The hardest part about accumulating wealth is accepting and convincing ourselves that the rich do not act like the stereotypical rich.

Hollywood glamorizes the rich lifestyle full of Lambos, champagne, and fame but that is the poorest and wrong way the rich live.

In order to be wealthy, you need to establish a professional rapport of some sort, have beneficial and impactful habits, and influence others.

As tempting as the driver of money is to get everything we always dreamed of, it never works out.

Why?

Well becuase I always strived for more and once I got it, I felt worse, managed my money horribly, and didn’t see any point in trying to pretend like someone I wasn’t.

As someone who has lived in the most expensive zip code in NY all my life, I know a thing or two about how millionaires and the Kennedy family live in this town.

It’s not as complicated and glamorous as you thought.

If you want to be poor, you buy depreciating assets such as cars and clothes.

If you are a millionaire and want to stay there or rise, you buy appreciating investments such as real estate and invest in yourself through education.

Unless you are in someone’s shoes, you have no idea what they are going through, regardless if they have money or not.

It can only solve a few problems, not all.

Money Will Buy:

-Friendships & networking connections ex. via country club exposure, LinkedIn premium, or dad’s golf friends

-Pay for medical bills to keep you healthy-up to a certain point

-Temporary Happiness-Vacation or nice dinner

-Make your life easier and comfortable: No stress about the bills and technology at your fingertips

Another easy misconception about being wealthy is that you are debt-free.

Debt VS. Ownership

Debt and your overall wealth are two separate things.

You can easily purchase a car financed in debt and take out a loan to pay for clothing.

It isn’t nonsense, many people who act rich do it to please others.

We are selfish but at the same time care too much about what other people think.

If you make a decent amount per year but spend it all through an inflationary lifestyle, then might as well earn less and work less hard as well otherwise you have to keep up with the demand for your expensive style.

What No One Tells You

-Millionaires could care less about what you do.

-They read the books that no one reads and spend their weekends educating themselves.

-They make the change and take advice only if they will apply it.

-They could care less about embarrassing themselves

-They love to waste time becuase that means they are getting somewhere with their thinking and curiosity

How you spend your time is a predicament on firstly, what you will get done and achieve, and two, who you will become.

Poor people don’t prioritize themselves.

It’s not being selfish it’s necessary for long-term growth.

They please people and believe they need to attain an image to gain more friends and happiness.

The wealthy don’t focus on that.

As I grew up in this predominantly white, generational family village, I picked up on a few habits that my family has transitioned to over the years.

As one of the only immigrant families here, we weren’t surprised by this style of living since we had to do the same in order to be able to afford to move to the states.

But no one told us it was the secret of the wealthy.

Walking

It is rare that you would see a celebrity walk down the street unless they are shopping on Rodeo Drive. Especially since it is easier and faster to get somewhere on foot in NYC, in my town outside of the city, it is the same deal. If I do see cars parked in driveways, there are no Lambos or Maserattis becuase these are smart folks.

They don’t focus on impressing others. Even top CEOs such as David Soloman from Goldman Sachs takes the subway instead of a private limo for pick up and drop off.

Cars are simply to get you safely from Point A to Point B. Most of the cars I see are Volvos, Subarus, and Audis. Certainly not cheap cars but moderately priced that are safe and reliable.

Walking is also a huge part of the culture here. It is cleaner for the environment and you get your exercise in at the same time.

We utilize our time wisely becuase it is the most precious and valuable asset.

Do what is best for you, not what looks like jealousy for others.

It will serve your bank account well and people will naturally accept you more since you are more relatable.

Cooking

Believe it or not, although we value our time and want to use every second of it, cooking is a big staple here becuase it engages the family and makes us healthier. Personally, I haven’t gone to a restaurant since February and been enjoying taking the time out of my evenings to cook one meal with my family. It’s relaxing, I learn a new hobby, save money and get out of my comfort zone.

Snooping

I always felt embarrassed picking up coins from the dirtiest streets of Manhattan when I was younger but since my dad did it and felt calm, I started to tag on and know that there is no reason why it is wrong.

It is free, in front of you, and there is nothing to lose or be ashamed of.

I think of it as cleaning the earth so no one slips on a penny or dollar bill.

Behind all the wealth is a lot of invisible work that is never revealed. Maybe it’s becuase little secrets add up to big results or that our methods are just proven to constantly work.

Regardless, the first thing you want to abandon in order to grow your personality, wealth, and future is to stop assuming everyone is staring at you and stay in your own lane.

The average millionaire wears a $60 outfit and eats McDonald’s for lunch once a week. Although cooking is popular, we aren’t afraid to look for deals.

Deals are for those who know what is an investment and want a great bargain for their money.

Who cares if someone sees you shopping at TJ Maxx instead of Bloomingdales.

It is only a loss to their bank account and no one will help you after that.

Trends die quick.

Religion

I wish Thanksgiving was every day so I could celebrate how fortunate I am and plus, my birthday would be daily. The most important feeling you can have is to be appreciative of what is around you. If you are healthy, safe, have some passions/interests and with a supporting family, there is absolutely nothing you can complain about. We will always have excuses and problems always exist. I evaluate which ones will take me further and which ones are made up for attention.

Especially when I was younger, as the only child I am, I was very greedy and quite spoiled. I wanted everything that I didn’t have and wasted so much energy on what people wore and the concerts they went to, that I couldn’t concentrate on my studies or friendships. After I obtained the Nintendo and Vineyard Vines Shep Shirt, I constantly wanted more and more until I got older. It came time to clean out my closet and reflect upon the year on Thanksgiving and I didn’t have a great few years becuase I begged my parents for things that added no value to my life, expect temporary happiness until I found something else.

It took me over 2 years to sell all of my junk and now I live a minimalist lifestyle. I buy quality clothes to wear for years and help manage our properties as a business instead.

There will forever be something you don’t have or want.

It is up to you to decide when that feeling is getting out of control and cannot last any longer.

The earlier the better.

The Most Underrated Investment

The only thing that you cannot take away from someone is the knowledge they’ve learned. You can take away that diploma and resume, but not the experience one has gained from their life.

The beauty of our lives is that we all go on different paths. Even if you like, study and focus on teh same things as me, we will all interrupt and find unique aspects of the field that may or may not have been uncovered yet.

Our perspectives lead to new discoveries.

Rich people value education over food.

Poor people spend more money on tobacco and drugs than on books.

Education and practice is the way you can advance in life.

Otherwise, you can attempt to be a 1 out of a billion TikTok stars that get lucky.

Otherwise, to make it far, you have to push through a different direction than most don’t have the patience for.

Take out that good debt on student loans becuase it will certainley pay off if you believe it will.

Togetherness

Becoming the best at what you do is not a solo job.

Maybe the business world seems competitive, but at the end of the day, you have to know how to work with a team and cooperate with one another in order to achieve something.

As an only child, when starting my business this past summer, I thought the best route was going solo since I always get 10x more work done in my room as opposed to working in the library and I found that meetings are a waste of time.

Until I started encountering problems.

We will never have all the experience in the world and cannot wait for a perfect moment or age.

The hardest part is starting and reaching out.

Instead of searching through thousands of Ted Talks and Coursera courses to fix my problem, I relied on my colleagues to help me and found a co-founder.

Ask questions and become stupid.

Show your interest in others and they will like then lead you into an easier more prosperous route.

Community is a central part of living a fulfilling and creative life.

As we’ve experienced during quarantine, it is impossible for humans to avoid interaction.

Although we may hate each other sometimes, we need more unity to get work done.

Regardless if it takes more time, patience and dealing with people is key.

Money only comes once you spread it and add value.

Unless you have extra time on your hands or a philanthropist, no one has time to volunteer.

Volunteering is proven to relieve countless stressors in our bodies and make us feel better.

Servant leadership is certainely the best.

Get out, stop being afraid and you will learn more than what you expected.

So Why Does The Poor Actually Spend More?

Well, as you can see, the rich are ordinary people and their lives are not Instagram filtered photos.

They use the same products we do and live a basic life.

They feel no need to impress others becuase they are confident inside and love their work.

I wear the same white Jcrew $15 t-shirt every day (I have 6 backups) and live below my means, never trying to prove anything only to myself if I keep my promises.

If you dislike your career and are self-conscious, then you spend money.

The wealthy have everything they need because you don’t need much to survive and love living frugally.

Money works passively for them and they are constantly finding ways for it to grow not spend on the next fashion trend.

It’s not how much you make but how much you keep.

Avoid emotional spending, develop self-discipline, and don’t get excited to get another paycheck or bonus.

When you make more, you need to manage more wisely and spend less to keep it because from taxes to deductions, it can slowly disappear if you don’t know what to do with it.

No wonder WeWork is on the brink of bankruptcy. SoftBank funded them over a billion dollars and they spent it carelessly.

They would’ve been better off without that hefty donation.

Besides the mentality and poor spending habits that the lower class follow, primarily due to a lack of financial literacy and education, the bulk of where their money gets allocated is a dilemma as well.

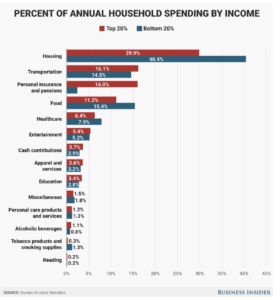

The 3 Top Areas of Spending for Americans:

1) Housing

2) Transportation

3) Food

Lower-income Americans spend a significantly larger portion of their income on housing simply becuase they have less.

High-income Americans spend more on insurance and retirement expenses.

What Does This Mean?

Higher-income Americans, not necessarily higher earners, plan for the future and understand it is uncertain.

They embody realistic pessimism.

You cannot be scared about what is coming in the future, but you need to be aware it isn’t all jolly.

By contributing funds for their retirement when they know they will have to cut back on spending tremendously when they reach that time in their life, they prepare early on for what to expect.

In addition, insurance is essential, especially when you have family members relying on you to keep them financially afloat and if any medical or emergency bill comes up, they are covered.

In regards to housing, yes it is important and a big expense for higher-income Americans as well, but prioritizing and planning for the worst is what comes first.

A fixer-upper second.

According to the Bureau of Labor Statistics, this is how household spending on particular categories compares:

Tax Investigation

As we’ve encountered with our president, the rich have more avenues when it comes to paying the least amount of taxes.

By paying fewer taxes, it simply means that you solely care about improving your net worth and self-centered ego.

Don’t bother helping the government raise more funding to support education, roads, infrastructure, etc. to make the world go round.

As a result, the poor aren’t able to afford tax attorneys, accountants, and lawyers to get them out of this annoyance of paying taxes.

As a result, they pay the most consumer and income taxes becuase every soda costs the same and they only rely on 1 income source.

The U.S. tax code is structured so higher earners pay a higher tax rate, but the ultra-wealthy take advantage of laws that are leviable to them to lower their tax rate.

It is obvious that if you make more, you have to contribute more in taxes.

There are many ways to go about this reasoning but the simplest fact is that the rich illegally try to avoid paying taxes.

These include:

Donations

Providing money to non-profit organizations for a deduction on taxes.

Equity Investing

The rich pay lower taxes because most of their income doesn’t come from wages and paychecks rather stems from capital such as investments that have a lower tax rate than income.

When it comes time to sell your portfolio, the taxes are lower than on wage income for stocks.

Owning a Business

This doesn’t mean leading the biggest investment bank. A business can have 1 employee to dozens and range from a blog to taking care of a property with tenants.

There are countless ways you can save money on taxes by charging your expenses to your “business” and getting tax right offs.

Off-Shore Money Laundering

As of May 2019, the word’s rich were stowing at least $7.6 trillion in offshore accounts, accounting for 8% of global household financial wealth which results in about $200 billion in lost tax revenue per year.

This is known as tax avoidance where taxpayers can easily, but for a hefty price that pays off in teh long run to offshore tax shelters in islands that have a small economy and can profit off of rich American’s secret money.

The rich pay a fee, anywhere from 20-100k to hide their money in islands most commonly in the Bahama such as the Bermuda triangle and smaller islands off of Africa.

Tax Breakdown

Most Americans pay 3 types of taxes: Federal, State, and Local Tax

Income Tax:

The richest pay the most in income tax.

Biden is prosing progressive-taxation which means that the rich pay a higher tax and raising the capital gains tax rate (a special rate only for investors that cuts their tax burden in half) instead of following trickle-down economics.

This will equalize the tax rate and shrink the inequality gap.

He also proposes raising the income tax rate on the top bracket of earners, or folks who earn over $400,000 a year, from 37% to just under 40%.

The upper class doesn’t make a majority of their income from their job and doesn’t have 1 stream of income. These streams of income can include owning a business, leasing out properties, royalties from a product, song, invention, book, etc., speaking events, Patreon, blog, side hustles, etc.

Rich VS. Poor Tax Difference:

Consumption Tax:

Sales tax is the same for everyone regardless of how rich we are.

Yes, the rich tend to buy more but relative to how much stuff they have and the tax they pay on that stuff, it is a small percentage of what they are worth.

To poor people, it is worth more to them becuase they have less.

Answer: The rich pay less

Payroll Tax:

Medicare and Social Security: FICA.

This provides health care and a modest income for when we retire.

Everyone pays the same but once you make over $130k, you aren’t subject to social security tax becuase it is caped and the wealthy pay less.

Answer: The rich pay less

Estate Taxes:

Rich inherit their money through their family hence estate planning

Answer: The rich pay more

Corporate and Property Taxes:

The rich tend to own businesses and more property in higher taxed states/cities/towns, etc. hence…

Answer: The rich pay more

Income Taxes:

Since the rich’s income doesn’t come from one job rather multiple investments, real estate, business etc….

Answer: The rich pay less

After weighing the differences, given the income inequality most Americans face, as someone who lives in the 10%, I’m certainly not opposed to having a tax imposed on my income as it will lead to a less divided income disperse country and a smaller burden for the rest of the population to prosper or catch up.

Yet, unfortunately, there will always be bad apples and these ways seem to still work in the best interest of the upper class.

Money = Power?