More time = more wealth?

It does in fact work and the easiest way to do so with the least amount of effort.

Someone who has worked in the industry for over 30 years naturally has accumulated more overtime than one starting out. It’s nothing to be shamed of, just facts.

To be able to earn 2x more with 2x less effort is the new definition of being rich and a train grandma and grandpa hopped on long ago.

Work smarter not harder is a mantra we try to preserve in the personal finance world and the main reason why investors are more well-off than non-investors. They let their money work for them while enjoying life.

Baby Boomers, those born after 1946–1964, dealt with everything imaginable. From Kennedy’s assassination to dealing with the end of WWII, this was no easy time to be alive and arguably the most inconvenient time to profit off of the market as white Wall Street financiers made up majority of investors.

More Risk, More Return?

Yet despite having a lack of financial literacy education than the generation attending school today along with less graduates, Baby Boomers have still been able to grab their share of wealth in alternative places that have boomed ever since.

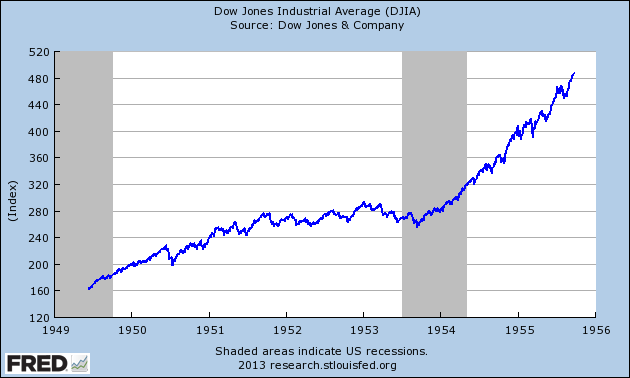

The forgotten bull market from 1949–1955 wasn’t well known since it never came to a “crashing end”. Because of these massive unexpected gains, the bubble never popped and the 1950’s stock market continued to climb for several more years until the crisis hit in 1970 when Baby Boomers were already invested.

The Silent Generation, those preceding Baby Boomers, stashed their wealth in bulk in real estate, a pattern followed by future generations. In terms of homeownership, according to Federal Reserve data, boomers surpasses the Silent Generation in real estate wealth in 2001 and are continuing to hold onto the bulk of wealth in major asset classes that have boomed during the pandemic.

How is this so?

All thanks to the buy and hold strategy, diversification, and negative correlated assets to the markets.

Real estate is by far my most favorable asset class and offers stellar returns for those who continue to profit off of their properties for generations. No wonder homeowners are wealthier than renters! They are earning money on a home they are enjoying!

Reasons why real estate has always and will always be in-demand:

-Someone always needs a place to live and if not, a foreigner will want it and pay full-price in cash for it in no time!

-Physical real estate is especially attractive as it is uncorrelated to the market

-When the market dips and gets in correction territory, 10–15%, best time to buy real estate

-Generating rental income is a rewarding business model as it offers enticing tax-write off opportunities to charge expenses towards the business

-Keeps you in control and manage your investments as opposed to a piece of stock

-Can depreciate it as it appreciates

-Less intra-day volatility

-Builds generational wealth

-Provides utility-appreciates when you do or don’t live there

These are some of the reasons why Baby Boomers have caught on to the housing train early on and have held onto their assets for so long.

Compared to the Silent Generation, those born from 1928 o 1945 along with Generation Xers, born between 1965 and 1980, majority of these folks continued to buy and sell within a few years, suggesting “musical chairs rather than substantial gains in homeownership and real estate wealth” according to the NYTimes.

The more you tinker, play and gamble within the markets to your spending, the more you loose! It’s as simple as that. Rebalancing is necessary especially the older one becomes yet following a passive approach will more often than not return you more than an active hands-on approach if you are patient.

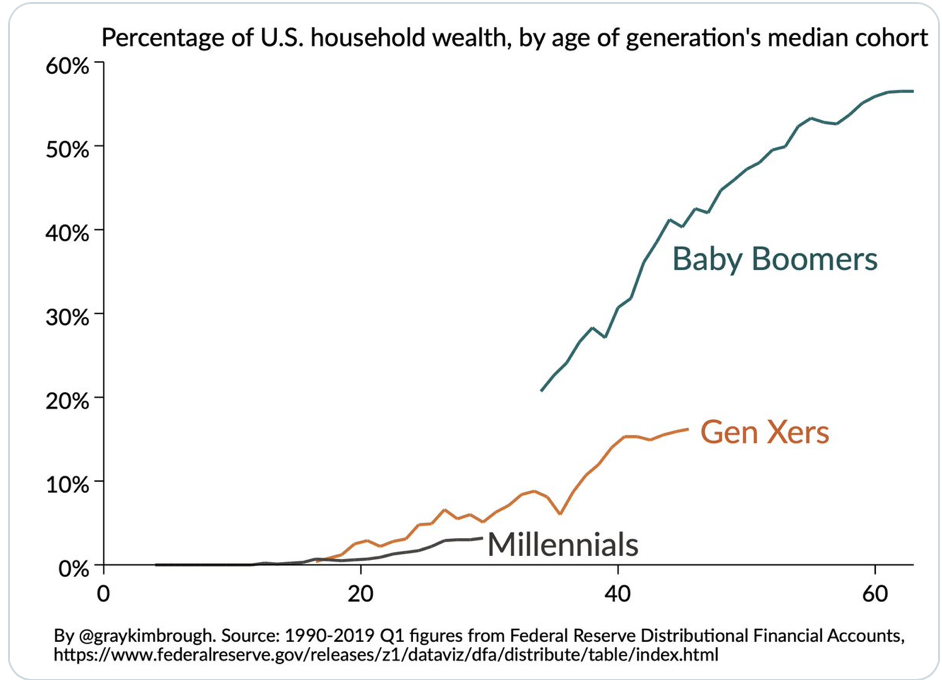

As a whole, boomers have fared better financially than Gen Xers (born between 1965 and 1980) and Millennials (born between 1981 and 1996) throughout every stage of their lives. Boomers currently own more than half (57%) of the nation’s wealth topping $60 trillion , while Gen X owns just 16%, and millennials 3%.

Generational Power

“The Gen-X share of real estate wealth is increasing, but not fast enough. In 2011, they held about 21 percent of real estate wealth, at which time the boomer share peaked at about 49 percent. Since then, the Gen-X share has risen to 31 percent and the boomer share has declined to 44 percent — still a wide gap.” NY Times.

As this generation is comfortably living in retirement due to their pent up savings and massive stake in real estate, some will eventually sell their homes to downside and younger generations will inherit their fortunes which can place them at a higher income threshold.

Currently with over 73.4 million Baby Boomers in the U.S. that are nearing or in retirement today, they are the largest generational group along with Millennials who to some standards seem to be catching up faster than expected.

Millennials also had a tough existence. Born at the turn of the 21 century, they had to go through 3 sessions to date all during pivotal periods of their life. As toddlers, the dot-com bust in the early 2000s emerged then the Housing Crisis as teens and now the covid pandemic as working adults! They never get a break except for the 13 year + bull market that erased all losses in the past.

Thankfully there is also an unexpected labor shortage and companies are offering anything they can to attract talent yet it hasn’t been easy sailing for the Millennials who had to readjust their plans.

The most vital lessons we can learn from Baby Boomers and Millennials besides the power of real estate, starting early ,and not putting all our eggs in one basket in terms of asset allocation is to plan for the worst, hope for the best.

What’s certain is uncertainty and we can in fact learn from history to predict the future. It won’t go as planned but bear markets leading into a recession tend to happen every 8–10 years.

Now that we know Baby Boomers are filthy rich from their lucky gains in real estate, let’s understand what else led to their rise that would be most beneficial for my generation, GenZers.

-Frugal, minimalist mindset with less gadgets, ads and consumption overload

-Valued less = more, spent more time with family, no social media, and were happier

-Educated themsleves to the fullest and took advtnage of it

-Low inflation

-Wages keeping up with education, health care, housing costs

-More common to stay at a job for their whole career than switch

-More homebuyers than renters

-No help from mom or dad, rare to have inheritances or generational wealth built up for this generation leading them to work hard for what they set out to accomplish and were more appreciative of what they had

-Splurged on necessities that meant more and could appreciate in the future

-Took less vacations and didn’t compare themselves

-Didn’t know how to pick stocks so invested passively long-term through a buy and hold boring yet positive strategy

-80%+ of Americans house majority of their wealth in their primary residence (not strategic since those who couldn’t afford to pay the mortgage or were bets against the bank during the Housing Crisis lost most but those who continued and hold their house untilt oday made incredible double0digit gains, up 13% in the last year alone)

No secret sauce just consistency, more time in the market > timing the market, and a continuous investment into themselves. I understand it’s harder to buy what’s really necessary these days with the distraction of social media and inflation eroding our purchasing power, yet if we just stick with what will make us happy not give us a dopamine hit in the short term, it’ll serve us better long-term.

Patience and delayed gratification are virtues.

Baby Boomer Spending Power

Although millions of Baby Boomers got lucky through the power of saving and waiting, many are still struggling to pay crucial expenses like medical and housing bills that have gone through the roof. There are still thousands of Baby Boomers who still have $50k+ left in student loans to pay off in America!

The main contributors to these expenses and rising debt load are due to the failure to invest during the Great Recession, unexpected longevity risk (outlive expected time horizon for your investments to work for you or insurance), not having the proper education, and the biggest red flag: relying on a spouse to keep their partner afloat.

As the wealthiest generation in history, Baby Boomers currently hold $2.6 trillion in buying power. Thanks to their massive time horizon, they have had the most time to build their wealth in comparison to other generations still chipping away.

Their spending habits + real estate portfolio make up a bulk of their massive power as they are both ways to earn wealth in a passive way without being a slave to their hours.

There is a threshold to how much you can make when you earn W2 income. Even with stock options, grants, bonuses, and a large stake in a startup, without a recurring investment that provides utility to someone else, most notably a property, you can only go so far.

Most of us can agree that saving more is easier than earning more and that’s one thing grandma and grandpa have taken advantage of since it’s the easiest choice after all and doesn’t fault. Something so simple as saving less each day compounds tremendously overtime. With their patience, Baby Boomers aren’t sidelined by social media or get rich quick schemes which have aided them in their wealth journeys.

Baby Boomers are the most savviest generation because they haven’t nor frankly know how to take advtange of all the spending opportunities online. Online shopping and mobile wallet purchases aren’t common amongst older generations which allows them to be frugal and know what they need. Paying by cash makes it easier to spend less.

67% of Baby Boomers own a smartphone compared to 96% of other generations according to Pew Research Center and only 27% of a Baby Boomers have ordered groceries online for home delivery according got Statista.

We can learn a thing or two from them. Being old school is what school needs to teach us.

Wealth Gap

The wealth gap between Baby Boomers and Millennials is drastic but is slowly narrowing thanks to the eventual inheritance.

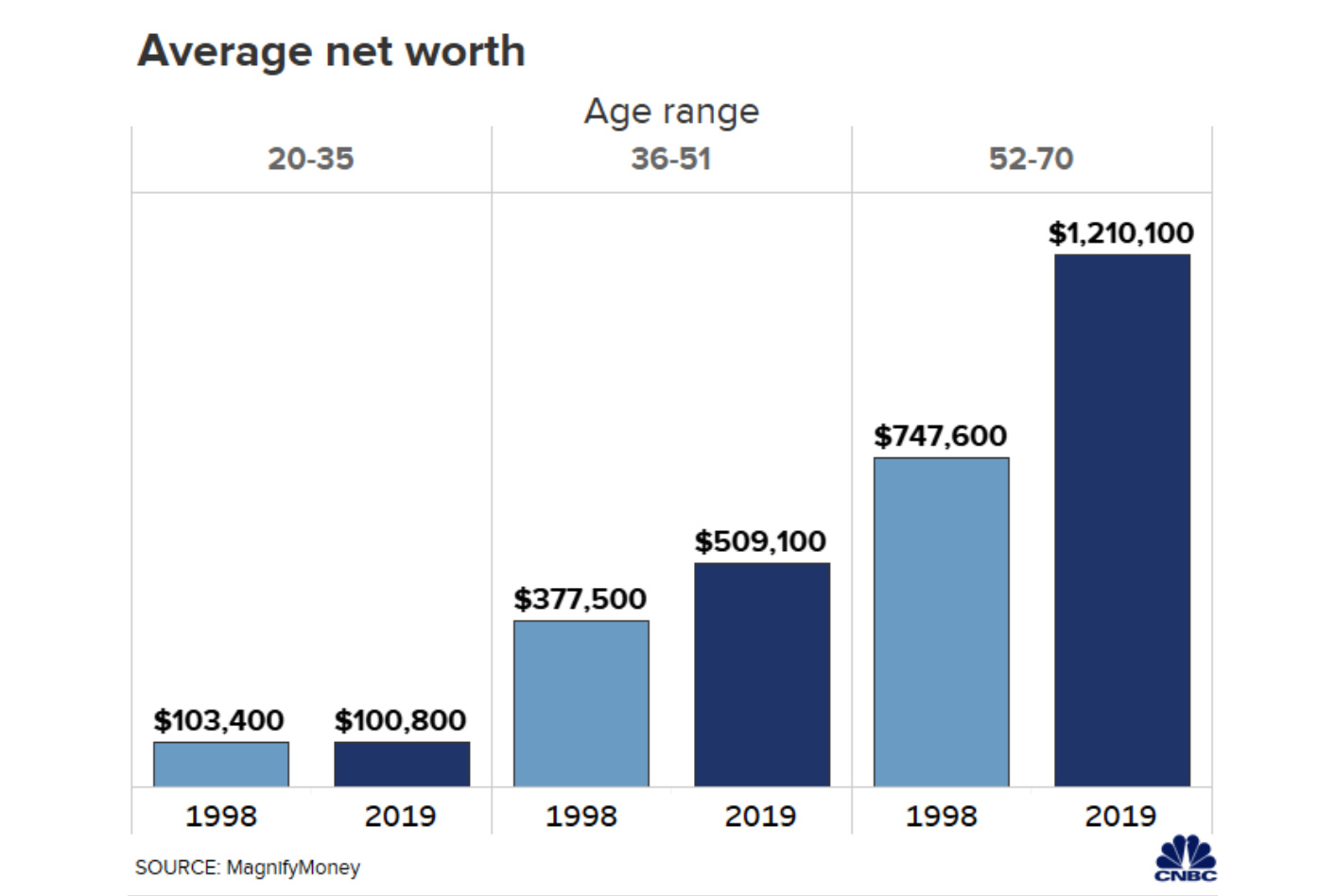

The older household had about 7x the net worth of younger households in 1998. Now they have about 12x the net worth according to a Magnify Money analysis of Federal Reserve data.

Over the last two decades, the oldest cohort has seen their average net worth grow to $1.2 million.

Meanwhile, the 20- to 35-year-olds have an average net worth of $100,800.

For the first time in history, Millennials will be poorer than their parents. Due to 3 recessions hitting them every 10 years, their wealth has stagnated and especially been beaten down by student loans.

In addition to lack of stability, financial literacy, and timing in the market, as with GenZers these days, they have always been hesitant about taping into the market as well.

Millennials neglect preparing for retirement and tend to not regard it as important which is harming their growth more than anything as retirement is known to be the most expensive and scary moment of one’s lifetime that must be planned for earlier than later. I have a feeling they are too scared about getting older that they push it back. Their procrastination is detrimental.

So what can Millennails learn from Baby Boomers to get back on track?

First off all, this isn’t a competition and your past doesn’t determine your future.

The most important thing is to get out of debt and not owe anyone, anything.

Especially when you get older, everything seems to be more expensive because unexpected things from our health to homes start getting rusty and break down.

That’s part of life and having a backup to cover the anticipated costs are key. I would suggest having a durable life insurance plan, whole or universal life insurance to have a peace of mind.

Pay off high-interest debt first. Credit card debt often has high interest rates near staggering rates of ~20%, which makes it costly to maintain plus it effects your credit score disabling you from taking out a mortgage on a new property or a business loan if you plan on conquering your entrepreneurial dreams as you settle down!

Refinancing a mortgage at a lower rate might make sense, in some cases as well and to get the most attractive rates requires a strong credit score near the 800 range.

Set up an emergency fund. Have enough money to cover six months’ worth of expenses. Set up an automatic transfer from your checking to your savings so you don’t have to think about making that small sacrifice each month. Make the process frictionless and somewhat fun to the point where you are earning more.

Take advantage of benefits. When you get your first job, put 10% to 15% of your paycheck into a 401(k) plan, especially if your company will match the contribution and increase that amount the more you make.

Luckily, it is hard to imagine that Millennials will hold 5x as much wealth as they have today all thanks to generational wealth and the bank of mom and dad! They will inherit over $68 trillion from their Baby Boomer parents by the year 2030.

This represents one of the greatest wealth transfers in modern times alleviating them from college debt, an overheated real estate market, the high cost of insurance, and low wages from covid.

Yet as with everything, too much of anything isn’t healthy. Moderation is key and when it comes to the recipients of the money (Millennials), they will have to focus on managing that hefty lump sum.

Comparatively to lottery winners, it’s easier to loose than to earn more on that inheritance and keep it. Over-exuberance and anticipation gets the best of us plus Millennials don’t need all of it anyway.

This will be an unprecedented hand-off of wealth and may have ripples effects access the economy leading to wealth inequality with a large transfer of wealth to a small portion of the population.

For good or for worse, I hope you learned some tricks under the Baby Boomer’s sleeves to become financial free and flexible yourself. Every generation has something to teach us.