The pandemic shifted consumer spending for the better.

It’s unfortunate most people only change when they are forced not asked or advised to.

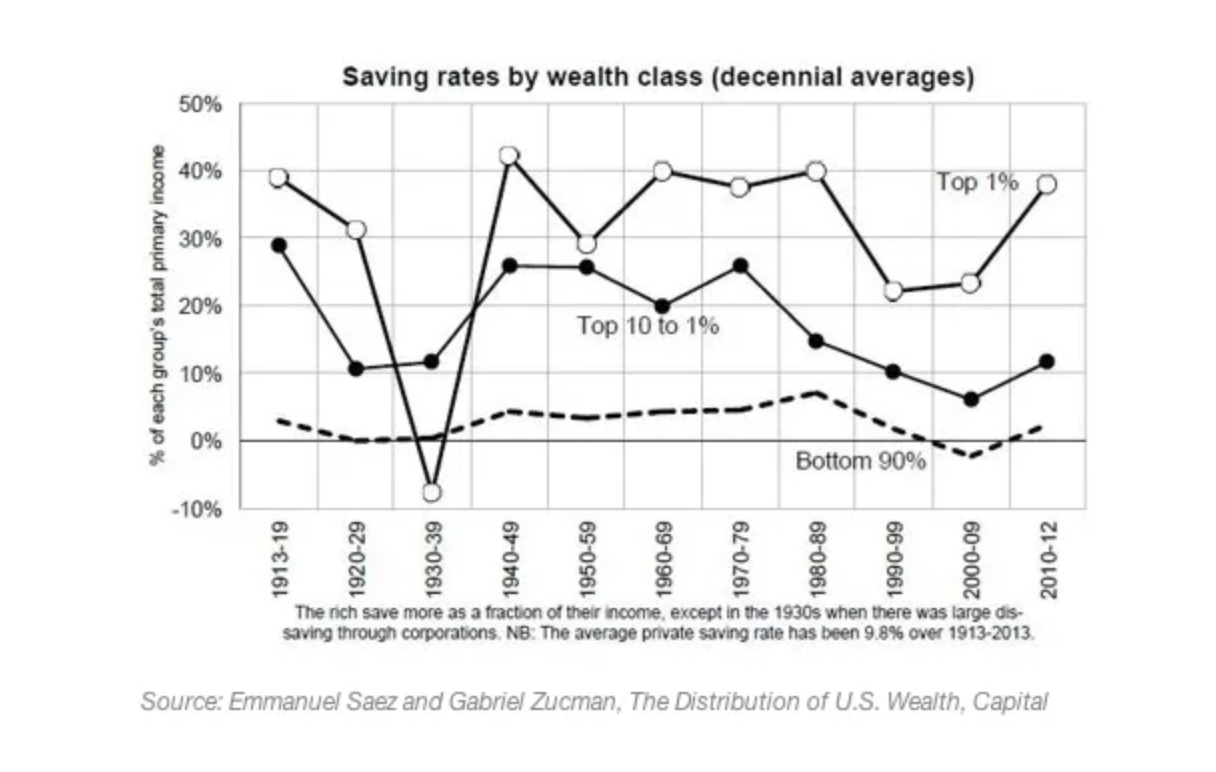

Believe it or not, the more income you make, the more you should and usually do save.

Although you would think that being worth more means you are safe and sound forever, it’s usually the opposite. People start to depend on you for things, you become more charitably minded, you creep into the cycle of lifestyle inflation and end up chasing after things you don’t need because someone else is alway richer than you.

Prior to the pandemic, the personal savings rate in America was around a staggering 5–6%. Thankfully, post-pandemic is has risen to above 25% as people have been wary about job loss, bottle necks in the vaccine rollout and supply chain, inflationary fears, unemployment and the overall future when it comes to reopening.

Imbalance causes uncertainty which leads one to panic and guard over their investments. That’s why I always suggest an emergency savings fund equal to 6–12 of monthly expenses in case a deadly bat virus comes around and lays you off or something crazy like that.

Nothing is crazy anymore.

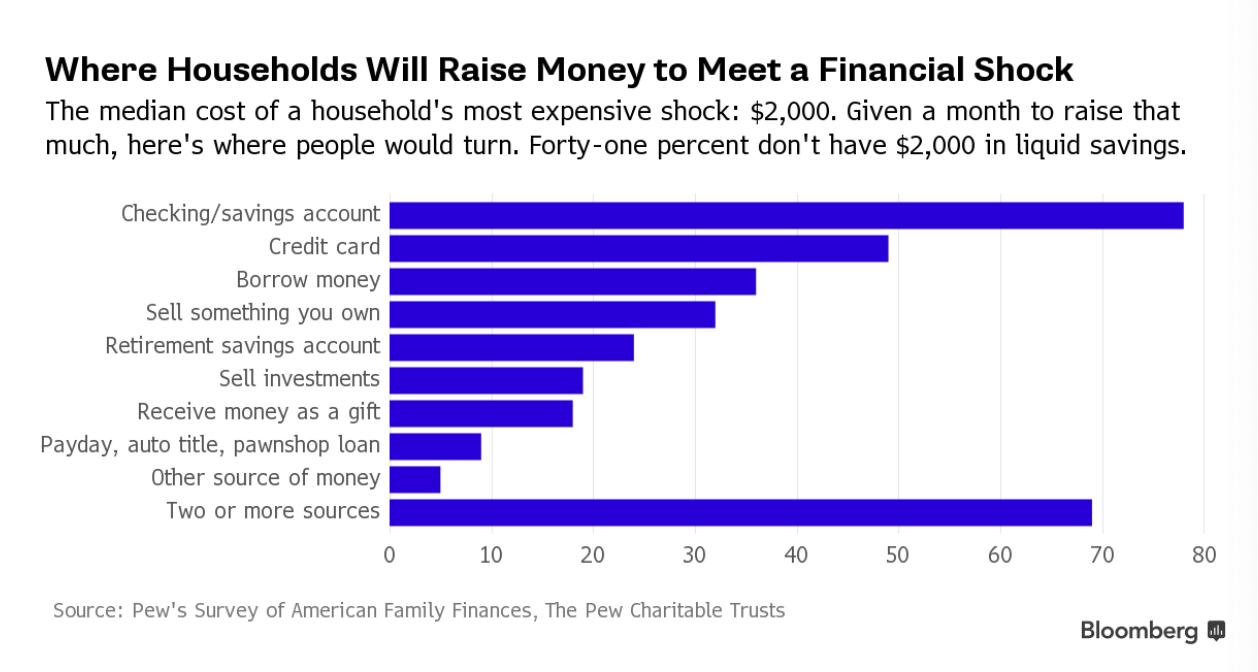

Saving is no doubt harder than spending but makes you feel like a million bucks. Unfortunately most people change when it’s too late when they really need to. This causes them to loose more money to find that cash.

The most common ways to gather cash when you have none is to sell your gains on your investments, if you have them and pay a shocking amount of income tax/short-term capital gains on-top. The last resort would be to contact a family friend/family member or close neighbor to engage in P2P lending with you but all in all, relying on anyone to keep you afloat is as dangerous as keeping afloat on open-seas as a novice paddle boarder.

Lastly, you can always borrow. The bank is more than happy to charge you extraordinary interest on your loans.

Prepare for the worst, hope for the best. Since majority of millennials are self-made entrepreneurs or influencers, they should realize the struggle of being one decision away from ending up on the streets.

The best thing you can do to avoid this fear is be over prepared because you can always adjust afterwards but being underprepared will leave you in ruins and possibly take a whole lifetime to get back to 50% or less to where you were before!

Don’t put that burden on yourself. Just like you can’t buy insurance when you need it, pay down any accumulating lingering consumer debt from your credit cards to car payments ASAP, set up an emergency savings account to stay sane and save at least 30% of your expenses to feel proud and reinvest.

Covid was no doubt a learning lesson but the big question is, will people stay this diligent?

Don’t let reopening and the vaccine rollout lure you into sabotaging all your hard work from the pandemic saving thousands on commuting, eating out, vacations and traveling!

You worked so hard for a year!

Don’t let it go to waste now!

Saving Is Savvy

When one thinks of saving, they presume the saver is living in a studio apartment not spending a dime on living life.

That is called being cheap not a strategic saver.

You can easily enjoy the fruits of life by being a frugal stealth wealth minimalist like me. It takes diligence, time and patience along with major focus and unwavering commitment, but overtime, it not only makes you more appreciative for what you already have, naturally you accumulate less and earn more as a result of saving 50%+.

So why is saving so difficult for people?

We live in a consumerist, stuff it in your face, buy 1 get the other one free society. Everything is advertised and proven for you to need. Our foot-traffic, eye balls and finger print movements are monitored by billion-dollar tech behemoths in order for them to sell you more ads and confirm your bias.

By The Numbers

Clearly, the US personal savings rate has been disastrous since covid. It’s shocking that people assume their financial future will never take a turn and everything will be jolly 24/7.

Unfortunately everyone is replaceable. Apple can easily hire an engineer in India who would gladly be paid $3 an hour instead of you entitled American at $30. So in order to stay afloat, on top of having multiple income sources from diversified locations, saving more and spending less will put you on the most reliable track.

If you want to consume less I suggest:

-Limit your social media presence to 30 mins a day (if it’s for work promise yourself you won’t buy anything and somehow resist ads)

-Don’t snoop online so much, go to the physical store when you need to that’s it

-Go on adventures, spend time with people not devices and pay for experiences

-Look at your closet or that dusty bookshelf, the average American has $1200k worth of stuff they could sell in their home

-Prioritize people not things

-Make memories not clutter

At a personal savings rate of 6% pre-pandemic, that will take someone 22 years to save up enough money to replicate one year’s worth of income. That’s ridiculous and unrealistic! Savings can help you earn much more income than you think. The average savings rate dipped to only 2.4% in 2006 and took years to bump up.

A recommended baseline is to save at least 20% of your after-tax income earnings per month after maxing out your 401(k) and IRA or pension. The younger you are, the more you can save.

Since retirement is your most expensive phase of life, living expenses are going to be extremely costly if you’re only relying on social security, your paycheck that you blew all your life to live the dream and your reticent benefits or annuity.

Today

The average saving rate shot up to 33% in April 2020, but has fallen back down to below 10% in 2021 as the economy gradually reopens.

I predict that the average savings rate will go back down to 7%, maybe lower once the economy gets back to speed as people become optimistic. At least we now know that if people WANT to save they CAN. It’s just a matter of choice and priorities.

Savings Rate by Wealth Class

Top 1%

38% This is unrealistic for the bottom 99% as majority of their expenses go towards necessities such as food, gas and electricity while the rich simply reinvest their earnings and never spend most of it since they’ve been in a cycle of benign diligent spenders!

The rich are rich because of their impressive savings rate.

Increasing savings by 2–3% isn’t difficult. Your spending habits will naturally adjust as you earn more income and that shouldn’t happen.

Why should you need a more luxurious car to show off and make people jealous of you when your 10 yr old Honda works fine and gets you to the same place at the same time?

The ultimate goal is to save at least 40% so that you can feel no pressure to earn more. If you’re lazy, this is your best bet.

If you save at least 50%+ or more, no doubt you will be on your way to the FIRE movement and independence as long as you don’t destroy what you’ve been building up for your whole life.

Top 10%

The savings rate goes immediately down to 20% and less.

If you are making less, ask yourself why you don’t have multiple sources of income. Invest and make yourself indispensable by curating relationships to help you get through the door.

To be rich, you have to follow what the top 10%+ do in terms of saving.

There’s no secret sauce besides saving more than you spend, being safe than sorry and knowing what is really important. Anyone can get anywhere if they become focused at what they have control over and what’s valuable in life.

Savings matter.