Graduating is one of the craziest moments in one’s life. If you have or had the privilege to do so, you are already ahead of 80% of the world.

But the next challenge isn’t reading the Latin foreign script on your diploma, which by the way can be a true test, but rather what happens afterwards which all starts a few years prior.

Granted, most students don’t plan ahead. They are the kings of procrastination and leaving things till the last minute until a handy dandy Google calendar alerts pops up on the screen. The future is seen as non-existent since their youth is blocking it.

A lack of preparation has led millions of students into more debt on top of their already sky-high student loans that are estimated to take them 20–30 years to pay off. On top of this, upon graduation they ponder why they pursued a major that won’t serve them.

Before I say anything else, please put your thumbs down. I know what you are thinking.

“Mia, how could you tell students to find a major that pays the big-bucks and only focus on that? I thought you preach money isn’t everything!?!”

Yes, it certainly isn’t especially since money won’t solve most problems and cannot buy what true happiness provides yet it is a huge part of life and unfortunately will make or break it.

The cool fun major title and dependance on the education system is holding graduates back.

You may be the most passionate painter at NYU or a wise historian at Stanford yet money does come first. If you have no savings, spend more than you earn and live pay-check to pay-check with the possibility of being evicted anytime living your Picasso dream, you aren’t going to sleep well at night and be more stressed than an investment banker.

Luckily, passion doesn’t need to be crushed. It can still stay there as a side hustle or even better, convert it into a passive income source on top of your real job that actually helps fill up the fridge and pay the bills!

Students need to be realistic. The living in the moment phase relying on the parent bank is over.

Adulting 101

School isn’t the real world. In the classroom we are taught to memorize information that goes in one ear out the other simply for a grade that might not accurately indicate what you know.

There are great test takers and better writers. Horrible interviewers but wonderful employees.

Besides the entry exams to become a lawyer to doctor, money manager to construction worker, after that, life is dictated by how much you know and what you do with your resources. No one is testing you except for yourself. You against you.

Behind retirement, graduates are in the stickiest situation of their lives as both phases require you to pinch your savings and diligently spend or else kaput!

Since finances are the biggest stressor in American’s lives, the largest hurdle holding any age back is a lack of financial literacy.

No matter if you studied philosophy to history, you have to wrap your head around money. If you were born into wealth and your parents gave you everything you ever wanted without working for a dime, buckle up because you have to learn how to not be careless anymore and if you come from a less privileged background, you have a lot of opportunity ahead of you and I hope you keep those frugal, minimalist grateful habits that you hopefully established at home.

Graduates are not only dealing with a major life change, personally and professionally but financially with little to no knowledge and plan. Paying off debt to establishing a cash cushion, learning about the difference between renting and buying a property and getting into a serious relationship are all tough decisions that will either make or break your career.

And who has the time or funds fresh out of school to hire a fiduciary and check up on them and acting in your best interest?

Make It Or Break It

Not to put extra stress on your future recent grads, but the decisions you make now have a major impact later on due to your expansive time horizon. This is your chance to build up your nest egg, income streams, diversity in your portfolio and cut out toxic Starbucks habits.

If you take on too much leverage on a home without any substantial equity to your name, you might not be able to afford paying the monthly mortgage interest and principal off all while dealing with those pesky student loans, a low-paying job, a rocky relationship, allocation of funds to your investment portfolio, retirement, etc.

And if don’t start investing now or investing in yourself since school didn’t teach you the basics, you can easily loose thousands through missing out on the compounding machine.

Obviously this sounds intimidating to most so we need to get around this problem by starting with a plan and de-stigmatizing personal finance because it isn’t just for math nerds.

As with everything in life, planning for the worst, hoping for the best is your best bet. Anything is inevitable and those who are true savers and planners are able to buy a third beach home during a recession. They are clearly prepared. Even if they lost an income source, they had others to supplement it.

Kids On The Block

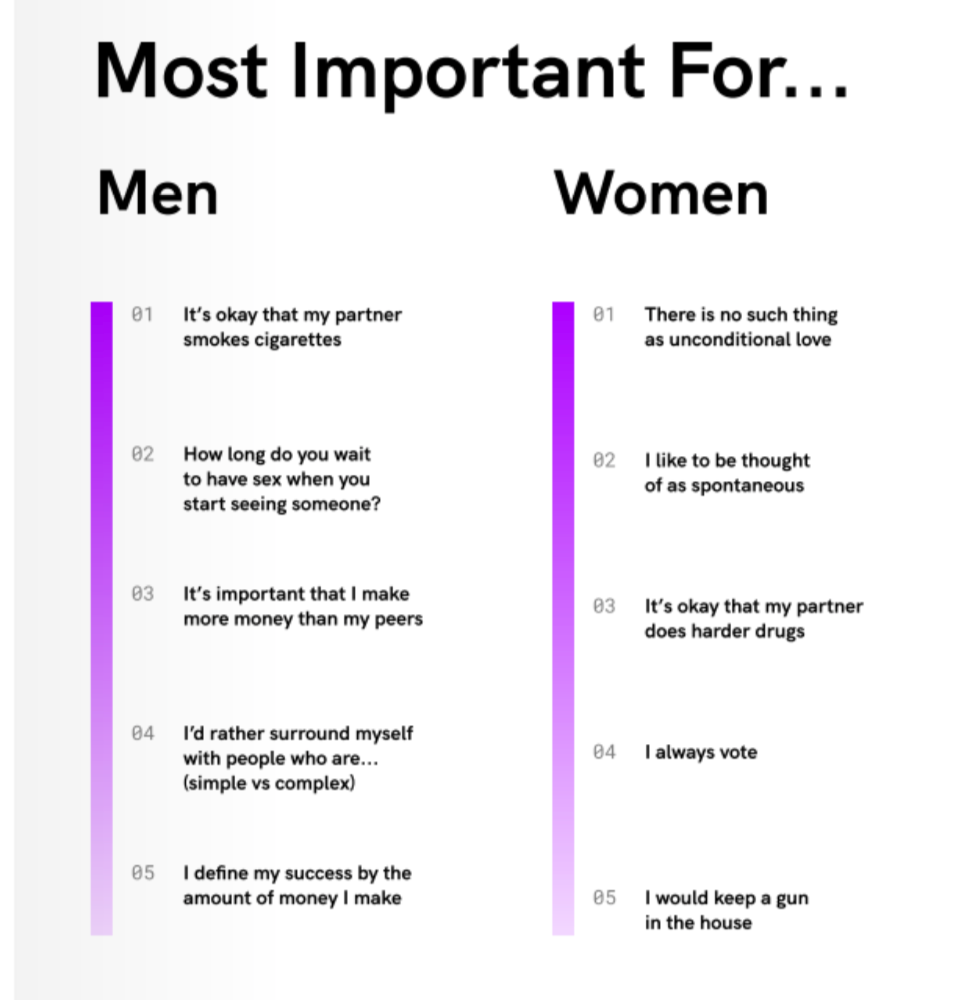

All I’m going to say is that we have a lot of work to do. For fun, I wanted to check out NYU’s dating report, aka the Marriage Pact which illustrates what my pals in college are focused on in terms of money and their future lives.

Since majority of students are just focused on getting stellar grades, wearing Gucci, trying out that new vape and sleeping in till noon, I wasn’t surprised with the results but I was expecting students to be more sincere, realistic, modest and humble when it comes to money, especially the guys.

The results show that men believe their success is determined by the amount of money they make (05) and even worse, they beleive it’s importnat they make more money than their peers (03) .

Now don’t get me wrong, that’s valid because money is an important part of our lives and if you choose to delay thinking or worrying about it, I wouldn’t want to be with you. Talking about finances openly is vital to a successful marriage especially considering that 80%+ marriages grow their wealth together and are richer than single people. Just like homebuyers versus renters.

Yet I wouldn’t go so far to say that success is solely determined by the amount of money one makes. That’s narcissistic and arrogant. Success cannot buy what happiness can provide.

Success is when you are fulfilled with yourself not the cars you have. This clearly indicates that students are a tiny bit entitled, care too much about what others think and are more than sure to blow it when that paycheck hits that bank account.

Having a balanced approach to wealth is key. Partners who openly discuss it, have separate credit cards and bank accounts, go in with a prenup and discuss their expenses, investments and asset allocation and come to consensus on a risk management profile that works best for both are key to a successful marriage. The leading cause for divorce is money trouble.

No matter how much money you may have, if you become obsessed, no one likes you.

Grow up kids. Learn the hard way what money provides through working.

Legit Plan

After you’ve identified your definition of success, that will help you transition into curating a timeline which FYI won’t be linear.

Just like in the stock market, the more you try to plan or time a price point or volatility level, the more out of whack your investments will get. Expect volatility but overtime, know what you want and when to cash in or out.

The more you change and experiment, the more opportunity and luck will be presented. I don’t mean changing your personality or hair color, rather taking more calculated risk, understanding how much you can risk you’re willing to loose, understanding that your time is your most precious asset and the best time to start is today, worst time tomorrow.

Make sure what NOT to focus on. Comparison is the theft of joy and online is all fantasy not reality. You don’t know what’s going on behind closed doors. People carefully choose what they want to show you.

Now that we’ve established crucial thinking points, let’s discover the actionable steps a graduate or preferably a freshman should take in order to prepare themselves for the real world:

#1 Identify Short and Long-Term Goals

Since you were too busy planning for the next sorority party every Friday in college, now focus on your financial goals and where you want to see yourself in 3 months, 1 year, 5 years down the road to help work backwards.

The future isn’t guaranteed and things will come up but what we can control is our perspective, attitude and what we do today to prevent any hurdles and hope for smooth sailing.

You’ll feel better when you prepare and have more control.

#2 Talk to Your Parents

Get a sense on where your parents are at at this stage. The last thing you should ever feel is embarrassed about staying with them instead of going broke on a studio in Manhattan. They are successful if you are successful which means doing what’s best for you.

Understand what their hopes are and their financial background. You don’t have to follow them just listen to see if you can compromise on a living situation or budget for the next few months until things settle down.

Graduation is scary because it’s your chance to make a living to support yourself but that shouldn’t terrify you because mom and dad are still here. If you’re an only child, you’re in good hands since there are no more tuition costs to pay for, parents are free and now have their full attention on supporting you not college.

If your level entry job requires you to live across the nation, in order to qualify for a loan and invest in real estate, you have to be credit worthy. Ideally diligent spending habits such as paying off monthly bills and avoiding consumer debt should’ve started before graduation in order to help ease you into renting or taking out a mortgage at this stage, but if you were careless like most students, look to crash into a friend’s place, ask your parents to split the cost for a bedroom or ask for a flexible working schedule for a few months until things are settled. If you never ask, you never know.

If there’s a will, there’s a way.

#3 Health In Check

Without your health in check, there’s nothing. The most laborious and financially stressful inducing job is one where you have to clock in and out for and is physically demanding. This will lead you to work till death as Buffett proclaims.

We all ahem energy tanks and in order to work smarter not harder, we need to take care of ourselves. Be selfish and strategic. Just because your friends have joined the hip Equinox for $300 a month doesn’t mean you need it. You focus on what will propel your financial future. Exercising is free and eating healthy is cheap if you know what is available.

Eating out and eating junk pays a price. Just because it’s cheaper today won’t be cheaper on your health overtime. Feel good through fueling you. This way your brain won’t shrink, you won’t be addicted to sugar or chemicals in fast food and you’ll work better.

Do yourself a favor and be selfish so prioritize you.

#4 Turn Your Hobby Into A Side Hustle

From Etsy sellers to beat boxers who are bankers, you always have enough time it’s simply about prioritizing what’s most important. If you find you’re squeezed for time after work or exhausted, wake up a few hours earlier to get your most productive work done as your most productive self in the prime hours of the morning.

Don’t complain you don’t have enough time especially if you don’t know where it goes.

The more income sources the better. An average millionaire has 8–10. More backup, more freedom.

#5 Diversify

No wonder the richest Americans paid a sliver of their wealth in income tax over the past few years. Majority, if not all of their income comes from their business, passive income streams such as real estate, entities, partnerships and portfolio income such as dividends, interest and capital gains.

They earn money differently and the tax system returns for the rich and taxes the poor.

Not only they have access to loopholes through tax havens and shelters to hide their money and not pay any income let alone corporate tax for their companies, they deduct expenses from their business and interest from their debt to pay no federal income tax.

W2 income kills since the more you make, the more you own. Assets grow and allow you to pay less overtime reinvesting the cash flow on unrealized gains.

As a result, the more income streams you have, the better. Not only from a tax perspective where you only pay taxes on gains that you sell, but you’ll sleep better at night. If 1 source flops, you’ll stay afloat since the rest will adjust.

Passive income works wonders. It allows the flexibility and control to adjust earnings and isn’t controlled by one employer.

#6 Set Up a Roth-IRA & Start Planning for Retirement

Along with setting up a dollar for dollar match with your qualified employer sponsored plan for your 401(k), 403(b) or pension, a Roth IRA is a compounding machine that should be set up as soon as you start earning, prior to a full-time job. The contribution limit is $7k.

It is a post-tax fund where earnings grow tax free and can be withdraw at anytime after age 59 1/2 or else a 10% pre-mature penalty is added. This is not a tax deferred account nor does it offer tax deductions on contributions compared to a retirement account and you can invest in almost anything except for US government bonds and cannot trade options nor short stocks.

#7 Get Certified

The more certifications you have to your name, the more credible you are. Distinguish and differentiate yourself by putting in the time and effort to take that online course, get that certification and pass the exam to skip the MBA to still attain a job at that level. It’s always worth it if you put it to work.

#8 Buy Low, Sell High & Sleep On It

Without going into the weeds with investing, if you know to “buy the dip” and “buy low, sell high” along with never equate your emotions to your decisions from your portfolio to life, you are all set.

JK.

There’s more than that but with 99% of retail investors loosing money simply because they don’t follow that premise, you are sure to earn if you follow the conventional, boring and simple advice.

Don’t make it a game. It’s a long-term growth strategy. The market should work for you not against you like a slot machine.

Although this article is a tad late since graduations were at the end of May, it’s never too late to start investing in your future and take control of what you have to best prepare yourself for the future.

It’s all in your hands. Seize it and know what you deserve.