When interest rates are low, this entails economic uncertainty and a recession are still prevailing. It also means it’s a great time to take advantage of cheap loans to build up your passive income sources, disposable income, pay off debt, net worth and income overall.

The Fed who deals with fiscal policy (interest rates, stimulus, tax, quantitive easing) stated several times throughout this pandemic that they will keep interest rates at record lows until there are signs of normal life with the vaccine rollout underway and heard immunity around 70% in the US.

Until then, we are in a frantic mode with the Fed buying as many bonds as possible which allows homebuyers to lenders to borrow them cheaply. When the Fed sells bonds, that means they have risen in price. This decreases the money supply by removing cash from the economy in exchange for bonds.

This has allowed a new generation of homebuyers, Millennials in particular to seize the chance to purchase their first home with record low 30 fixed rate mortgages at roughly 2.5%, cities getting cheaper and WFH leading city dwellers to migrate to low tax states most notably Florida.

There have also been talks of the NY Stock Exchange relocating to sunny side Miami because of the influx of New Yorkers.

When money is cheap, people tend to borrow, invest, reinvest, and spend more in this lifestyle inflation cycle they’ve built up. As a frugal minimalist, I don’t prefer this way of living as it can seem very stressful to keep working more in order to buy more junk, yet it keeps the economy growing. The more money you make, the more businesses can get compensated.

But for now, whether you like it or not, interest rates will eventually rise and we’ve certainly seen investors worried last week due to the sharp rise in the 10-year bond yield rising to 1.6% which is the major indicator for inflation.

Currency the Fed Funds Rate (FFR) is at 0-.25% and inflation will have to pick up post-pandemic and is even starting to do so now as the savings rate, brokerage account openings and net worths have skyrocketed for a slim majority of Americans to get in while its cheap but that also means the wealth divide has grown.

As 44 million Americans have lost their jobs with 42% of people falling behind and the top 10% have grown their wealth by $1.5 trillion, the wealth divide is clearly evident and only grows larger during any recession. The rich get richer and the poorer get poorer due to one main premise; not being vigilant enough about an emergency savings account and holding off on becoming financial free with no high-interest debt.

10-year yield bottomed at 0.51% in late 2020 and has since climbed to 1.6% since last week and now slowly declined back down.

Why is it troubling to see the yield go up?

First off, this means inflation is headed our way and the economy is moving faster than what we expected. This worries investors, especially those tied to tech stocks because that means bonds are now competing with stocks.

Tech stocks sell off when the yield (bonds) get higher because now bonds and stocks are competing for a larger equity portion in the market. When yielsds get higher, it is crossing the threshold of the dividend yield, hard to differentiate if bonds or stocks are a better bet.

However, this volatility isn’t here for the long term since indexes always go up. With the the S&P 500, savings rate, national median home price and investor sentiment at all time highs, inflation is here to come, we just don’t know when.

Remember that the stock market is trading in future value 5–10 months down the road, not present value. That can be one of the tricky parts about timing the future in itself since we are technically buying and selling in tomorrow’s value which is unknown. To be best prepared, staying bullish for the long term through this rocky wild ride of the interest rate environment is your best bet.

The Scoop of the Fed + 10-Year Bond Yield

What we’re witnessing now is similar to stagflation, except for the slow economic growth but with relatively high unemployment curated by rising prices (i.e. inflation) on the horizon.

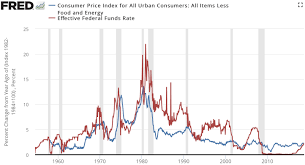

According to history, for the past 40 years, interest rates have fallen dramatically and this is the primary goal of the Federal Rserve to contain inflation, promote employment and orderly healthy growth in the economy. The Fed has an inflation target of roughly 2% and this is adjusted for interest rates or when they buy back debt to increase the price on bonds.

The Fed Funds Rate(FFR), directed by the Fed is controlled by a committee of people across the US to discuss policies and how to direct growth towards the country.

The 10-year yield is swayed by the Treasury bond market in the stock market.

Since a committee of people determine the FFR, the FFR and 10-year don’t move at the same time because the 10-year is controlled by the market, dealing with much more magnitude and volatility than a vote in a boardroom.

Which One Is More Important?

The 10-year is a powerful indicator for borrowing rates and it moves higher ahead of the Fed hike. The Fed follows the 10-year so sentiment is already baked into the market so negative reaction shouldn’t be felt by markets when they do decide to hike rates.

The treasury yield, similar to a 10-year yield is the effective interest rate that the U.S. government pays to borrow money for different lengths of time. If it goes up, it means you get less bang for your buck hence inflation.

The Fed is On Your Side

Whenever there’s a recession, economic downturn or meltdown, the Fed has to cut interest rates to spur the economy growth and employment which allows everyday consumers to home buyers and banks to offer cheaper loans out to those who previously couldn’t afford to borrow them.

Too Cheap

Yet as with everything, too much of a good thing is bad. We need a healthy amount of inflation to keep the economy running. If everyone can afford a cheap mortgage, then nothing will be stabilized in price. Decrease in pricing means less production & wages will fall, which in turn causes prices to fall further causing further decreases in wages, and so on.

Too Expensive

On the contrary, too much inflation is bad for buyers who are eager to purchase homes, food and clothing. During a recession since the wealth gap grows, ironically, inflation dampens consumer confidence and spending and reduces aggregate demand.

Secondly, inflation increases costs and reduces competitiveness, which can lead to falling demand.

Inflation will always reduce the value of money, unless interest rates are higher than inflation. And the higher inflation gets, the less chance there is that savers will see any real return on their money as $3 million will really be only worth $1m.

10-Year Signals

When the 10-year yield moves up, as signaled last week, this pressures the Fed to start raising the Fed Funds Rate to counteract inflation. They follow each other in order to counteract any negative reaction from the economy and stock market.

Inflation Shipped?

Although there’s talk about a possible replica of the dot-com market bubble due to crazy valuations and Reddit WallStreetBets gamblers betting on unprofitable stocks to beat out the hedge funds along with sentiment of the Roaring Twenties, all of this fear is still at bay, for now.

Inflation is here to come, its just a matter of timing since the economy must get back up and running eventually. As we’ve seen last month with the trading frenzy, it has surely calmed down and compared to the Roaring Twenties after the 1918 Spanish flu, Americans are much more prepared for another recession if one does hit in the coming years again.

Winners and Loosers In a Rising Interest Rate Environment

Since I believe interest rates will stay around 1.25% and the 10-year yield with inflation around 2% once we reach herd immunity in the coming months, it’s important to understand what indicators do poorly or well in a rising interest rate environment since its sure to come.

Winners

Tech and Health Care Stocks

These sector companies don’t prefer issuing dividends. Instead they reinvest their retained earnings for more growth instead of giving out ‘not really, free money’ (you can read here why dividends are a bad choice made by companies).

Brokerages

The top brokerages such as Fidelity, Vanguard and Charles Swab earn interest income on invested cash in customer accounts that’s why they advice at least 10% of your net worth or a 8–20% cash weighing for your portfolio case so they can trade on behalf of it.

When rates rise, they invest this cash at high rates for their own expense while your cash is sitting there. But that doesn’t mean cash is bad, its necessary for emergencies and in fact necessary to stay afloat in case you get evicted, loose your job or an unexpected pandemic hits.

Retirees and Savers

When you are nearing retirement, this is the perfect chance to have your fixed income rise with higher interest and dividend incomes. This is a good time to withdraw at a higher rate.

Cash becomes more valuable as other assets such as equities and bonds decline.

Cash King Companies and Investors

If an individual or a company has no debt and is a cash hoard, this will be the least riskiest time for them. They are secure as stocks tend to become more volatile and loose value during this time. Obviously, having an excessive amount of cash is a waste and instead a company should use it for dividend payouts, but roughly 20% in net worth for both in cash is key.

Losers

Let’s examine the underperforms/losers in a high interest environment

Individual Debtors

People with credit card debt, student loans, mortgages, and future car or luxury loan borrowers watch out because the good old days have already passed. If you haven’t refinanced your mortgage, this isn’t the right time to do so as the 30 and 15-year mortgages always lag during a rise in the 10-year bond yield. During economic hardship, this is the best time to buy, refinance, sell and build up your nest egg when everything’s cheap

Highly Leveraged Firms

Similar to individual debtors, if a company has a lot of outstanding debt with a negative cash burn rate, debt servicing will go up with higher rates. The risk of default goes up as well since everything is more expensive so investors will sell highly leveraged firms at the margin just in case.

These firms include: Utilities and REITS, any company with a high amount of capital expenditure.

Long Term Horizon + Go-To Strategy

Any volatility can be scary but over the long term, rate hikes is a positive because economic activity is accelerating, people are back to work, less unemployment, healthy amount fo inflation, less separation between Main and Wall Street and more demand overall from consumers.

The Fed isn’t out to get you. It wants to help the economy as much as possible and will only raise rates if they see inflationary pressure and hopeful spirits.

Whatever you do, don’t panic because the Fed Funds Rate will be performed in tiny increments of 0.25% and the 10-year is anyway much lower than it was at the start of the pandemic roughly at 2% almost when the economy was even booming.

Yet since the economy isn’t exactly booming at the moment, it will never reach that threshold so continue to buy, but of course just because its on sale, doesn’t mean you need it. Spend wisely and save better.

Let’s go over some quick tips on what to do in a rising interest rate environment so you won’t feel you are in a recession when the economy is booming:

-Reduce any outstanding debt

-Increase your cash to boost income and reduce any emergency hassle

-Refinance your mortgages. When you can lock in a 2.5% 30-year fixed and the 10-year yield hits 2.5%, you are essentially living for free

-Reevaluate short and long term goals + retirement

-Mentally prepare for volatility and sell-offs as inflation is arriving slowly especially readjusting with tech stocks as they are the most volatile and expensive

-Realign your passive vs active and dividend vs growth stock strategy (see post)

Overall, higher rates mean higher investment income and opportunity to see your net worth grow. Remember to appreciate these gains and start enjoying life more as well.

Since the Fed is on our side, keep your investments within a long term horizon outlook. Keep your ‘cash is king’ type focus and look into tangible passive income strategies such as real estate as it is less volatile and tends to outperform stocks.

There will always be volatility so embrace, expect it and make sure you have a game plan.