Can we pretend January’s Reddit drama never happened? With Robinhood happy to steal from the poor (retail Reddit investors on WallStreetBets) and give to the rich (hedge funds such as Citadel to keep them in business) and the wild swings we’ve encountered over the last couple of weeks in shares of the video-game retailer affecting major indexes that investors never even wanted to be a part of but in fact did affect their investments in the broader markets, we want 2020’s boring and green gains to get back on their run.

Short squeezes and market-cornerning maneuvers are only fun and games for those who had extra money to spare from stimulus checks. Otherwise, the rest of us, conservative and moderate investors that base our trades off of realistic fundaments, don’t want to have to deal with swings in the market based on social media trends anymore. Whether or not you are familiar with what happened in the past couple of weeks with a surge in unprofitable stocks leading to volatility and market manipulation, you can go check it out here. It should only take you a few minutes to read since we all should be familiar with how our money can easily be shaken by some teens on an online forum. That’s where 2021 has lead us.

Thankfully during the first week in February, markets have ended 4 days in green while these unimaginable valuations have gotten back to their record lows of where they really should be as unprofitable stocks with no future.

As a 20 year old who has invested since I made my first paycheck as a model for an athleisure brand, grocery deliverer, tennis caddy, then tennis coach and many more income sources I fought my way into as a pre-teen, I was able to get into the stock market at a prime age because time is your most precious commodity and asset after all.

Why Time Is Vital To Consider While Investing:

-You can never buy it back

-No one can take it away from you if you are smart about using it

-Time = Money

And you would have to pay me quite a bit to waste my time because I gt anxty quick

Setting up a mindset where nothing is scarce except for time working with an open and deliberate intentional mind will allow you to reap the benefits of being a timely investor.

Slow and Steady Wins the Race

For young investors these days, it is harder than ever not to be tempted into being a part of the massive short squeeze of the Reddit era. With the extra stimulus, birthday money or as a trust fund inheritance funds one didn’t use on junk this year, you convince yourself that day trading is a better option because you believe you are not only on the route to possibly substituting your degree for options trading returns, you are also faking yourself into learning.

After speaking with 5 of my guy friends who live for options these past few weeks, they can’t even tell you what debt means and they are on the brink of it. One has already lost 40k dollars and only gained 3k in his 3 year career doing this and all have the wrong level of confidence to keep going.

They tell me, “what’s the point of getting a degree if I can just be dinking RedBull, playing and conversing with my friends online all day, and waiting for my lucky moment on becoming Warren Buffet?”

FYI: Warren has never gotten rich off of options or day trading mania. He deliberately reads financial statements daily to uncover the best growth companies and sticks with index funds, never individual stocks.

I was debating on translating that exact response my friend told me because I hope none of you ever have that same attitude towards investing again.

With all of us bored at home, making money is really our only outlet. It’s great that there are positive intentions to learn something about the markets, but Robinhood, WeBull and other retail trading platforms are only gaining from your losses selling your behavior and recommending trades that they can profit off of more than you. They are in it to save themselves before their clients with billions on the line.

Investing Shouldn’t Be About:

-Becomign rich quick

-Having fun

-Mimicing casino gambling

-Short term rewards

-No thought process

-Based on emtooin and feeling

-Bet amongst friends

Instead Investing Is:

-Should be done solo, with atruted family member or with a certified fiduciary, broker, portfolio manger, you name it

-Should be boring like waiting for paint to drip but even longer, like a couple of months to a year

-No touch and fiddle with your investments all day long

-Not feel addicted or obsessed with intra day activity

-No blindsided by how much you’ve made and want to take actions all day long

-Let it sit, don’t touch and even harder, don’t monitor or look at it

-Be patient, digligent and understand what index and mutual funds, ETFS are best suited to your risk tolerance of cnsrevative, moderate or aggressie(more risk = more reward and more reward = more loss) and your time horizon nd goals

-This is about goal planning not making money in a snap to impress your friends with a lucy draw you made

In this day in age when all we want are results ASAP, we have programed our minds to loosen our attentions and not be patient.

Remember when you were a child waiting fo the bus to come pick you up from school and you did nothing besides just stare at your untied shoelaces the whole 30 minutes or even worse, pick a conversation with another kid from an opposing school?

Fast forward today, whenever I walk past some school pick up bus stations in NYC in the mornings, all students are huddled with each other, socially distanced of course but all staring at their individual phones, not communicating. Might as well continue Zoom school if there’s no communication or connections being made face to face. We’ve lost our attention to stay still, something that will not work in the investing world.

Stocks Have Offered a Great Return No Matter Where You Invest

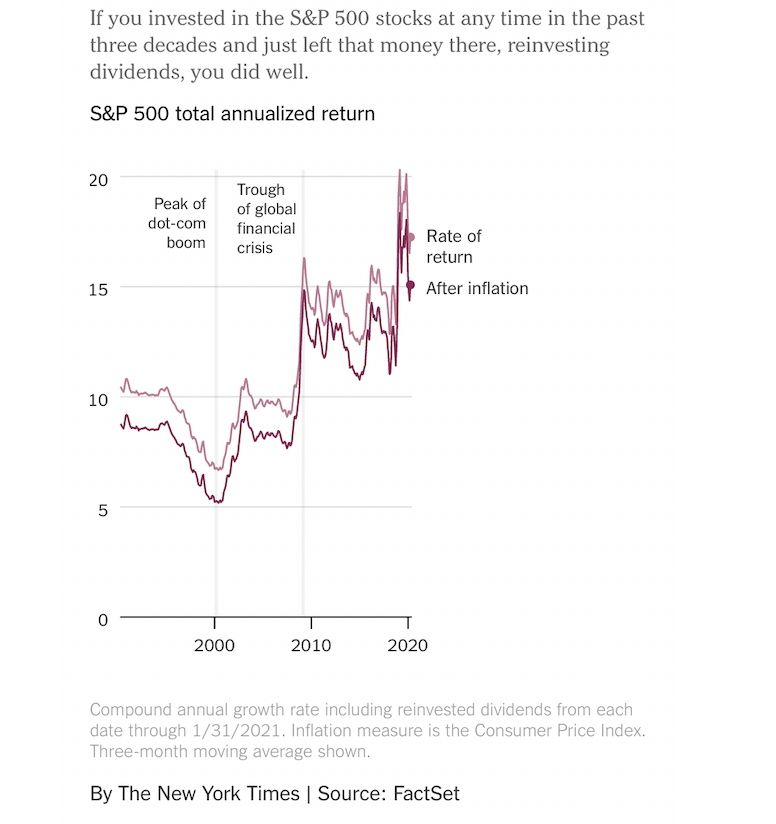

Even if you invested during the worst times in history during the Great Depression and Financial Crisis of 08 in the S&P500 and just left that money there through reinvesting dividends and holding secured treasury and municipal bonds, you still did better than if you didn’t invest in the first place.

Investing long term guarantees profit, trading short term guarantees loss.

Every year for the past decade, the stock market has beaten the prior year. The returns keep skyrocketing past their expected results or just slightly beat the benchmark of where it started the prior year, but all in all, indexes always outperform and go up.

So why do people continue to day trade?

I suspect it’s possibly a mix of thrill, boredom, competition, mo money = mo problems.

By casually investing in an ETF that tracks the S&P500 top blue-chip stocks for the next 3–5 years, you will make more than an average day trader who reports quick daily gains. Sure there are those such as the founder of Chewy that earned over a billion dollars in a week by correctly longing GameStop at the right time at the right moment, but that’s why only 1 person is in the news, not a million. It’s a rigged game, no one knows how to be a proper day trader no matter how much experience because there is no formula! With investing there is so just follow it for goodness sakes! Calm yourself down, have fun with something else and enjoy your life while markets are making money for you.

Even if you did make a trade and invested in GameStop 10 years ago, despite the massive selloff, if you did sell at it’s peak of roughly at a $30b market cap, you would’ve become a multi-millionare by now.

Your return would have been strong even if you had terrible timing because you were long, consistent and patient.

Staying Low

There are no guarantees in life. Some people who are aggressively trading meme stocks can hardly walk away with significant profits and that’s why most don’t. Index and ETFs won’t generate that kind of overnight payoffs that buyers of BlackBerry options are evidently looking for but being decades in as a spectator instead of a player in the markets, that play will offer you immense returns than most investors can ever expect.

Successful investing cannot be exciting because it is your hard earned money on the line. It is precious to you and using electronic money online is a dangerous ballgame to be in as your concept and perception of money is altered since it is only in numbers, not tangible and goal oriented.

What do you want to use that money for? Have a purpose before a bet.

If you want to grow real wealth, achieve real dreams, not waste your time with Reddit hypbeasts and ditch the painful mindgames of trading options, stick with being a lazy old bum who is rational, slower and mindful.