Relying on business school or any institution is a bad move.

They will not teach you the most important thing about money.

Personal Finance.

Sure, when you graduate from any business school you will know the difference between enterprise and equity value, how to tabulate macros in Excel, know all the logistics of the IPO process and how the 3 financial statements are linked, but after you attain that beautiful Latin script degree, you most likely will have to deal with the burden of student loan debt with barely any knowledge on how to take charge of your own finances.

Schools rip us off big time and will continue to do so.

They make us believe that once we attain a degree, we will be set for life and only become richer after that.

They gauge prices because they can.

Although the more educational you receive, the higher your chances of becoming a millionaire grow, there’s absolutely no guarantee especially these days with the power of the internet at our disposal.

To tell you the truth, I’ve learned more online than in any classroom and can credit most of my success to reading books, mentors, YouTube and making mistakes through loosing money.

Yes, loosing money.

It’s the best way to learn how to invest.

Investing isn’t for quant or statistics nerds out of Wharton, it’s for every day people to take part in profitable companies and rely on an alternative income source to keep them afloat.

There are 4 basic steps in order to invest:

1) Decide how you want to invest in the stock market

2) Choose an investing account

3) Learn the difference between investing in stocks, indexes, funds and other alternative assets

4) Set up a budget and handle your emotions ASAP

That’s it and business school still can’t teach us that in 4 years.

Luckily you have this article for free so you can ditch that $70k+ tuition and hop on board.

Let’s get started.

1) Decide how you want to invest in the stock market

People have different reasons they want to invest and it mainly depends on one’s age.

By Age

< 30

If you are 20 like me, you are investing to hop on the train to grow your portfolio income for the rest of your life so it can eventually replace your earnings income one day through compounding.

When you are young, time is on your side and you have the most free resources at your disposable.

You have the option to save thousands off of a fiduciary or brokerage doing the same work they can do since they have no insider trading or secret formula so I would recommend researching which funds you like, splitting up a balance between passive vs active investments, roughly 60% passive, 40% active since you can counteract those losses over time and understand financial statements, what companies you use, growth vs value stocks and defensive vs cyclical stocks all on your own.

30 – 60

When you get older, you immediately have more responsibilities. You may have kids as a dependent to a mortgage you must pay off, insurance to set up and a full time job that keeps you busy until the weekend when you just want to relax and get away from any work.

As a result, it’s difficult to take some time for yourself and your finances. With every moment you aren’t with the kids or working, you may not want to check in with your portfolio yourself and readjust it every month, unless you enjoy it. In that case, I would suggest you look into hiring a robo-adivsor or portfolio manager to take care of your portfolio for you. Although there are recurring fees and expense ratios taking about 1% of your gains each year, it does bring a peace of mind for clients knowing that an experienced fiduciary is doing the work for them.

< 60

Lastly, when you are older this is the best time to have someone take charge of your finances. You are laying low, relying on your hard earned income, getting ready for retirement and using for 401(k), pension and IRA to keep you afloat.

Although retirees have more time on their hands, it is always advised that they speak to a professional to make sure they are on the right track because if grandma chooses an uneven tech heavy balanced portfolio exposed 100% to stocks, she will not have the time to recover from those losses. Staying conservative is key when you are older, especially since you aren’t working anymore.

2) Choose An Investment Account

As mentioned, there are options to have a robo-advisor or professional money manager (broker) take care of your finances for you if you aren’t willing to spend the time to do so yourself.

Regardless if you do it yourself or not, to invest in any type of asset, excluding physical tangible real estate, you need an investment account. This means a brokerage account opened at a brokerage institution such as Vanguard, Fidelity, Charles Swab, Atticus Capital or even at investment banks such as Goldman Sachs, Citi and Chase and lastly another option is retail trading apps such as Robinhood and WeBull to test the waters as an amateur investor.

Brokerage Account Options:

Through an account, this is the quickest and least expensive way to buy stocks and other alternative investment types which include:

Commodities

Derivates

International stocks

REITS(Real Esate Invemsnet Trusts)

Fixed-incoem assets usch as high-yield, corporate, treasury, etc. bonds

Options

You can open an IRA (Individual Retirement Account) or a taxable brokerage account to simply earn more money through your investments as well once you start working. Make sure to match the benefits to get every dollar you deserve.

Every institution and brokerage has different fees so you want to make sure to evaluate the brokerages based on trading commissions, if they’re a fiduciary, account and expense fees, how they make money off of you and their policy for holding your money.

Ideally to be most tax advantageous, you want to hold your money, especially your gains as long as possible to not only earn more since the markets continuously goes up but most importantly so you don’t have to pay income tax on your gains!

If you sell your investments after 1 year, you will have to pay capital gains tax, less than income tax but still tax!

But unless you don’t have enough cash on hand and need to liquidate (turn investments into cash) to fund some emergency random unexpected expense, there’s no reason to panic sell.

Robo-Adivsor

This may sound expensive, but the management fees here are generally a fraction of the cost of what a human investment manager would charge. Most robo-advisors charge around 0.25% of your account balance if you don’t want to take charge of your portfolio yourself.

3) Learn the difference between investing in alternative assets and stocks

Stocks are simply shares (pieces of the pie) of a company. You are directly investing a part of your money to fund and grow a company while it pays you back overtime.

Stock market investing involves 2 parts:

Stock mutual funds or ETFs (exchange-traded funds)

Mutual funds: Actively managed with higher expense ratios (when money invested), higher barrier to entry minimum $1k, price doesn’t change until end of trading day and incur fees regardless if you lost or earned money. These funds purchase small pieces of many different stocks in a single transaction.

ETFS/Index Funds: Passively managed, lower expense ratio, lower barrier to entry roughly $50, bought and sold like stocks and more tax efficient. ETFS are kinds of mutual funds that track an index. Ex. index that replicated S&P500 by buying the stock of companies in it.

When you invest in a fund, you own small pieces of each of these companies.

Purchasing many several funds, you build a diversified portfolio.

Individual Stocks

The younger you are, the less risk-adverse you are simply becuase you have a longer time horizon. The older you get, the harder it is to take risk because your losses take a few years sometimes to recover from and you need a cash cushion and safe haven assets such as bonds to keep you afloat.

Building a diversified portfolio is most recommended when you have a split allocation with a basket of index funds a.k.a ETFs. Even when you are young, having a portfolio exposed to 100% equity (stocks) is dangerous because any company can tank at any time and leave a part of your portfolio in the dumps.

Mutual funds are inherently diversified which lessens your risk and are unlikely to rise in meteoric fashion while the odds that an individual stock will make you rich are exceedingly slim, unless you’re RoaringKitty and have a crystal ball that GameStop would reach a 15 billion dollar market cap for no reason.

Not a recommended way to invest btw.

4) Know your budget and emotional threshold

Money causes a lot of emotional spirals. As investing solely deals with money, it is imperative you understand how much money you are willing to invest.

The number one rule is to invest whatever you are willing to loose.

Whether you are paying off debt or only have birthday money to spend, there’s no excuse not to invest.

By contributing through dollar cost averaging (DCA) instead of lump sum dumps once a year, you are already ahead and will earn more due to compound interest over time.

Spread out and start investing early.

It always pays and you cannot catch up or reverse time.

Overall, the amount of money you invest need to be the leftover after you’ve paid for your expenses.

Once you’ve confirmed that your income exceeds your expenses, you can open up your portfolio.

You don’t want to borrow on margin (take on debt to purchase a stock) when you are first staring out because you will have to pay double debt if the stock tanks.

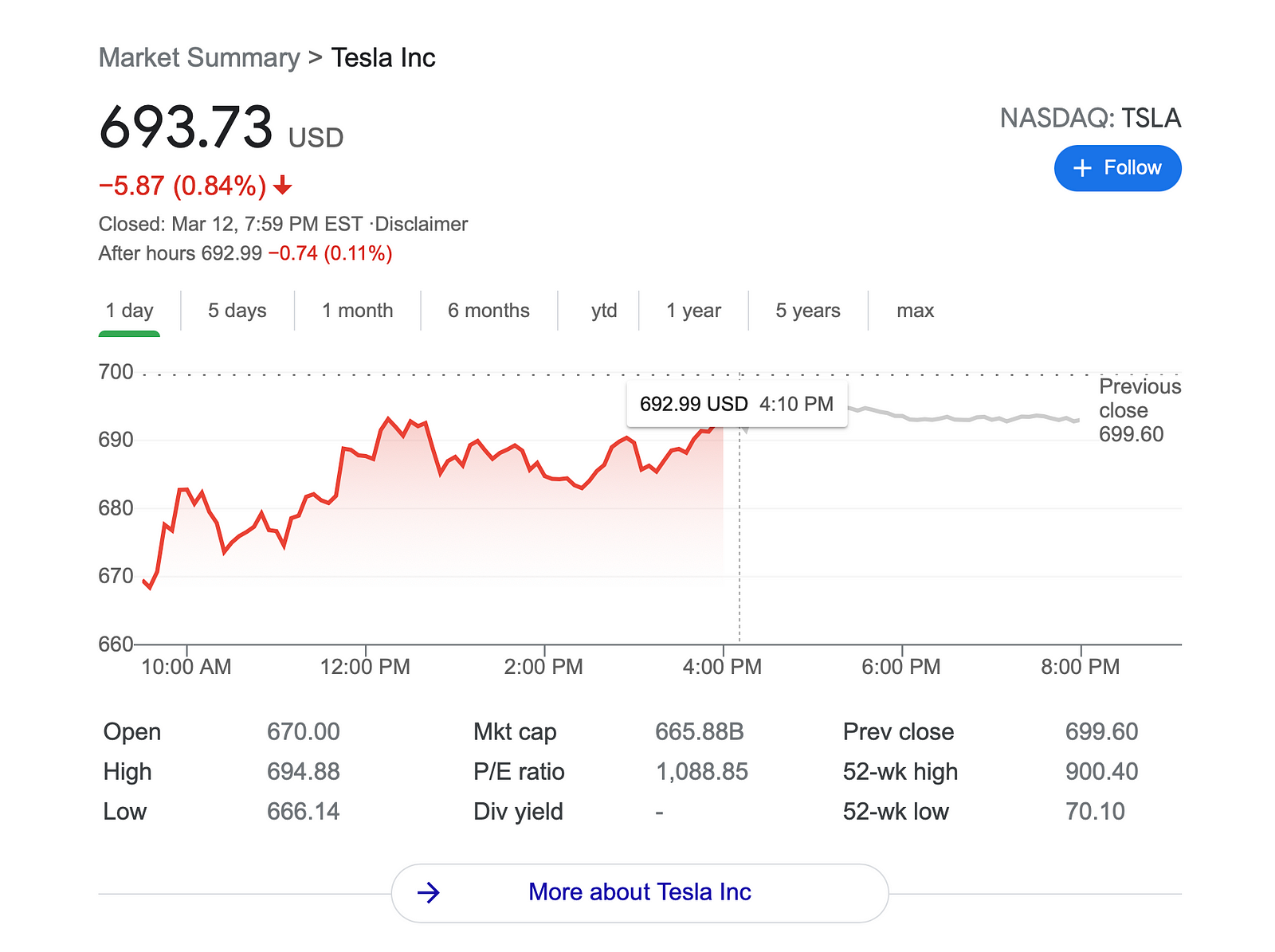

When it comes to price, share prices can range from a few dollars to a few hundred dollars such as Tesla at $693 per share.

Best Deal

If you want mutual funds and have a small budget, an exchange-traded fund (ETF) may be your best bet. Mutual funds often have minimums of $1,000 or more, but ETFs trade like a stock, which means you purchase them for a share price — in some cases, less than $100).

When it comes to emotions, money isn’t your best fried. Investing FOMO is real and dangerous. Understand that this is your hard earned money on the line, and not a gambling casino game will put you on the right track.

Some of the most successful investors such as Buffet and his mentor, Ben Graham have stuck with stock market basics since they began investing as teens. This includes investing in a basic low-cost S&P500 index fund.

Lastly, don’t look at the intra day volatility because it will obviously and always go down and up. Think long term as the markets always go up yoy(year over year).

Sum It Up

Investing is a process everyone should be a part of. Rich or poor, you don’t need a lot to start and understanding that the stock market is not the economy is critical as well.

The stock market trades for the future, a few months down the line. Markets are forward looking and 70–80% of the market are institutional investors so let’s bridge that wealth gap and get every day Americans into this free money making system!