Over time any true asset slowly rises in value and there’s no investment that isn’t somewhat volatile.

Ideally within one’s portfolio, most investors want to take the least amount of risk for more reward. That is clearly hard to do especially if you are trying to beat the market versus trail it which there’s nothing wrong with yet thankfully there are several alternative investments that allow you to get ahead of the passive approach.

From precious antiques to farmland, certain collectibles to real estate, these all have a track record of steadily rising and are poised to go up. The only problem is most people don’t have the patience to generate massive gains over time.

On the other hand, volatile crypto and suspicious NFTs do not make the cut.

Real estate has always been a loved asset class for the wealthy. As a refresh in the U.S. according to Schwab’s 2021 Modern Wealth Survey, in 2021, you need to have a net worth of nearly $2 million, $1.9 million to be exact to be considered wealthy. Currently, there are an estimated 8 million households that fall into this category which is 6.25% of all US households. Out of the 8 million, 95% are homeowners as renting is a -100% return. This makes sense as homeowners also fall into higher-income brackets and have more financial stability.

Luckily, if you can’t beat them, join them. One of the reasons why I love real estate is because there is variation and inclusivity. Clearly, the so-called “wealthy” are doing something right and in this case, not always, it would be a prudent decision to follow their lead. The other decisions should be weighed by your personal circumstances. The rich aren’t always wise.

Not everyone is a genius and no one can consistently beat the market. Not even the Fed who controls it! Past performance isn’t indicative of future performance yet with rents and homeowner’s income rising by 3-fold, real estate is on an unbeaten path.

The most dangerous misconception you can carry as an investor is that you are smarter than the market. You aren’t and no one is so lower the ego and don’t bite off more than you can chew, especially in real estate where putting down 2% is allowed.

Skin In The Game

Whether you have a net worth of $1 or $100m, real estate should always and can be part of your portfolio. Sure you can buy fractional shares on your favorite retail trading addictive platforms of Robinhood and WeBull but you certainly won’t build a momentous, stable consistent long-term cash cushion as within real estate.

Real estate will always be in demand and the locations that were once thought as nomads land and too remote for any civilization to venture to or wifi to connect to are all the rage these days with the pandemic’s shift to WFH, more space, family time, scenic outdoors and peace.

Believe it or not, the U.S. is one of the least expensive places to live. It might not seem like it as the median home price has jumped 22.9% from a year earlier to $363,300 in June.

If you follow the rule of thumb of not spending more than 20% of your gross income on housing, roughly only 30% of Americans can really afford a home at this cost. Americans spend way too much on a home, between 30–32.8% of their gross income on housing and with 89% of the U.S. as renters versus 64% homeowners, this is a stretch for most. No wonder millions’ homes went into foreclosure during the Housing Crisis! Banks relied on faulty lenders to pay back the dues they never could afford anytime soon!

That’s why it’s better to be safe than sorry, especially with physical tangible real estate. Plus it’s a true hassle until you have consistent reliable renters for a few years. Of course, if you follow the adage, “if you put in the work, the work will work for you” and treat a rental like a business, then you will be rewarded eventually after a few years, but buying a house for the sake of it appreciating isn’t a prudent move.

Danger Zone

Currently, roughly 40% of my portfolio is in real estate. Since I’m only 20, the rest is heavily concentrated within equities, fixed-income, venture capital opportunities and alternatives as I can handle more risk.

You may be wondering how is it possible at age 20 to own and or take care of tenants?

Spoiler Alert: I certainly didn’t start here!

Out of this 40% real estate split it consists of:

-Crowdfunding opportunities from Fundrise and CrowdStreet

-Farmland -alternative asset class

-REITS and eREITS in the secondary market-not entirely real estate since it is correlated to the broader market acts like a stock

-My primary residence fully paid

-Studio to lease out to –read here how I did it

Follow the Right Crowd

When we hear real estate, we mainly think of buying commercial properties or traditional residences yet majority of the wealthy don’t want to deal with that upkeep. When starting out, it’s certainly a wise move since you have to put in the work somewhere. Yet as you slowly grow your rental income you can then potentially negotiate your hours once your side income surpasses your salary from your primary job.

Let’s say once one has hit a net worth of roughly $40m or above, it is suggested to really assess if keeping tabs and babysitting renters is necessary anymore. Presumedly if it’s helped one build their wealth, it will be virtually impossible to let go of since they are already in the money making dopamine mindset and hopefully enjoyed the work since they would have had to been doing it for quite some time to earn stable income.

If your time is being wasted on tedious tasks such as renovations or dealing with leaks after each rainstorm with the income not adding up, it might not be worth it to keep up with the rental anymore, unless your spending is out of control. Time = money after all. Just because something generates revenue doesn’t mean it’s worth the time especially if you’ve done the grunt work already and know you will be fine without it.

Special Breed

Homeowners and landowners are a unique bunch. They know good things are worth waiting and fighting for and they don’t jump the gun, listen to Reddit gamblers, buy on margin or sell every time they are having a bad day or hear Jim Cramer scream. They know there will be volatility. That’s part of investing in any world. Nothing will be linear or else everything should be invested into. They know past the hours, the days, the months, and the years count, the real gains lie and more often than not unexpectedly outperform the big blue-chip names and possibly the market as a whole.

Everything comes with trade offs. Equities are a one-hit wonder and you may be lucky once, twice or never. That lump-sum generated from perfectly timing the GameStop short-squeeze could’ve been enough for you to pay out your retirement or made you worse off.

Real estate isn’t a rocking chair left outside in a hurricane. It is a mountain to climb with a nice view at the top.

Overall, with anything and everything in life, you must risk whatever you’re willing to loose. Fixed-income, equities, P2P loans, private equity, venture capital and other alternative investments are no doubt powerful and all unique but for consistent wealth that is stable for less risk yet ironically more reward, less volatility/headache, more rewarding work and gratification, powerful networks and negative correlations to not side-hustle with the market is a choice that has tremendously benefited the wealthy and lead them to take bigger stakes in real estate every year.

Who knows where the market will go. Sometimes it’s a little frothy, confused, uneven, speculative, a gamble and messed up serving the wealthy not correlated to the actual economy while real estate is here to stay and makes sense if you really dig into what is out there. Real estate is not a quick purchase you can make on your phone, that’s why it’s worth paying attention to.

U.S. Real Estate vs. Abroad

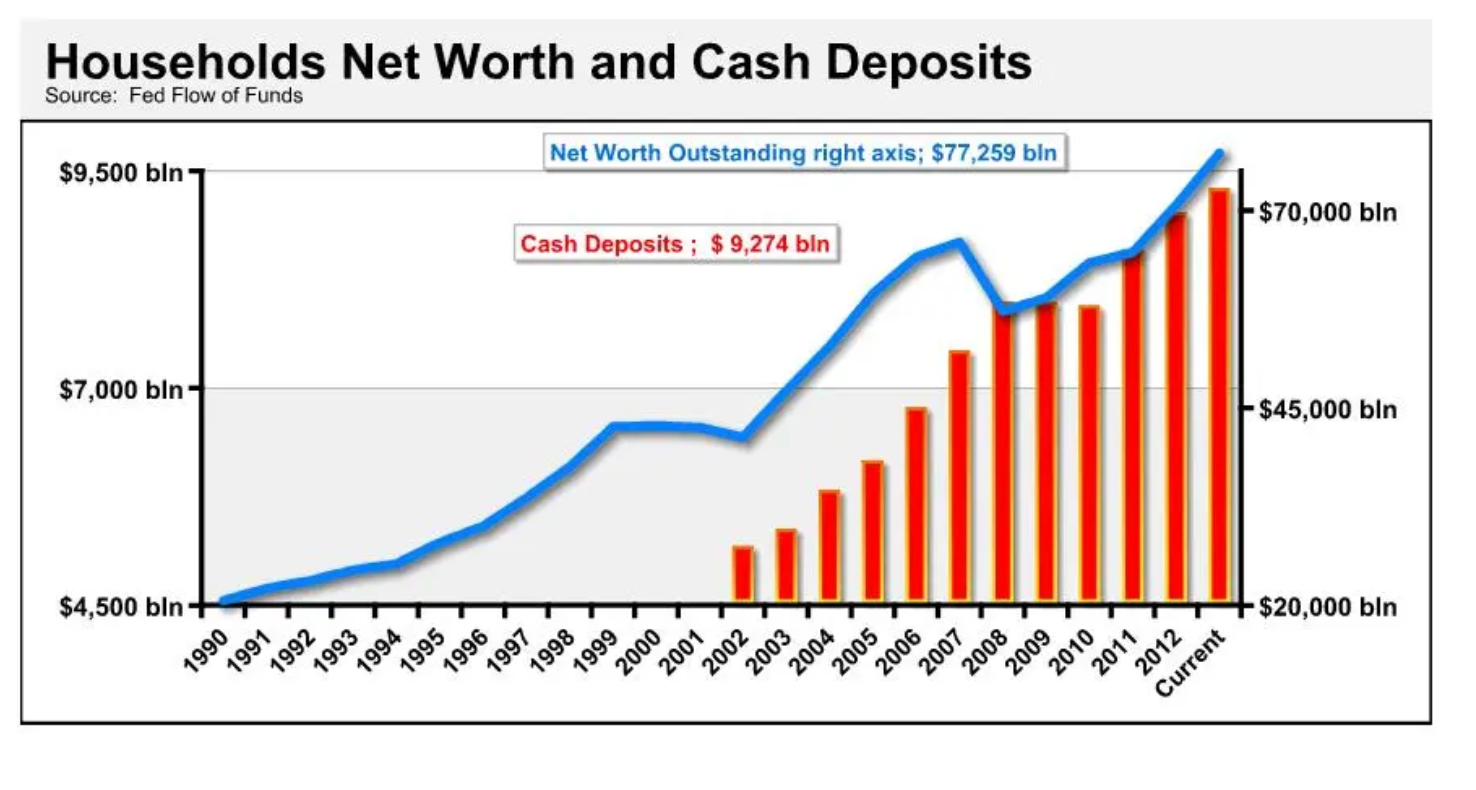

The main reason we believe U.S. real estate is overpriced is because home equity and annual gross income don’t correlate. They have been moving in opposite directions for years leading up to ’08 and have only make sense in the last few years since the housing market spiked in 2013–2014.

Since 2020, gross income and housing prices have been rising in tandem as the labor shortage is fueling signing bonuses, incentives for employees and higher wages mixed with inflation which has subsequently lead home prices to peak.

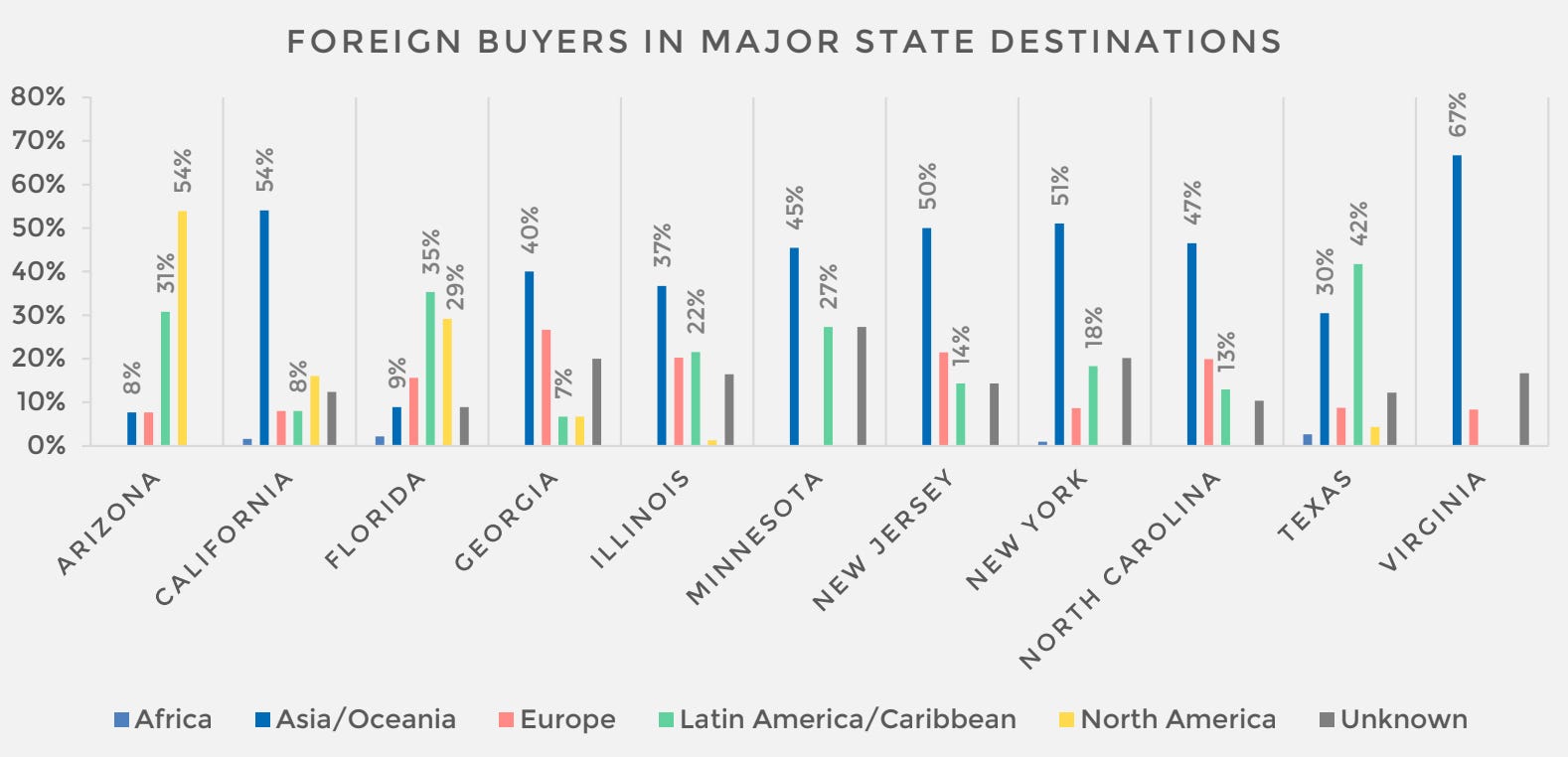

As 80%+ Americans are not able to own a home, the second most common buyers of U.S. real estate are from abroad. These international buyers are mainly from China, Canada, the U.K, Mexico and India where real estate prices are even heftier as household income compared to home prices are flopped and disperse.

To get a comparison, international buyer purchases made up 4% of the $1.7 trillion existing home sales in 2020, not including luxury real estate which most international buyers have a stake in. If you ever get a chance to tour a luxury building in NYC to LA, you will notice majority of the units are vacant or have year-long renters as international buyers park their money here.

At the moment, what looks like an unfathomable price for a studio is in fact a discount for a foreign buyer compared to the prices in their home base yet when it comes to the rest of the properties in the U.S., hopefully international buyers won’t take up all the juicy reasonable deals Americans can actually afford.

Part of the reason why foreigners buy U.S. real estate is for 3 reasons:

-The attractive price

-Education with endless opportunities

-Tax shelters

Real Estate Side-Door

Everyone says housing in the U.S. is either too expensive, too cheap and just right depending on where you live that’s why sticking to alternatives in real estate is your best bet so you know you are getting a fair and affordable price.

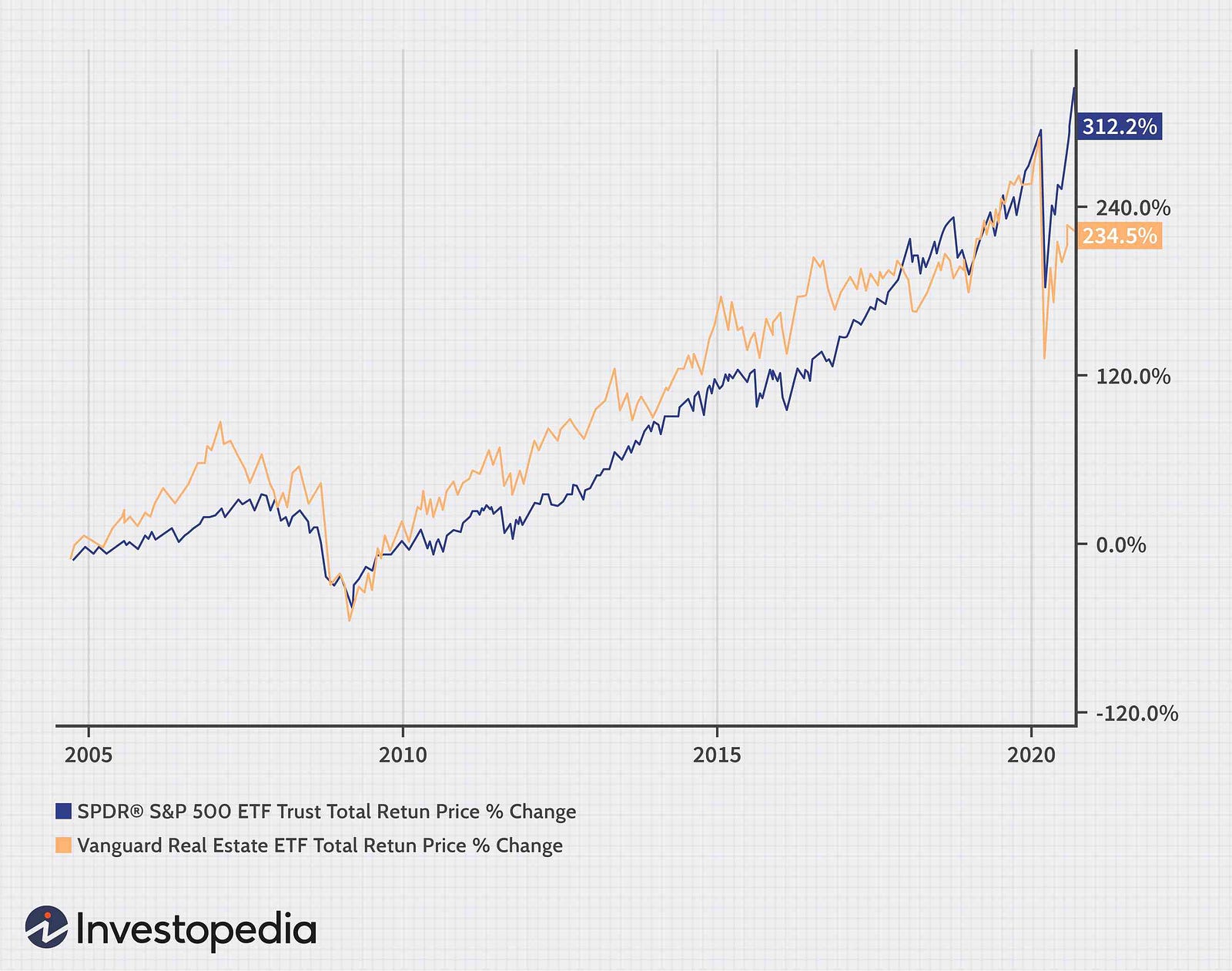

Plainly comparing equities to real estate according to recent data, equities beat out real estate right away yet there are several things to continue that many are missing.

Ask yourself this:

Is anything in the market guaranteed?

No.

Are stocks kept for the long-term?

Not always.

Is it tax-advantageous?

No.

Is it business tax levy friendly?

No.

Is it tangible?

No.

Illiquid?

No way.

Subject to market, economic and inflationary risks?

Yes.

Is it volatile and can turn any moment?

Of course.

Do equities offer one hit wonders?

Yes yes yes and we need to stop that.

Out of the group of real estate investors I know of that consist of full-time investors, entrepreneurs, full-time 9–5 employees, retirees, extreme savers and multiple side-hustlers that are heavily invested and ironically more conservative with an estimated net worth of above $5m, when it comes to real estate what they collectively tell me is that they are mainly in it for tax reasons. As Ben Franklin pronounced, taxes, death and uncertainty are true burdens for investors and the wealthier one gets, sadly the less you want to give away to the government.

When you buy an investment property (rental or home), you get to write off the purchase price over a certain number of years. This is a tax deduction known as depreciation. Many homeowners I know are too frugal entrenched in the stealth wealth lifestyle to dish out $100k on a Range Rover out of pocket yet many still have them not to show off per say, rather because their car qualifies as a business expense since they need to drive to the rental to take care of it. That’s a legitimate excuse. People look more well-off than they are because they take advantage of depreciation through their businesses. If you care, owning 300 shares of Apple can’t do that.

And if you want a cherry on top , REITS provide an extra benefit in that they avoid corporate taxes by paying out most of their income as dividends. If you purchase REITS in an IRA or Roth, any tax-advantaged account, you can avoid the dividend and capital gains taxes altogether!

All in all, there are too many variables and no reliable way to track total returns achieved by individual real estate investors. The easy answer is to say real estate is slow and costly.

Birds Eye View

To get a good overview of real estate is to examine real estate trusts through the Vanguard Real Estate Mutual Fund, a strong benchmark index of equity REITS and in fact a fund I’ve been invested in since I started college back in 2019.

Investing $10k into securities buys $10k in value in equity yet with real estate, $10k could buy a small studio in Louisiana, 60 commercial properties in Alabama through Fundrise. Cash garnered from rent is expected to cover the upfront costs of the mortgage, expenses, property taxes and repairs as well.

Something to note, real estate stocks are correlated to internet rate fluctuations. When there’s a dip, that means the Fed either raised or lowered interest rates yet over time, the effects of interest rate fluctuations balance just like with regular real estate after bumps in the saturated market.

There are only two ways to make money with stocks: value appreciation as the company’s stock increases and decreases or dividends.

With real estate, you acquire physical land, property and most real estate investors make money through the property’s value overtime simply living in there. Real estate can be leveraged and ironically with less risk, you generate more reward and you don’t need to have enough cash hence you take out a mortgage rather than buy on margin which can get addictive in the markets.

At any age and lifestyle, real estate and stocks are a great mix to have and should be your top two asset holdings. This isn’t an apple-to-apples comparison. Both can take a hit during economic recessions as seen in the 2000 Dotcom Crash, 2008 Great Recession and 2020 Covid Crisis yet as opposed to bankrupt companies, if you continued to keep up with your property and keep yourself afloat through all these valleys, your property would have appreciated by more than 50% since 2020.

The national housing market added $11.3 trillion in value and 30% in the last year alone during a crisis. Hence, don’t be fearful when others are greedy even in real estate.

All in all, no investment is better or worse than one another. They both are fantastic wealth builders and have clearly worked for majority of the top 10% and investors we idolize.

To sum it up, here’s a brief list from Investopedia on the real estate versus stock holdings rundown:

Real Estate

Pros:

-Passive income

-Tax advantages

-Hedge against inflation

-Ability to leverage

Cons:

-More work than buying stocks

-Expensive and illiquid

-High transaction costs

-Appreciation isn’t guaranteed

Stocks

Pros:

-Highly liquid

-Easy to diversify

-Low transaction fees

-Easy to add to tax-advantaged retirement accounts

Cons:

-More volatile than real estate

-Selling stocks can trigger big taxes

-Some stocks move sideways for years

-Potential for emotion-driven investing

Readers, what are your stakes in the real estate market? Do you find it complicated and confusing to get into? Is it pricey cross country?

Curious to hear your thoughts.