When investors plan on maximizing returns and following conventional investment advice, most wouldn’t think of following century-old college endowments, pension funds or 401 (k)s retirement plans to get ahead.

Well, due to their ignorance, investors are missing out on a whole lot of juicy returns, simplicity, value and time back.

Sadly the reason investors don’t pay attention to what works across the pond is because these century old funds don’t ‘look’ fun or exciting as Vegas. Instead most focus on the up and coming hedge funds that haven’t beaten out the benchmarks in decades, VCs, private equity or of course, other novice retail traders fresh out of school huddling up on WallStreetBets in an effort to bet on unprofitable stocks that have no future and prove fundamentals wrong.

This is what investing, or shall I say, gambling and planning for the future has turned into: following Millennial sensationalists on Reddit, parading against bit Wall Street hedgies (hedge funds) to capitalize and democratizing finance in the most dangerous way possible alongside Robinhood.

To be rich takes discipline, willpower, overworking everyone else, working not only on your good days, saving diligently or as I like to call it aggressively till it hurts, investing wisely and prudently until you know you only have money to buy staple goods.

Now of course you need to live life as well. That’s the point of working hard. Nothing is more depressing than seeing your hard energy and time go to waist on your deathbed. But after your needs and vacations are taken care of, you need to let your money work for you and saving more is always more rewarding than spending.

Slow and Steady Wins The Race

The rich invest in boring assets that foolish gamblers don’t follow. Institutional investors rarely bet on individual stocks such as Dominos or AMC. They barley spend anytime on social media let alone following sensational news coverage. Instead, they read financial reports, follow Chris Camillo (read here) and stick to their first instincts.

The rich have no higher IQ or special talent than the average person. They didn’t dish out $100k on a master’s degree to only get to the same place as an undergrad from a community college. Becoming rich is about utilizing the resources you have. Your constraints make you work harder.

They invest in boring, simplistic things they understand while taking a calculated amount of risk management into consideration.

Success = preparation meets opportunity.

You might hear asset allocation thrown around. That’s all about NOT putting all your eggs in 1 basket. To truly test your risk tolerance, see how you deal with corrections and a bear market. Institutionalized investors have gone through multiple recessions and know how to differentiate fear from fact.

They’re greedy when others are fearful and fearful when others are greedy to get them far ahead.

Most millionaires and billionaires are first generation. They built their wealth from the ground up themselves. No trust funds or inheritances for 80% of the top 10% which means the best way to build wealth is through a slow and steady approach which starts with learning about college endowments.

A Sneak Peak

This shouldn’t be a sneak peak since there’s nothing secretive about an endowment’s allocation. It’s all public news yet everyone is skeptical it’s too good to be true.

Before we get into the base portfolio, let’s uncover what a college endowment is. These are the donations/gifts received from philanthropists and most commonly alumni who have more disposable income than the average American graduate earning $70k per year out of school and decide to give back to their alma matter.

These funds are used to operate the school since wages and costs only go up each year. Alumni also receive benefits from donating. Those who give back to their alma matter can not only boast about it to their colleagues at their 50th college reunion and LinkedIn fam, being charitably minded provides tax breaks/benefits which the rich are all in favor of especially as Biden’s tax plan rolls out. You can read about it here. Saving on taxes doesn’t have to be dangerous or illegal after all.

Breakdown

Endowments invest like any other fund. The universal goal is to maximize returns and minimize losses. From Wood’s hot ARK Fund to Dalio’s trillion dollar hedge fund, large institutional funds to an individual portfolio, we all want to take the least amount of risk for the most reward and the best place to do so isn’t in your conventional stocks and bonds anymore, rather through Yale’s secret sauce: alternative investments, most notably real estate.

Real estate provides utility, diversification, inflation hedge, passive recurring stable income, can be physical/tangible and many more benefits. Even prominent billion dollar funds own a large percentage of commercial real estate or bypass the physical laborious process and invest through crowdfunding or REITS (real estate investment trusts) via the market. Real estate, especially today as housing prices are 11% higher from the prior year outperform stocks in many scenarios. To choose which real estate option fits best is based on risk tolerance and short/long term goals.

More risk = more reward but also more possible downfall. Similarly to options, if you put a call option on a stock, your gains are infinite but shorting a stock through a put, you could loss up to your premium (the price the holder/owner paid) to place the trade.

With any investing strategy comes trade-offs. Hedge funds take on the most risk since they have a long lock-up period for a couple years to even a few decades, less liquidity demands, higher expense ratios due to more aggressiveness in their trading strategies and a heavy focus on diversification.

They take on leverage, buy on margin, get into speculative investments such as bitcoin and ethereum yet at the end of the day their goal is to preserve capital and take on less risk as with any other fund. Their goal is to beat the benchmarks and outperform yet they tend to underperform since they are too ambitious like Melvin Capital who lost billions due to shorting AMC and GameStop at the start of 2021. Yet hedge funds are still a favorable pick amongst endowments since they offer diversification and calculated risk.

Welcome to the world of investing where nothing is guaranteed!

Yet what is guaranteed is that taking on a more moderate approach and not following the crowd won’t keep you up at night and will help you slowly but surely earn consistent gains.

That’s an endowment’s premise and the reason to why they’ve been able to generate more than most hedge funds through their simplified yet different approach.

Alternative Landscaping

Universities take a more conservative approach (similar style to what an investor nearing retirement would take) for their endowment because they can. They have no timeline or real demanding budget. They can borrow or beg money from corporations to alumni anytime and although some can go bust like Concordia College, if you have a strong alma matter, alumni fan base and a prestigious title that doesn’t mean anything besides more press and a reason to bid prices, they are able to test out different options.

Endowment Strategies That Lead Them To Outperform

1) No Liquidity Constraints

Since endowments aren’t like traditional investors who are relying on 1 stable earned income and supporting a family to keep themselves afloat, they DON’T need the liquidity in case of an emergency. Liquidity is how fast you can convert the investment into cash in case of a hiccup and how fast you can pay back expenses.

On an individual basis, your risk tolerance and level of security dictates your liquidity ratio. The younger you are, the less liquidity (hard cash) you may need due to high savings/low expenses and longer time horizon able to swallow debt and losses in the market. Endowments don’t have a timeline or lifespan which allows them to negate liquidity, a factor individuals must take into consideration as part of their portfolio at a suggested rate of 20%+.

2) Alternatives

The largest part of Yale’s endowment, the highest-performing fund behind Harvard’s invest 60%+ or so in alternative investments. This asset class has gotten hotter by the minute especially during the pandemic as stock valuations and asset prices are through the roof and the market seems frothy that endowments seek another reasonable fundamental place.

Alternative investments range from artwork to NFTs (read here what the heck these are), private equity, venture capital crypto, lumber, real estate, etc.

Anything not correlated to the middle-markets.

3) Value Stocks

I was surprised to read that the top performing funds only shoot for a 5–6% return while amassing more than a 30% return at year’s end.

They blow their epxectiaons out of the water and shoot for low. If you don’t expect much, you are always impressed by your gains.

Prime

Let’s look at the top performer in all of endowment land: Yale University’s Endowment.

The rich invest like Yale. This endowment has helped pioneer alternative investing all thanks to David Swensen, an investment analyst turned endowment revolutionizer and CIO.

In 1990, Yale became the first institutional investor and university endowment to define absolute return strategies as a distinct asset class.

Breakdown

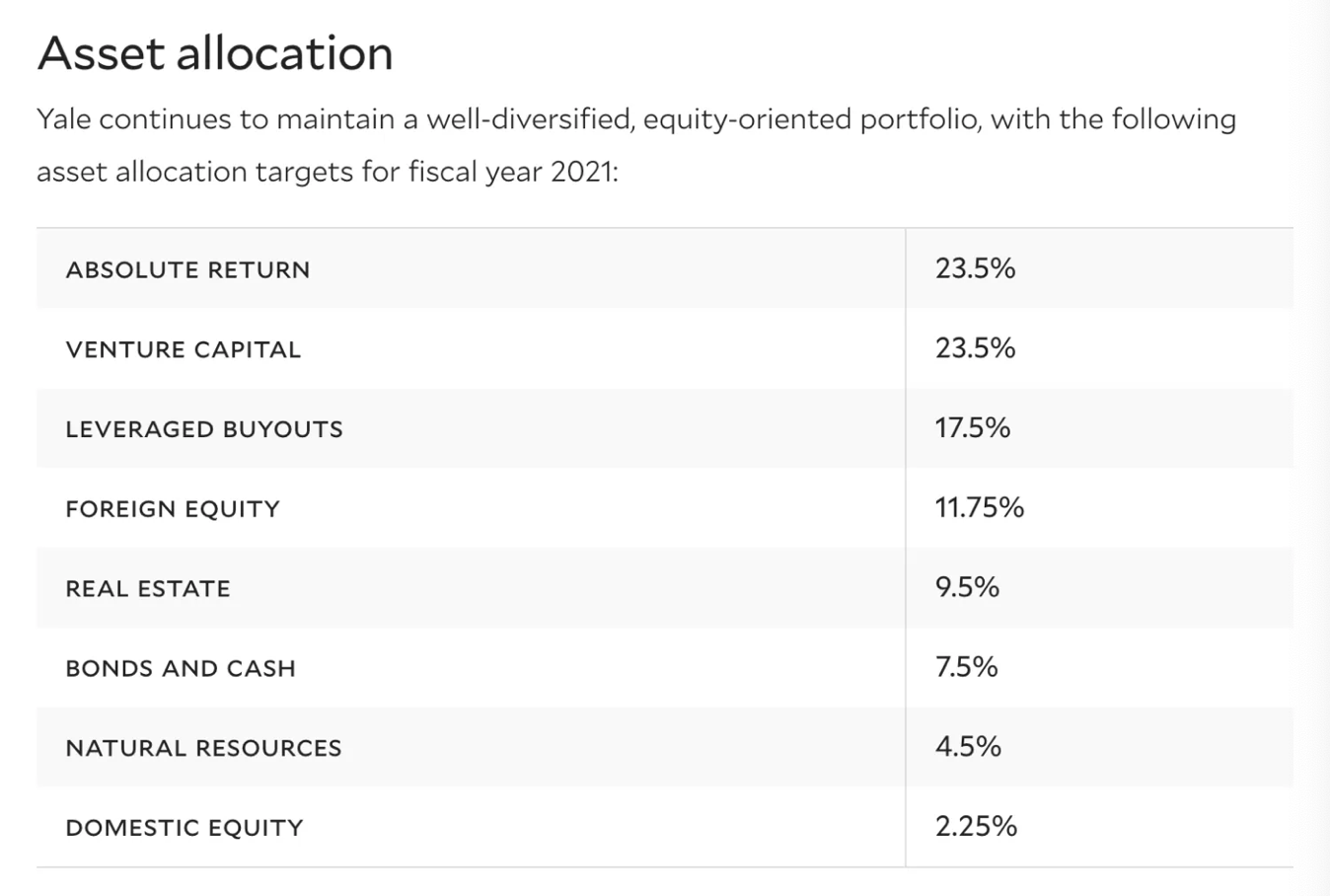

Here’s Yale’s 2021 planned asset allocation breakdown. This is where the rich are eyeing in hopes to replicate an epic 30% return YOY!

Minimum allocation of 30% into market-insensitive assets (cash, bonds and absolute return)

These assets outperform in a bear market + underperform in a bull market

Illiquid assets (venture capital, leveraged buyouts, real estate and natural resources) — 50% of the portfolio.

They also focus on non-traditional asset classes beyond domestic marketable securities which are less than 10%. While foreign equity, private equity, absolutely return strategies and real estate represent nearly 9/10ths of the endowment.

Accords to Yale’s investor report:

“The heavy allocation to non-traditional asset classes stems from their return potential and diversifying power. Today’s actual and target portfolios have significantly higher expected returns and lower volatility than the 1990 portfolio.

Alternative assets, by their very nature, tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market inefficiencies through active management. The Endowment’s long time horizon is well suited to exploiting illiquid, less efficient markets such as venture capital, leveraged buyouts, oil and gas, timber, and real estate.

Since its 1990 inception, the portfolio exceeded expectations, returning 11.2 percent per year with low correlation to domestic stock and bond markets.

Over the past two decades, the Endowment returned a cumulative 1,152 percent relative to the Cambridge median of 402 percent, an outperformance of 5.1 percent per annum.”

Take Aways

Diversity is key. The typical investor may think they are diversified with a split of 60% passive and 40% active in stocks, bonds, treasuries, maybe some crypto if they’re fancy and tech mixed in with cyclical, growth and defensive companies yet they will never be able to amass the return as any endowment has simply due to size, experience, time horizon and pure stability.

Although Yale has to fund the school’s operating expenses which they seek more stable returns and passive income for, they don’t invest based on retaining earnings as opposed to businesses.

Big Duty

David Swensen, a money manager who gave up a lucrative Wall Street career to oversee Yale’s endowment, earned it the top spot as the best performing fund in the country over a 20-year period.

This was an immense undertaking when he took over Yale in 1985 since the endowment was only worth $1.3 billion. Since then it has grown to $31.2 billion surpassing every college only trialing Harvard.

So you may be asking, how is $31.2 billion used up? Is Yale really improving? It seems college is getting more expensive and caring less about students.

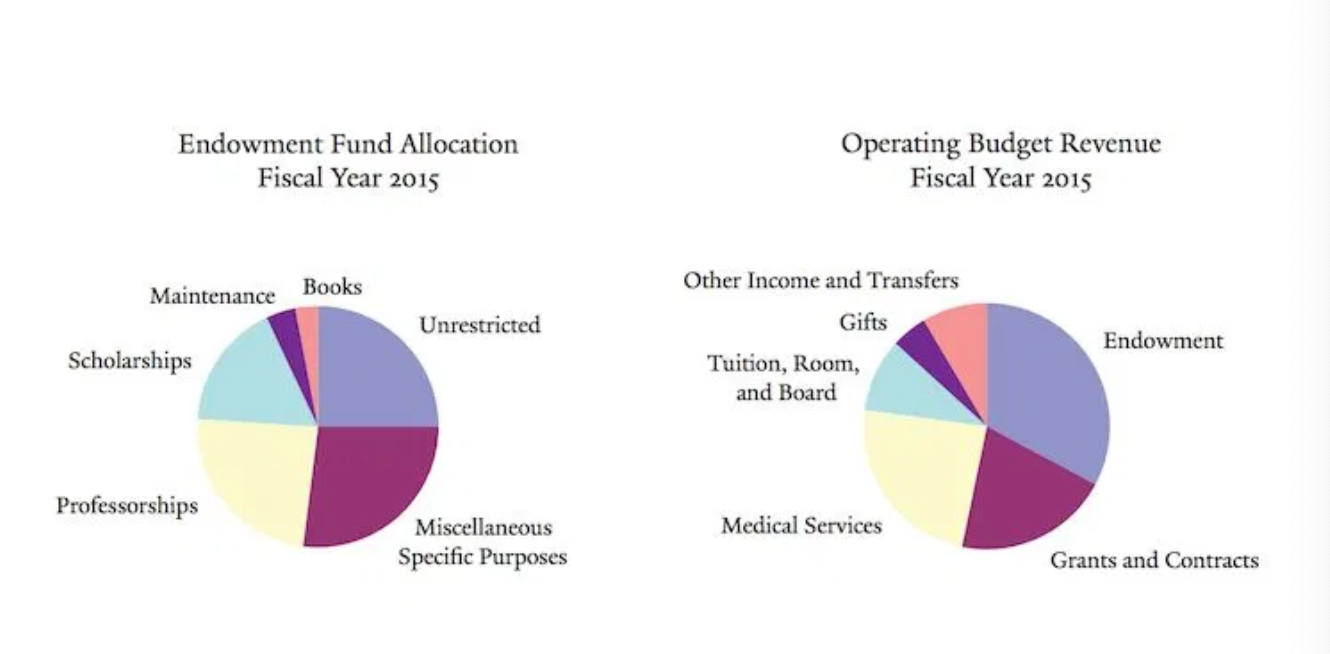

Surprisingly, it’s still not enough to cover the school’s entire operating budget. The endowment only covered about 30% of its 2015 operating budget.

These charts are a hassle and confusing since majority of costs go towards “unrestricted” and“Miscellaneous Purposes” which seem a bit fishy. These are one of the many mysteries colleges are all about.

How We Can Learn

Sadly, most of us won’t have the luxury or pain of amassing billions under management in our lifetime yet we can still invest the same way. Lumber to chipping into real estate doesn’t have to be expensive. It’s all relative to your AUM and how much you can afford.

What’s most common these days is the largest endowments and wealthiest individuals invest a good portion of their assets into alternatives, not where everyone else is. They keep an open mind and look outside of the crazy meme stock market. They prefer value driven stocks with low P/Es but expected growth and bright potential.

David pioneered simplicity and humble investing to generate spectacular returns. Without his financial leadership, Yale could be struggling for a top seat and colleges are all about those titles.

In essence, David believes, “A combination of common sense (don’t put all your eggs in one basket) and finance theory (diversification is a free lunch) caused me to improve the diversification of Yale’s portfolio,” he said. “An understanding of the long-term nature of endowment investing caused me to increase the equity exposure of the fund.”

David Swensen died early May in New Haven, Conn of kidney cancer.

He was 67.