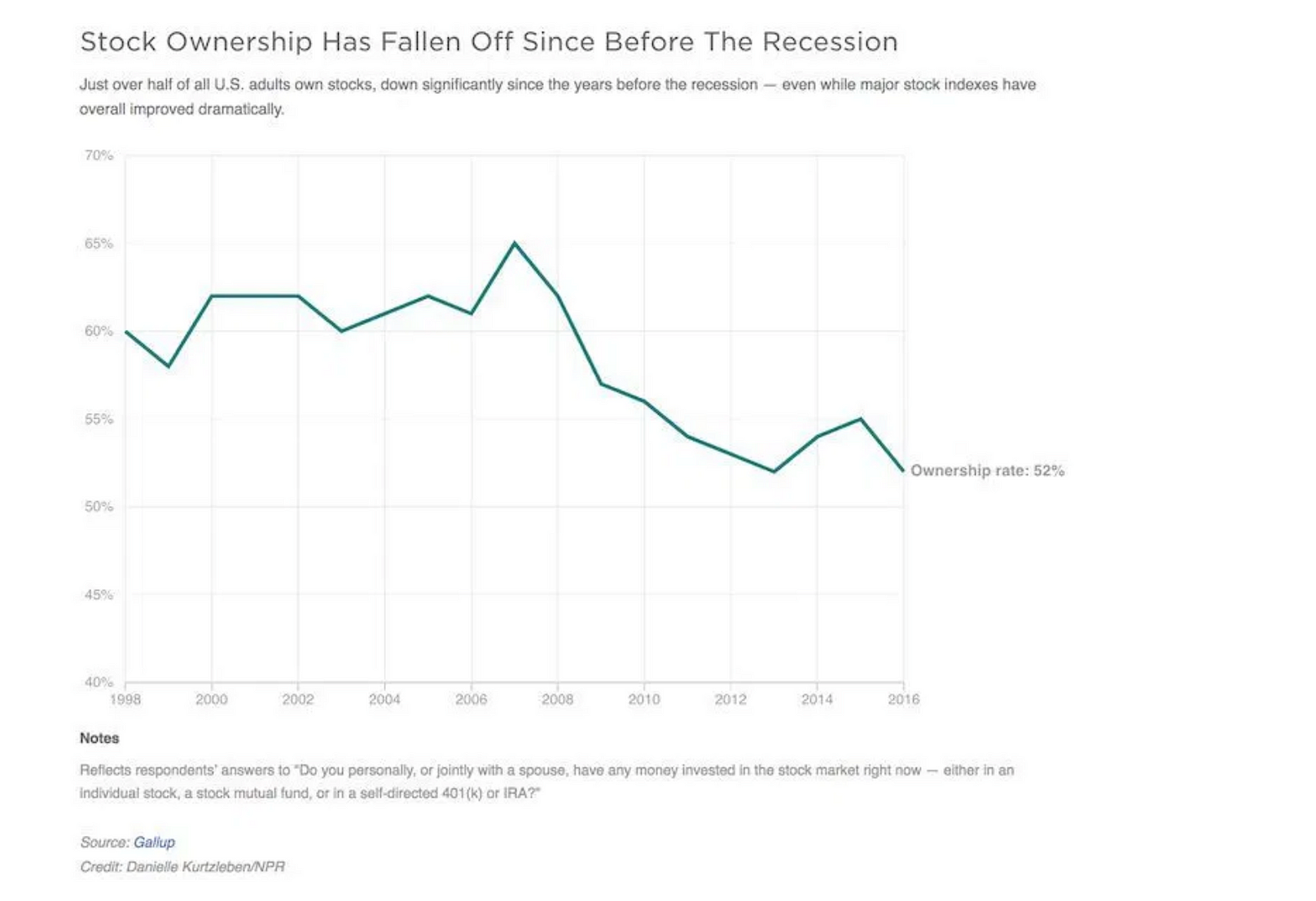

Surprisingly stock ownership has fallen to a record low of 52% overall since the financial crisis of ’08 despite the S&P 500 climbing to record highs each year since!

Are stocks too EASY and FUN to be true?

Stock Preference

Stocks are an easy way into the market. They don’t take much time to look into and since most Americans are financially illiterate, most investors don’t bother reading financial reports or hiring a broker when they can get all the information they need online for free.

With their inflated ego and lack of knowledge, most stocks buyers believe if they like a company, use their products/services, it has a decent balance sheet, presentable image and history and expect it to grow in the future, they simply stock pick from there.

Although many use their preconceived misconceptions to evaluate stocks, stocks are also a great pick for many alternative reasons and save a lot of money, time and hassle down the road in one’s portfolio which include:

Return + Pride

Although stocks have historically returned 8–10% year over year compared to other investments such as real estate which yields 2–4%, stocks can boost much higher returns if one gets lucky. In addition, you get to invest in any stock you want. If you’re a huge fan of wearing Gap jeans and using Apple products, its a great feeling to make money off of the companies that you love!

More Risk = More Gains with Ease

For those who aren’t educated on the markets(85% of Americans), they treat the stock market like a casino gambling game, especially on retail trading apps such as Robinhood or WeBull.

I highly don’t recommend having stock ownership of more than 50% of your portfolio unless you’re 10 or a hedge fund.

You can literally buy a stock, and it will pay out dividends for a lifetime. Those who choose to fiddle around as day traders are the losers. They are loosing more than gaining if you just stayed put. It may not return exactly what you hoped, but it requires no maintenance and you don’t even have to pay a mutual fund manager for 1% a year if you don’t want to!

Tax Benefits and Less Ongoing Fees

The longer you hold your gains, the less you will be taxed. Whenever you sell your gains, you will be taxed. If you sell your gains in under 1 year, you will be taxed the income tax rate amount. Over a year, it’s charged the capital gains tax.

In order to avoid paying taxes on investments:

-Invest in municipal bonds

-Consider real esate invemsnts

-Fund your 401(k) beyond yor employer match

-Max out your IRA and Roth IRA savings each year

-Keep your money in tax sheltered accounts/investments such as real estate, Roth IRA, IRA, pension, etc.

Compared to real estate, holding property requires paying property taxes equal to 1–3% the value of your property each year on top of maintenance, insurance and property management costs that can easily drain your investment and not allow you to make a profit off of your home especially if you sell it under 5 years of living there.

Diversification

You can invest in a multitude of cheap sectors from industrials to energy, information technology to consumer staples which will naturally make your portfolio more diversified which lowers the risk of corrections and loosing money.

Liquid

Compared to real estate, the least liquid investment, if you need cash from a property, you would need to take out a home equity line of credit which runs into hassle and is costly taking over a month to file sometimes.

But with stocks, they are relatively liquid and you can sell your gains typically in under 24 hours for cash.

The most liquid is cash but I would only reserve 20% of your portfolio for it since it depreciates in value but still necessary for emergencies. That way when an unexpected expense does come up, you can keep your investments and not have to sell them paying tax on top.

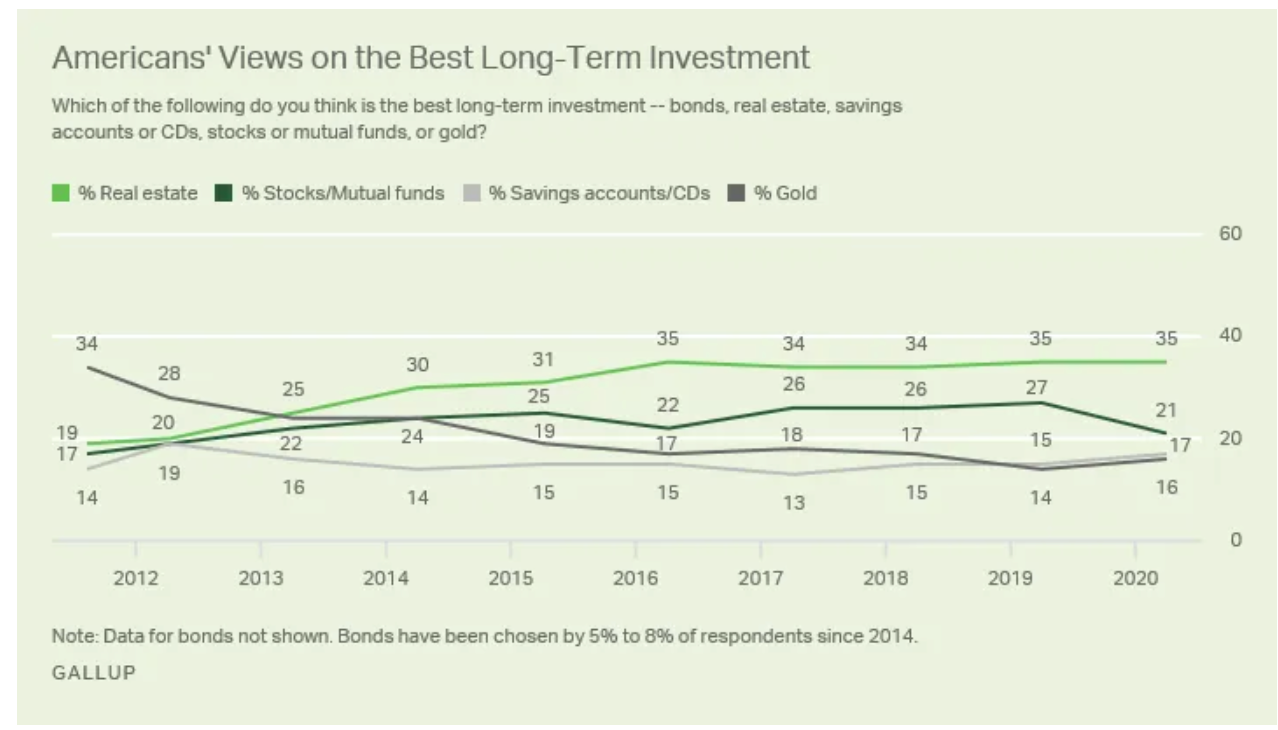

After investigating why stocks are an attractive investment, it might seem obvious why it is the best option.

Yet with record low investments pooled into stocks in the STOCK market due to economic uncertainty these days, the wealthy are invested in alternative investments that are paying them dividends for a lifetime with tax advantages as a cheery on top that the less savvy need to get their hands on.

These alternative investments include:

#1: Real Estate Investment Trusts (REITS)

REITS are like mutual funds. They just hold commercial properties such as large apartment complexes, retail centers, malls and office buildings inside a fund. Although 2020 wasn’t a good year for commercial properties, the industry as a whole for real estate boomed. Inventory shrunk and demand leaped as WFH was bound.

Real estate is the primary inflation hedger when it comes to growth. When the dollar looses its purchasing power, rents increase to keep up.

90% of millionaire and billionaires are invested in real estate because:

-Less volatility

-Physical tangible asset as opposed to a number and ticker

-Estates provide more stable positive income streams

#2: Real Estate Crowdfunding

This is an alternative way to invest in real estate, similar to REITS but crowdfunding isn’t tied to the market.

Crowdfunding connects investors and property developers together to bid on properties.

As an investor, instead of being 100% sure on 1 property and needing to physically purchase it which can take months along with needing to possibly renovate, negotiate a price with a broker on, put a cash and mortgage through, with crowdfunding, you can easily select the properties you want to invest in and never visit them! You don’t need to manage anything and can pitch into real deals for only a few hundred dollars.

There are a variety of ways to invest in commercial real estate and you don’t have to have 300k+(average American house price) to invest in another property.

Across the country there are low cost areas to invest through Fundrise and Crowdstreet (not sponsored), the most reputable real estate crowdfunding platforms where you can invest as little as $500 in one of its most diversified eREITS that gives you broad based real estate exposure with low volatility across regions of heartland America.

Personally I’ve invested in $500k in real estate crowdfunding to diversify my investments and not have to deal with another round of tenants, maintenance, property taxes, brokerage and lawyer fees, etc. on top of my first property I purchased in 2020. (you can read here how I did it).

#3: Fixed Income Annuities

An annuity is an investment contract you make with an insurance company. This is a flat payment amount that the insurance company pays you overall several years. This is an alternative income payment that can be set up on a monthly basis, especially for retirees who don’t have a pension or IRA and want supplemental income.

#4: P2P Lending (Peer-to-Peer Lending)

Banks are known to offer very low interest rates on Treasury securities and on bonds, so you may want to look into P2P lending for a more attractive higher interest rate.

P2P lending is a safe investment that involves issuing loans to consumers through lending platforms. These are personal loans that can be used for any purpose. With any type of lending, it involves risk yet with higher grade loans, it is more attractive and safe so no hassle that the buyer would default.

These small investments are referred to as notes and there are many different types of loans for as little as $25.

#5: Hot NFT Market

These are blockchain investments where you can purchase images, FIDS, songs, videos artwork, etc. with a certain price point and are deemed valuable!

Recently I went to an auction at Sotheby’s in the city that had a bidder who was sold a $35 million dollar digitalized art piece.

Anything can be considered an investment now!

Even Jack Dorsey (CEO of Twitter) had a bid for first Tweet at $2.5 million.

Obviously, these are high price points for art and collectibles, but even selling baseball cars to tangible assets overtime on the resell market, you can make a lot.

#6: Startups/Private Business Investments through Private Equity

These are private business investments that are conducted by angel investors who are investors in startups and Series A, angel round companies. These are wealthy investors that pool their money and provide multi-million dollar investments in promising business startups.

You don’t need to be a wealthy investor to pitch in. You can even go to Start Engine to join and become like Kevin O’Leary on Shark Tank.

This can be a direct investment into the company and comes back with a risk-reward on how promising the company is.

99% of companies fail due to a poor idea, no vision and problems faced between the founders.

Make sure you understand the logistics, who’s behind the brand not just the idea as well to ensure your money will be well worth it.

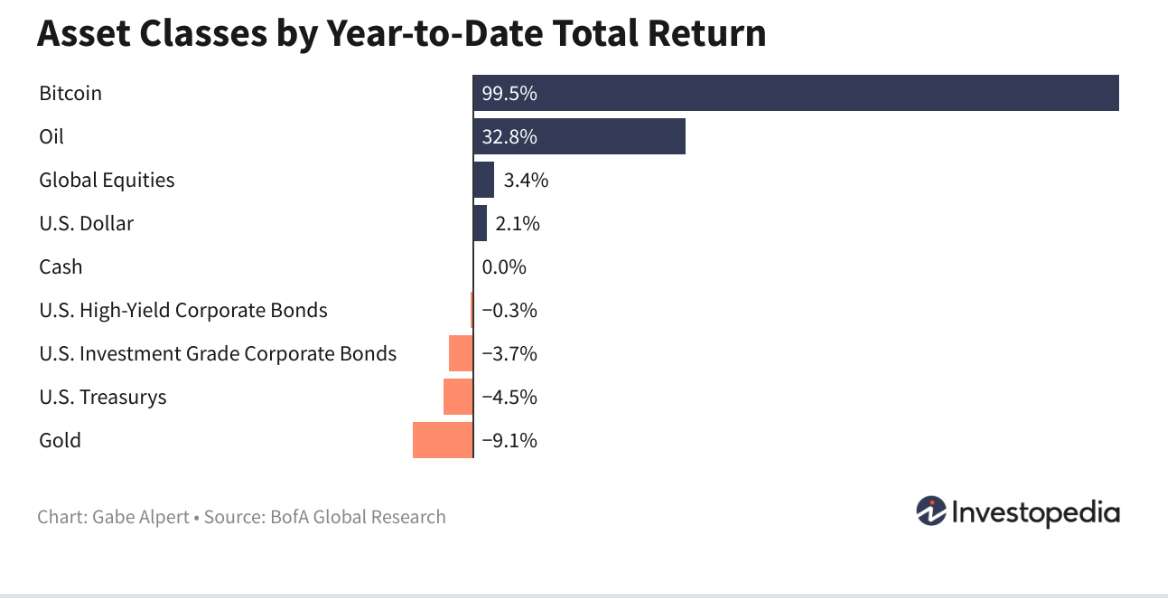

#7: BitCoin

With its sky high evaluations, some investors are wary such as Buffet and others such as Cuban are all in for it accepting BitCoin as an alternative payments at vendors. Although BitCoin is volatile and not regulated like a fiat currency, it may be the new currency of the future.

Overall

Stocks have had an incredible run for the past few decades and will continue to rise high for the foreseeable future until interest rates creep up, but sometimes their valuations cannot be justified and especially during recessions, even defensive companies and especially cyclical ones tend to downfall due to the nature of the economy and worries between investors.

Compared to real estate or tangible antiques to real estate, stocks are the only investments that can tank overnight and rise by 300 basis points.

If you want to have a unique balance to your portfolio and make it to the 1%, you must think like the 1%. As the pandemic is slowly fading, this is the best time to spread your investments over a variety of classes as borrowing is still relatively cheap and move past the traditional easy ways of investing through stocks and retail trading.