Unfortunately politics has to be intertwined into everything these days including the markets.

Surprisingly one of the reasons why Americans vote for a certain party is due to their anticipated portfolio returns!

Is that one of your reasons?

Nevertheless, you’ll soon find out whether or not it actually matters.

From masks to Big Tech, there’s no getting around conventional politics. It’s infiltrated our lives for better or for worse and sometimes we rely too heavily on legislation to build wealth.

With 89% of the country owning 20% of the wealth, wealth inequality has been exasterbated by the ones who created the rules. While the country is running into a massive deficit on the brink of a shutdown if no resolution comes about to suspending the debt ceiling by October 18th, the top 1% are finding ways to pay less taxes against supporting the one and only corrupt government.

Although part of being an American citizen is agreeing to give back to the country typically and most conveniently through part of your income in the form of taxes to Uncle Sam’s pockets, those who write the rules end up not doing so as our former president only paid a generous $75 to the government while the middle and income class paid 80%+ of all taxes according to Forbes.

So let’s cut to the chase.

Market Power

Does political controversy, tension, political debates, elections, SNL reenactments, and whistleblower news actually affect our portfolio returns and by how much?

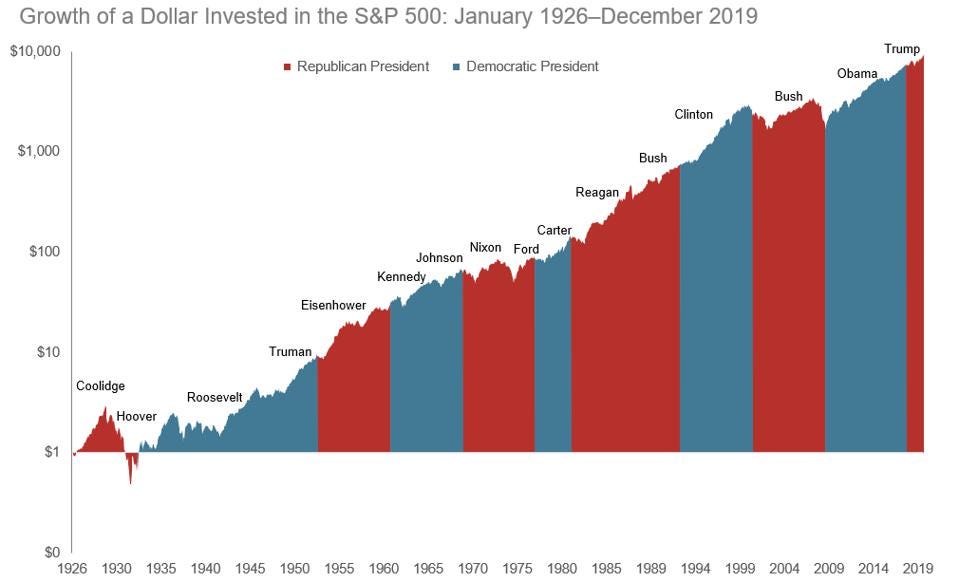

According to the S& P 500’s performance since 1926, the political party in power seems to play a substantial role in swaying markets a few days pre and post election but soon after, it has little to no influence.

Democrats are known for levying higher income, estate, and wealth taxes to lessen wealth inequality and promote social mobility in support of all income classes not just the top 10%+ who play golf and hide their money in Bermuda tax shelters.

Yet Democratic reform tends to discourage Americans from working as hard as during a Republican presidency since the more one earns, the more they give up in income tax. Although working hard shouldn’t be reduced by the need to give back to the country to support troops, infrastructure, climate change and everything else the U.S. needs to repair, it sadly is.

While during a Republican presidency, Americans feel more encouraged and motivated to earn more since they pay less in taxes, can inherit more through the step-up basis by saving in taxes once again and the president works in the interests of a business man not an essential front-line worker. Fewer Americans retire during a Republican presidency and can earn more in a short perpetuating wealth inequality further.

Both parties have their pluses and minuses. No one gets richer due to the political party in power since no matter how much one may earn, it’s how much they keep.

The rules an administration makes may just happen to work more favorably for you depending on your tax bracket at the time.

We can all agree no matter who’s president or what type of war is raging, someone is always earning at the expense of others and it tends to be the same top 10% of people for a lifetime.

75 Years Without A Difference

In the 75 years since the end of WWII, according to Forbes, “the Dow Jones Industrial Average has averaged about 8.3% per year while during this period, we’ve survived 12 recessions, the Vietnam War, an oil embargo, a Tech Bubble, a housing crisis, and now, a global pandemic.”

Similarly to today, despite a global pandemic, the bull market has been raging on for 13 years and the major indexes are at their all time-highs with 5 Republican and 6 Democratic presidents holding power throughout this time.

So how is it possible for the stock market to perform this well despite the country being in turmoil?

-For the most part, the stock market is uncorrelated to the economy as it works for investors not workers

-Traders aren’t looking in current time, rather future time, placing their trades to be executed 6–12 months time-extra hopeful

-The major indexes always tend to go up overtime as digitization, innovation, new investors, better education, higher net-worths, and high hopes on the horizon are all baked into the markets

-Companies’ motives are to maximize shareholder value and profits, not always in interest of wellbeing of users e.g. Facebook and any other Big Tech monopoly

-The stock market doesn’t proportionately represent what’s going on on the front lines, small businesses or Main Street only Wall Street bubble with Fortune 500 companies or unicorns

-Most investors are institutional or affluent (net worth in excess of $1m) who control and sway markets with their large positions

Despite endless turmoil during each presidency, it’s more about investors’ sentiments about the future of markets than what policy makers and the sitting president do or say about it. After all, investors are the driving force for how the market moves, not the people on the front lines or legislation passed. The greatest risk one can make in their investment decisions is to tie emotions to it and that tends to happen most frequently when investors are unsure about the future.

Most volatility tends to occur prior to election cycles. Pent-up demand or uneasiness is drilled into investors’ minds. Similarly to any announcement of a Fed meeting which has larger implications for the economy as their decisions are based on inflation, interest rates, QE, etc. affecting the 10-year Treasury yield an indicator on investor sentiment on buying or pulling back from safe-haven assets, markets go hay-wire on the day of the Fed’s meetings and then historically get back on track the next trading day.

What’s certain is uncertainty something we forever must deal with.

Especially for a country as massive and influential as the U.S., global markets that own U.S. stocks or have a large stake in domestic equities become wary overseas and foreign investors start pulling out of their positions or buying some cheap penny value stocks in hopes of them booming before a new administration takes office but this practice is pointless.

All the election noise starts leveling off and the annualized S&P 500 return by President becomes consistent and ends up looking identical simply going up overtime.

The absolute worst thing you can do every 4 years is tie your emotions to your decisions or have bias towards a President within your portfolio.

Selling a majority of your holdings just because your favorite candidate didn’t win isn’t a legitimate excuse to rebalance especially if you look at historical data and according to it, the stock market rides in waves and always gravitates up if you’re patient enough to see it.

Diving Deep

According to the chart above, if you observe at the start of each new administration when stocks market returns began being recorded as Hoover was sworn into office in 1929, you will notice the market always goes through a dip, near correction territory of around 10% for a few days and then goes back up to record highs a few months later.

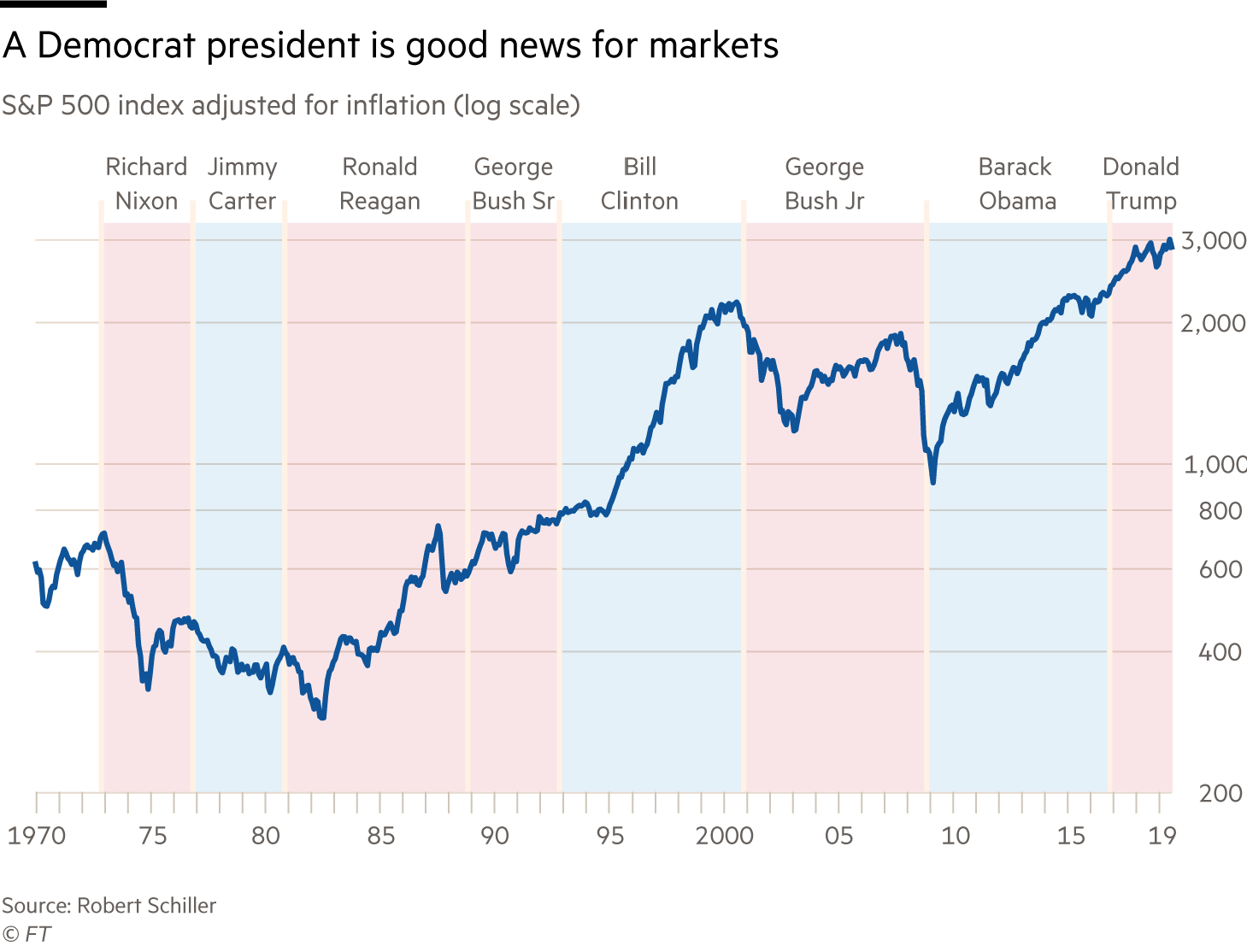

Overall it looks like the S&P 500, an index that tracks that 500 largest companies on the U.S. stock exchange regardless of a Democrat or Republican in charge, doesn’t move yet when you look closer, you can see during the periods of 2 Republican presidents, 1969–1978 and 200–2009, the S&P 500 stayed stagnant but under every Democrat, it has risen.

Ironically although the oldest retail investors who were white males leaned on the Republican side promoting pro-business and capitalism, they saw their gains stagnate and deplete. That meant some investors were devoted to their political leaning that they would give up paying less taxes for lower market returns. Not sure I would prefer that.

Clearly someone wasn’t looking back at history and according to it, it does in fact repeat itself so they missed out on some juicy returns. Only if they were less politically motivated could they have caught on!

Politicized Markets

Now that we’ve uncovered that the political party has less to do with markets returns than we might have expected, let’s understand the annualized returns for the S&P 500 since 1930 and how our portfolio performance is holding up.

According to data, democratic presidency has yielded more gains and boosted the economy further, most likely due to their equal policies that help all income classes not just the top 10%. In addition they are less capitalist minded and promote equality, transparency, and the break down the financial industry and Big Tech instead.

Yet the annualized S&P 500 performance under Trump compared to Biden at this point in time was higher than Biden’s first few months in office at around 16% for Trump versus 13% for Joe.

But at the end of the day, each administration has to deal with its own hurdles from the past and most of the time, the returns have no relevance to what they are up to on Capitol Hill anyway and all to do with Musk’s tweets or Robinhood’s retail trading bonanza.

In essence, the most unexpected things/events/factors/news move the markets the most and we tend to call it politics even though it isn’t.

There’s no doubt politics is essential to imposing proper legislation to keep the markets from becoming frothy by instilling the SEC and ERISA committees to control big business, but if you are choosing a candidate based on boosting your market returns, I would say it’s a waste of time and not a very logical way to choosing who you want to run the country.

If the president is slow to enact any new changes, doesn’t bother alleviating the student loan debt burden, chilling out on his yacht, stubborn on passing any legislation to help its troops or the roads, not taxing the rich and instead W2 earners, banning immigrants, imposing Reaganomics for the upper-class, and solely supporting capitalism not social welfare, the U.S. and any country will go down and so will the markets in tandem but all in all, the president doesn’t have as a large say since overvalued unicorns seem to have a louder voice.

There are countless variables that are baked into the market and they are all predictions. No one has a crystal ball. The president is the CEO of the country and just like with any company, if any suspicious internal documents leak out or the CEO unexpectedly resigns, the stock will plummet by a few percentage points for the next few days, and then back to business.

All in all, vote for a president that will help the most people not just you. Just like within higher ed, instead of helping the top 1% become billionaires, institutions should help the bottom 90% become millionaires.

Not only will gains be higher if more than 80% of the country invests and regularly begins to through DCA (dollar-cost averaging) not lump sums, contributes to their Roth IRA, IRA/401 (k), spends less than they earn, invests in themselves through financial literacy, and not become polarized or take things so personally when it comes to politics, the country and investors will do and feel better.

Currently with the Democrats in control, tax legislation is on the top of their minds. Everyone hates taxes but that doesn’t mean you should hate the party. There are tactics you can take to legally reduce your tax amount and earn more that works during any administration.

Universally, setting up 5–10 passive income streams is easier than ever in a digitized “no need to get up the couch” world and in a country where there is something for everyone, no one is stopping you except for yourself.

No one can predict nor beat the market but can set themselves up on a stable path towards letting it work for them slowly overtime.