How would you describe the last year and half in the markets? (Besides Black Friday)

Frothy, over-concentrated, speculative, peculiar, exuberant, possibly volatile?

It’s important to keep in mind during any massive bull rally, especially with the one we have lived through for 13+ years till today, a prudent investor should never mix skills with momentum, luck, and overall general activity in the market.

One of the greatest opportunities about investing is that everyone has a chance and does not have a crystal ball. No matter your prior experience or past trades, you are only as good as your last trade. Whether you hold an MD in day trading or a PhD in technical analysis, it’s extremely rare and almost impossible to consistency outperform and beat the market. Sure, if you got into a position early on and stuck with the company when no one except for you and the founder believed it could thrive and with some hard-core patience it became a unicorn within a few decades, you got lucky based on hope and prediction, not on analysis, stock charting, or DCF forecasting.

Staying prudent, humble, optimistic, and realistic are key in the markets and in life. These traits can help you fast-track your success and take you much farther than where you intended to end up. And remember, you aren’t smarter than the markets nor should ever fight the Fed, the greatest economic indicator.

Billionaire and Beyond

With high-flying valuations, excess liquidity in the markets, pent-up demand, SPAC and IPO bonanza, crypto to dogecoin to meme stock madness, and a hot housing market, these days more investors are conflating brains with a bull market. My generation, GenZers are guilty of adopting this way of thinking the most since they have never witnessed a bear market as INVESTORS. They believe booming random asset classes and speculative investments with no fundamentals are the norm or due to their freakishly remarkable skills. Sorry to say but less than 1% of us are freakishly remarkable and it isn’t a precursor for success. Willpower and staying diligent within your habits are much more useful.

The brief correction, more like a sharp short recession from Feb to March 2020 when the markets declined ~35% was the first time this generation witnessed a meltdown with their money. Thankfully the markets trade in today’s price in future time and with excess pent-up demand and an optimistic outlook, traders need to be hopeful. Uncertainty to the market is like a bad rash so it tries to block it off as much as possible. With the Fed’s dovish measures of pumping monetary stimulus into the economy, Americans have been flushed with savings, rock-bottom interest rates, and prioritized building robust portfolios and startups with extra time and ‘play money’ into their pockets.

The pandemic was the most opportune time for the upper class to grow their wealth holdings even more and especially the top 10%’s. They capitalized on their time and resources the most. With the WFH boom, EV craze, home media/furnishing/fitness, real estate market, and VC and angel investing downtime, investors of all kind had their big-break. And with all this ‘play money’, stimulus, and roaring market, came more opportunities to grow wealth in an easier, frictionless way that no one could wrap their heads around.

With over 724 billionaires in the U.S., the most out of any country, the U.S. paves the way as the wealthiest yet most politically and economically divided country in the world. Out of the G7 nations, we are the most unequal advanced industrial nation in terms of wealth and vote. We may be rich at the top but poor throughout. This past year we’ve seen a resurgence in wealth, the top 1%’s climbing collectively to over $13.1 trillion and now own more than 50% of the wealth in this country. Majority of this wealth was funneled through the stock market because at the end of the day, you can’t be truly free without a portfolio of some kind.

Big Tech, at home stocks from at home fitness to social media, home media, food delivery, technology, financials, home furnishing/modeling, pharma, eReits, industrials and new asset classes from crypto to NFTs came into existence. This caused frothiness, lofty valuations, and more billionaires. Fortunately, with over 2/3rds of Americans reporting they are in a better financial position than pre-pandemic, millions evaluated their circumstances and not only invested in themselves, their time, their properties but also their future.

In this past year alone, there were over 3+ million accounts opened across various brokerage platforms and financial literacy has never been hotter. This can be good and bad. I certainly encourage one to invest earlier than later but with precaution and limitations. Swing day trading isn’t the way to go to let your money work for you long-term. 18 yrs old may or may not be old enough to break free from the custodial account especially after the retail trading platform boom in January. Don’t even get me started on social media. There’s no FOMO that exists or isolation for not being plugged in. Companies should bump the age to 16 not 13 to join this lethal tobacco weapon that social media has become!

Profitability Isn’t Hot

With excess liquidity in the markets, angel investors are betting big on young startups, especially within the ESG, AI, FinTech and Big Tech space as WFH is here to stay.

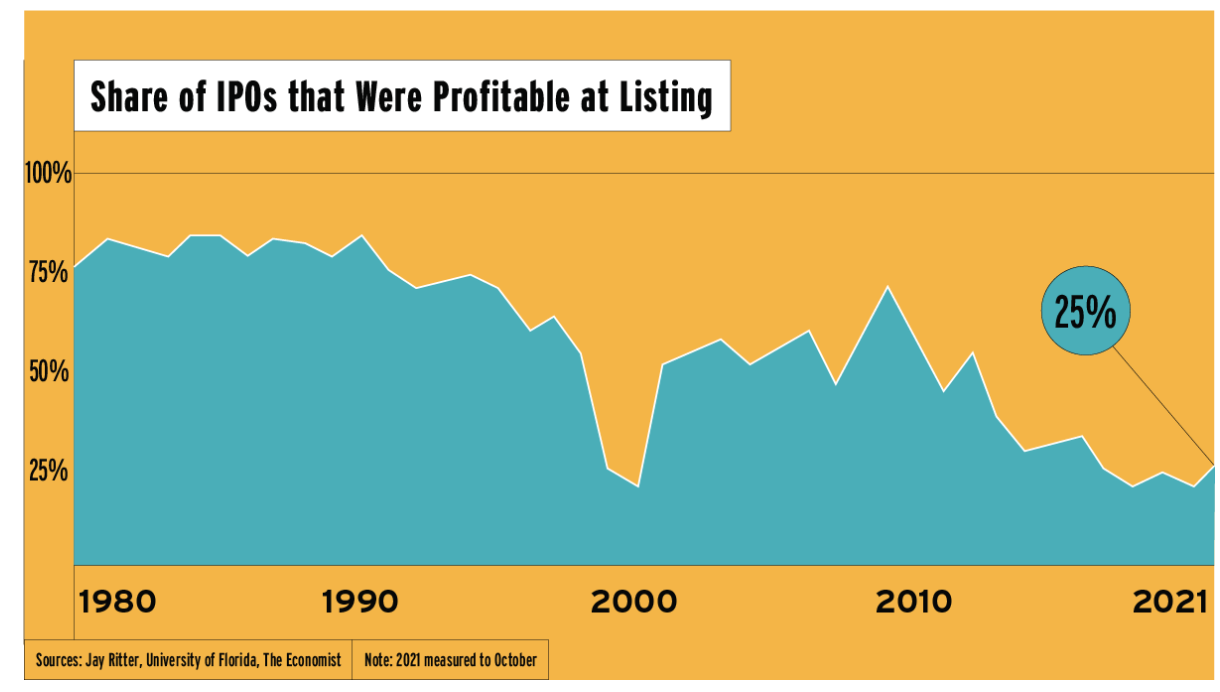

Believe it or not, only a quarter of this year’s IPOs were profitable! During the Dotcom bubble when indebted internet companies made loft promises and most didn’t deliver on them, companies played it safe and investors focused on companies with proven fundamentals instead of betting on long-term prospects. Compared to the 1980s, over three quarters of companies were profitable back then.

Too much time + money + lack of knowledge = exuberance, premiums, and lack of reasoning. At least this is better than deflation.

The billionaires, mostly founders of these profitable, but also unprofitable high-flying stocks profited handsomely due to future outlook and expectation. By going public, you rely on your shareholders to keep you afloat. Having your net-worth directly tied up or be a large part of your stock price’s movements is frightening since volatility is part of the game but seems worth it when the market continues to rally and detach from fundamentals.

Even with little production and no cars on the road, not to mention no cash flow, EV truck maker Rivian, and car maker Lucid current market caps are greater than traditional car manufacturers such as Ford and GM that have been in existence for centuries earlier due to their ‘coolness’ factor, newness, and digital transformation.

What’s certain is uncertainty. Although it may be hard to spot a discount these days, never loose sight of what the future can hold and how your predictions can be enough to build your nest egg or for some, land them a coveted spot on the Fortune 500 list. No dream is too big.

Apparently zero cash-flow isn’t standing in the way and investors are investing in your ability and vision.

Never be discouraged to build something that doesn’t seem realistic today but promising and questionable in the future. The market is where dreams and the future come alive.