With the S&P 500, NASDAQ, real estate, commodities and other assets at record highs, it would be silly not to spend a little more for yourself these days.

As many Americans are still cooked up in their homes saving more than they could’ve ever imagined, learning about financial independence, opening up their first brokerage account and finally contributing to their emergency funds, they are also feeling a little revenge towards spending again.

It’s money’s best friend after all.

As the vaccine rollout has gone underway and normal life looks like it’s around the corner, so do our spending routines or shall I say bad habits?

Isn’t that the point of working anyway?

To spend in order to make your life better?

At least for some people. Personally, I cannot live without a task or meaningful career so I plan on working until I die for fun not the money.

Now, revenge and comfort spending traditionally goes against my way of living. I’m a frugal minimalist which means I don’t spend or shop often. I value what I have and believe less= more.

Yet, as a student who would traditionally commute to school, go out, eat expensive overrated Big Apple food and do teenager stuff, I’m spending a lot less than I would’ve and its making me feel like an adult.

Yet, with spending less comes major perks we can all reap the rewards from. For example, I’ve been able to purchase my first apartment which I’m leasing out to an old colleague, grow my net worth shy of a million in a couple years, go to one of the best and most expensive institutions for free and avoid wasting time commuting, my biggest pet peeve because Time = Money after all.

But what’s most important is to not be tempted to reverse all your gains when everything opens up. It’s important to reward yourself but when your ego is in the Prada Store 24/7, you can soon land at where you were at the start of the pandemic.

As the classic saying goes, ‘just because it’s on sale, doesn’t mean you should buy it.’

Checklist

There are some boxes to check off that I suggest you follow to see if you should spend more than normal. Revenge spending isn’t filling up your freezer with all you can eat frozen Pizzas, it’s still spending smart on the things that you either waited for until you got older, wealthier or smarter.

Don’t let your guard down now.

You should comfort + revenge buy if:

-You worked hard all pandemic with strategic breaks

-Started a business or alternative side hustle

-Didn’t catch COVID or give it to anyone

-Maxed out your 401(k) contributions

-Saved at least 20% of your after-tax income

-Went over budgeting reports na monthly expenses

-Learned something new

-Didn’t spend all this time binging 600 shows

-Vigilant about spending

-Tried to balance work, school, kids, pandemic life, tech fatigue and mental health

-Socially distanced and followed science about mask wearing

-Set up or contributed more to a balanced 6–12 month emergency fund, have extra cash on hand, contributed to ROTH IRA and tried to pay off all outstanding debt, especially toxic debt such as car loans and luxury goods

Once you’ve checked at least 5 of these, you can guarantee yourself that you need a break and a life again at the register.

The best time to comfort spend is during a crisis and recession because that’s when interest rates are low. I’m not just talking about material goods such as an iPhone or couch, tap into real estate, VC, growth equity, startup investments, etc. to help make you money instead of draining money out of your pocket.

Ideally, if you could spend and let that purchase be either an investment into your future such as education or in yourself, that’s a total win and doesn’t feel like a transaction in the first place.

The Results of Covid On Our Wallet.

According to the NY Times,

“Credit card issuers and other consumer lenders have not seen a rash of defaults — for many lenders, they’ve actually dropped below normal levels — thanks mainly to the stimulus checks and expanded unemployment insurance. Most creditors don’t expect that to change until the second half of next year, at the earliest.

The average American credit score has also steadily increased this year, reaching a record 711 in July, according to FICO. Credit scores can be a lagging economic indicator — in the Great Recession, they didn’t bottom out until late 2009, months after the recession ended, although they started dipping much earlier. But this time around, consumer debt levels and missed payments have actually dropped, which explains why the scores are rising.”

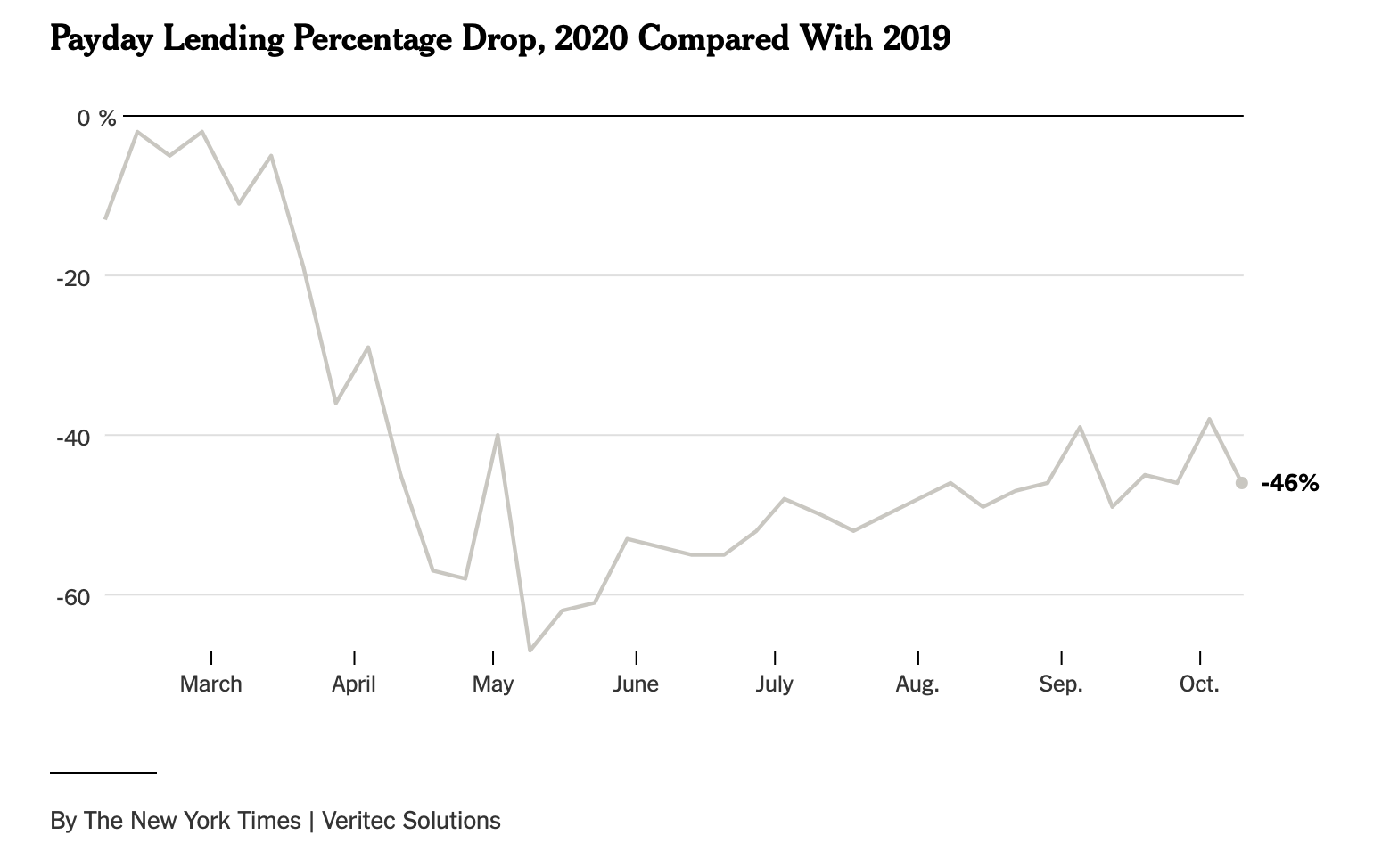

For the non-finance people, to put that in English it means that people have been saving, getting out of debt since there have been less defaults to credit card spending, missed payments and credit scores boosting with payments on time! Even pawnshops haven’t seen as many empty shelves before and payday lending(cheap loans) have decreased tremendously.

Both Sides

So you saved a little money this year but with the uneven economic recovery due to the outcome of the pandemic and systematic inequality, millions of Americans still remain unemployed and the wealth gap has increased as evictions are on the rise and the bipolar weather has affected the vaccine rollout and production in hard hit areas such as in Texas.

Yet for those who have been lucky and diligent at home, more Americans than ever have been able to save money and pay off debt with spending less on entertainment, eating out and travel. This is the first time some people are living without debt and are financially free.

The first thing they want to do is travel to Spain and eat 60 pizzas to celebrate!

Yet what’s more important isn’t how much money you make, it’s what you keep becuase its easier to spend than save.

“Money is just like math, in that there is a good way to proceed to get the answer right in the long term with your personal finances,” said Brian Preston, certified public accountant and host of the YouTube channel and podcast “The Money Guy Show.” “This is the best time in history for a person who just has a few thousand dollars lying around.”

The secret is being good at money so what are the fundamentals we should get cracking on?

#1: Create and Keep an Emergency Fund

If we’ve learned one thing during this pandemic, it’s to be ‘prepared for the worst, hope for the best.’ Before paying down high-interest credit card debt or dealing with student loans, fortify your finances by having cash on hand in case another recession hits which historically happens every 5–10 years. Better be safe than sorry.

Cash is king after all.

Saving for an emergency fund is the first priority. Saving first then paying off debt second. 3–6 months of expenses into a fund if you have debt, then slowly build up to 6–12 months so you don’t risk going homeless if you loose your job and get evicted during the next recession in 2026.

Where to put your emergency fund money?

High-yield savings account-offer higher interest rate than typical banks

#2: Pay off High-Interest Debt

The magic of compound interest works with you once its paid off. The rich own assets not liabilities.

#3: Cash left over = be proud and reinvest then possibly splurge

This past month’s frenzy involving meme stocks has taught us an important lesson about investing in individual stocks. These are day trader tactics that will more often than not lower your returns and literally make you go crazy due to the volatility and nonsense swings. The last thing you want to do is borrow on margin (borrowing debt to place risky trades since if your trade isn’t profitable, you will have to source the equity to fund the commodity value which you probably don’t have because you borrowed the funds in the first place).

Data across the industry proves that investing in low-cost index funds passively is the surest path to financial independence. It’s not the faster or most glamorous way to rich quick but in the long term it will pay big bucks.

Don’t go through the hassle of gambling meticulously tracking the market because no matter how much experience you have, you could still loose big.

Laziness is the best tactic in investing.

Risk whatever you are willing to loose. Investors all need to be reminded of that. Especially those Reddit WallStreetBet peeps.

#4: Surplus Soup

Once you save 20% of your gross income, you can decide to have fun and revenge spend but only after the debt is paid off, an emergency fund in place and contributions to the respective retirement and Roth IRA accounts are made.

Reasonable and Responsible Methods To Spend

Comfort spending is unique to one’s needs. For my friend, it would be to buy an Xbox and for myself, it would be tickets to a concert. We cannot compare ourselves to what others need or have because we aren’t in their shoes or have the same tastes.

I cannot tell you how much to spend but I will give you a rough baseline estimate of what I recommend.

FOMO is the key emotion in spending. No one gets more emotional with anything other than with money. Most consumers get FOMO when they purchase something they regret or don’t have.

The way to slowly cure your FOMO is to first appreciate what you already have.

List out exactly what you are hoping for.

Money Moves Test

If you had $500 million dollars, what would you buy?

Obviously, if you had less, it would be different but understand what you want in the first place.

Is it for brownie points to make others feel jealous, simply to boost your self esteem or share it?

If it falls into that category, I would suggest switching to something more modest and realistic that will actually serve you instead of being another piece of junk in your living room that you own which collects dust.

I suggest a spending ratio of 10x the consumption. If you want the latest $1k bag, then you have to make at least a $10k return on an investment to pay for that piece of junk.

The most responsible and reasonable way is to take 10% of your annual investment and blow it on whatever you want so you still have 90% of your investment working for you so you don’t go bankrupt on Gucci.

As an FYI, Gucci won’t help you repay that bag if you get the case of the FOMOS.

A Harsh Look Back

As much as we want to push 2020 and Q1 of 2021 away, Americans are dramatically reflecting on their coping methods and spending habits over the past year.

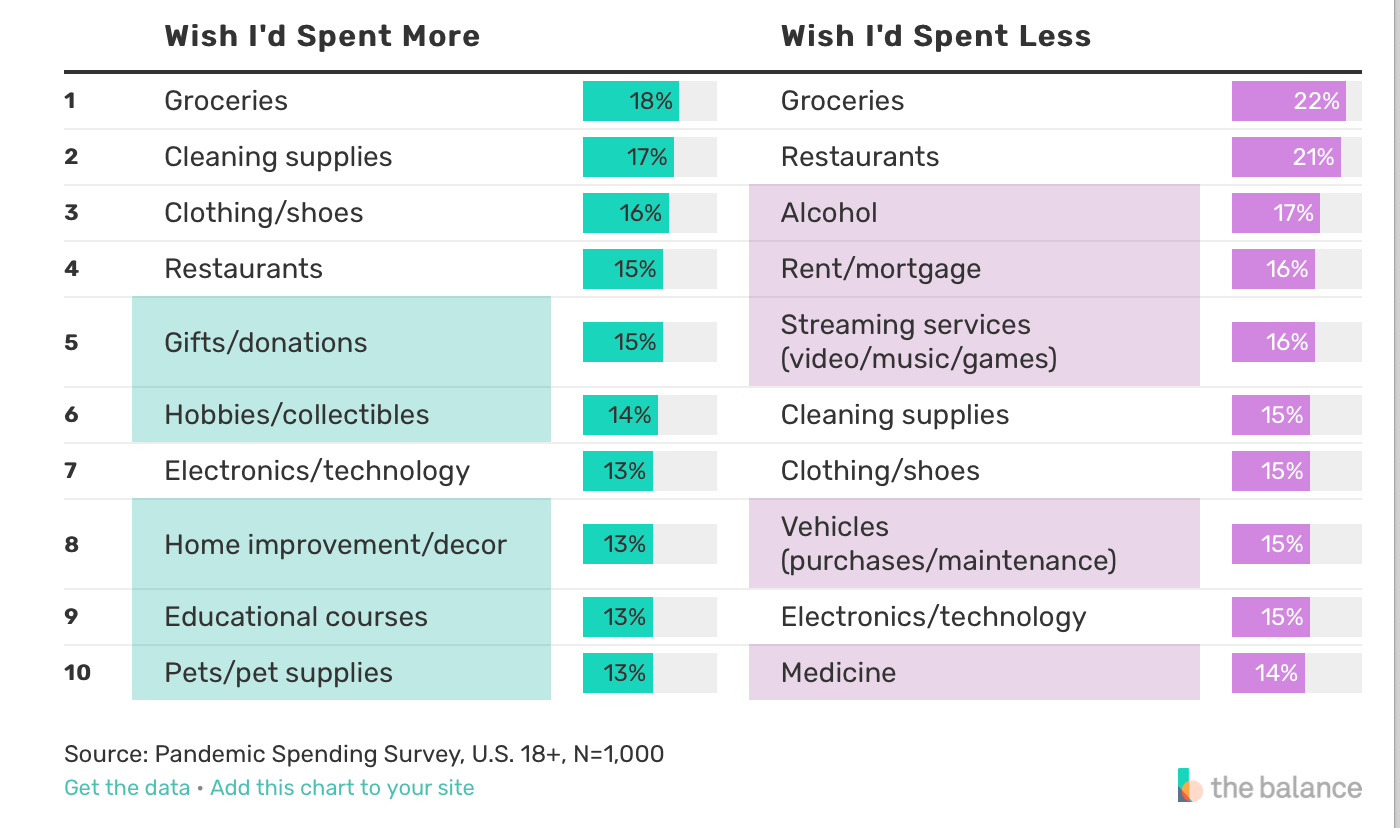

According to a survey conducted by The Balance, 56% of all Americans made at least one comfort purchase over the course of the pandemic, with 58% of them saying the purchase was worth $500 or less.

What do these include?

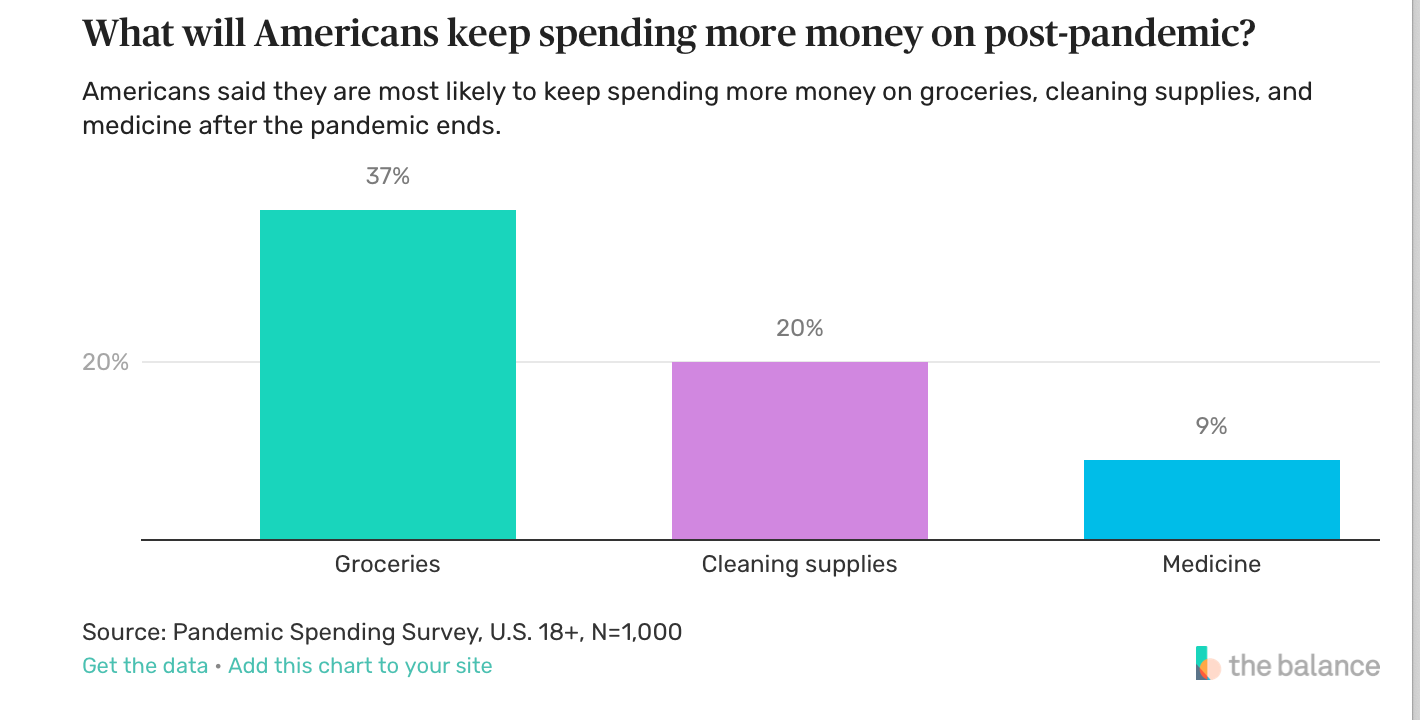

No kidding, food such as groceries and alcohol were the top contenders along with cleaning and pet supplies following the lead. Yet, this didn’t completely cure our mental health as depression, anxiety and a newly formed case of Zoom fatigue were at all time highs. On the physical side of things, as many as 71 million Americans have gained weight.

No more Freshman 15. More like Covid 19.

Food is classic because well, that’s why there’s classic comfort food. Whether you plan on spending more on food, which I don’t recommend unless its organic or at a restaurant for the experience, I would suggest investing in yourself which pays dividends for a lifetime instead.

These are the main purchases I’ve made over the pandemic, at least of what I can remember that have improved my life in some way and helped me earn money indirectly:

Battery iPhone case

New Laptop

Weighted Blanket

Lounge Wear

Good Books + Kindle

Space Heater

Bose Sleep Air Buds

Looking Forward

At this point, we’re all dying to see one another and live life again which means comfort spending to the extreme. I hope consumers don’t end up reversing their financial goals and erase all the hard work they were able to achieve these past few months. It would be a shame if they wasted it all on some yacht or vacation.

Once the pandemic is over, Americans plan to splurge on the things they couldn’t do or didn’t have a need for over the past year, including restaurants, travel, entertainment and better clothing/shoes. As in the markets, reopening trades most heavily include companies in the hospitality, luxury, travel and transportation industries.

With revenge spending comes regretful spending but I know you can manage it since after all, you’ve come this far already.