Funding your retirement nest egg will most likely be the most expensive and serious decision of your life. And it CANNOT start the night before.

It reminds me of a high-stakes competition. All your life you are building up to this moment to then see how long you can live off of your hard-earned sweat and tears.

Life isn’t guaranteed so planning for the worst, hoping for the best and preparing to live until 102 are necessary these days.

If you thought higher education was expensive, buckle in.

Blindly following the 4% withdrawal rate and buying the dips aren’t going to cut it in your 60s.

For many with stronger supplemental income streams, a greater financial buffer, and flexibility with our time, the true wealth driver, these past 2 years haven’t been a waste and in fact the greatest catalyst for our portfolios. With over $6T added in nationwide home values since 2020, more than 8% of homes in the U.S. are now listed over 6 figures.

Yet the financial wins haven’t all been spectacular for certain groups. Even last year many have regrets and made mistakes, especially early retirees and young homebuyers. Far too many Millennials rushed the decision of moving out of their childhood crib and are now looking to jump back in realizing the immense maintenance and hassle of owning a home. At least they won’t have any trouble moving out with tight supply.

For retirees, it is arguably a bit scarier situation. Luckily in this booming hot tight labor market, the bargaining power is back in employees’ hands and jobs for everyone, anywhere are plentiful! The only downside to jumping back into the workforce part-time is missing out on the benefits that make full-time employment most beneficial.

Whether or not you are stuck with needing to sell your first home after only a year or join the workforce again, this environment couldn’t be better for those two scenarios. While when it comes to rebalancing our portfolios, it’s certainly not as rosy.

Whether you are looking to retire fully on crypto, not recommended at all, or through the diversified income streams, ventures, and portfolio(s) you’ve generated all your life, it’s important to remember that the higher the withdrawal rate, the more income, lower net-worth you have in the long run.

When you consider your net income, risk tolerance, cash flow needs, longevity, and time horizon, it may be prudent to stick to a hefty balance of risk-free assets and alternatives instead that you understand. As they say, don’t bite off more than you can chew and crypto certainly doesn’t align well with that sentiment.

Old Crypto

When the financial community including myself heard the news that Fidelity, the largest nationwide retirement provider will be offering crypto for retiree’s accounts, I was shocked. Given that it isn’t a proven asset class yet with a short dangerous track record, this can be disastrous for the future generation of retirees.

Luckily for current grandmas and grandpas, or those aged 30 that already regret following the FIRE movement, I’m not too concerned since they presumably already planned for retirement years in advance and most likely weren’t aware in 2009 Bitcoin would take off for no reason.

Other institutional asset managers most notably Vanguard and Charles Swab are pragmatically hesitant and have pulled back from the noise. Since all of these brokerages offer free commission trading, payment for order flow isn’t top of mind unlike retail trading apps such as Robinhood and WeBull where they are incentivized to encourage their users to invest in the most volatile speculative stocks because they earn more commissions from more trading volume, not from the most quality safe-haven assets that you can rely on in retirement.

Retired Generations

It’s never too early to start planning for retirement. It’s not as glamorous as you think so plan for the right reasons.

If you think it is for older folks, you are already too late. If you’re like me in college, no one should tell you NOT to open a Roth IRA in your 20s. If they do, they are a fool, since, at the end of the day, or your life, it’s always better to live with a bit more than a bit less. Time is on your side and is one of the few things in life that cannot be purchased.

I can only imagine how much our purchasing power will be eroded by 2095 when I’ll be 95. Staying diversified, starting early, and taking advantage of the 8th wonder of her world, compound interest, is in your best interest earlier than later.

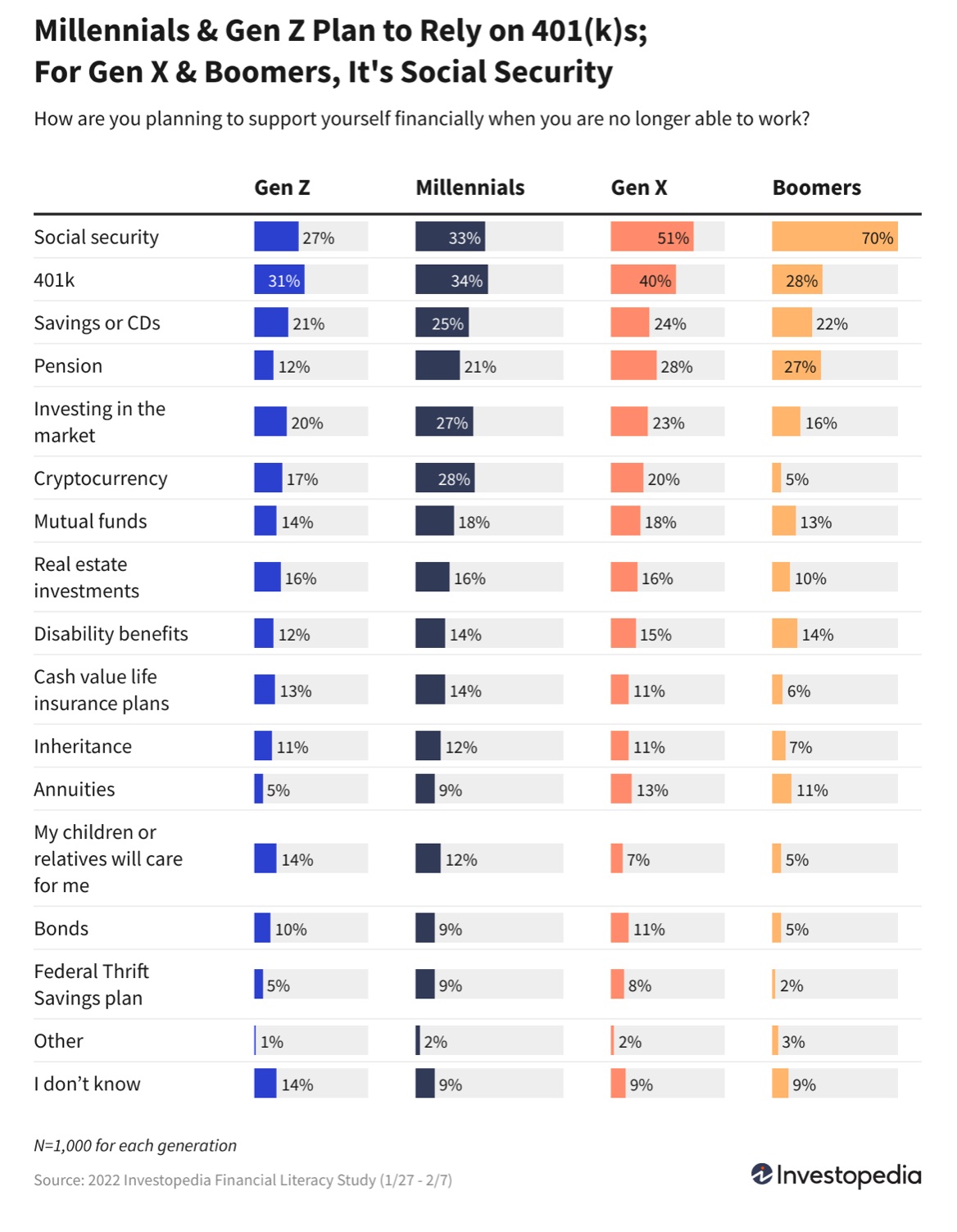

According to Investopedia’s retirement holdings, to no surprise, Gen Z and millennials plan to fully rely on their investments and social security. I know a couple of millennials myself fresh out of college living solely on their investments.

Certainly not the most ideal situation in this correction! Nonetheless, at least it builds endurance and flexibility for the long run. You’re always walking on eggshells though.

There’s only so much you can save but returns are infinite here!

Social security to annuities are most likely foreign to most Gen Zers as they are stable guaranteed sources of income that are planned for later on in life.

Although millennials have gone through their fair share of hiccups starting with the 2000 Dot-com crash to 2008 Housing Crisis, brief collapse in March 2020, and current 2022 correction, their 401(k)s and Social Security seem to be top of mind.

As the second most savvy generation behind Gen Zers, when it comes to cryptocurrency for Millennials, it is the highest asset class they plan on taping into in retirement at around 28%. I’m very concerned about this high rate. At least Millennials will be the main beneficiaries of $2T+ assets handed down from Baby Boomers that they can benefit from.

But in any case, especially for the financially illiterate and early retirees, a windfall to crypto tend to be more dangerous than helpful.

Even Gen Zers have become more skeptical! I’m assuming due to my massive influence in the personal finance space over the years?!

The most likely reason is that many are still younger than 18 when they can open an investment account. Standing at 14% for “not knowing what their backup will include” (at the bottom) for retirement makes sense since it is a ways away yet never too early to start planning for the most expensive period of one’s life where you rely on your whole life to support you then!

Crypto — That’s It

Luckily Fidelity isn’t jumping too far and not allowing retirees to invest in more speculative high-flying crypto, non-fungibles such as NFTs or Dogecoin.

Who knows when that might change! Tomorrow, tonight, never…?

Regardless, just because it is served, doesn’t mean you need to eat it. Also at a buffet.

When it comes to investing, overcoming your internal mental hurdles and calming your inner emotions, are most prudent. Don’t equate emotions to decisions. Sticking to your intentions and values are better than following emotions since investing isn’t intended to be a rocky road or go through stormy waters. It is a long-term vehicle.

In that case, I always suggest putting no more than 10% of your net worth into any asset, venture, or class. This recommendation comes particularly handy with Bitcoin retirement accounts.

Employers will determine what percentage of assets their employees can allocate to Bitcoin, up to 20 percent imposed by Fidelity. Yet these accounts always come with a catch. Not only is volatility something these risky retirees should expect but hefty fees as well upon purchase not just realized gains. Accounts with Bitcoin will charge fees of as much as 0.9 percent, which is much higher than traditional retirement accounts.

There’s always a price to pay for more risk. It is logical one expects more for giving up more but we cannot always be certain that will pan out, especially when fundamentals and intrinsic value aren’t evident within cryptocurrency.

Whether you are dreaming about retirement or realizing it’s coming in no time, diversification and cash will always be king.

If you don’t understand it, don’t plan to live off of it. Your life is really on the line this time.