From inflation to supply bottlenecks, vaccination rates to weather forecasts, frothy stock prices to SeekingAlpha’s estimates, you name it, everything seems like a valuable indispensable indicator these days.

What’s certain is uncertainty and there’s too much we cannot control.

There’s a saying in investing and in life that goes something like this:

“When you know too much, you don’t know anything”

Too much of anything can be a bad thing. Information overload is a killer.

Or as my MS English teacher used to repeatedly say to me,

“You’ve attempted to say and pack everything into your essay and that leads you to say absolutely nothing.”

I’m sure she didn’t expect me to be a personal finance blogger today.

Although I’ve attempted to write more concisely, short and sweet to the point since then, when it comes to unpacking the markets, myself and I’m sure other investors alike have trouble now and then pin-pointing leading indicators and coming up with a reasonable investment thesis. There are just far too many factors at play these days!

Although the markets in 2020 were volatile and have beaten all odds of underperformance, I would be worried if you lost money in the last year as all losses from March 2020 were wiped out in weeks. These past few months have gotten so high and stocks are trading at around 20–30x their earnings, normally 5–10x that there’s no reason you should’ve lost money.

If you did, perhaps you were new to the investment world and your friend Jimmy gave you his referral code to dabble at Robinhood during a party. Bad move.

As much as we want to be a part of the hype of these new FinTech players striving to democratize finance, one dollar at a time, we have to look at this from a pragmatic point of view. Besides the short squeeze phenomenon in January of this year, when you try to unpack Robinhood’s valuation, it is insane. Robinhood along with other retail trading apps are worth more than Barclays and Deutsche Bank combined. Two leading bulge bracket institutions! It’s taken Robinhood only a few months to surpass their client base.

Not only the sheer size is alarming since these apps have a massive influence on negatively persuading GenZers and to a lesser extent millennials about the wrong ways in which to invest, but the emphasis on day trading which historically underperforms passive investing 80% of the time is dangerously advertised as well. And those who end up swing trading loose on average about 35% of their capital every time they place a bet.

Robinhood’s revenue breakdown is extremely speculative and sketchy!

60% came from meme stocks and another 40% from crypto! That’s not a way to invest!

Anyways, besides observing the performance of retail trading apps this past year and a half that have put may generation in debt and misery, we need a better indicator that can actually help us predict what will happen next.

When Is It Over?

Many economists, investors, traders, reporters, and myself are speculating that the bull market is over.

This year and a half was beyond bizarre and the good times are gone.

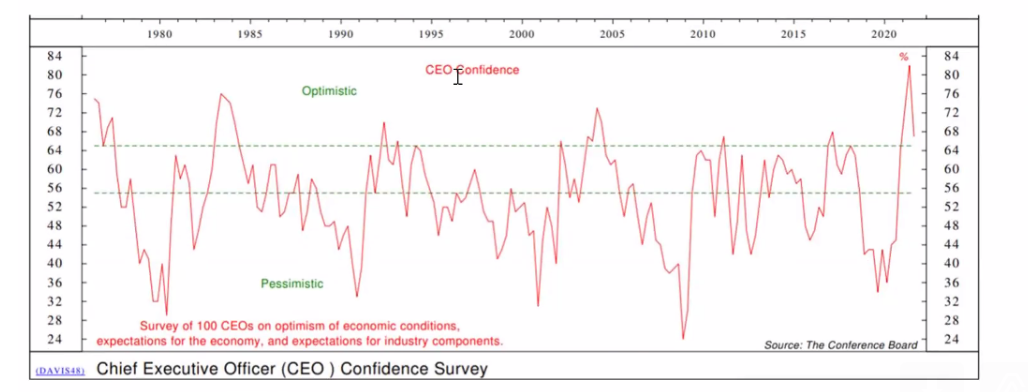

An indicator I frequently use when I’m in the mood for individual stock picking, which is quite rare is observing CEO sentiment. According to the chart below, it has suddenly dropped this past month and CEOS have never been more distressed.

Granted September and October are worst performing months of the year but with tax hikes coming, the infrastructure bill, winter + a possible new variant, supply chain constraints, the holidays + travel, and higher prices CEOS are concerned if their customers will be able to and want to pay for $20 applesauce.

P&G isn’t worried though. They have frequently stated in the past few months that they are raising prices and see consumer sentiment go up higher. This is not the same across the board but in retail specifically grocery where you have no choice than to eat, people are continuing to spend and deal with the high prices.

Although CEOS aren’t the gods of the world or know anything more outside of their firm than what analysts know, it’s worth paying attention to these leaders as they do play a massive effect in how the market works.

If Apple sees there is more demand for iPhones, they will hire more worker, raise their salaries along with iPhones prices, and Apple will be trading at even higher frothy valuations around 40x earnings.

Decipher the Noise

It’s very difficult to discern what the market is up to at the moment or ever since traders trade in future-time not for today.

How much higher can it get?

Its fair market value is much lower than what it is currently trading at. With Tesla reaching a trillion dollar market cap when only roughly ~2% of the vehicle market is electric and incorporates energy efficient non-gas and instead solar and electric vehicles, it’s unlikely that the rest of pro-fossil fuel polluted America will move over to electric anytime soon yet Tesla has always been killing it for no real reason due to investor optimism down the road.

Or take WeWork. Although their valuation is now roughly a fifth of what they were valued at almost 2 years ago at $50 billion, they went public for the second time through a SPAC. On the first second day of trading last week their stock soared. Thank goodness they had SoftBank, the Japanese conglomerate to bail them out and provide equity and debt financing. Adam Neuman within management was not a safe idea.

A company reaching unicorn status is quite noble yet it’s becoming more common for companies to reach this level without providing anything new or truly transformative. They practically act as SPACs, with no operations or sales. Flexible work is dated but WeWork’s bold promise somehow differentiates them.

Or take any other crowded saturated industry.

From social media to streaming wars, food delivery services to ride hailing services, there is too much fluff and not enough substance.

GrubHub to Uber, Lyft to DoorDash, all of these massive players barely had a profitable quarter yet are still trading at larger valuations than profitable ones!

Solely focused on individual companies is a hard approach to come by these days.

We need to pay attention to sentiment and something different instead such as trucks.

This starts with being fearful when others are greedy and vice versa. Although we need to make our own judgement in each case, there’s nothing wrong with following this mantra and in fact, it works more often than not.

Currently value stocks are outperofming growth. At the start of the pandemic and for much of the 13 year bull-rally, it was the opposite. If you followed the crowd in FAANGS, you would’ve missed out on the utilities and financials who killed it.

In 2020, people stayed home, needed gas to power their cars to their vacation homes, were reliant on deliveries and banks had excess cash expecting a massive wave of foreclosures and bailouts but instead consumers spent less, paid off their debt, and saved as much as possible so in return, banks had blowout quarters engaging in buybacks and issued dividends.

The Little Engine That Really Could

So where does trucking come into play?

In sum, without trucks, none of this would’ve been possible.

No masks delivered or paper shelves stocked with toilet paper.

The massive supply chain constraints are worse than ever due to the halt of deliveries at the start of 2020. Manufacturers, facilities, and trucking companies shut down and had lay off staff due to uncertainty about the future not expecting consumer demand to be higher than ever before.

Fast forward to today, with massive stock market gains, diligent savings from lockdowns, and the vaccination rollout, there is extreme pent up demand easing back into normal life. All that pent up savings hopefully won’t go to waste. People are revenge spending and going hay-wire at this point.

This is requiring shipping logistics companies FedEx and UPS to cram their shipments not able to deliver on time. With less workers, less can be done. Speaking of timing, if you’re looking for Xmas gifts, I recommend doing it now or never.

Trucking is part of almost every industry and if it isn’t part of yours, you need to jump on it since everything is online these days. Unless you are a small business, you are aren’t secure offline. We need goods to be delivered to us accordingly or else the trillion dollar industry of online shopping would go to waste. Barely any Americans live near a factory and even if they did, they wouldn’t just be able to pick up there. They need it sent to the store in order to shop or have it delivered to their doorstep.

This impending shortage can surmount to roughly 160k drivers by 2028 and by 2020 there were only 1.8 million tractor-trailer truck drivers according to JournalistsResource.com

How Can Drivers Fix The Economy?

In addition to CEO sentiment, we should focus on truck drivers’ routes.

Economists are too distracted by the metrics on their terminals instead of on the road.

Truck drivers are arguably the most powerful metric since anything sold arrives by truck in some way or another. Raw materials need to be produced and shipped in order for them to be delivered to Walmart’s empty shelves.

Since trucks move products before the consumer notices they are available and decides to purchase them, they are major indicators of anticipated supply.

Truck traffic tells us a lot about unemployment and the supply chain shortages. Currently with over 500k cargo ship truck on California’s coasts mixed with a truck driver shortage, it’s taking an extra few months for these goods to be delivered and shipped out.

No pun intended, they do drive the economy. Even with hefty pay hikes, there is still a shortage looming since thousands of drivers were laid off pre-covid as operations shut down.

Now there is still massive turnover at around 95% according to CNN Business for truckload carriers despite juicy bonuses and crunchy snacks. This is one of the most severe driver shortages in history. Even with increases of $4-$6k per year, about 9–11% isn’t enticing. Not only are truck drivers not enticed, higher pay is exacerbating the shortages as drivers want to be home more and are in turn buying more and want it delivered, a job they used to command themselves.

Truck drivers and deliveries are the blood of this country — and Bezos’ wealth.

We couldn’t have survived without them during the pandemic. While we wait and see how high pay must jump to entice these essential workers back on the gridlock roads, for now all we can do is go to the store ourselves.

Sorry about the inconvenience.

Remember when it was the only option?