The companies that have hit the coveted trillion-dollar market cap (multiply the total number of a company’s outstanding shares by the current market price of one share) are obviously well-known and it is guaranteed you have used at least one of their products today alone.

You could argue it’s luck, timing, the founder, funding, their entrance to YC but believe it or not, what truly separates them isn’t any of those factors.

Scarcity and Trust

When you identify the hottest new crave for NFTs (non-fungible token-blockchain pieces of artwork, videos, audio, other digital files), it is all based on scarcity.

People want what they don’t have and when there is only so much of something, they want it.

The artwork that is sold by Beeple, an NFT artist, it isn’t Picasso’s paintings that are hidden away in a cellar once purchased. The buyer simply buys it online and it is still accessible for the world to see. Surely the reason why someone would purchase it is for the prestige and possibly re-sale in the future, but it is mainly because there is just one out there.

Remember in March 2020 when there was a massive toilet paper and hand sanitizer shortage and people were clamoring to purchase it in desperation despite another store across the street housing it in bulk and or just needing to wait a few more days until a surplus again?

That’s how these trillion dollar behemoths have made us feel. Their products are juicy, invaluable and precious that every time a new one drops, cough, cough, Apple, there are lines out the door, waitlists that have broke the system and anticipation like it’s the first ever product.

In tandem with scarcity, trust aligns directly with it. If something is scarce, you believe it is valuable no matter how poor quality or cheapish it might be. I’m not saying these companies lure us into believing something that isn’t true, it’s just that they are excellent marketers and these products are gauged in price.

It starts with being relatable, personable, having a story and meaning along with a reason.

Sure, you might have a mom and pap shop that sells boogie boards and have all the reasons why the world should buy your boards. You could go on to sell thousands per day and reach a high market cap but what’s stopping you is trust. Trust that the boards will last, get better overtime, always help the users and they will NEED it to make their lives better and easier.

When we compare billion dollar companies to trillion dollar ones, what stands out are these two characteristics of scarcity and trust.

Sure a little bit of luck, founder’s experience, grit, funding, etc. doesn’t hurt but Amazon beat out Walmart, Google crushed Yahoo and Apple destroyed Samsung not for their products/services but for their compelling, raw and sincere message.

“People don’t buy what you do, they buy why you do” Simon Sinek

When It’s Hit

When everyone in your household has to have at least 2 of the products, you know it is big.

After all, great brands don’t attract customers, customers are attracted to the brand.

Any firm that approaches $1T in value has unleashed incredible potential, become a dominant player and has created leverage in the industry. They are usually the top performers and take up a majority of market share in that industry.

What stands between the laggards and winners isn’t necessarily their products, vision for their future or price range, it’s the simplicity, brand and usability to make lives easer.

So let’s identify what these trillion-dollar companies have in common and the steps that got them there because there can only be so many companies that can reach this mark.

Lesson #1: Everything takes time and longer than expected

This is not just a lesson you need to take into consideration when building a trillion dollar company, it’s a message a student to barista needs to acknowledge when perfecting their craft.

Good things come to those who wait. Don’t be greedy or expect a paycheck in the first month.

Expect to loose money, fail and continue.

Let’s see how long you’ll last.

Lesson #2: We overestimate how much we can do in a year but underestimate how much we can do in a lifetime.

When we embark on the path of entrepreneurship, it is a daring and unrealistic one. We immediately want to resort to filing for an IPO, be in the press on the front page of a magazine and take in all the glamour but we must acknowledge that sometimes hard work leads to nothing and those who are truly ready for this wild ride of entrepreneurship, don’t let anything stop them.

These companies in this exclusive 12-digit club have embraced that head on. If you’re starting something, expect it to take long, not provide any immediate result and most importantly be something you can sustain.

Resist short term gains for long term results.

Lesson #3: It Can Never Be About The Money

If it is, get out now. This isn’t a one hit wonder or rich quick scheme. It has to last and in order for it to do so, you must embrace the challenges that will come because there sure will be. The more you want, the more challenges you have to face. Rejection is redirection. Look up how many rejections Airbnb’s founder received from YC. That should give you a better outlook on life.

That’s part of the game so be prepared. Money is a byproduct and will naturally come once you produce impact and deliver a true result.

Lesson #4: People use these products daily for a multitude of reasons

In order to be best suited for any environment, demographic and be used by the largest audience and diverse customers, it must be accessible to all and something that customers can’t take their eyes off of.

As we’ve witnessed with social media, video sharing platforms and retail trading, these platforms initially intended to either ‘democratize finance’ or ‘connect with people across the globe’ until they spun out of control and now all we pay attention to are metrics, gambling or following which has lead to addiction and a variety of mental health consequences.

Ultimately you want to create a product that will stir you away from that as possible, even if you don’t see it happening in the future. Brands fall into rabbit holes that are hard to get out of.

I believe Google is one of the few global businesses that isn’t necessarily addicting as opposed to Apple which can easily be especially every time there’s a new product launch.

Lesson #5: Defensive and Blue-Chip Stocks

To tell if any company is fool proof, see how well or poorly it does during a recession.

As we’ve witnessed during the covid pandemic, the leisure, hospitality and travel/tourism industries have all plummeted as social distancing and lockdown went into full affect.

Although a virus like this only happens every couple centuries, it is important to keep any downfall or negative consequences in the back of your mind when starting a startup.

Plan for the worst hope for the best, especially with your own personal finances. Having a cash cushion is necessary to stay afloat for you and a company.

Luckily despite the losses during the pandemic, analysts and the economy have faith that the large brick and mortar stores and billion dollar businesses such as cruise lines to airlines will recover swiftly as there is already an uptick in travel a few months after the vaccine rollout has begun and gauged prices will most likely take affect as many are willing to pay whatever it takes to travel and experience life again.

While e-commerce, technology/telecommunications, real estate, banks, the healthcare and ed-tech spaces have all boomed as we all transitioned to online. For the housing market and banks, interest rates were at all time lows which lead to a buying and borrowing spree with low inventory and ticked up prices for homes.

Lesson #6: Mostly Free and A Variety of Price Ranges For All

The worst thing you can do is charge a base fee for a seasonal product.

Although most small businesses thrive this way, they are impossible to scale.

If you offer a variety of prices and even free products, what most and only technology companies do such as Microsoft and Google, this paves the way for incredible success down the road.

Just because something is free, doesn’t make it free. Stop being close minded and start finding out how these behemoths are making money off of their free services most notably through advertising, subscriptions and selling user data which gets them into trouble but also makes them big bucks that helps millions of small businesses, entrepreneurs and those willing to get their name and product heard out there through advertising themselves.

When something is free, customers forget they are they are the product and don’t mind it. Free is probably the best option. Anything with a price tag takes convincing.

Lesson #7: No Prerequisite or Upfront Knowledge is Needed to Utilize Or Be A Part Of

KISS (Keep It Simple Stupid). A company wants you to believe you are brilliant so they make it as easy as possible.

If a toddler can’t figure out how to use the product in 10 minutes, then no adult should be able to bother using it.

With our short attention spans and instant gratification these days, the marketing world has caught onto our ways of being and has attempted to make every single product available and easy for anyone to use.

Typing in words into a Google search isn’t difficult.

Opening an iPhone takes 2 seconds with a password or Face ID.

Formulating a spreadsheet to your liking to as advanced as you please is your choice.

Investing in BitCoin is easier than pouring a glass of water and then spilling it.

Lesson #8: The Services/Products Genuinely Make Lives Easier Not Just Clutter your Life Full of More Stuff

Online is great. The minimalist frugal lifestyle is coming back in full swing because of it. It was never truly popular until technology came into our lives and everything we used to carry before (record player, CDs, books, wallets, contact list, etc.) is all dead!

Yes, there are still some hoarders out there that have some sentimental attachment to everything they own, but there are a lot of people who have become more interested and attached to the trend of, ‘less = more.’

The only things we take with us when we leave our homes these days is our phone and maybe wallet if you aren’t savvy enough to already have it a part of your Apple Wallet.

Sell products that benefit lives and keep us together, not spread us apart and keep us cluttered.

Back to Business

Obviously, there aren’t many companies in this line-up because well, it’s quite a lot of dough.

Yet you would probably be surprised if I told you that it took a few decades for these companies to become this large. It certainly didn’t come overnight and with only a handful of ventures reaching this milestone, there are hidden secrets that are found in all of them.

Yet, most of them followed the same regime and kept it simple, relatable and basic to add the most value.

Let’s identify who they are:

Alphabet

Alphabet is Google’s parent company.

Google’s value constantly increases and has a variety of diverse products that allows them to continuously outperform all their competitors.

Google is surely a staple part of everyday life and with over 5.4 billion searches per day with 90% of the world using Google, there’s nothing that you cannot do with their search engine!

After all, the easy part if getting onto Google, the tricky part can be finding your answer if you’re not concise and short!

They’ve been able to simplify their business model by focusing on what they do really well. They want people to find reliable information fast and in a seamless experiential way.

Apple

This is the first US company to become a trillion-dollar company in mid-2018 and ever since it has only beat expectations, especially during this remote environment where I personally upgraded all my systems, purchased a desktop and laptop and had to upgrade to a new phone case.

Apple’s main product is the iPhone. Despite facing many challenges including overcoming the brink of bankruptcy in 1997, this tech giant lead innovation forward with its iconic, simple brand.

Similarly to Google and the rest of the trillion dollar behemoths, offering a variety of products and services was key to Apple’s success.

From iTunes and the Apple Store to watches and AirPods, constantly upgrading to offer increasingly more expensive products, this is how the company has remained in the top seat in tech.

Maybe it’s just me but I feel like Apple can put any price on anything and people will still buy it. They were in talks of making the iMask for $500 and the price was justified by a more softer fabric. That’s it. No tech or AirPods attached.

You know you are big when you can sell anything for any price.

Microsoft

Ironically, Microsoft has dipped in and out of the trillion-dollar group a few times. Currently it has a strong focus on cloud computing and this helped drive the company’s shares to the highest it has been since 1991 before the venture became the 3rd US public company to be valued over the trillion-dollar mark.

It is the world’s largest software and a household name. Anyone in any industry has used Word to Powerpoint and Excel.

Amazon

It is relatively an oldie in the trillion-dollar space having reached the golden level five weeks after Apple despite being founded and kickstarted after the dot-come bust, a few decades after Apple.

Along with its diverse product offerings from AWS which accounts for more than half of Amazon’s revenue, it’s e-commerce business and newly formed position in the healthcare space with Amazon Pharmacy has lead it to grow its vision further.

BitCoin?

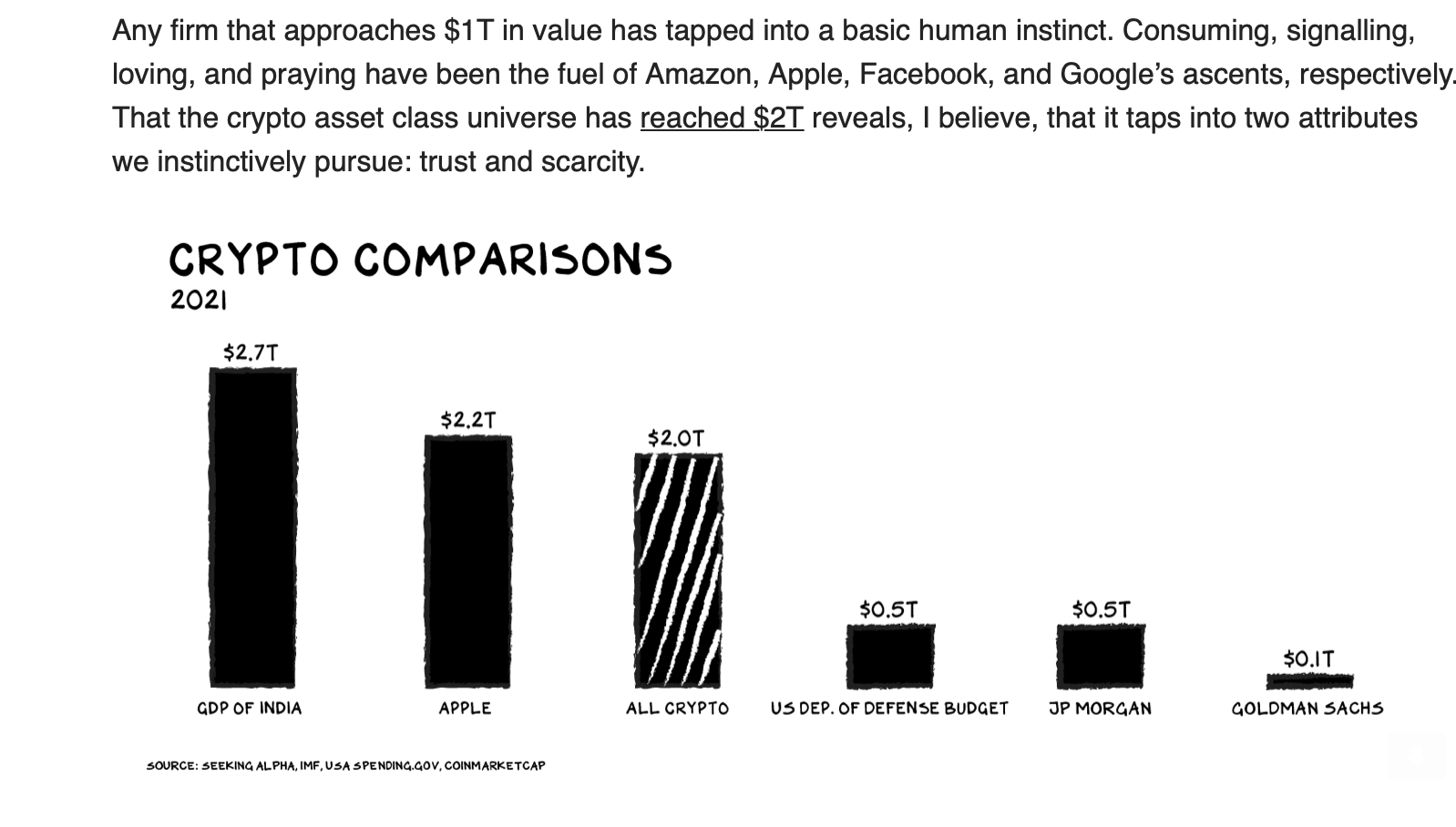

Technically not a company but there are companies such as CoinBase who’s IPO is set to launch later this week of the 12th of April 2021 is all about the buying and selling of cryptocurrency. The cryptocurrency market capitalization hit an all-time peak of $2 trillion on Monday, April 12th.

Strangely compared to the Crypto asset class universe that has reached $2T, it is more than any big bank and getting closer to beating out Apple, an almost 40 year old company.

BitCoin is the largest of the more than 6k coins tracked by CoinGecko is worth more than $1 trillion alone. The five next biggest coins — Ether, Binance Coin, Polkadot, Tether and Cardano — have a combined value of about $422 billion.

With more companies pouring billions of its reserves into Bitcoin and accepting it as payment, many investors are still skeptical of its rise, how far it will go due to no regulation and extreme volatility swings.

There’s no doubt these companies are simply amazing, diverse, offer a variety of products/services and took a long time to get to this point. They have a cult following for a reason. It is truly a badge of honor but it doesn’t mean they will alway keep this ranking as we’ve witnessed with Microsoft who’s been in and out of this group several times.

With the expansion of digitalization and this remote world, who knows what will happen next but all I know is that when the next AirPods come out, my name will be on that waitlist.