April 15th is tax day. Yay?

Since we have a variety of readers spanning multiple generations from GenZers to Baby Boomers, hi grandma:), we can all use a refresher on tax policies especially since this year is going to be even tougher for many filers.

Taxes aren’t more complicated because Biden is in the White House and Democrats are known for increasing taxes for all income brackets, but rather the transition to remote work, widespread employment and stock-market palooza has gotten taxes to be more complicated than they already are.

There is even a worst-case scenario for some wealthy folks who’ve moved into their second homes.

They have to deal with double taxation. This means if you’ve lived in one state but telecommuted to another hiding this past year in your upstate beach house or cabin, there is a chance that you will have to pay both state’s income taxes. And to top it off with a cherry on top, the rich don’t only have it bad, if you’re unemployed, benefits are taxable as well with a higher-than-expected stimulus bill coming your way if you make less than $80k per couple.

Tax Breakdown

Working remotely surely has its benefits.

These include:

-Being able to work from anywhere

-Have the freedom and choice to exercise, sleep more and eat healthier

-Have more privacy and peace if you chose to move out of a dense city and most notably, pay less in consumption and state tax.

-Have time alone + extra family time

-Be outdoors and not in a smelly, congested office all day under artificial lighting and snacks

Although it does sound like a nice vacation, it doesn’t end so peacefully there.

There are also major drawbacks that the wealthy in particular really have to deal with since they were the ones who’ve moved around this pandemic, seemingly acting like there never was one hidden in the Hamptons or in Florida for the past 9 months on private jets bored every week.

The bad news for them is while you’re living in one state and working in another, both states may come after your income. These rules are complex and vary across the country. In some states, you are required to pay income taxes if you work there for just a day or two but in others, it’s 60 days.

For our mental sanity, it might be worth it to reloate but for tax purposes, not so much.

As managing partner of tax at Cohn Reznick, Patrick Duffany states, “It’s a mess out there. You need to have rules that taxpayers can comply with and you can administer. Neither is the case right now”.

Vacation or Not?

These WFHomers who have several properties for sure have it the worst. The State of Vermont, for example, has explicitly warned New Yorkers: “If you are living at your second home in Vermont for more than two weeks the income earned while you are in Vermont is Vermont income” making it subject to the state’s income tax, which has a top rate of 8.75%.

According to Bloomberg,

“Last year, Massachusetts imposed an emergency rule to tax people working from home in other states whose jobs are usually based in state. New Hampshire, which doesn’t have its own income tax, sued on behalf of its residents. States including New Jersey and Connecticut filed briefs in support of New Hampshire.”

Paying more in taxes doesn’t really feel like a vacation anymore. New Jersey and New York are the biggest hit with ‘leftovers’ (those who fled). Prior to the pandemic, half a million New Jersey and Connecticut residents would travel to both cities for work. In 2020, New Jersey lost about $1.2 billion of tax revenue on work performed in NJ.

And if you’re a millionaire or billionaire, pick your poison, you might be a bit concerned and need to watch out for Elizabeth Warren’s new pesky tax plan. She proposed that the 100 richest Americans would pay $78 billion under the Warren tax. This is part of her plan to encourage auditing as we’ve encountered our former president only paid $775 in taxes. This is a proposed 3% annual tax on the wealthy who are worth more than $50 million. This will help double the IRS (Internal Revenue Service’s) budget which would help the education sector, bridge the wealth gap, lessen unemployment, increase wages, and help stimulate the economy.

Trading Taxes?

More like trading places. If you were a part of the stock mania with Reddit investors earlier this year bored out of your mind, you aren’t off the hook either. Whether you joined Robinhood, WeBull or any other addictive retail investing platform, get ready to file paperwork and pay more than what you’ve made on your gains.

Rule of Thumb: If you sold any holdings within a year, you are subject to income tax.

Majority of investors on these platform unfortunately have no understanding of tax policies, let alone really how to trade. They were bored out of their minds during this pandemic and made gambling fun and games.

Electronic currency is dangerous because, well, it is electronic, not physical tangible cash so investors, more like Reddit gamers, tend to spend more than they should. There’s even been reported suicides linked to Robinhood’s dramatic side affects on teens. This manipulation of user behavior is yet another concern for Robinhood as they are headed towards an IPO as soon as late March.

Sneak Peak

The U.S. tax code penalizes speculative trading by taxing short-term gains at higher rates. The dividing line to pay less which is in capital gains tax is 1 year.

So to get your tax threshold lower to the longterm capital gains rate, investors must hold their investments for at least a year.

That’s what investing is about anyway. Long term investing isn’t trying to beat out the market.

Instead it’s buying undervalued, value stocks through a basket of stocks such as an index, mutual fund or ETF that will stay in your portfolio for more than a year. You won’t feel the urge to touch it and glance at the intra-day volatility, reduce headaches and taxes.

Seems like a win win to me!

Good things do come to those who wait especially since the major indexes always go up so save yourself time and a life and let your portfolio work for you. If you’re really impatient, buy a few target funds.

Long term means goal setting not betting out hedge funds. Money shouldn’t be fun. It’s not a game. If you still don’t believe me, read any report comparing passive vs active investments. Passive investing has consistently beat out active investing.

Biggest Misconceptions when it comes to taxes on investments:

-Long-term losses are applied to long-term gains.

Ex. if you have a net short-term loss of $1k and a net long-term gain of $1200k, then you’ll pay tax on only $200. You can deduct up to $3k from other income.

-Won’t be taxed as long as they don’t withdraw the money and say, move it to a checking account

True for retirement accounts ex. 401(k) plans but other investment income such as stock and bond gains, dividends created by mutual funds are all taxable.

From WFH to Robinhood taxes, there’s a lot of money Uncle Sam is asking for. Make sure you speak with your accountant and read the regulations on what is required to pay in taxes so you don’t get into the trouble of paying double with added fines if you pay a little less.

Buying Spree + City Center?

I’ve lived in NYC all my life and during the pandemic, I’ve never seen NYC transformed at this magnitude. It’s been the first time where wildlife actually came back to life, no fumes right in my face, no taxi taking a sharp turn and splashing a mix of a water and oil puddle on my way to school, no bumping into tourists even though I don’t mind it since that’s what makes New York, and a lack of noise from less traffic and visitors which has given my eardrums a well deserve break.

I have lost my threshold for noise at this point.

With interest rates rising due to the 10-year bond yield raising its rates close to 1.5% in the past couple of days with anticipation for a successful vaccine rollout as Biden declared that there will be enough vaccines for every American by the end of May if they want one and normal life again, this means bonds have lowered their prices, there are less of them as the Fed sells them, bonds are now more expensive to buy with higher interest and hence, real estate is more attractive than ever.

Even during the housing crisis of 08 when interest rates were low, real estate was still booming because people could take out faulty DD mortgages without CDS (Credit Default Swaps), just for the wrong reason but demand was still up and inventory was low! If you waited it out for a few years, kept your home, made the recurring payments, you would’ve made a juicy return by now.

Unfortunately since most Americans have 80% + of their net worth tied up in their home with the median home price of $320k, this is not a smart move especially since you could be easily making more returns through REITS, crowdsourcing or another property.

Several asset classes perform exceptionally well in inflationary environments. Inflation rises with interest rates.

Most notably these include tangible assets such as real estate and commodities as they are inflation hedges.

Real estate not only outperforms stocks and are less risky than equity in the market since banks are willing to loan more, with real estate, rising prices increases the value of the property overtime since during inflationary periods, interest rates are higher and loans are able to be taken out at higher prices yielding higher returns.

What is fascinating is that typically low yielding assets = low returns yet with real estate, you could easily make more consistently than gambling with a few stocks.

Just as the value of the property rises with inflation, the amount tenants pay in rent can increase over time. Even non-tangible assets such as REITS, Real Estate Investment Trusts are traded in the market and are indirect investments like securities.

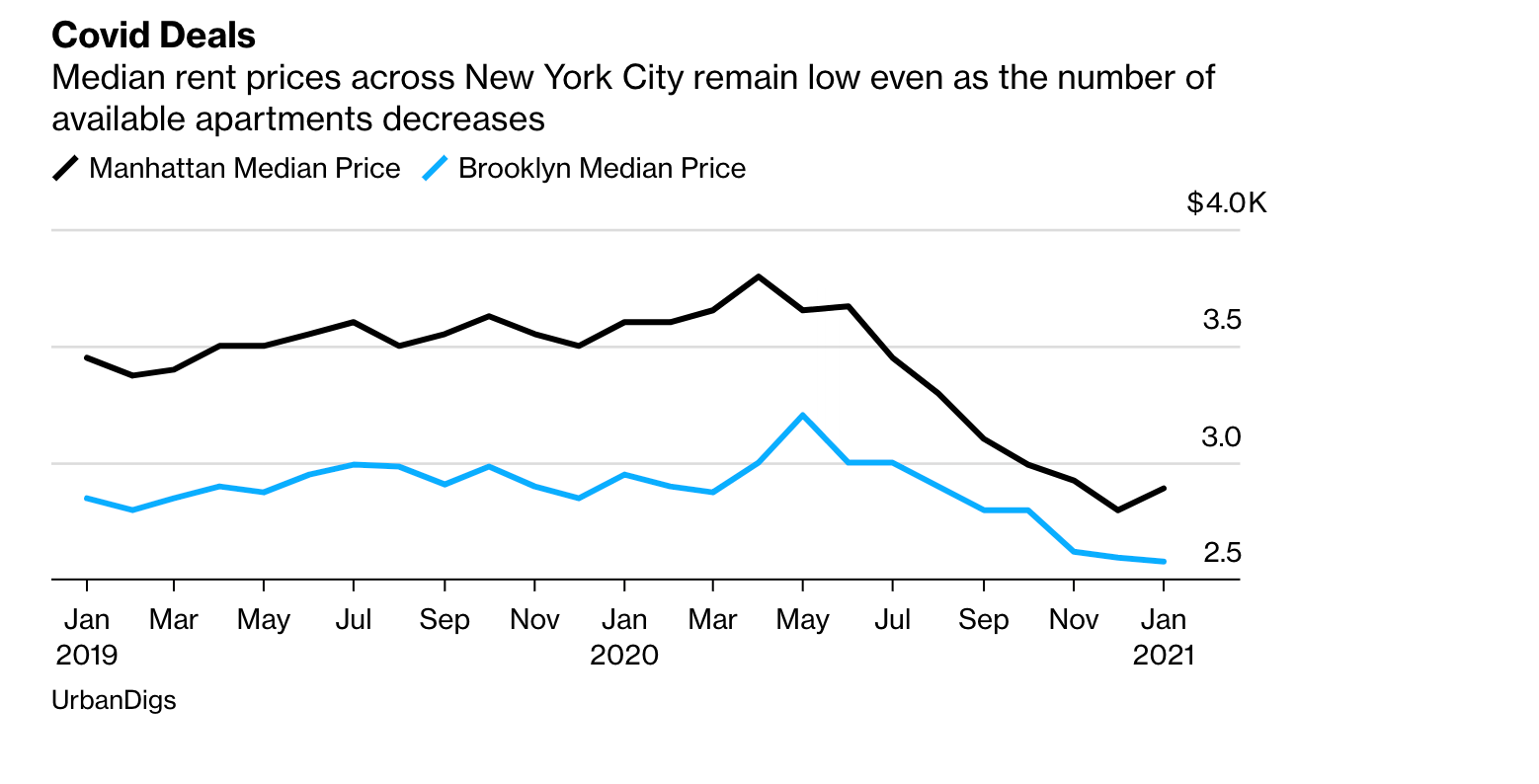

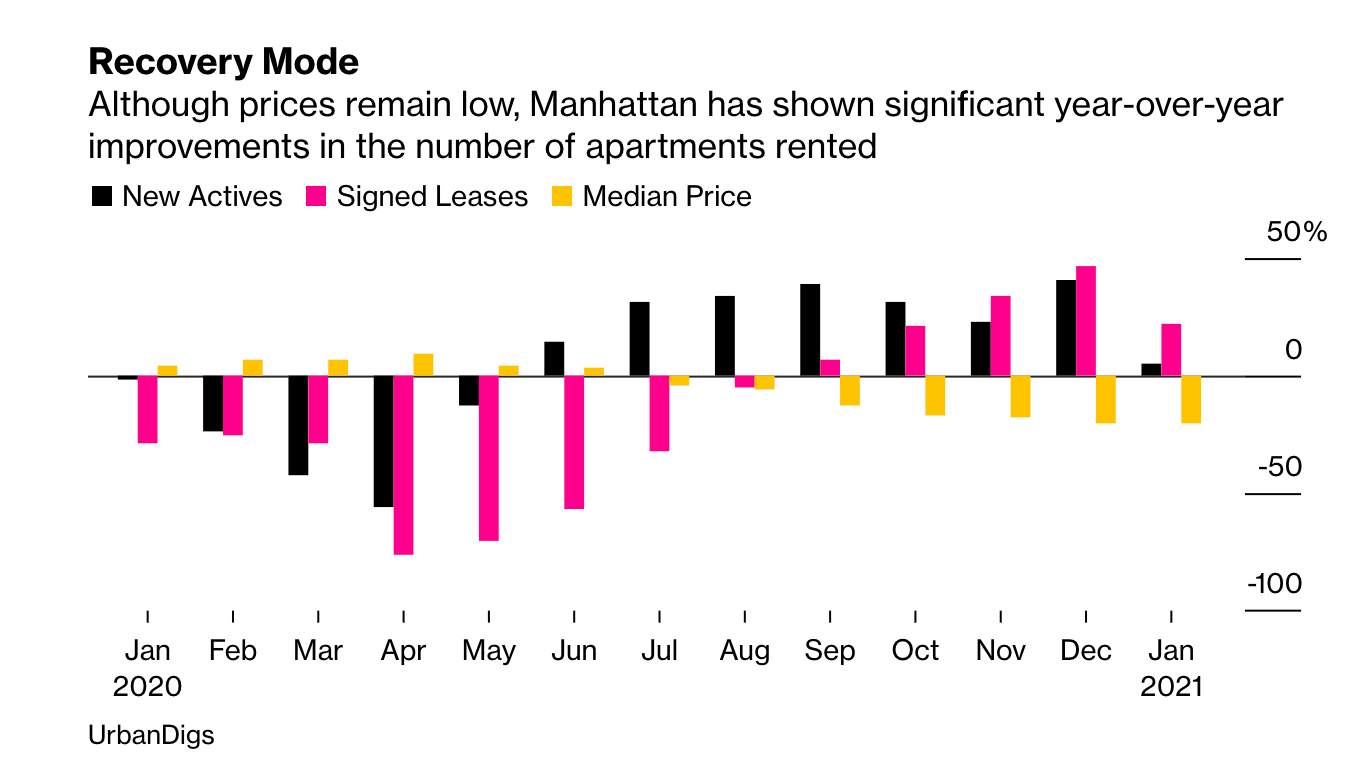

As New York to San Franciscio, the most expensive coastal cities are dealing with plunging rents as demand continues to decline overall and vacancies are up, these are luring bargain hunters to their dream cities. Those who previously couldn’t afford NY’s high rents now can with record low deals.

“Things have certainly changed in the rental market. Though brokers’ fees are still paid, mostly, by the landlord, prices are becoming less negotiable. Free-rent incentives are decreasing as well,” Kowalczuk said. “Just as in the sales market, where there are many more buyers, there are many more renters looking as well. The competition will only get more fierce as the weather warms up and more people are vaccinated.”

Although New York isn’t what it’s known for at the moment with a stripped cultural, entertainment and its gastronomical perks blinded due to Covid, they’re all here to come back.

According to various companies, WFH is here to stay but not at the same magnitude. Most employers expect their employees to come into the office 2–3x a week max. With landlords and office spaces scrambling to find tenants and make ends meet, this is a great opportunity for startups, WeWork and individuals who always wanted to move to NYC or high rental cities to get their shot.

Landlords scrambled to fill spaces, offering Covid “deals,” lowering prices, throwing in free parking or a few months’ rent. All this has created the perfect opportunity for others to move into the city of their dreams, and lock in rents that have reached the lowest levels in a decade.

So for those who believe cities are dead, trust me they aren’t. As soon as we can get back to normal life, people will be clamoring to visit Broadway, the MET, eat at overly expensive restaurants indoors, sit at a bar till dawn and experience life again the New Yorker way, even if it means paying double.

There’s nothing more prized than experience after all and no city can replace it!

No tax journey is super exciting but I hope I helped you find some direction on what to focus on so you don’t end up going to jail and reassure you that our hopes are high for any big city!

It’s just a matter of time.

There is light at the end of the tunnel. Except for taxes.

Happy filing.