I shouldn’t generalize but I’m pretty certain about this statement:

It’s easier to spend than make money.

Prove me wrong but with the average household debt in 2020 roughly at $145k and the median debt load for an individual at $67k, there’s no denying people don’t have their priorities straight.

Where is this debt coming from?

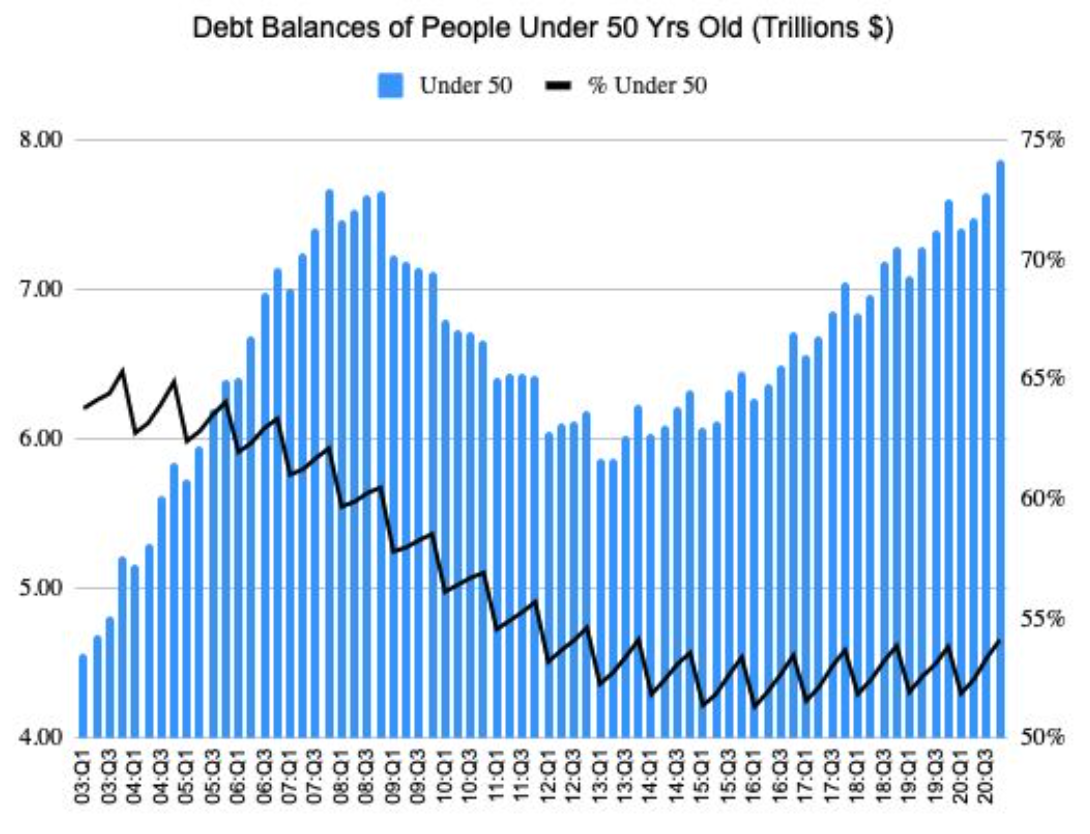

Americans under 50 held $7.86 trillion of debt in Q4 ’20 with T. That’s the most in US history, higher than the U.S. 3+ trillion dollar deficit.

Here’s a breakdown:

🏡 Mortgages/Home Equity Loans = $5.28 trillion (67%)

🎓 Student Loans = $1.20 trillion (15%)

🚗 Auto Loans = $0.80 trillion (10%)

💳 Credit Cards = $0.37 trillion (5%)

🏥 Other/Medical = $0.20 trillion (3%)

At least the Fed and government can explain themselves with their debt balance which includes:

-Providing stimulus packages 2x for Covid relief

-Stabilizing the economy

-Reducing inflation and unemployment

-Providing for the military, education and farmers

For us citizens, there’s no reason anyone should hold this much debt.

Don’t get me wrong. Debt isn’t all the same. Yes, it’s a negative number but it carries different purposes which may not be all bad.

Good debt: Use those funds in hopes of them appreciating as an investment into the future

-Student loans

-Business loan

-Mortgage, home equity loan

-Experiences (certain ones such as a wedding)

For example, paying for a home with 100% in cash is a waste of money. The only time you may want to do that is if the home is extremely rare, there’s only 1 out of a million on the market and has an incredible deal with many bidders asking higher prices.

To stand out to the seller, you need to have all cash to buy it immediately so they can sell it ASAP. Yet for most properties, most people can’t afford them out right at once. In fact, only about 15% of all homebuyers in the U.S. can afford their property if they were to purchase it! According to Zillow only 37% are clear meaning there’s no mortgage beholden to it.

Clearly people bit off more than they can chew.

Looks mean nothing.

Almost anyone can afford a 10 room mansion with 5% down.

Not paying in cash isn’t necessarily a bad thing since properties have been increasing in price ever since ’08 by 30% and during the pandemic, we’ve seen heart land America have a tremendous uptick with WFH(omers) resort to the midwest resorting out f expensive coastal cities such as NYC and San Fransisco.

By no means I don’t think NYC is dead, nothing will replace this great city that doesn’t sleep and now this is the best opportunity to rent or purchase something when everything is below average value for those who always dreamed of coming here but never could afford it. Cities will come back once social distancing stops. New York is clearly not made for separation when subways are packed like sardines 24/7.

Anyway, when buying a property, it is suggested to pay 20% in cash upfront and the rest through a mortgage. Obviously a mortgage has to be factored into the rest of the costs such as the maintenance, brokerage fees, property taxes, on and on and you can read here if you are stuck on why a property isn’t great for you. A mortgage is something that you will have to continue paying the bank for until the term date. Whether it’s a 10 year or 30 year fixed mortgage, depending on interest rates, especially now as the 10-year yield is inching towards 1.25%, it’s better to refinance in a lower interest rate environment and pay off your debt as well since the Fed will be inching interest rates up following the 10-year eventually to stabilize the economy and get back to normal but I believe that won’t be until after Covid and when businesses such as luxury, air travel and tourism will get back to pre-pandemic levels even if it takes a few years as analysts predict.

Bad debt: Well, it must be the opposite. It’s purely money down the drain and doesn’t provide any future benefit to make money off of the loan

-Luxury goods

-Credit card debt

-Fancy junk

-Vacations, weddings, parties, etc.

I believe credit cards and student loans are the two biggest threats to the financial security of people under 50 because banks love to charge interest through compounding in order to eventually effect your credit score and make it harder for you to take out more loans, not saying you should do so with that amount of debt afterwards anyway. With a poor score and lots of debt during a high interest rate environment, banks take advantage of you because you need ‘help’ to eventually pay more for their services. Taking out debt isn’t bad, paying it back is the problem for most.

Choose Not Chosen

As a financial literacy advocate and blogger, I prefer to be modest and not full of myself but for a minute I will. I would say I have quite a bit of experience knowing what not to buy and what to buy. My parents taught me to live the frugal, minimalist stealth wealth lifestyle not because we had to like most Americans do when they end up in financial ruin, but out of choice.

That’s the biggest takeaway.

The person who wears the most bling and purposely shows off is the one who is the poorest but tries to act rich.

The wealthy know that they need to invest in something more profitable than junk. For example, one of the greatest investments is in yourself because it pays dividends for a lifetime through education. No one can take it away from you and you can do anything with knowledge.

People who are good with money avoid certain things not out of forcefulness but rather out of gratitude and appreciation for what they already have.

Less = More.

Focus on what you have instead of what the Joneses across the street use. Sure they could look happy and elegant on the outside in their fancy 20k ft home, but until you look into their bank accounts, they could be as broke as OJ Simpson living in a 20 bedroom mansion.

Looks mean nothing so let’s look at what really looks good to preserve your wealth and to follow.

#1: Quality > Quantity

To be good with money doesn’t mean you have to be obnoxiously cheap and mean. Wealthy people foster connections and care about treating others right, not impressing them. You don’t have to be wealthy to be good with money but most are because they aren’t living the lifestyle you dream of.

Living below your means means valuing what you have.

Especially when it comes to food, many people assume organic food is the same as washing a chemical infested fruit. I wish. Although organic, vegan, fresh vegetables outsourced from upstate can be more expensive in the short term for your budget, in the long term, more expensive foods usually mean more quality and they let you live longer which puts money back in your pocket as if you didn’t spend it!

Just think about it. You’re sure to save thousands of dollars a month eating McDonalds 3x a day as opposed to fresh fish, veggies and organic fruit but your life is almost guaranteed to be cut down a few years. If you wish to save money and die early, by all means do so but I’m assuming once more that we all want to break the world record of longest person alive and would rather have less doing so. Plus when you’re older you get massive tax breaks, medicare benefits, pension, 401k you name it! You’re practically living for free so giving up your life to eating fast food for your whole life is a horrible mistake.

With those few extra years of life, you could easily make thousands or millions more in the stock market, enjoy spending time with family, have more energy to do what you want and just live.

Health = Wealth folks.

Don’t just look at the dollar sign, look into the future benefit. Being cheap doesn’t help.

Same thing with material things. Don’t fill up your closet with fast-fashion that you cannot wear for years to come and buying an abundance of cheap things that will break tomorrow is silly.

Investing isn’t just in the market. It’s your life. Unplug from consumerism.

#2: If you cannot afford it twice, you cannot afford it once

I learned this from my dad in 6th grade. I’ve been extremely fortunate all my life to be able to travel, experience things, go to an incredible university and do a lot of experiments that others without living a stable, nice lifestyle can afford.

But it wasn’t due to my parents paycheck and knowledge of the financial system that I got to live this way.

It was due to saving and choosing as referred to above.

Till this day, whenever I buy something in store, I try to bring as much cash as possible. I ditch my Apple Pay and credit cards because I know I can be spending all I want on the and even if my account bounces without enough funds in check, I can still keep going!

Banks are evil. They make money when you loose it.

Cash doesn’t allow the banks to profit that easily. I know it’s lame and a hassle to carry a thick bulky wallet with cash but it’s the best way to only spend what you need. I’m not talking about bringing loads of cash with you on vacation, but rather for the small daily things you do.

Whether it’s buying lunch to hailing a taxi, having physical cash will allow you to be aware of how much you have.

It’s physical so if it’s gone, you can’t dip into debt.

If you can’t afford something, don’t spend money on it because it will hurt you more than heal you.

#3: Money can really buy happiness

It sure can if you take advantage of it in the right ways.

Happiness and fulfillment are two different things.

It won’t bring you fulfillment because you need to work hard on your own to make people’s lives easier and better to feel that way but you can travel, go to places and meet people you wouldn’t normally be with without it.

Just by sitting in first class on a plane waiting an hour for take off, you can meet your next co-worker or possibly strike a deal and or when you go to a networking brunch you’ll meet famous people that you paid to see.

Notice a pattern?

Connections are everything and the best use of your time and money. Nothing about cars or guns. That’s just stuff. It doesn’t make you a better person.

If you haven’t earned that much, be different. Don’t try to win the lottery or become an NFL star to just blow off your first exciting paycheck with no education, instead earn it through networking online for free.

Be creative with no resources. Sign up on LinkedIn, post consistency and keep the posts that have no engagement up because that is a sign of strength these days.

Consistency pays off.

I did that for a few months and have met incredible people on the platform who’ve helped me land jobs. Money won’t give you jobs, it’ll give you the stepping stone to do so.

Resist social media and scams that don’t put money into your pocket and sell fake dreams.

Choose wisely.

#4: Don’t buy junk and gush over titles

Those who are good with money are “less interested in brand names or tags and labels,” says Khalfani-Cox.

As Insider’s Hillary Hoffower reports, “Showing off wealth is no longer the way to signify having wealth. In the US particularly, the top 1% have been spending less on material goods since 2007.”

I looked into my closet just now. I can’t name a single brand. I’ve never worn anything that advertises a brand’s logo before and have 6 pairs of white shirts that I rotate daily. I have my priorities and not only choose not to waste money on clothing that won’t fit me in a year, but would never spend my precious time on choosing an outfit.

Our morning are sacred, clothing shouldn’t be a part of it unless it’s your full time job.

Stealth wealth is all about this lifestyle. You are content and so fulfilled inside that looking like a homeless person won’t destroy your self esteem.

That’s true confidence.

You don’t have to be an extrovert.

It has nothing to do that.

Don’t show off and you will gain more friends and win people.

They will be attracted to your character instead.

#5: Time = Most Precious Commodity

Being wealthy doesn’t mean working 9–5 or grueling hard work 24/7 M-F.

They work when they are ready to work.

Waking up at 5 won’t make you a millionaire but it will instill a perspective in you that only 1% of the people in the world have which is diligence and perseverance.

Say you have a jam packed day but still want to get your workout in. You can skip the workout or stay obliged to do it needing to wake up at 4am instead of your usual 6am one.

Lazy bums follow emotion and they would stay in bed.

Those who stay accountable, do it no matter what because they know if they skip a promise, it will ruin their mood and rest of their week.

Till this day since 7th grade, I workout at 5am not to impress anyone, but for myself. Ironically it gives me more energy that I can give to others in my life and especially on weekends and holidays I have to do it.

It’s a routine that’s part of my life.

Find something that you take seriously and makes you a better person.

As an approaching millionaire myself and who’s encountered them all my life, I can tell you a few key differentiators that made us who we are all based on the weekends:

-Read

-Sleep

-Best time to work with no distractions

-Eat together

-Take walks and be in nature

-Gratitude

-Major family time

-Plan out weeks

-Go grocery shopping because health = wealth

-Go over budget and spending

Sounds typical right? It should be but it’s so boring most people expect it not to be.

You can never buy back time nor reverse it.

#6: Perspective is Key

Timing the markets just like with your career is only going to slow you down. Economic professors preach that there’s scarcity instead of abundance. No wonder school doesn’t teach students how to succeed! They are teaching us the wrong philosophy!

If you believe there’s abundance, luck made out for you through trying and experimenting with more, then it will come naturally for you to grow. Passion is a buzzy word that doesn’t pop in your head one day. It comes through making mistakes and meeting new people. Money is out there and should be in your hands. If you think it isn’t, then you won’t earn it.

You don’t have to be wealthy to be good at money, but most are for these reasons. Rich is a mindset, wealth is a power. Use what you have and prioritize it. Invest in yourself and take that leap of faith in understanding the hardest part is always starting.

I hope you learned something.