During a crisis, in most cases, the rich get richer and the poor get poorer. Unless you tied all of your net worth into real estate not leaving a cash cushion or earned any gross income through bonds, dividends stocks or a stable 9–5 job during the 08 housing crisis, then you would’ve been crushed. But this time around, you could easily get by with having all your net worth tied up into your property because locking in a great deal and overcoming the ravenous demand for a suburban piece of land has never been harder.

For most of you youngsters reading, my purpose is to make your life extra easy by simplifying what most of us cannot and do not want to try to comprehend in the news. The important things that we actually need to know aren’t found anywhere so we are stuck searching and researching for hours on how to make money and take advantage of this free time. I don’t blame you. The internet doesn’t help at all. But also don’t feel the pressure to work because you are at home 24/7. Breaks are absolutely necessary. They never mean you are lazy, rather there to refuel you.

Luckily, these days, many young Americans have found themselves in the most prime position to take charge of their financial health, pay off those pesky student loans or Gucci bag debt that’s been looming on their credit card balances since last year. Thanks to the government, we’ve been able to take advantage of these opportunities, regardless of your income.

Any students, regardless of age, gender, marital status (hopefully not yet), income level, location can be provided stimulus. This is a great way to start building your own supplemental income just from the government!

Stimulus Direction

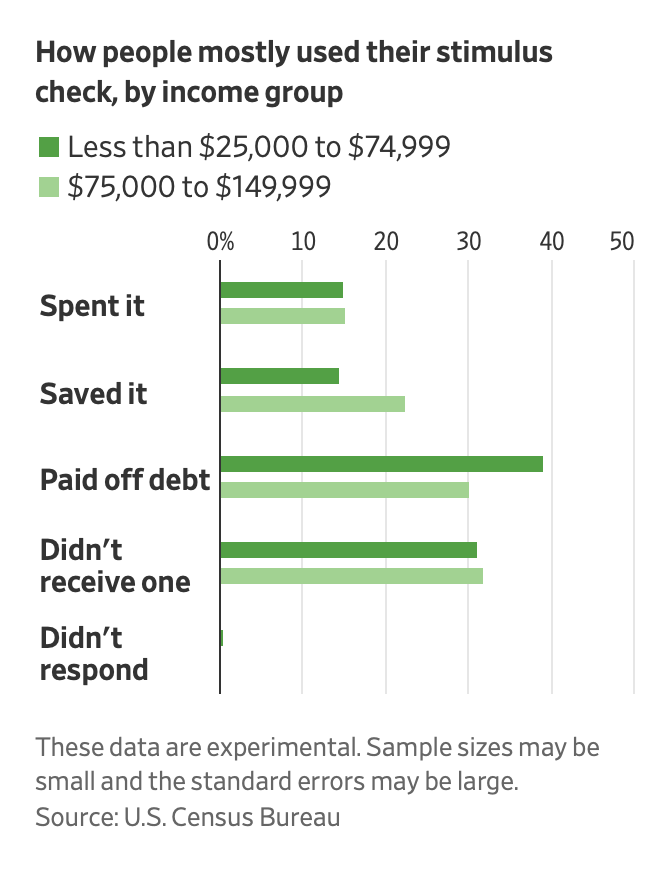

For millions of Americans, out or in your neck of the woods, stimulus payments have been a lifeline. What’s shocking is that these Americans who’ve been desperately relying on the government to keep them afloat aren’t necessarily poor, in fact most can be classified as middle income to rich earners.

Folks, this is exactly why judging a book by its cover never works.

A person who makes $1m a year, although it would seem reasonable that they would be able to handle their spending appropriately and manage it well never getting into debt can easily be in more financial ruin than a conservative farmer with a decent paycheck of roughly $40k per year in Oklahoma not burdened to paying NY state, income tax, fees, and instead fulfilled living the frugal, minimalist stealth wealth lifestyle the same vision I propose in my life as a life long New Yorker.

At the same time, the less you spend, the more you are grateful which equates to happiness. You can’t be happy without being grateful. I learned that from my SoulCycle instructor in my cycling class the other day. That’s the type of advice that applies to all areas of life.

It’s not about how much you make but rather how much you own.

Quick tips for not being broke = wanting to look rich but instead feeling truly wealthy:

-Don’t care what others think

-Try to impress yourself not others

-Focus on savings rather than spending

-Make a goal to save upwards of 80% of your income. Trust me you can do it. The best time is now when streaming services are the only major activity.

-Watch how many subscriptions you ahve all ober the place. $10 a month is already $120 a year. Keep close track

-Use stimulus to get out of your fiancnial situation not put you below it

-Stimlus isn’t to spend, it’s to save. The other S.

-Be mindful by waiting and deciding 24–72 hrs before a purchase is made

-Becme grateful for what you have. There’s no need to buy more junk to keep up with

And for the rest of Americans, about 30% who have financial literacy, patience and are diligent about their spending as they hope for the best prepare for the worst for any situation to keep me afloat, they have been presented with teh best opportunity yet theis past year a nd a half to build up their savings, pay off debt, buy that property or more they always dreamed of and possibly spending a little on what is actually legal to do these days without going ot prison becuase you broke the 2-week quarantine rule in Brazil. Yes, that really append to a rich family.

Too much money is equally a bad thing.

2nd Stimulus

While Americans have been taking advantage in the right way with their stimulus checks to put them in the best financial situation that they’ve never seem themselves in before, banks have been also seeing their cleints boost thier credit cores, get out of financial palooza and take out less loan amounts ot fund their next business venture or property. This all sounds great to us but banks who are made to make businesses and profit off of those who canot pay their credi card bills on time, are suffering, a tad. Of course, a bank will awlays prosper if they have clients to serve, prortoflios to manage, ATMs and various other services to cash out checks and money, but there has been a decline in less financial stability for Americans which sadly banks are opposed to. There will always be businesses that are there for you, but their interest really lie in the other direction!

Credit scores have continued to improve, and credit-card debt has dropped for the first time in eight years, according to Experian. The credit-reporting company reported consumer credit-card debt was down 14% in 2020. Average credit-card debt held by millennials dropped 11%.

Experian also reported people reduced their credit usage and delinquencies in 2020.

Banks Hate Stimulus.

Whether or not you applied for stimulus, which in all cases you should, especially if you have a valid reason like an internship got canceled, this can all be done through your state government employment services website. According to the U.S. Census, most Americans who’ve gotten their hands on recurring stimulus checks since last March 2020, myself included, have directly reinvested it into the stock market. I haven’t spent a penny on it partly due to being a frugal minimalist myself and two, what would I spend it on? Another car that my Volvo can get me to the same place in cheaper form?

As soon as the pandemic is over, there is no doubt everything from airline to hotel and experience type travel will be gauged up in price so I will wait myself on taking trips as well as I like to take advantage of lower prices during off-peak seasons. So that’s where my stimulus money will be put to use, if there ever comes a time when travel is on the decline after the pandemic, in which that case, I’m expecting that will take a while.

Stimulus Stimulus

For most adults receiving the stimulus felt like an extra birthday present that kept on arriving every week for the last year but for me it just felt like another addition to my income streams which you can read about it here.

So what did your fellow Americans, rich or poor spend their friendly governmental birthday booster presents on?

Thankfully no more cars and Cartier!

Top 5 Stimulus Uses:

#1: Household expenses: utilities, telecom payments

#2: Pay off debt or outstanding loans

#3: Invest

#4: Spent on discretionary, unnecessary stuff

#5: Education

Hey, at least education is on the list! As Americans, we would much rather binge TV all day than teach ourselves something but I’m impressed with my fellow Americans this time around. With investing as the top third choice, I’m not that thrilled in fact because majority of that investing crave was most likely played into the Reddit WallStreetBets saga that controlled the movements of the stock market and lead to peaks and troughs of volatility leading the VIX(Volatility Tracker) into mayhem the last few weeks.

“If you can’t expect what’s going to happen in the next couple months you have no incentive to actually go spend it,” said Cameron Turner, 23 years old, who lives in Berkeley, Calif. While Ms. Turner has remained employed at her job in public relations, she decided to put the check into her rainy day savings account. But compared to this time around with 2021 stumluus checks, it is cerantely different.

Consumption is down, savings is up, banks are unhappy people are paying on time and malls are crying.

Up to a certain point, happiness cannot come out of many alternative things. The rich and poor value the same things. Family, health, love, security and also enjoy traveling and leisure. But especially when you have more money to spend, vacations and excursions take up a bulk of your time and income, that’s exactly why the rich are getting richer these days saving upwards of $20k on a typical vacation. As someone who tries hard to eat 1–2 meals per vacation, take as many free bees such as not being a part of a club poor or play golf, an average vacation price to our favorite places Hilton Head, SC in the summer and Aruba, in the winter add up to $10k roughly per week and that’s why the rich are saving big time these days.

Saving $300 = Making $300.

Going out to restaurants, getting a couple of drinks, partying, staying out late, going to see entertainment venues, the theatre, traveling and leisure you name it are all halted now so the only thing you can do with your money is streaming services so saving is really the only option with paying off debt. Not bad choices for your future.

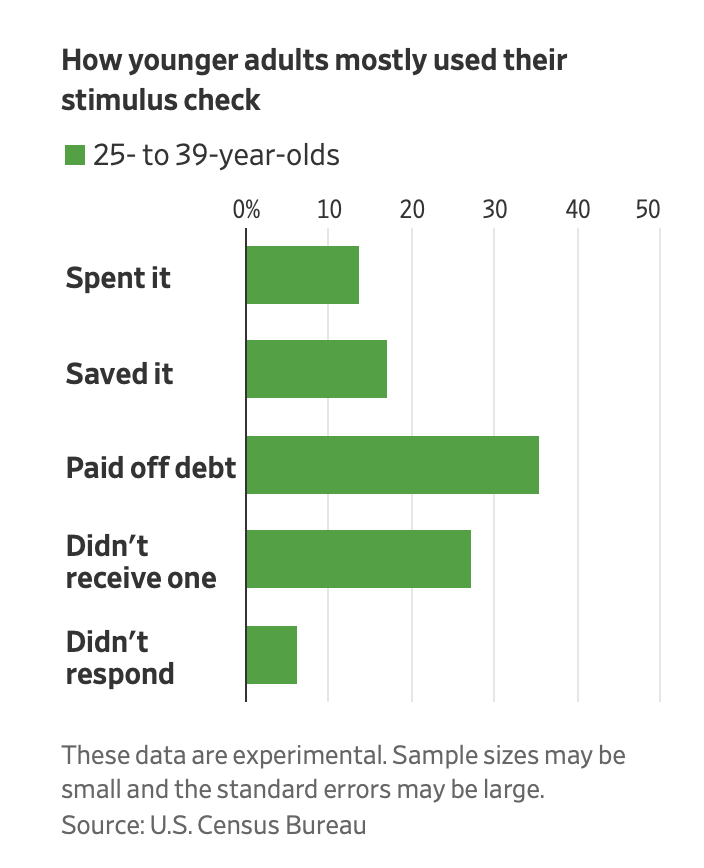

Uses By Age

According to the U.S. Census:

54% of people between the ages of 25 and 39 reported they mostly used the stimulus money to pay off debt

26% said they mostly saved it during the Jan. 6–18 period.

57% of people between the ages of 40 to 54 said they mostly paid off debt, and 22% said they mostly saved it.

Now there’s a question that we never saw ourselves asking ourselves. We are stuck in a problem with too much. With the $600 stimulus checks being pushed out by the Biden administration in the coming weeks, Americans are debating on what to do with the extra dough.

I know, this isn’t a crisis question, there’s always something to do with money you can say, we all have our reasons, good or for bad, but even with the uncertainty around the economy, vaccine rollout, unemployment, economic situation, fiscal deficit rising and the possibility for even more, yes I said more stimulus, when is too much, too much?

If you can’t expect what’s going to happen in the next couple months you have no incentive to actually go spend it,” said Cameron Turner, 23 years old, who lives in Berkeley, Calif. While Ms. Turner has remained employed at her job in public relations, she decided to put the check into her rainy day savings account.

Although most Americans’ top concern is financial security, I would strictly advice doing what Cameron has set her mind to. With the unemployment rate at a high 6.3%, having a cash cushion is crucial for your life. Cash is king after all and don’t let skimpy Millennials tell you otherwise who trade aggressively, go into debt and end up in homeless shelters during an economic downturn because they would refuse to have a little cash on the side for an emergency in case they loose their job.

Those people learned the hard way. Unfortunately that’s how most lessons are registered.

As more stimulus rolls in, the more savings accounts continue to rise. Frugality is finally coming through my friends! Little late but always better than never. It’s heartbreaking to see that during the worst times, we really learn our biggest lessons.

Unless you fall off the bike, you won’t learn how dangerous it is to ride one without a helmet.

An analysis by the Federal Reserve Bank of New York found consumers saved more than a third of the first stimulus checks. Even if savings accounts pay you at notoriously low interest rates at an average of $.04 cents per year, it’s certainly better than spending it on a car that looses its value the moment you drive it off the lot.

After all, remember, the more you consume, the more you have to take care of.

Does impressing people really matter anymore?

The Cost of Stimulus

Although free money is terrific and we wish it would keep coming, it is going into some financial educated American’s pockets for no reason and a majority of those who really need it still don’t have enough. But for those such as myself who have simply invested it directly into my Roth IRA letting it accumulate to shy of 10k in the past year, I want to be mindful that sooner or later, all of this spending will have economic and political costs for the government.

Yes it is keeping Americans afloat and vital to prevent Covid from spreading, but what about our government? It’s part of the country as well and it doesn’t have any stimulus to fall back on except for the Fed. Since I live in this country, it is my responsibility to care about our community we call this nation. My family and I don’t hide our money in tax havens or shelters over seas to pay no corporate or personal taxes like the monopolistic FAANGs. We live in the second most high taxed state and most expensive city in the nation because of our circumstances. We can’t just move our Tesla factory to Texas. My mother’s job is located here, I get free tuition for 6 years at one of the best universities in the world, there’s the most diversity and a mix of cultures in NYC, incredible connections, ideas, prosperity, so on and so forth that we continue our journey here despite paying more than the average midwestern American since the 2000s but also have no debt, no liabilities, loans, poor credit score. It’s achievable. All it takes is persistence and patience. Be lazy after all with your investments and be grateful for what you have. Following those basic principles will help you shave off 60% of your spending ASAP.

When it comes to taxes, yes, it is important to pay Uncle Sam’s salary to help bridge the wealth gap and fund the country, but it also isn’t illegal to find tax strategies for your advantage because big businesses and philanthropists worth billions are more than capable of doing your part in paying taxes for our country instead.

The quickest ways we save on our taxes:

-Count all our business expenses such as our properties, websites, intellectual property as losses to limit amount of tax and capital gains

-Keep investments. The stock market always outperofmrs and profits in teh long run. Why give yourself headaches and mental didsaster day traidng and options trying to avoid capital gains if you just stay patient, make more and spend mor eitme doing better things than watching your money fall

-Live in parts of the country with less tax throughout the year when WFH is feasible to pay less taxes for the year

As the budget deficit looms to over 3 trillion dollars, America isn’t the best example with knowing how to deal with debt. No wonder Americans are in the same position. Our country is like the bad parent teaching them all the wrong rules, at least stimulus is like the teacher getting them out of financial trouble. I believe the best economic stimulus for the country isn’t necessarily the spending bill to keep the economy growing because it will need to be paid off eventually and those who are receiving it such as myself and millions of other privileged Americans don’t need it! It could be spent on better uses such as the environment, military, education and homelessness, you name it, America needs it! I believe the best economic stimulus is to end the lockdowns and accelerate the vaccine rollout as that will lead to herd immunity and Main Street to be back in session. Wall Street can calm down. They have too much help.

As with what I recommend you do with your money, it is always up to you. I can only tell you what I do and advise my best predictions. By what I’m seeing, I’m very impressed by my fellow Americans putting their financial situation on the front line, the other one, and boosting their circumstances as much as they can.

So for now, since it’s there, don’t be embarrassed or ashamed to take advantage of that free money but remember, the more you have of anything, the easier it is to loose it. It won’t be deposited into your account for long so appreciate it and be proud of how you can possibly let it change your life in the long run.

Happy stimulating.