Beach home?

Doggie?

Range Rover?

Crockpot?

We’ve all purchased something we thought would be handy in lockdown but at this point, we are over it.

Alongside inflation bitting us, millions are now dealing with the financial, mental, and physical impact of their pandemic splurges!

These splurges aren’t as easy as unsubscribing from one out of a dozen subscriptions. Last week I sat down with my family and we canceled 3 in the food, entertainment, and lifestyle department alone! I’m sure I’m not the only one who isn’t using them on a daily basis or forgot I signed up until I wrote this post.

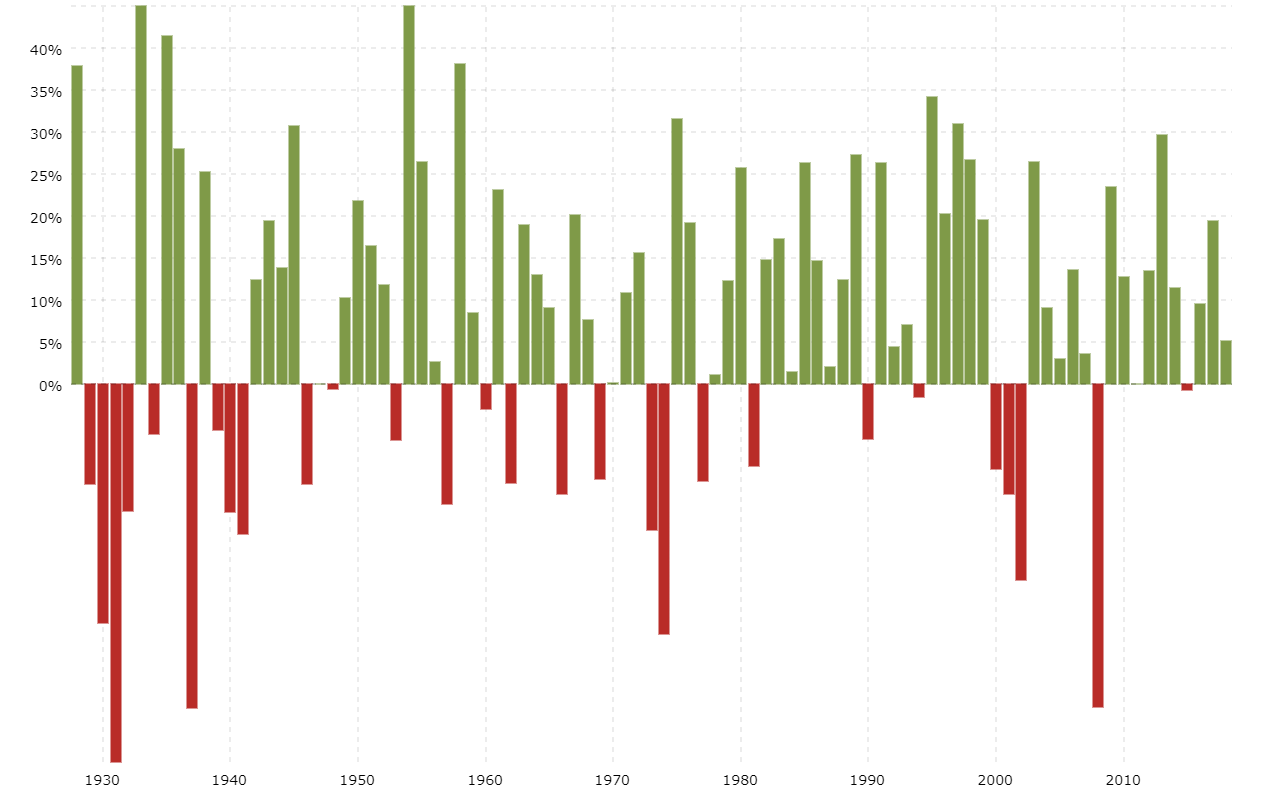

Who would’ve thought that during one of the worst years in history during a global pandemic, the stock market would roar back and return ~25% yoy, reach over 67 record highs, and reverse the brief ~35% correction in Feb-March 2020 within a few months? Compared to 2020, seemingly, ‘average’ quiet years such as 2019 had a worse year for the markets.

Why is that?

Since investors trade in today’s price in future time (futures), they are only looking outwards not inwards. They want their money to work for them not against them so they feel inclined to be optimistic and carry pent-up demand so their holdings end up beating last year’s performance!

Plus with unforeseen excess liquidity in the markets, monetary and fiscal stimulus pumped into the economy at record rates, WFH boom, investment craze within meme stocks, crypto, and alternatives, alongside the Great Resignation and gig-economy, this has all fueled massive demand leading to inflation and thicker balance sheets.

Although 26% of Americans believe their financial situation will get WORSE in 2022 according to CNBC due to 2nd Dotcom concerns, rate hikes, additional variants, omicron cases, delayed life, and inflationary imbalances, even flushed with cash and the option to be picky on what job they want not necessarily need, Americans by various measures are in the best financial situation they’ve ever been in although that is quickly relapsing.

Americans felt most optimistic about their financial future in early 2021 once vaccinations rolled out but up until this summer, once inflation was really felt on basic goods such as gas and food staples and covid cases still rose, Americans became more fearful. At this point, deja vu has hit us back to 2020 with higher cases counts and breakthroughs with the vaccinated. With money already spent, not only national savings rates have declined back down to 7% from a record of 30% in August, there is more concern, emotions tied to investment decisions, and spending recorded in unnecessary places.

According to CNBC, “The top reasons cited by those who don’t anticipate any financial improvement include the Covid-19 pandemic, stagnant or declining wages, personal debt and fluctuating interest rates.”

Personal debt load, fluctuating interest rates, and declining wages are all culprits of overspending and splurging during the easy money “good” times.

Get Going

For the shareholder class and those who have a decent share, over 40% of their net worth tied to real estate, they’ve witnessed their wealth compound tremendously since Q3 2020. If you’ve had career success and large gains from the market, you most likely spent more on the number one largest expense Americans have which is on real estate. Not bad but unless you are renting it out or owning the property for at least 5 years, living for 5 months out of the year, it’s not an asset to own. Buying utility and renting luxury is the most logical choice.

Compared to cars or vacations, real estate is an appreciable asset that is not only one of the best diversifiers in one’s portfolio but a passive investment that offers over 2 income sources if actually applied.

After all, money is made to be spent, appropriately, and with a great handful of investors reliant on the stock market to fund their lifestyles, they took advantage of the housing boom before it got overheated and frothy. But what came with this exuberance and abrupt decision a year later was annoyance, regret, not enough savings, and embarrassment today.

Just becuase it’s on sale or in 2020’s case, a low-interest-rate environment and stimulus checks delivered, doesn’t mean you AREN’T SPENDING MONEY. It was understandable when everything was shut down and we were locked up at home, we felt compelled to upgrade our at-home lifestyle that we once didn’t pay as much attention to. As we spent more time at home and spent more on it, the intrinsic value of our homes went up. These upgrades include remodeling, various construction projects, and higher quality furniture, lighting, etc. The ultimate downside to owning a home is that you actually need to take care of it and it can add up to as much as the purchase price since there’s ALWAYS something you need to change. Immediately after our 6-month kitchen reno a few years ago, the bathroom then my closet then the living room needed desperate help. It never ends but that work comes with owning a physical inflationary proof asset after all. Hard work = real returns.

Deep Return?

Although we may have saved thousands on commuting, eating out, vacationing, and on pricey big-ticket items, we tend to forget that it hasn’t gotten EASIER to spend or STOP spending! I’m sure other bills such as your heating, electricity, gas bills have gone up at home! I’m sure you were using more toilet paper, washing your hands more, cranking up the heat or the AC, and bought a puppy that needs as much care as a child.

As consumers, we are at no shortage of spending. We love it as we are consumed by a world of upgrades, consumerism, commercialism, and everything at our fingertips. Yet we must realize we can never have everything and we will forever be miserable if we continue chasing the latest gadget, what the Joneses have, and what we don’t have.

The grass isn’t usually greener on the other side and looks are extremely deceiving. It’s unfortunate people still buy things they cannot afford to impress people they don’t know or like.

They haven’t found the meaning of real-life and the point of it. It is a waste of time trying to live for someone else, especially a stranger. Focus on what you need which starts with digging into how you can invest in yourself and let your money propel your life not degrade it.

Materialistic items go out of style the fastest. We are all addicted to something. Chocolate, exercise, technology, sleeping you name it. It is vital for all of us to understand how we can control our beliefs and relationship with money instead.

Money is the most invasive and addictive drug as we believe it is tied to promises and solutions. Yet what ends up happening is that more money = more problems and sadly people cannot fathom that truth bomb until they are there.

Just because you may have cashed out your investment losses through tax-loss harvesting (read here what investors are up to this time of the year) doesn’t mean you need to spend it. Let it invest instead to stay realistic and prudent.

Pandemic Hiccup

Although Americans report being in the best financial situation of their lives today than pre-pandemic, these numbers don’t seem to be updated. Adding inflation into the mix, although we were at home, that doesn’t mean we didn’t spend. We just spent on different things that we didn’t care to pay attention to or use pre-pandemic as discussed above.

Some notable high ticket pandemic purchases include:

-House (#1 expensive purchase an adult will make in their lifetime)

-Car

-Staycations such as Airbnb, 2nd home-beach home, weekend home

-Electronics

-Furniture

-Ordering-in

-Flying private

No wonder inflation is at its highest point in 40 years at ~6.8%! Consumers have been flushed with cash and have lived it up too much! With HANGER (hungry and anger) from lockdowns, consumers couldn’t control themselves and now due to this expectation that the pandemic is over and free money is a given, has led to the supply chain constraints and inflation eating them back.

So what can we do about our mistakes?

Usually, the larger the purchase, the harder or impossible it is to return most notably a home, car, and puppy, the most popular pandemic splurges. A home isn’t meant to be ‘returned’ along with a puppy — unless you are cruel. With a car or any electronics, check the return policy and warranty. In case anything breaks, repair costs can be covered. Nothing is wrong with leasing or renting short-term as long as you earn enough disposable income to cover the costs.

The golden rule with spending is if you cannot afford it twice, you cannot afford it. Everything seems fun and more glamourous at the moment. Commercials, stores, and sales reps lure us into believing we are missing out but the truth is, you rarely are.

Although we cannot avoid ‘not’ spending since we work hard and deserve to see our money be put to use, I’m sure if you didn’t purchase half the things you own, you would still be as happy or even happier than you thought.

Feeling FOMO, guilt, and all things buyer’s remorse are painful. A property to a puppy shouldn’t be a quick decision based on a lockdown. We were all delusional and in panic at that time. It’s better to spend a bit more on something you know you will keep. Sales are usually a waste. It only causes more trouble in the long run and most consequently costs more as well! Owning more won’t provide you with more bliss.

If you purchased a puppy during the pandemic and at the time really weighed the decision but are now back at work and cannot handle it, there will always be potential owners who can take better care of it hopefully for longer this time.

When it comes to a home, selling it a few months after purchasing it is certainly the worst move for your wallet and sanity. Moving while working with an agent isn’t fun. Before attempting to get rid of your pandemic property, attempt to find a renter and enjoy it while you can. In order to feel less guilty, allow someone else to use and appreciate it while earning passive income. There’s no better feeling than making money yourself.

Readers, what are some purchases you wish you hadn’t made during the pandemic? How are you dealing with them or letting them go? We’re all guilty!