This is impossible to believe but the U.S. is the second most affordable country in the world.

Thanks to the pandemic, the average median home price in 2021 bumped up to $374,900. This is the largest jump in 11 years and a 16.3% rise from a year ago.

At this point it seems like the U.S. is becoming more expensive and unequal. If you follow the recommended guide of stashing no more than 30% of your net worth into your primary residence, with 20% down, ~$74k to dish out on a first time property is sadly unreasonable for most.

Ironically, it seems like the U.S. has never been known as land of opportunity for its fellow citizens and instead the prized possession for foreigners who view it as a sweet bargain.

As fresh grads are dragged down with student loans with no financial literacy education to back them up, millions are forced to tap into the bank of mom and dad to finance their hefty mortgage and even put down a down payment in order to start building generational wealth for themselves aside from their full-time job.

At the same time during the pandemic, frivolous Millennials who insisted they couldn’t live without a chef’s kitchen or basement went ahead and spontaneously purchased a bigger crib due to enticing mortgage rates and stimis (stimulus).

Now 80% of homebuyers are regretting it reporting they want to move back. But not to worry, another gullible buyer will snag it eventually or leave it to a foreigner and they’ll buy it fully in cash tomorrow!

Real estate is notoriously illiquid and there’s no going back once you sign the dotted line. Luckily these homebuyers, majority of Millennials, did catch a great deal at the bottom of the market in March of 2020 and today if they really hate it or no longer can afford the place, real estate always has another way out.

Rent it!

Although most Millennials are still ravaged with all sorts of debt from credit cards to student loans and had to catch up after being slowed down by 2 recessions from ’08 and 2020, many are still able to manage their housing costs which is reassuring as that’s all that matters when it comes to real estate since there are multiple ways to earn income and you know it won’t crash overnight like a company.

Although the housing market has cooled off a bit since May, buying and holding real estate couldn’t be a more strategic move for a youngster.

Although home prices have stagnated more in midwestern, southern and western suburban areas where the cost of living is less expensive with more greenery, and better quality of life in terms of raising a family, pollution and and remote work positions, I believe 24 hour cities such as NYC to LA will come back hotter than ever later this fall. As a fellow New Yorker who’s been in the Big Apple throughout the pandemic, I’m seeing more tourists and newcomers than ever which are driving small business growth, traffic and rents up.

As a local, it’s easier than ever to spot a tourist these days!

How Could U.S. Real Estate Possibly Be Cheap?

Although today is still considered a good time to buy especially in 24 hr cities which went dark for the last year and are slowly catching up to raise prices, for the most of us, U.S. real estate still seems extremely expensive and according to Zillow’s photo gallery, all the ‘great deals’ are gone.

As with every country, there are certain areas that are more expensive than others, especially within dense cities which are located near transportation hubs, have a blend of diverse cultures, and offer new experiences. These high priced properties are most attractive to foreigners as they offer the most diversification possible with little correlation to the returns they earn in their home country market.

The more expensive a place is, the higher wages employers must pay to compensate workers’ higher cost of living yet as white-collar workers or billionaires who fled cities to income-tax free states like Florida, this lead to a labor shortage in cities and the pay isn’t as enticing as it once was. Now instead of Americans, foreigners are slowly pilling up their cash into big city real estate.

In order to entice workers back in, companies are offering juicy signing bonuses, accrued benefits such as extra vacation days and I even heard Pelotons at certain banks but it will take a while to lure everyone back in.

The median home price in the U.S. isn’t even half a million but by 2030 I have a feeling it will surpass that mark. Yet in other parts of the country such as in NYC or in San Francisco, the most expensive city, the average home price is around $1.5m for a studio (1 bed)!

With California being the most populated state with the largest immigrant population, highest homelessness rates and unequal home prices due to income inequality and scarce land, in a year from now, I can’t imagine how many people will be forced to flee California to support themselves and live a decently priced life. It is insane over-there!! By 2030, the only people residing there will be 1% of producers, 5% of Oscar winners, the Kardashians, Ryan Seacrest and foreigners!

Kinda Not Affordable

Due to a lack of inventory on the markets and record home buying this year, it seems like most Americans are still somehow able to afford properties since they are all taken! Yet most Americans can’t actually buy them out in full, meaning 100% down in cash which isn’t recommended anyway since borrowing on a home is one of the least riskiest things you can do to build wealth since it’s bound to appreciate the longer you hold it.

If you are a reliable trustworthy borrower, which is revealed in your credit history report, who can reasonably afford the mortgage payments each month for the next 30 years you can buy almost any home you want it’s just a matter of if it’s worth it.

But besides these borrowers, who else is buying more expensive real estate that require at least 20%+ down?

Not everyone can put 700% down on a $20m dollar townhouse in Soho.

As discussed in my latest post about the buyers of million dollar + overpriced condos in Manhattan, you guessed it.

They are foreigners!

The U.S. is a top choice for real estate deals as the U.S. dollar and debt securities are the safest investments that entice foreigners who are concerned about their own government defaulting on their credit, inflationary fears or trade tensions between the U.S. in the future.

Despite mortgage lending that was going on in 2008–2009, long term fixed rate mortgage loans are extremely attractive to foreigners. The U.S. gives access to mortgage lending and financing at incredible rates and most countries don’t even have long term fixed rate mortgages. The ability to lock in low interest rates and payments for 15–30 years is a massive benefit to investing here and many of these buyers don’t even reside here. They just lock in a great deal and move back.

The U.S. dollar is the top international reserve currency and is interchangeable across the globe making it easy for foreigners who want to diversify their holdings or park their money here in case a country one day decides they want to snag it which happens quite frequently in dictatorship-like countries when working for the government.

Buyer Up

As Americans, we don’t even realize how dirt cheap the real estate is here. Though this makes sense as 28% of Americans still earn minimum wage and 80% are on the crux of bankruptcy if an unexpected $1k charge comes up.

This is beyond disappointing considering the rich want nothing to do with helping 90% of the country instead digging into loopholes of paying nothing in income taxes and buying their 5th vacation property unable to help out those who just want a roof over their head.

Although 89% of all housing in the U.S. is owned and lived in by that homeowner, renters are on the rise at 30% and the rates haven’t been this high since 1965 according to Pew Research Center. This explains how unaffordable the market is getting.

Home buyers want to own a piece of physical tangible real estate they can call their own. It is also a hedge against inflation, appreciates over time, one of the few assets that you can depreciate as it appreciates, isn’t correlated to the market, get massive tax write offs, erase your mortgage with rental income, add on less risk for more return and you can put as little or as much cash as you please as long as you can pay the monthly mortgage back.

In 2020 there were approximately 43 million housing units occupied by renters and 79 million lived in by homeowners . Renting is usually -100% down the drain unless you are younger, don’t want to settle down yet, or have an abundance of cash flow and prefer to change up your living space every few years not bothering with taking care of a property as foreigners prefer. Although there is no return, they don’t mind testing out the U.S. real estate market first before they’re sold on purchasing properties later.

But for the rest of us it’s wiser to own real estate for appreciation and generational wealth purposes. Buy utility, rent luxury for more time back, hassle and peace of mind is ideal.

So why is it considered cheap here although it is expensive for most?

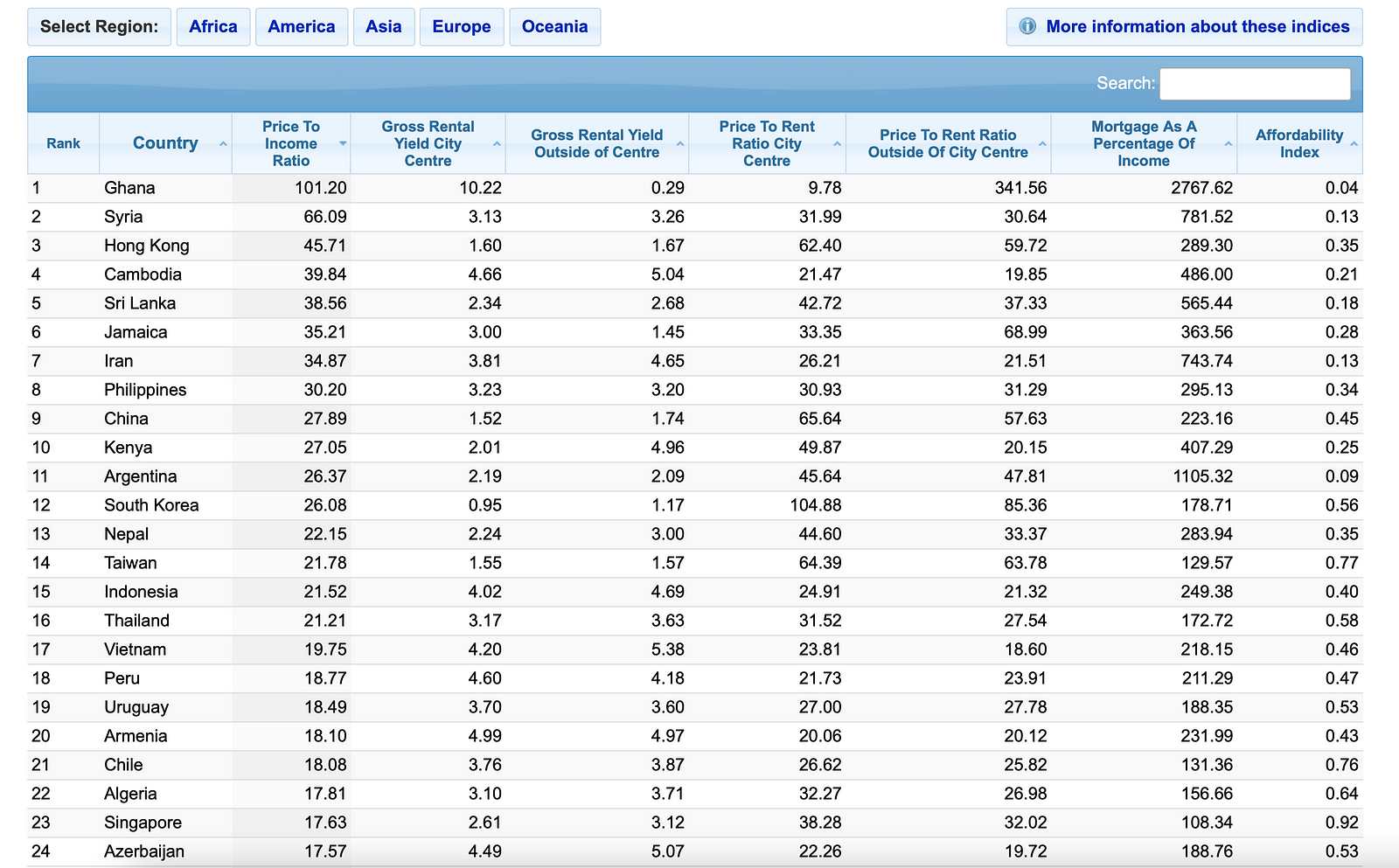

Answer: The discretionary income to home price ratio.

Down the Drain

The easiest way to see how much more expensive a housing market in a country is is to compare the U.S. housing market visual of home prices versus disposable income.

U.S. disposable income is roughly 10% higher than in any other country however in Canada for example home prices are roughly 75% more expensive.

Compared to other countries, the U.S. is arguably a leader in all things innovation, speed to market, efficiency, opportunities, better life and peace which fade into income.

So in factoring in income to home prices, it is a perfect deal especially for foreign buyers who want value, safety for buyers, and long term fixed rate mortgages.

Look Out

Although you should never jump on a decision especially an emotional and exhaustive one like home buying just to add more real estate into your portfolio and beat out foreign investors who are snagging your land, international buyers have been eyeing properties for decades now and most likely located in your neck of the woods as well.

I only recently found out that an entire apartment complex in NY that’s worth $2b in total is owned and operated by a Chinese conglomerate.

All those vacant condominium buildings or rental properties leased out that report to a management company not an actual landowner are most likely foreign owned or a U.S. brokerage not advertised well which usually isn’t the case here.

America is known to be the home to immigrants and has an open-door policy which allows foreign investors to park (hide) their money here and compete with locals to buy homes. In addition, with all this money stashed here, illegal money laundering is involved. U.S. real estate is a common place to hide funds especially since foreign households can only withdraw $50k out of the country every year and are able to easily afford $5m+ properties more than the average American can dream of.

Top 4 Foreign Buyers Of U.S. Real Estate From April 2020 — May 2021:

Canada (8% of foreign buyers, $4.2 B)

Mexico (7% of foreign buyers, $2.9 B)

China (6% of foreign buyers, $4.5 B)

India (4% of foreign buyers, $3.1 B)

Source: The National Association of Realtors

Along with illegal money laundering and parking their money in fear of a government monopoly takeover similarly to what Alibaba and other Asian companies fear due to the communist socialist dictatorship, starting connections and a business here via real estate are part of the game plan that can save many foreigners.

Compared to formulating your diversified portfolio on your own through Fidelity, real estate is all a partnership and negotiation. Strategic foreigner buyers that may own a development company or are regular families want to get involved within a community in the states to build a better life for themselves as well.

So you may be asking, how are these foreigners so much wealthier than Americans?

First off, they don’t impress anyone. For the most part. Although Asians are the largest consumers of luxury goods, they have to keep their expenses low, income high, focus on education and have a sheer amount of luck to be able to buy high sky real estate here.

At NYU we have a large international presence across all campuses and I’ve learned the best money lessons from these students, and their parents, that have saved me thousands!

Considering it is double or easily triple the cost for foreigners to go to school in the states, they must have some elite budget strategies!

What I’ve noticed from a couple colleagues that study from abroad is that they are extremely frugal, diligent with their spending, risk-adverse, focus on the books, cherish experiences rather than materialistic items, perfectly patient and not sidetracked by any schemes or deals and save diligently no matter how difficult it may seem from the outside.

Looks are deceiving folks. Teens like to look cool but inside they are cautious and know when the price is right.

Plus having a family inheritance of a couple billion always helps as well. If your family comes from the oil/energy/industrial production business in the Middle East or were heirs or worked somewhere in government, the kids are most likely set for life.

The lower the price to income ratio, the more buyers in that country are able to reasonably afford their home despite many Americans putting less than the recommended deposit amount on their home only sometimes 5%!

Yet with Americans spending roughly 30% of their income on a mortgage, this seems more reasonable compared to in New Zealand or in Germany where it is more than half!

Thankfully foreign investors are buying luxurious high rise apartments and properties most Americans cannot afford so we can let them do their business there as long as it’s not invading into our land which may cause a problem later on as roughly 4% of American land is owned by foreigners at the moment heavily represented in farmland taking up 30 million acres! That’s almost equivalent to the amount of land the largest independent land owner owns who happens to be the one and only Bill Gates!

Prices will eventually slow as real-life resumes but it’s strange to see what others across the globe see in our country as a ‘deal’!

A deal in real estate terms seems to be defined by price to income ratio.

The appetite for foreign investors is at all high demand and may be more insatiable than ever as the U.S. will continue to be a hot market as WFH is here to stay.

The terms Americans get on mortgages are unheard of anywhere else in the world and locking in a low interest rate for 10 to 30 years, no pun intended is foreign to foreigners.

Mixed in with low property valuations, overabundance in land and constant developments, there’s always positive cash flow to be made here!

Don’t feel bad if you are convinced U.S. real estate is crazy hot and overly expensive. 99.9% of Americans feel this way too. We are spending way too much time house-hunting with no luck.

Thankfully with new developments on the line begged by foreigners and regrets by pandemic house hunters from 2020, there will be more opportunities on the horizon.

House hunting is a process not a rushed decision that should be made tomorrow.

Although it may feel like a competition with foreigners, dig into alternative investments within real state if you feel stuck and still want some exposure into this incredible asset class.

Everything from REITS/EREITS in the market to crowdfunding through Funrise or Crowdstreet (not sponsored) or even farmland through Farmtogether, there are a plethora of ways to act as a homebuyer or landowner without all the hassle, tenants, fees, open houses, and negotiation!

I believe everyone should and can own a piece of real estate in their portfolio for ultimate diversification, negative correlation and financial freedom + flexibility.

Keep digging.

You’ll find the one eventually.