The amount of money that you need to make it to the 1% in the US compared to other countries is very different. Not because the US is the richest country, has a large diverse population, innovative job market and a swamp full of entrepreneurs, rather the currency, location and where the future is headed makes all the difference.

Who Are The 1%?

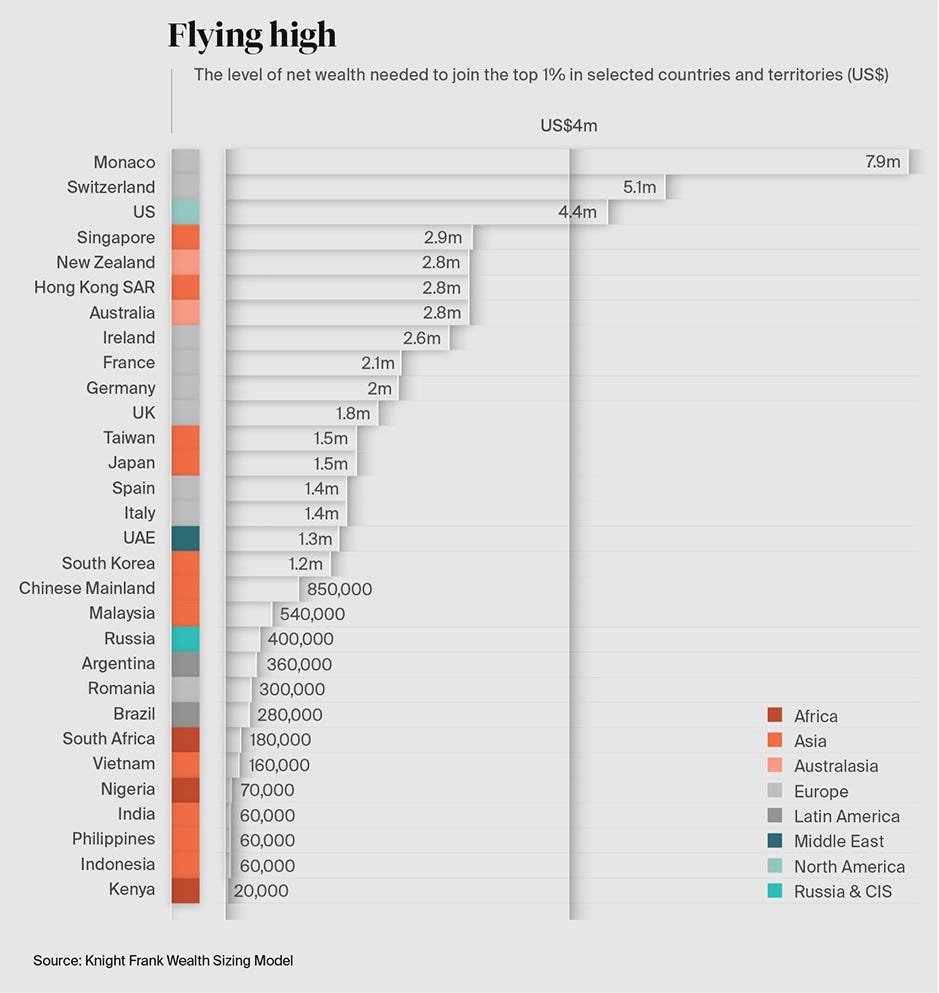

Across the globe, there are different cut offs to be considered in the 1%.

It means you have an abundance of wealth to live comfortably, take reasonable vacations a couple times a year, live in a decently high tax state, pay for college and not have any looming debt.

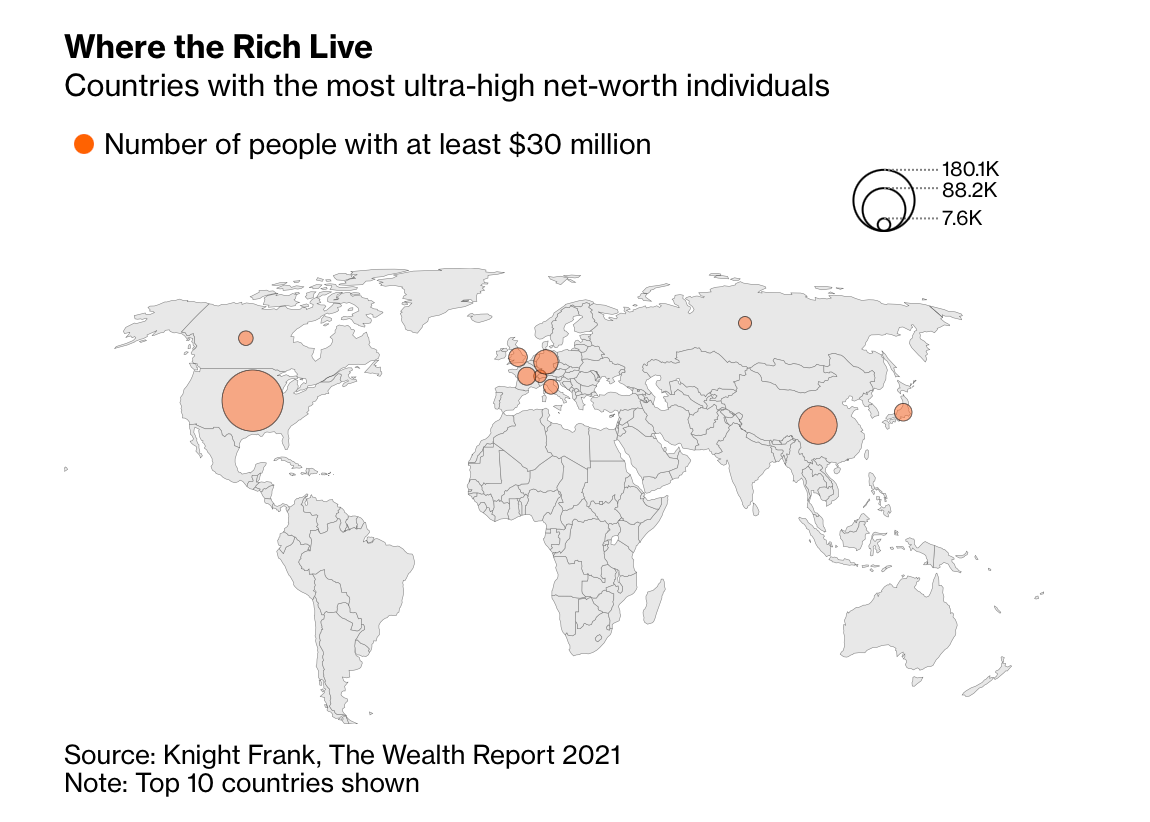

The U.S. leads in the number of ultra-rich individuals even as wealth growth has surged recently in Asia-Pacific locations such as China and Hong Kong, according to Bloomberg.

Where You Stand

There are 46.8 million millionaires in the world that own $158.3 trillion of wealth which is 0.9% of the global population while the bottom 56% owns just 1.8%

So how do these folks get rich?

Well, most millionaires are frugal miniamlists. Looks are deceiving. Those who look rich are usually not and those who are poor and comfortable living the stealth wealth way are more often than not the rich ones.

It’s not how much you make or keep, it’s how much you own. If you make a CEO salary but spend it all and give it away in taxes, you are left with a minimum wage salary.

As hard as this is to believe, it has nothing to do with the clothes or cars you own, rather all the appreciating assets you’ve build up, passive income sources you’ve manufactured and value you provide to the world.

Just think about it.

Why do people pay you in the first place?

They see value and benefit out of you.

Most millionaires did not inherit their wealth. They weren’t trust fund babies or win the lottery and if you did win the lottery, you probably lost it all by now as 90% of lottery winners and sports players go bankrupt in the first year of making an inconceivable lump sum.

Millionaires look like everyone. They don’t feel the pressure to stand out and if they did, they want to get away from it.

They are hard to spot and are deceiving because they don’t look worthy. They never try to show off because they are too comfortable in their own skin and have nothing to prove. Plus for their safety, its a better idea not to show off as well.

An average millionaire:

-Wears a $60 suit

-Owns 2 homes

-Drives a sensible car roughly in the $40k range

-Eats out 1–2x a week

-Family person

-Flies commercial

An average 1%(er):

-Wears the same clothes daily

-Has 3+homes

-Doesn’t’ drive

-Eats out daily

-Family + friends = life

-Flies private

The most popular asset classes are real estate and equities. You cannot get rich by a job. Those in the 1% don’t work for anyone except themselves. The top job you can get is as CEO or in the entertainment industry but they don’t last forever. They are also the most volatile careers. Sure you can make a couple million per year after a lucky break on a sitcom but after that, you already have to be chasing and planning for more side hustles to keep you afloat.

The more you make the more you give away. You can learn about that here.

The bigger the business you work for, usually the more expensive city you live in where everything is more expensive so as a result, you are essentially earning and spending the same as someone who is making half of what a New Yorker is making in Nebraska when you add everything up.

As opposed to working for someone, with a business, you can charge your expenses and deduct them to pay less taxes, with real estate you can use leverage and use tax advantage strategies to earn passive stable income and through investing, as long as you don’t play day trading games, in the long term, the index will always go up guaranteed.

3 Pieces to the Pie

1. Half of millionaires’ income comes from wages through business

2. Other half from investing, dividends and capital gains

3. Saving + budgeting

You don’t need to be cheap to save. Have a realistic plan of what you use and don’t use to better calculate your monthly expense report.

These things will help you stay a millionaire. It’s easier to spend than save. True millionaires keep this constant and are addicted to saving in a healthy way. As a result, there aren’t many millionaires that last, just like lottery winners.

Flying Around

To be considered in the top 1% in the US, you’ll need to be worth $4.4 million but in both Switzerland and Monaco, you’ll need to be worth double.

The US has the third-highest wealth threshold to break into the 1% but the highest number of ultra-high net worth individuals, which is defined as someone who exceeds $30 million.

As we’ve witnessed during this pandemic, the wealth gap has only widened and the reason the rich are so good at paying less in taxes isn’t because they are necessarily smarter, they produce income through tax-advantaged mechanisms leading them to sometimes pay less in taxes than the poor.

The region’s richest billionaires are now worth a combined $2.7 trillion, data compiled by Bloomberg show, or more than triple the amount at the end of 2016.

Ahead of the US, let’s dissect the rankings of the wealthiest places:

#2: Switzerland as the second-highest wealth threshold with a person needing $5.1 million to join the richest 1%

#1: Monaco as the top seater has the densest population for the super-rich resident and you need $7.9 million.

In other parts of the world, countries with the lowest wealth thresholds to crack into the 1% include Indonesia, where a person needs $60,000, and Kenya, where a net wealth of $20,000 is needed for that status.

What It Takes To Join the Richest 1%

Joining the ranks of the richest 1% is never easy without patience and courage, but it is easier in Asia, Mediterranean and Southeast where residents typically don’t pay income taxes, according to research on more than two-dozen locations by Knight Frank.

“You can clearly see the influence of tax policy at the top,” said Liam Bailey, Knight Frank’s global head of research. “Then you have the sheer breadth and depth of the U.S. market.”

The entry point for Monaco’s richest 1% is almost 400 times greater than in Kenya, the lowest ranked of 30 locations in Knight Frank’s study.

According to Bloomberg, “The World Bank estimates 2 million people in that African nation have fallen into poverty due to the Covid-19 crisis. Meanwhile, the world’s 500 wealthiest people added $1.8 trillion to their fortunes last year, according to the Bloomberg Billionaires Index, with U.S.-based technology entrepreneurs Elon Musk and Jeff Bezos gaining the most.”

Up and Comers

Singapore is also expected to see a surge, though the city-state is already a hub for many of the world’s super-rich for reasons ranging from its high standard of living to strict privacy rules.

The US still leads as the richest country for centuries and is trying to hit the top seater for the highest 1% mark even though that might not necessarily be seen as a bragging right since the wealth inequality gap would only get larger.

Rich vs 1%

The rich focus on things the poor neglect even though they have all the power to look into it themselves.

Anything that brings money into your pocket is an asset. From owning a house to earning rental income, it’s all cash flow. Yet, the problem is that most Americans have 90% of their net worth tied up into their home equity. As we’ve witnessed during the Housing Crisis of 08–09, when the value of homes went down and homeowners needed to sell, their net worths plummeted.

That’s why diversity within assets is huge. Don’t ever have one income source and your net worth shouldn’t be tied up only into tangible assets.

Quick ways to diversify is by investing in the stock market.

If you’re really scrambling, buy fractional shares or an ETF that monitors the S&P500. It’s guaranteed to go up year over year.

Tangible assets are real estate, intangible are investments more liquid that are able to be converted to cash quicker.

Stocks include: Individual stocks, index funds, mutual funds, ETFs, structured notes

Bonds include: Government treasuries, corporate bonds, municipal bonds, high yield bonds and TIPs.

For the first 8 years of work, the majority of your net worth should be in stocks through growth stocks (80% active, 20% passive) and risk free assets such as CDs, higher yielding savings accounts and money market funds + always emergency cash.

The rich also try to escape renting ASAP since the return on rent is always -100%. You never get anything back only a nice existence for a few months/years. Renting is allowed but if it’s more than 5 years, it’s money down the drain.

Real estate usually outperforms stocks as it is less volatile and provides continuous income so if you can get your hands on physical real estate great, if not, pitch into Crowdsourcing or REITS in the market so you will be ahead of 90% of Americans by age 30.

Liabilities, on the other hand, are things you own for your comfort and convenience what the rich enjoy binging onto. They don’t bring income. The most common example is buying a car. In the first five years, a typical car will loose 50% of its value! No car will get you any faster through traffic. The only reason people have fancy cars is to show off. You’re better than that.

As a result, the rich buy assets and the poor spend their money on liabilities.

But don’t the rich enjoy life too?

Of course. It is possible to see a real rich guy with a nice car without debt. It shouldn’t be a problem to spend what you want as long as you’re diligent about saving and spending.

But after the fancy bling and hotels, it gets boring. More often than not the rich spend their money on education, investing in themselves, the market and business, not drugs, alcohol or clothes to push them back.

You only have 1 brain, why feed your brain toxicity when you expect it to bring greatness as well?

Hence, the rich don’t spend their capital on liabilities. They build the residual income slowly from their assets and investments to be able to afford the liabilities they choose. They stash their income through automatic funding right into the market and or retirement not able to spend it right away.

I know, this article left you either frustrated and jealous or eager and motivated. Well, I hope it left you more excited since you’ve read information that will always serve you well.

But what’s most important to remember is that regardless if you do become a part of the 1% club or not, how will your personality and character change?

Will you become more loving and caring for others or selfish and spoiled because that’s how people will really remember you for your legacy. Not what you told or gave them but how you made them feel.

The more exposed you are to money, the more you start to feel comfortable but also addicted to making more. Make sure to realize there’s more to life than green dollar bills that can buy you a pool or Lambo. What counts are the people and experiences that you cannot replace.