After last week’s wild ride with Reddit traders manipulating the market and taking it through a storm none of us want to endure, especially the folks on the East Coast, the markets have finally calmed down, pretty much because GameStop has lost more than 60% of it’s value retrieving back to it’s realistic share price of $67 and easily lower in the future. At least silver now is booming at it’s all time 9-year high for no apparent reason! We could say that makes sense as it’s a commodity that is GDP factor based rather than just a random dead stock speculated by WallStreetBet dudes.

To say the least, we’ve endured craziness in the markets starting in 2021. We haven’t been off to an incredible start with the new year starting in the red for most of January, but looking back in history, pretty much every single year, including the Great Depression and 08, there have been returns that have either beaten market expectations or over exceeded return expectations so with the herd immunity on the rise and optimism about normal life again, I can conclude this will be another impressive year. It’s always bumpy at the start with a new president anyway. Thankfully, the Robinhood frenzy didn’t last long and we are back in solid green digits, the color of money. Nothing can be better!

Yet that wasn’t enough to convince us that the stock market doesn’t rely on pure nonsense and opinions from people who really shouldn’t have a say in driving the market upside down. But since we are past the frenzy trading week, hopefully, all thanks to Robinhood and bored Reddit conspiracists, investors are loosing immense trust in the market compared to last year.

Readers, compared to last year, whether or not you took part in the stock market or just starting, how do you feel about it at this moment?

How It Began

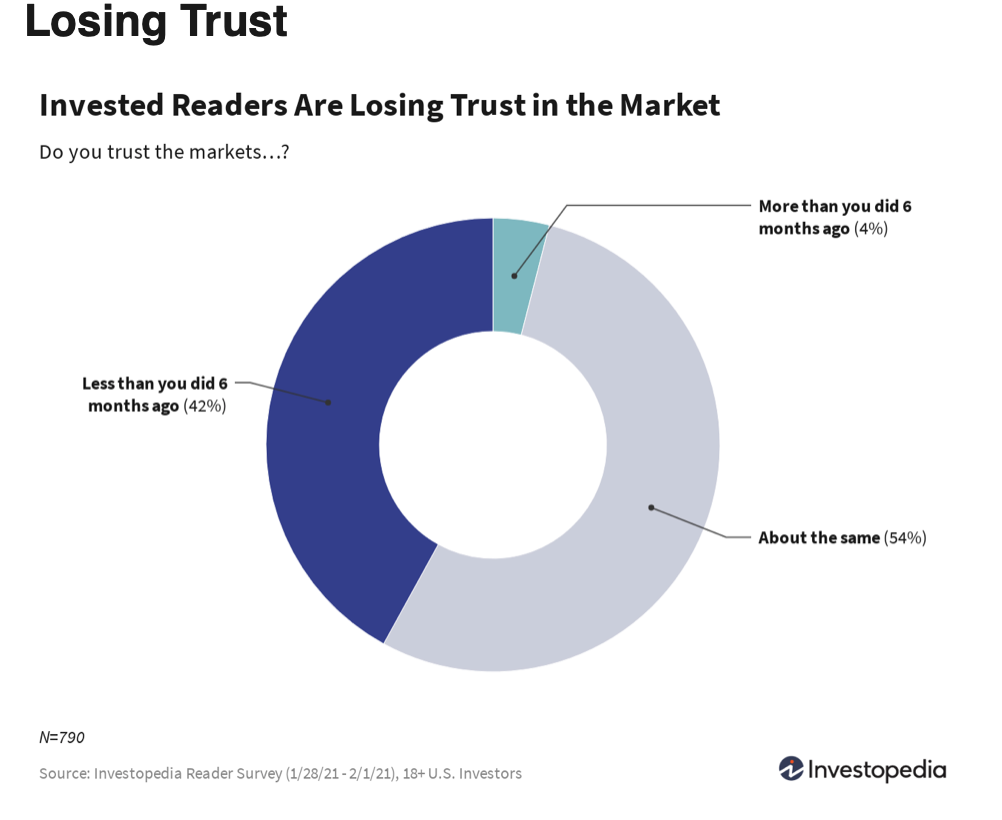

We’re all pretty much in the same boat. Unless you day trade and in that case, you are running for your life. According to Investopedia, 54% feel about the same or on the verge of feeling less trustworthy of what is going on with their money in the markets.

This is understandable for several reasons, and don’t worry, I won’t mention the Reddit palooza again:

-Although the economy and stock market are not directly correlated, what is going on in the government in relation to unemployment and GDP and health care with vaccines and normal life all still play an effect into the anticipation that investors are having about the future driving optimism but careful consideration.

-Since investing is all about the future and when you buy securities you are really trading in 5–6 months from now, optimism is coming closer than ever with the vaccine rollout but there is still a little craziness not knowing what to expect since it’s far off expectations

-With Biden in office and no more gridlock on Capitol Hill, Americans (except lunatic conspiracy theorists) are reassured and not surprised that Biden along with Dr.Fauci and the WH medical team were able to ramp vaccine distribution and more shots in arms by their first week. This allows investors to be hopeful for herd immunity to come sooner than later

-IPO frenzy espeially in the SPAC market. SPACs are an alternative way to bringing a company public through a blank check system where investors pool in money to help fund a company as opposed to having the startup pay hefty fees to an investment bank to do it for them. As with the newly listed IPOs that have come to market in late 2020 such as DoorDash and AirBnB, both have seen crazy evaluations that spark some concern in questioning where the fundamentals are at

-Hedge fund disaster. Yes I said I wouldn’t talk about Reddit but since most of the volatility, if not all in 2021 was caused in the last 2 weeks by Reddit retail investors taking over hedge funds most notably, Melvin Capital lost a few billion dollars shorting AMC, Blackberry and GameStop. They shorted them for the right reasons because they are unprofitable stocks with no future but due to the Reddit gang thinking and seemingly succeeding to overthrow them, the hedge funds ended up having to short squeeze their positions. This means they shorted (predicted stocks would go down) but it ended up reversing track and now they have to pay back what they don’t owe due to their fundamentally right but stupidly wrong bet against regular folks.

-At home stock mix up. Although Peloton, Chewy and most notably Amazon have had record years, especially the FAANG (Facebook, Amazon, Apple, Netflix, Google and Spotify) the most dominant companies in the information technology industry of the S&P 500 most blowing it out of the park with 100 billion dollar quarters, something hard to fathom, investors invested in at home stocks are staying vigilant as they are becoming stagnant. They haven’t been moving up in the past few months as much as expected and stagnant in their bull run, even though the major indexes are still at their all time highs compared to last year which makes complete sense in a recession ironically.

-Wealthy investors who haven’t been financially affected from the pandemic are itching the same scratch for the past year to go spend their money on travel and leisure, the second biggest expenses to housing for the rich and are bearish on at home trends creating mixing results

-Robinhood suspending, halting and who knows what’s next to trading in order to fund themselves through a liquidity crisis and back up hedge funds who hold a majority stack in the company. They don’t work in the client’s best interests anymore. Sixty-two percent of investors agreed that online brokers should not be allowed to restrict trading during periods of volatility, while less than 25% say they should.

-Cobalt and random metal such as silver surge, skeptical about Reddit investors again. It’s hard to avoid them!

With 42% of investors say they trust the stock market less than they did dix months ago, this loss can creatively be coupled with various factors that most of the time aren’t in our control. It is understandable that investing means becoming part of a system that will be volatile and unpredicted, but staying lazy, vigilant and hands off will always provide returns guaranteed.

Where It’s Headed

So how can we restore fairness and trust in the markets after what we’ve seen with Robinhood taking control of how we spend and place trades to keep themselves alive?

According to The NY Times and some of my thoughts this can include:

-A transaction tax, even of 0.1 percent of a trade’s value, could reduce the attractiveness of the high-speed trading.

-End payment for order flow, which means that online brokerages like Robinhood couldn’t sell customers’ trade orders to firms like Citadel Securities to execute. That could give retail traders more confidence that their brokers don’t have a conflict of interest — though it would also end zero-commission trading.

-Change how people qualify to access private investments, perhaps using a financial literacy test. The less you know about how to spend and trade, the less freedom you have over management for the client’s benefit.

What’s In It For You

As always, whenever you invest in stocks as a reasonable, patient and lazy investor, yes, I said lazy long term investor, stocks will always make you a return, guaranteed. If you sold your investments or bought into places too late, you can even make a return. It’s all mental and there are no guarantees except for being in the game.

As someone who has a portfolio breakdown of 70% passive and 20% active investments as a 20 year old, mainly in index funds and high performing ETFs that were established 40–50 years ago, I’ve seen consistent returns since I set up my Roth IRA and Vanguard account back when I started earning enough money to reinvest into the stock market in 2012. It’s never too late to start and don’t feel the pressure to dabble with everything. Truly, I haven’t touched my assets in 1 year and checked it since last month and I’m outperforming most benchmarks I set!

Recommendation?

If I were you, regardless of age, there is no incentive for you to be on Robinhood. Set up a free Vanguard, Fidelity, Charles Swab or E*Trade account. They are safer, better customer service which is key and aren’t a recently founded startup! The competitive advantage of free trade no commissions, haunted trading stealing your money and behavior is gone from Robinhood. Every brokerage house that is more reputable has adopted it by now.

As Robinhood raised more money in five days than its previous eight years after receiving huge collateral demands form Wall Street’s main stock trading clearinghouse, been asking its banks for additional debt financing, and it’s unforeseeable IPO, there is no point in wasting your time on retail investing platforms or Reddit in that matter to pretend you are going to become rich. Sure, you can estimate and speculate all you want but how far will you get? Very limited unless you are willing to loose millions.

Stay safe, stay distant and don’t fear. Your money is in good hands.