In this day in age, the debate between finishing college or just dropping out to build luck and rapport without a degree is a question looming over millions of students minds and is becoming an increasingly more vital decision to consider.

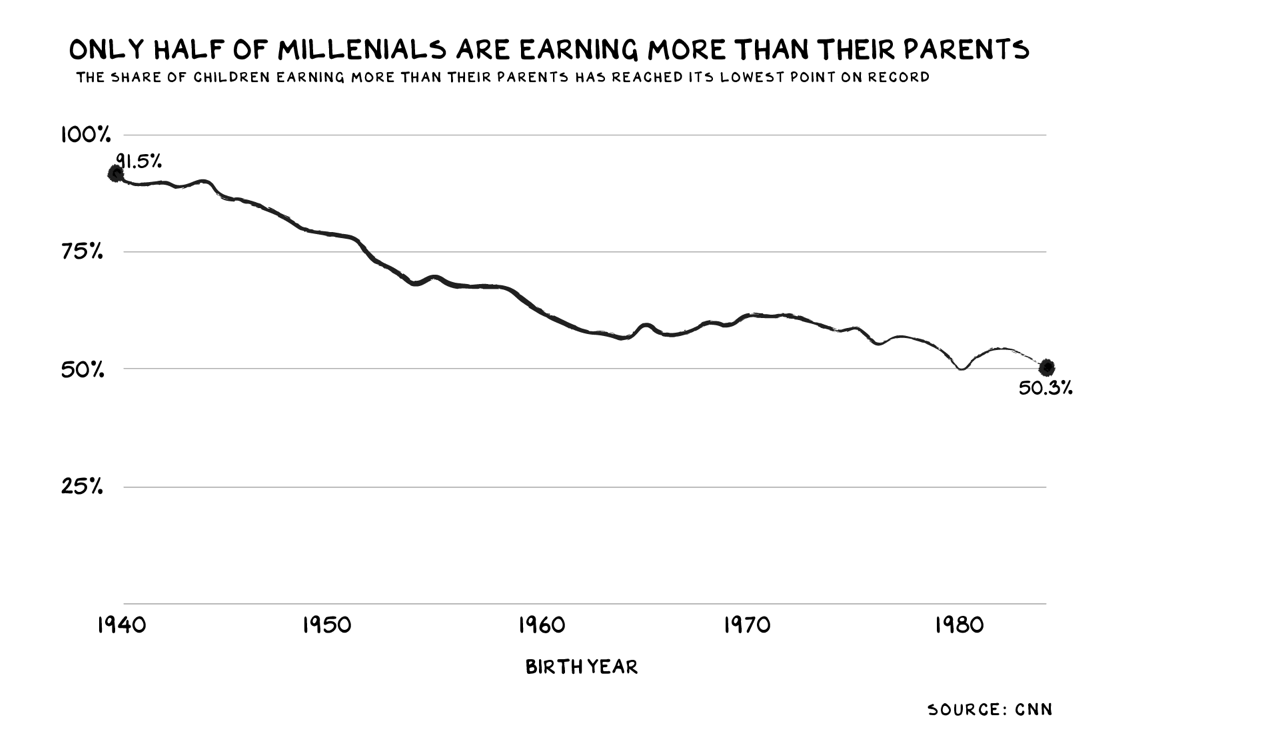

Since 1989, people under the age of 40 have seen their share of the nation’s wealth plummet from 19% to 9%. According to marketing professor and economist, Scott Galloway,

“For the first time in U.S. history, young people are no longer better off (economically) than their parents were at the same age. And, the distribution of this shrinking wealth remains unequal across race and gender. Fading economic opportunity and mobility is a disease, the symptoms of which are shame, frustration, and rage.”

With the age of the internet, more opportunities to freelance, build a risky startup, earn passive income, and quit school to never run into trouble with student loans, has become more enticing for students to opt into since education is becoming more and more expensive. Surprisingly, although the education system seems to be getting worse or the same as students are taught exactly what their parents learned, especially during this pandemic, students seem to still stick with the most stable, secure path of getting a degree more than ever before.

Yet with millions of Ivy league and intelligent, brilliant high IQ students securing no positions even from the top universities, no matter where you come from or experience you have, the job market is a risky place with no fair game guaranteeing nothing even for top performers.

So why do students continue to study at institutions that loan them thousands without being able to afford it?

Even if a 9–5 isn’t stable, it’s still a reputable firm with a great community, something students more than ever locked at home want to seize. Maybe students are getting the case of the lazies and just want to do what their parents did not caring to leave a family legacy?

We feel the pressure to make a living online even though it can be a scary unreliable place as well so school seems to be the best outlet.

At this point being online for almost a year, we just want community and most are sacrificing their paycheck for it.

Recently, there’s been an uptick in MBAs at top performing schools, applications are on the rise at prestigious universities and it shouldn’t be a surprise that millions of students are now interested in going to medical school to be known as the future essential workers for the next pandemic in 2034. This uptick can be partially blamed or accredited for 2 things.

During the pandemic, students want to take advantage of all the time they cannot buy back as they are young to shape their future and invest in themselves and over the years, it’s been easier for families to take out loans for education, boosting profits for the businesses we call colleges/universities and debt for families, but it seems not to bug them!

Covid Mentality Shift

Stability and being risk averse is a safe path for the mind. Not too much thinking, just rule following similarly to what we’ve been taught since Pre-K. Follow the line, complete your homework then you will be rewarded with the lollypop and gold star.

We also believe luck isn’t in our favor as if you buy it at a store. People are reluctant and not courageous enough to believe in themselves anymore with cabin fever getting in the way.

Compared to pre-Covid times, people were much more willing to become solo-entrepreneurs, hustle on their own and WFH was no biggie with the internet as their playground. Even though technology runs school and businesses, stability, reliability, community, in person(ness) and the professionalism vibe without the hoodies and slippers in your bedroom is less appealing to people these days. Being an entrepreneur and working alone for years is depressing and hard.

Students not only sacrifice going into debt through college but would also lower their paychecks to work in the corporate world instead.

Our economic professors have taught us about scarcity, believing that wealth isn’t abundant. That has shifted our perception on what it means to grow and preserve wealth. If you think of abundance, money will be attracted to you instead of the opposite. Opportunity should remain abundant as well even if the internet, social media, hate, politics and the young bring us down.

This shouldn’t be about success but rather how to achieve economic security through hard work, talent and a tremendous amount of focus on, you said it, money. We cannot live without money and it must be at the forefront of our minds. We think about it more than we should and there’s no single person on this planet that doesn’t want it and that’s perfectly okay.

But what differentiates the rich from wealthy isn’t the dollar amount, it’s what they strive for.

“Follow your passion” and “money isn’t an issue” it’s bogus. Passion is a buzzy perfectionist like word that you cannot buy and money won’t spring out of nowhere with timing luck and constantly searching. Education relieves that comfort and support helping us believe we will always have a back up plan. That’s what students need as a security blanket, just like cash. Education is the only outlet where we will spend thousands and go into debt for for no immediate reward but have the highest hopes of finding a passion once we are delivered Latin script on a paper.

Key Pillars of Wealth

If you hear, “rich is a mindset, it takes courage, diligence and long term thinking” to the average investor or non-investor, that doesn’t mean anything until you apply it.

Rich and wealth are two different things.

Rich is about:

-Being a homeowner

-Stable 9–5 job

-Owning goods and junk that depricate

-Went to a prestigious university or any college but made no use out of it

-Has a partner and either the sole provider or relies on someone else to do so

-Has a mediocre healthy lifestyle and relationship

-Loves cars, vacations and loves to show off

-Isn’t always available for their kid’s or family’s birthdays for the expense of making more money to most likely blow

-Owe thousands in toxic debt which includes car, luxury goods and credit cards

-Enjoys binging TV or eating crappy food during their free time instead of educating themselves

Being rich doesn’t seem so glamorous or have a humble sole after all huh?

In fact, it’s very self centered, clueless and spoiled. No one wants to be around a millionaire that buys friends through an exchange of taking them out to fancy clubs or buying a yacht for them.

That will slowly fade as with every bribe.

This is the 21st century and these folks known as the rich are realizing that it isn’t so safe for your reputation and physically for your safety to show off.

Just think about it. You can save thousands just by not showing off and really hiding what you have.

For example, let’s say you hire someone to give you a quote on your blinds because they came with the house you bought in early 2010 and are outdated with food and dog licking stains. The salesperson has to go into your home to take the dimensions of your current blings to estimate how much the price for your new ones will be. They park in front of your house and right when they enter the driveway, what’s always in-front? The homeowner’s car.

Those who own moderate cars are the smartest. They feel no reason to impress and show off because no matter what car you buy, unless it’s a million dollar Lambo that you have a separate garage for to store and never use to eventually sell in an auction 30 years later for a couple more thousand at asking price, all cars depreciate once you drive them off the lot so there’s only one reason a person must have a fancy car.

TO SHOW OFF.

Anything with 4 wheels will get you to the destination the same way. If you find a car that hops over traffic, call me.

Immediately when the salesperson sees you driving a BMW, they will already give you a harder time with negotiating the price. Guaranteed. If they see a Honda or a more reasonable family car such as a Subaru or Volvo parked, they will be gentler simply because they assume you are really looking for a good deal, on a budget with a family and live the stealth wealth life. Also they will automatically see you as a nicer person because they will be jealous if you have a cooler car and treat you harsher before even meeting you.

It’s crazy how materialistic goods shape our perceptions of strangers.

If you’re a truly confident person that has no insecurities, then you have no need to wear $600 suits and drink Matcha lattes every morning. Shop at Gap and Zara like I do and save yourself some pity and debt!

People don’t bother you and their views on you don’t tempt you to change. That’s who a truly wealthy person is.

Sure you can be rich and confident, but how you get rich is not in terms of wealth.

A wealthy person is defined as:

-Has several jobs, possibly 9–5 but has investments on the side and possibly additional real estate for positive recurring cash flow each month

-Always has a back up plan and understands that cash is necessary for emergencies

-Takes pride in their work and enjoys it but makes sure to spend quality time with the people they love because those are irreplaceable

-Experiences, works with diverse cultures and perspective to grow

-Any time they get, they education themselves and invest in their future

-Love living the stealth wealth life, not flaunting anything

-Live in a modest home with no fancy depreciating assets such as luxury goods or fancy clothes

-Health = Wealth and taking time off to rejuventate and sleep = best medicine

-Doesn’t mater if an introvert or extrovert but confident people are those who don’t talk about themselves and rather listen not wanting to be the ‘smartest’ in the room

-Enjoys checking in with budgeting and savings to make sure on track and optimizze as best as can

-Living below your means, feeling no pressure to compare yourself to others.

Rich vs. Economically Healthy

I know a lot of people who make extraordinary amounts of money but few people are wealth.

Why?

First off, the more you make, the more you spend and provide to Uncle Sam’s paycheck.

You fall into the trap of lifestyle inflation where you feel the pressure to want more but in tandom, have to work harder getting into this addictive endless cycle of accumulating junk. Junk doesn’t define your character, it boosts your ego for a hot sec and then you feel worse about yourself a few moments after realizing nothing brings fulfillment besides accomplishing something meaningful.

Second, to go from rich to wealthy, you have to know how to keep your wealth. It’s not how much you earn, but rather how much you keep.

A farmer who makes $70k per year, saves 80–90% of his income and lives in a low tax state of Wisconsin in a home he purchased for $90k in 2000 is far wealthier than a doctor who spent thousands on medical school, in debt, living in a high tax state of NYC where up to 40% of one’s income can be taxed and vanish to the government, not take care of himself and instead smoke, use drugs, not exercise, become obese which leads to higher life insurance costs and medical bills down the road while only saving 20% of his income.

The people who are on a path to growing real wealth don’t focus on earnings or impressing others, they focus on what they should do instead of shouldn’t.

Let’s banish once in for all that you need to go to this prestigious school, get a certain degree, study some money making major to become wealthy. Sure, it has worked for millions of students and certainly helps and is probably why most students during this pandemic are following the path of stability.

But it’s concerning that most don’t realize, “you get as much as you put in.” Whether students were trust fund babies, got scholarships or just went into the school due to their ACT tutor help, after that, the higher ‘status’ you have, the more you have to represent it and prove you earned it and most don’t follow that and hence are in the same pool with community college students.

It takes logical, reasoning to preserve wealth. It isn’t about earnings, it’s about preserving.

So how can you actually get where you want to be without going on the traditional stable path?

According to Scott Galloway it’s called the Algebra of Wealth:

Focus X Stoicism X Time X Diversification = WEALTH

Break Down

I’m not going to lie or sugar coat anything, ever. You know I’m all about uncovering what we need to know not being plane rich and stupid. I’m not here to impress you or allow you to compare yourself to me or make you jealous. I’m here to tell you the truth about my wealth journey which I would recommend you start learning here.

Okay, yes I did grow up wealthy but my parents didn’t. They were immigrants who moved to this country, went to decent schools: UConn and Fairfield but worked their butts off to work at top Fortune 500 firms all their lives. They didn’t get any help from their parents or family members. They weren’t trust fund babies, nor was I, they were just smarter than all the geniuses who were too comfortable in America.

Because to tell you the truth. It’s hard to become motivated in the richest country in the world.

They learned early on working in a toxic, workaholic, burnout type environment takes a toll on your health quick.

Only after 10 years of working roughly 70 hours per week making roughly $600k per year not including passive income which you can adopt yourself, they were exhausted. When you are young, you have all the energy in the world and that is the moment to seize it but after that, face it, no one stays in the same company all their life. You’re lucky if you can stay with a company for more than 20 years but I’ve never heard someone stay with a bank for more than 40 years.

What corporate life does to people because I know there are kids out there reading this enticed by the paycheck willing to ruin their health:

-Establishing incredible work ethic, time management and soft skills

-4am and 11pm lifestyle that is kinda permanent, no wonder I cannot wake up past 5am on most days myself since I was born

-Companies don’t teach you about gratitude, rather only hustle which has no meaning in the long run

-How boring business is without diversity

-Businesses chase money no mater how risky it is and insider trading isn’t regulated. Still.

After learning this, they eventually transferred to jobs that offered roughly the same compensation, a bit lower but much less intense which I personally think is most important. Health = Wealth after all.

Finally they would be able to spend more time with me, enjoy life, not ruin their mentality and health sitting on the trading floor for 18 hours a day and finally have focus on more important things in life besides more money.

That leads me to the first pillar of wealth creation:

FOCUS

Talent has nothing to do with focus. It’s all about being self aware about how you are feeling and what you can do with the situation that you are dealing with. Intelligence and talent aren’t correlated to success. The strongest signal of future success is perseverance and resilience, what both my parents learned as immigrants in NYC in high stakes American white male environments.

Passion is a buzzy, perfectionist like word. People who tell you to follow your passion are already wealthy. Follow your gut not your talent. Talent comes second. You don’t have to be a genius and in fact, why be one? Instead have an open mind and a generalist. Anyone can teach you anything, that’s why there are training programs for months prior to working at virtually any company. You’ll be more than prepared but soft skills take time outside of bootcamps. They are nurtured on your own and create focus. Yes you need to know the basics and what’s going on with the firm, where it’s headed, the departments and the overall gist of the industry when applying, but after that, it’s really character and how perseverant you are. If you’re wearing a $30k Rolex to an interview, expect to get nothing but rejected.

Just like with the blinds salesman example. First impressions matter. 97% fo communication is nonverbal. How you walk into a room, your demeanor and expressions. Never undermine them as they will help you create lasting wealth in yourself that you will manifest into your accounts. Connections are everything and working for free will give you that focus to build more.

Stoicism

This is patience. You can only control so much in this world until it become noise and a hassle.

Scott put it best:

“Billions of dollars are spent every year on schemes to manipulate our natural impulses into spending more money, consuming more fat, and believing everyone around us is more successful than we are. The upgrade from economy to premium to business to first class to private jet can seem like an investment in yourself — it’s not. The most powerful forward-looking indicator of your financial freedom is not how much you earn, but how much you save.”

The rich are fooled into buying the hottest trends and wasting money on splurges. Experiences are great and the best investments that last. I’ll be honest, even though I’m a frugal minimalist, I would rather spend $300 on a US Open ticket than on a ring. Even though I believe ticket sales are a rip off especially since you get a better view all day not burning in the sun and drinking $9 water in-front of your flat tv screen instead, it’s the memory that counts and nothing can replace it.

As with everything. Moderation is key.

And nothing is free. When the casino offers free parking and a few free chips to spend before you walk in, that’s signaling to spend more becuase you’re already in a good mood. Compared to how much more you spend, the casino isn’t loosing anything from giving up a few chips.

Day Trading vs. Investing

Trading — distinct from “investing” — can feel like work and productivity. It’s not. It’s gambling and becoming dumber.

If you trade unprofitable stocks by following Reddit retail investors on social media, that isn’t boosting your knowledge on financial literacy.

One study found that over a 12-year period, only 5 percent of active retail traders made any profit at all. This time around, apps including Robinhood, with its dopamine-triggering confetti, and 24-hour-a-day, volatile crypto trading are the drugs of choice.

“Most day traders will be fine, and will suffer affordable losses … most. However, for many there are darker outcomes. Young men are especially vulnerable, as they are more risk aggressive. Between 80 and 85 percent of day traders are men, and 23 percent of men who gamble become addicted (as opposed to seven percent of women). Most of us can gamble without becoming addicted, just as most of us can drink without becoming an alcoholic — but, know the risks.”

This isn’t patience. This is giving into short term gains for no long term result.

Focus on goal setting and being ‘in it to win it’ for the long run.

Real estate typically outperforms the indexes and stocks always go up in the long term. Why put so much pressure on yourself? Stop touching your investments and start living.

Time

This is your most precious asset along with your attention. You can’t buy it back. How I view time is no different than how I view money and I believe that’s why I’ve gotten the place I’m at.

When you give up 20 minutes of your time, it’s loosing $20. When you’re young, your concept of time is faded. You don’t understand that time flies by, not only when you’re having fun and it doesn’t exist in the air.

I will pay someone a lot of money to waste my time.

It fads daily due to multitasking and screen time which is robbing you from producing your best work.

It is incredible how people have no idea what they are doing with their time yet they ask for more of it. There is a way to bend time. Don’t get me wrong. Wasting time isn’t necessarily all bad. Taking time to debrief and recharge from a long day with a quick 20 minute power nap is incredible for your mind and body, but being purely lazy 23 hours out of the day and not investing in your future is nonsense.

Don’t look to tomorrow, look to 2030. Where do you want to be then and do you see yourself in the same position?

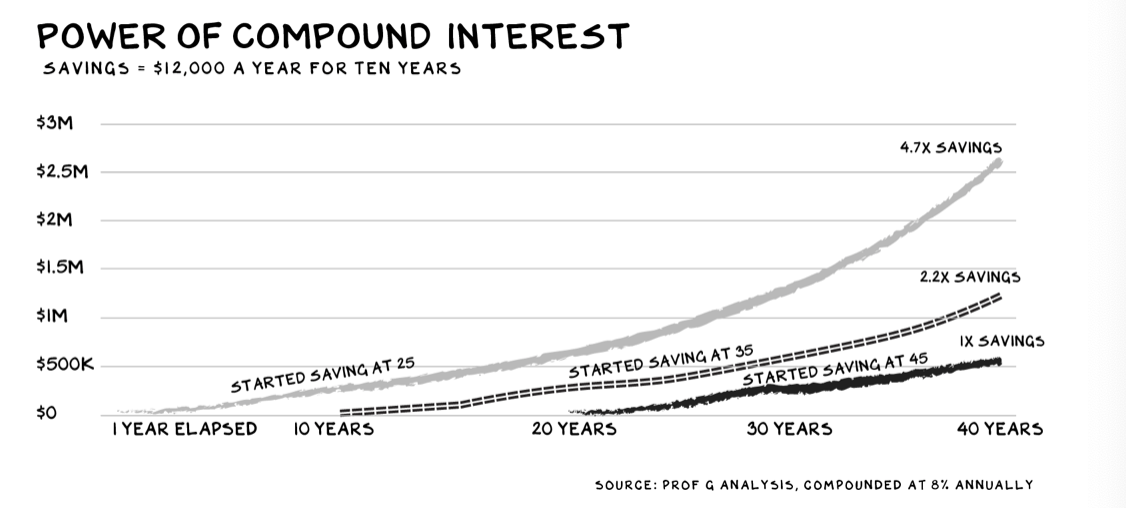

Regarding financial terms, compound interest is our best friend. It pays dividends for a lifetime because it is money that is reinvested on top of interest, the principal amount.

As Einstein supposedly remarked, “Compound interest is the with wonder of the world” yet our brains aren’t wired to understand this because we want short term gains immediately. But small investments can supply the base of your income in a few years from now. When it comes to life and money, they work together. Compounding hobbies, habits and relationships overtime will lead to lasting results.

Diversification

A good balance of diversification is based on several metrics, most notably one’s risk tolerance, age, short and long term goals and current debt load.

Owning stocks, bonds, various equities and securities, international holdings, ETFs, index funds, dividends, growth stocks, commodities work best no matter what risk tolerance: conservative, moderate, or aggressive you have.

Your risk tolerance is more about your time horizon and being risk adverse isn’t just for retired folks, it’s for anyone who wants to have a cash cushion and invest equally in growth and dividend stocks in a passive invested way.

Focus on what matters. Be stoic in the face of fear. Use time to your advantage. Diversify your investments.

Life is so rich but make sure you don’t live that way. Wealth is so much better.

In any economic situation, you can foster fiancial stability, optimism, freedom and comfort by feeling rich and becoming wealthy.