This weekend is the big game. To be brutally honest I didn’t know the Super Bowl was in February. I only knew the Grammy’s were in March. Don’t hate on me. I’m a female and life long New Yorker for goodness sakes. We only have patches of grass the size of your car.

As much as I would rather watch the Puppy Bowl, since most of my friends are guys, obsessed with wrestling and this violent sport of football, I will join them Sunday night to steal the store boughten guacamole dumped into a Mexican stone bowl and chicken tenders pretending we made them ourselves just to act like a true American. Although I could care less about the winner, I want to avoid FOMO at all costs and that’s exactly where our money ends up.

With the halt on all events in the past year and half, the sports fans I know, myself included are practically dying to see something, anything in action at this point! Thankfully live sports with strict health precautions followed by the players and no fans in the stadiums came back onto our televisions, as if we needed to be on the screen more, in summer 2020 which lead to optimism and our competitiveness as Americans to fall into the cracks, as if we needed those things as well, once again.

Since I played tennis all my life and in fact was one of my first jobs coaching tennis at various beach and country clubs making roughly $100 per lesson this opportunity which finally lead me to start contributing profits into my ROTH IRA, till this day, I only watch tennis. I thank rich people for contributing to my net worth. Without elite country club members paying $200k per year and $80 to reserve a court for a $200 lesson coached by a High school amateur to throw balls not even pass the ball back, it was certainly worth it. I’m not saying take advantage of those people, but when you get a chance, it’s always good to be connected to them if you want extra dough and strive to become them as soon as in your twenties as I did. It usually works out that way more often than not. Philanthropists and big donors aren’t the middle class after all.

Point of Play

But watching a group of masked up players whether it’s the NFL to the NCC championships with a bare, empty crowd around them isn’t the same. It feels awkward, shallow and sad. After all, that’s the world we’re living in currently.

People escape to events, sports arenas and action packed nonsense for the thrill, escapism and most importantly, expecting to pay a lot of money. I’ve been fortunate enough to learn a thing or two from the NFL commissioner, Roger Goodell as both of his twin but not identical daughters went to Kindergarten to twelfth grade with me. As a New Yorker, I wasn’t particularly interested in the game, I still don’t know what the heck a quarterback and kicker actually does but regardless, I learned a thing or two about their lifestyle and how my the sports and entertainment world with live events steal your money and gauge the prices like there’s no tomorrow without hesitation all into Roger’s pockets. It reminds me of Apple. No matter how much they charge for a piece of tech, since it is quality and a piece of luxury, anyone will buy it. They could sell an iMask for $500 and people will wear it guaranteed. Patent is open for trademark Apple FYI.

What I Learned From The NFL Commissioner

His most important day of the year is coming up this Sunday Being a commissioner is a hard job. Not only you have to control these beasts(sports fans) and plan the largest event in all of America a year out in advance, there is a lot of pressure to make it perfect and better than last time!

Over our thirteen years together, the girls spoiled a few secrets here and there. From the private jets to the half time performers they get to meet, it sure can be seen as glamorous, until you see how much money is filtered to their dad which is more astounding than anything.

Sure anyone could do his job and most would love to, but I think the most disappointing part about working with athletes is that most are college, high school dropouts which mean they have no financial literacy understanding or degree. That explains why 70% or more of them file for bankruptcy a few years later after retirement. And in sports terms, retirement means shy of 30, 40 years old, excluding Brady and Federer playing peak performance till this dayrolling on to their 50s by no time.

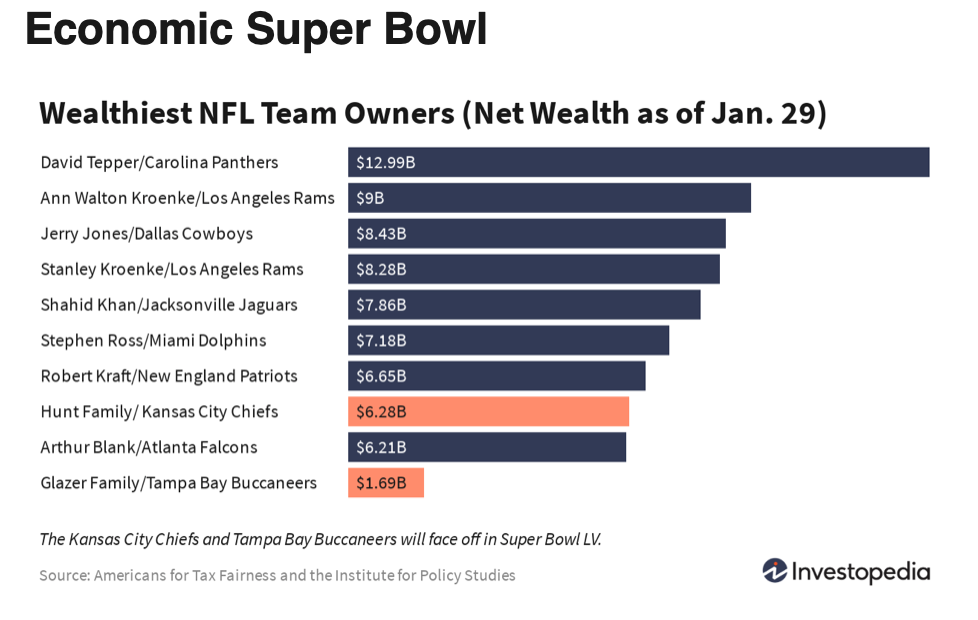

Wealth by Team

As I mentioned, I’m not familiar with all these teams. I know there’s the Yankees, the Stealers for baseball and Buckawhos and the Kansas City Cashwhos playing on Sunday. These are one of the least wealthiest NFL teams in football history.

According to Investopedia, the least is Tampa By and third to last is Kansas. The reason I bring this up is because although the commission makes a generous salary of roughly $20-$50 million annually, most of his income is compounded thanks to all of you crazy guys and gals who watch football too.

As with everything in life, whenever you purchase something, even when it’s free since you are the product in that case, there is a buyer and seller. Someone is spending and someone is earning. In his case, although a degree in finance or sports management would be preferred, it certainly isn’t necessary.

If you read about Roger, he got his job really by luck and perseverance. That’s how most successful people get their positions. You can’t time the market or apply for a job not knowing anyone. Instead as general as this sounds, working your butt off in a unique way for years will get you a step further but once again, not guaranteed. Most people aren’t willing to work a little bit harder for extra time so they end up comparing why they aren’t CEO.

He got it through luck and now is taking all your money. But we must enjoy life. We will always have to pay for something, whether it’s our time reading my article now instead of cooking dinner or doing laundry instead of Snap chatting away. There’s an opportunity cost to everything and sport’s fans don’t seem to mind.

What Sports Players Teach Us

It is 10x easier to loose money than to make it. The more you have, the more you can spend hence loose it faster. Through my articles, I advocate for breaking the gender gap in the financial literacy field and democratizing finance for all. Yes, that’s what Robinhood’s catch phrase is as well but since they are ruining their reputation right now, I will borrow it.

Regardless of what you study whether it’s architecture to biology, everyone in this world must know how to budget, save, compound, invest and achieve your goals. Without financial literacy, you will not be able to live in life.

Money doesn’t have to control you if you can control it first.

The richest athletes in the world have lost it all due to no financial literacy background, spending it on luxuries to impress their fans. They are duplicates of lottery winners because they are overwhelmed by the amount of money they assume they will forever have and end up foolishly blowing it. It’s quite embarrassing from their perspective. Really you just lost 200 million? No education = carelessness and no priorities. It’s an addiction.

Be humble, live below your means, enjoy saving and appreciating what you have. Trust me, it’s not a lot of work, it just takes patience and staying in your lane. That’s one of many ways you can become guaranteed millionaire by 21 if you started at age 8 when I did. Don’t doubt yourself just be careful and cautious.

So Where Is Your Money Going?

Each year my best friend and I go to the US Open. This has been a tradition of ours for a couple years now because we love the thrill of being in the action, court-side and seeing the players in real time, live. This is the same feeling Superbowl fans to golf spectators have. This is becoming more and more popular amongst the GenZ and Millennials to pay for experiences instead of materialistic things, at least that’s what I’ve convinced my friends which have saved them thousands.

I’m not a big concert goer and I prefer to jam out on Spotify on my own but a tennis match is unlike any other. Playing Millenial Monoploy the other day I had such a craving to go back to the courts and get Serena’s autograph in the summer months in NY in Armstrong Stadium. There’s truly nothing better.

But with great experiences, meeting the best players in the world, eating top Michelin star food and buying triple size your head tennis balls, it all comes at a price. As a financial literacy advocate, I practice what I preach. I don’t recommend anything I haven’t tried because there’s truly no point. We’re supposed to make money fun but realistic of course after all.

On average, we each spend roughly $300 on the US Open event. Due to inflation, it rises a few $20-$50 per year and as soon as herd immunity exists and we can go back to events, I guarantee you and expect that all live concerts to sports events will be double the price due to extreme unheard of demand!! It will be bonkers!

101 on Sports Spending

It is up to you to decide what is most appropriate for you to spend. I will never tell you what you can or cannot spend. You must weigh your priorities straight and what makes you happy but as someone who believes in stealth wealth, frugalness and not overpaying for what you don’t need, you need to be cautious, especially about events like these that although provide memories, disappear once the night is over.

When attending a live event, it is best to have an intention. If you just want to be with your friends while listening to music, save a couple hundred to thousands and go to the park instead of Coachella. No need to rent a hotel room for a day to pack your bags and go to the Super Bowl for $5k just to see a live game in action.

Upgrade to a larger TV, buy as many snacks as you please and get those high in depth speakers to feel like you’re in the stadium or cheer on your son at his HS. It will be the best dad-son moment you’ll have.

Growing your wealth takes extreme laziness, but in a different way. It doesn’t mean being lazy, buying the tickets ASAP because you want them without consulting your budget, financial advisor or partner, it means being patient, weighing your options and not having too much fun with the payment process, even though the anticipation is usually better rather the event itself, especially on vacation.

Quick Savers

Just like with building passive income, it is easier to reduce your living expenses than increase your income and in fact it is better for you as well.

If you are looking forward to a sports game, instead of helping Roger or Tom Brady boost their salary to an extra 30% each year as the median salary for all NFL players is about $860k and winning the Super Bowl surmounts to an extra $130k bonus according to Athlon Sports, not including endorsements, give some of your hard earned money back to yourself.

Spending $500 less is the same as making $500 more being creative and lazy the right way.

What Make Up The Costs

Over the years, the price of playing a sport has increased dramatically and especially due to the pandemic, racquet sports and polo, socially distanced friendly sports have gone up, although those are ironically the most expensive sports to play.

Part of these costs include the operating costs, the entertainment behind it, sport-casters, moderators, cheerleaders to spectators, arena, advertisements, you name it, it’s a business that people need in their lives to stay sane, happy and human!

The enthusiasm for playing sports has only grown to a point where as some booking sites are already full for the US Open 2022 grand slam tickets and the hotel room rates are high jacked for the Tokyo Olympics this summer.

So what can you do?

Make sure you evaluate your why. Obviously having fun is a top priority and getting out of the house to see anything can be a valid reason once this is over but as with everything, don’t erase all the hard work your investments from 2020 stellar stock market year have made you and the savings you’ve generated from staying home not commuting or buying a $7 overpriced latte from your daily commute on live events. Be cognizant what you are paying for and if it is really needed. Remember you will feel a deep urge to go anywhere soon. Be mindful of your feelings. After all, a TV is much less expensive than paying quadruple for Patrick Mahome’s fifth home.

Enjoy the game!