For those who didn’t graduate from middle school yesterday, the Roaring Twenties, 1920’s was a decade of economic growth, prosperity and exuberant hope in the United States after a swift recovery from wartime devastation and lack of economic activity during World War I, the “Great War’.

This caused a boom in spending to inflation, rapid growth of consumer goods of automobiles and electricity and the activity even spread beyond the land of freedom across the sea to Asia and Europe.

The 1918 Spanish Flu was almost identical to Covid except for the main fact that this time around, Covid is much deadlier as the flu only killed about 50 million people representing about 6% of the population. Also, let’s not forget that this was the 20th century when technology such as the internet, Clubhouse, Andrew Cuomo, onesies, major vaccine rollout and infrastructure were not implemented yet.

If the Spanish Flu had rolled around today, it would’ve been similar to Influenza, the common flu which still lurks today but is much less deadlier and contagious, especially as we’ve taken more proaction over Covid.

The Roaring Twenties was time for celebration. Instead of families dealing with cabin fever, mental illness and too much banana bread, they were free from the war.

Prohibition, indulgence in new styles of dancing and dressing and the rejection of moral standards within the flappers and Jazz Age came alive.

It’s human nature to become rebels and feel alive when we go through something hard.

It’s a sign of the times and a feeling of relief, something we all are waiting for these days as Roaring Kitty has got us all riled up!

Emotional Rollercoaster

So what are we really waiting for? Throughout this past year, I’ve felt embarrassed and almost ashamed for having fun but the truth is, we all need to to get through it.

I haven’t left my Manhattan apartment in a year, taking weekend trips with a few close friends and family but otherwise, stuck in a skyscraper with a pretty spectacular view but after a while a boring one with a few sad lights of New York.

Although this city is known as the place that never sleeps, New York has officially slept and vanished for a couple months.

Only now are we seeing Millennials and those who couldn’t afford but always dreamed of coming to the city flock here in hopes of getting the best deals they could ever get on a studio apartment for $2k equivalent to a 5 bedroom home in Atlanta.

And that’s an epic deal for the city.

New York is certainly not dead, it will just take a while for it to come back, since it mainly relies on commuters, WFH(omers) and tourists to fill its streets and cabs.

Trying to make the best out of a tough situation is okay to do. Having bonfires with a close goup of friends or playing a game of ping pong is fine but gathering in large groups to celebrate and pretend this pandemic isn’t happening doesn’t feel right to me.

What’s for certain is uncertainty but we do know, according to Dr. Fauci and history that this will not last forever. So we can buy that bottle of booze and put on our office outfits pretending its the Roaring Twenties at home on Zoom. It’s tough for everyone but hope is all we have.

Ushered or Shuffled 2021

2020 feels identical to 2021 except for a new administration in the White House which evidently translates to more ease, a lower case count and higher interest rates as the dems love taxes.

You may ask, does the stock market do better with a democrat or republic president?

Let’s examine.

During a democratic presidency:

-Emphaisze working to pay for Uncel Sam’s paycheck and give more to gov’t

-Higher taxes

-Poor and middle class = priority, corporations = enemy

-Incentive to contribute to community and help those in need

-Break the wealth inequality gap

Republicans:

-Laissez fair approach, work less to pay less

-Community isn’t evident, everyone on their own

-Tax havens=best friend for corporations

-Pay for individual health care, banish OBAMA Care

-Less ease and more turmoil due to havigna rushed approach ex. Trump and Nixon

When it comes to the markets, investors become worried if the election will impact their portfolios over the short term but not to worry because as I always state, the market always rises yoy(year over year) if you’re patient.

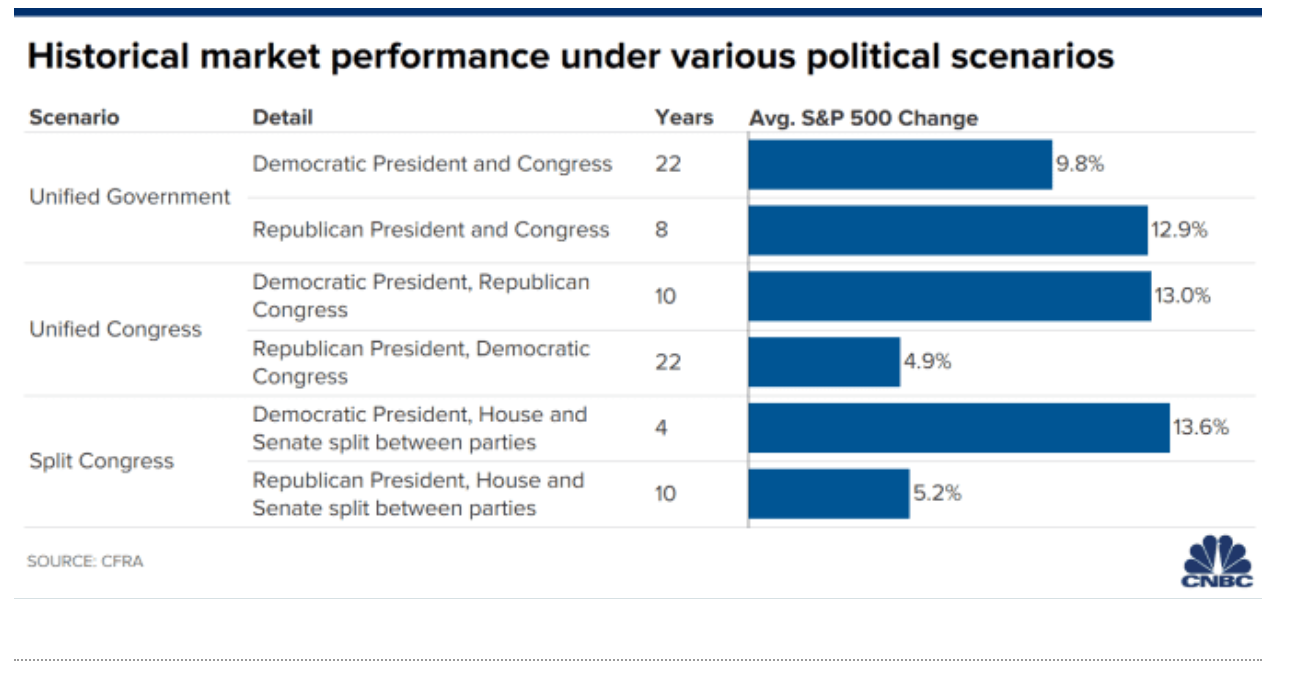

According to history, which is all we can count on since we know it repeats, stocks actually do well regardless of which party controls the White House or Congress.

Since the blue wave hit the majority in the Senate to win the White House and keep control of the House, surprisingly the start of the year was rocky as uncertainty about herd immunity was on the rise but slowly disintegrated after the trading frenzy with Reddit investors and Robinhood.

Presidents and My Money

Data over the past 78 years shows that party control over either chamber has relatively little to do with long-term changes in the broad S&P 500 stock index.

“At least 90% of [our] portfolio strategy would be identical under either win,” Lee from CNBC said in a note on Oct. 6. In either case, Lee predicts the outcome of the election will be bullish for stocks.

Overall, there’s no need to worry because what’s really effecting the stock market includes:

-Vaccine rollout

-Herd immunity

-Economic stability

-Stimulus package

-Fed rates and inflation concerns=keeping low interest rates=more buying/borrowin while it’s cheap

-Rising 10-year yield(based on market) which effects the Fed’s deciions(based on officials on our side)

-China and US relations

-Unemployment

-Texas-oil, gas and water=homelessness and death on the rise

Biden has come in with a lot during this presidency and I commend him for sticking with it as the oldest president. Although I don’t want to get political, as you can probably tell as a life-long New Yorker, I am in high spirits that the Roaring Twenties are soon to come alive earlier than later.

Hope on the Rise

It’s all we got.

I believe we may see some sort of normalcy towards the end of 2021 that’s also when I predict interest rates to increase as saving will be on the decline and spending on the incline.

Biden didn’t affirm that Christmas will be different this year but he certainly hopes to with the projection he has set out although Texas and the wild weather is slowing down the vaccine rollout.

Ultimately the main predictor is the vaccine distribution rate. It can get confusing and frustrating especially since you have to take 2 shots over a period of a month to become fully vaccinated otherwise you might not be protected and some people, especially elders are opposed to getting it.

I asked my grandma the other day why she was scared and reused to take the vaccine. She said during the 1950’s, the virus was actually inside the vaccine to let your body become adjusted to it. But that also meant most would have mild or severe reactions but at least it did prevent illness in the future. Since you can’t teach an old dog new tricks, it took her a while to understand what’s going on in 2021.

Although I’m not a vaccine expert, this method has stopped and now vaccines are made out of entirely different chemicals, not related to the disease itself.

Spending and Blow Out 2022 Concerns

It’s hard to fathom going out without a mask and enjoying a concert, but it will become the norm one day, as people are social creatures and enjoy being around others.

I can only image the amount of traveling that will kick in. I predict airlines will go back to break even next year. Traveling and gaining experiences is the best medicine.

I wonder if there will be ever a time when people will not care about their homes anymore.

Will there be a real estate bust and will consumers reverse their healthy spending and investing habits they prioritized during the pandemic?

We don’t want all that hard work to go to waste!

The U.S. savings rate soared during this pandemic. In May of 2020, it already hit a record of 33% as more women, blacks and Hispanics are invested due to financial literacy and great rates and brokerage accounts were opened at record rates.

Can this last?

Will people be addicted to living life again, going on excursions, cruises, clubs and frivolously spend and reverse their discipline they created this past year?

I hope not.

That brings me to Roaring Kitty via the stock market craze. No, this isn’t a kitty and has nothing to do with the Roaring Twenties.

He’s just an ordinary middle aged dude Reddit trader part of the WallStreetBets forum that has manipulated the market last month.

Although the trading frenzy has slowed down with GameStop, BlackBerry, now BitCoin and Dogecoin are at a new record high of 50k with a market cap of a trillion.

I’m concerned for those that believe trading this way can last forever and is legal. Sure he’s made great returns, $48 million with this cult like following but manipulating the market and going against hedge funds is hard to beat long term.

It’s only a test of time to see what happens next with the Financial hearings and if Roaring Kitty will end up getting sued but all we know is that short squeeze investing isn’t responsible or based on fundaments and as a result, cannot last especially when we release our masks and go into real life with less time to spend day trading.

People won’t have time to manipulate markets, stare and replace trades intraday all day and deal with headaches selling and buying frantically following social media.

Our phones will be our worst enemy soon as being present in the moment in the world will come back. Maybe the stock market won’t even grow as big as expected as there’ll be less volatility and emotion baked in as everyone’s enjoys life again soon.

It’s only a matter of time until we get back to reality but what I can say is that following the 3Ps: Persistence, Patience and Positivity are the best rules to follow during this time as the Roaring Twenty Twenty Ones or Twos will certainly be better than 2020.