Education is one of the easiest ways to plunge into debt, the hardest to pay off and compounds to a hefty amount after graduation.

These days, more than ever, most graduates in this internet savvy, entrepreneurial age are questioning if there is even an ROI on their education anymore.

The main reasons we accumulate debt result from paying for unforeseen emergencies or unemployment.

But most debt is from a result of bad spending habits having missed charges and default payments that can easily be avoided.

Hence, biting off more than you can chew.

What are the main causes of debt?

1) Low income or underemployment

2) Divorce and relationship breakdown

3) Poor money management

4) High costs of living

5) Overuse of credit cards

6) Unexpected expenses

7) Declining health and medical expenses

8) Job loss

If we’ve learned one thing from this pandemic, it’s to plan for the worst, hope for the best.

Why Debt Is Addicting

No one wants to be in debt, but the convenience of borrowing makes it almost impossible to escape entirely. As someone who grew up in a family who never took up debt, except for a mortgage on several rental properties to earn recurring passive income, it’s really relieving to not be beholden to something that the bank owns.

Until you pay off that mortgage, you don’t officially own the property and that could take 30 years hence a 30 year fixed mortgage.

From banks to governments, they make it easier than ever to give out loans regardless of your credit score and with the flexibility to be able to print money out any time for less than a dollar, this leads large amounts of money, in the trillions per year to be distributed.

The only downside to this is that more people take advantage of borrowing when they don’t need to and the purchasing power for money goes down as there’s an abundance.

$3 million with the expected inflation rate of 2% next year will only be $1 m so its becoming harder and harder to become a real millionaire that’s why I prefer to have at least 40%+ of one’s portfolio in real estate, commodities and the stock market as it is an inflation hedger.

Luckily, Jerome Powell from the Fed stated several times in the past few weeks that he won’t push up inflation to the target range of 2% until interest rates go higher which won’t be until a few months from now until herd immunity reaches 70%+, the economy destabilizes and unemployment doubles down.

Per Individual

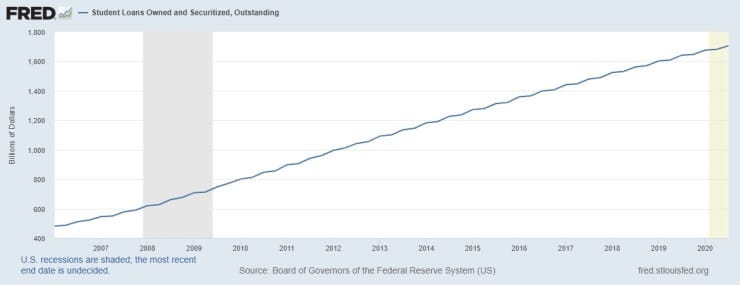

The Federal Reserve estimates that in quarter three of 2020, Americans owed more than $1.7 trillion in student loans — an increase of nearly 4% compared to quarter three of 2019.

The decades-long increase in student debt is even more noticeable when compared to decades prior and the US Student debt has increase y 100% in past 10 yrs according to CNBC as education is only becoming more expensive as well which doesn’t always pay back, especially for those concentrating in ‘poor’ industries such as the arts and teaching.

According to US News, on average, a student owes: $30,062 in student loans.

I wouldn’t call that horrible since an a typical mortgage is roughly double and is paid off in 15–30 years, but still, student loans are a hit or miss. You could make it turn into an investment or it could be a totally waste it. A degree doesn’t mean as much as it did before when no one went to college during my parent’s age.

College graduates from the class of 2019 who took out student loans borrowed $30,062 on average, according to data reported to U.S. News in its annual survey. That’s around $6,300 more than borrowers from the class of 2009 had to shoulder — representing a more than 26% increase in the amount students borrow.

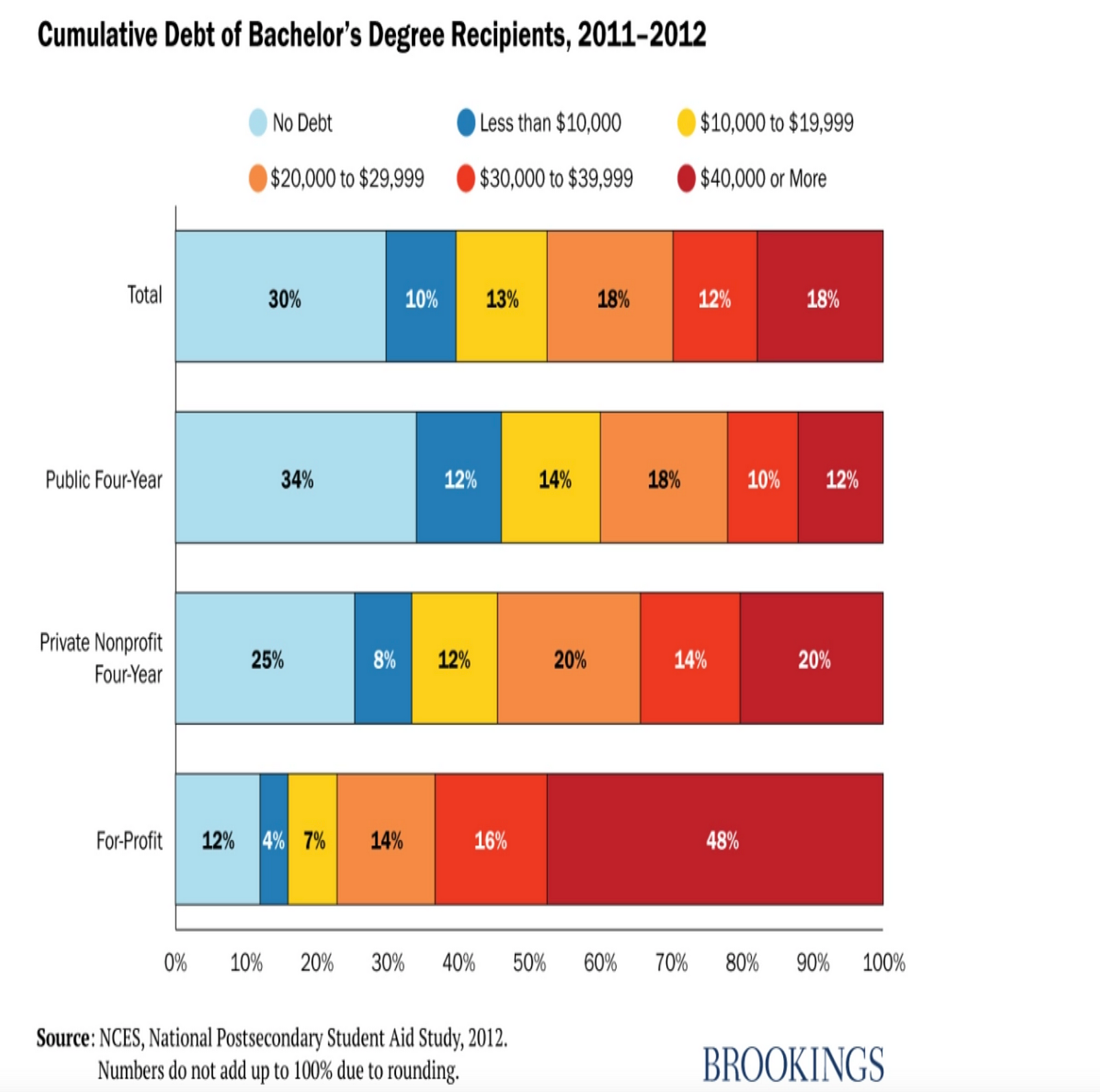

A new study from Brookings Institute released new data on who exactly is holding the $1.5 trillion that American owes in student loan debt. The report concludes that majority of student loan debt is held in households that have higher earnings and a graduate degree.

The wealthier the household = the more you borrowed, hence you believe in education taking the safe route.

Why Education Is So Expensive

Attending college is the the second largest expense an individual will make in their lifetime after purchasing a home. Tuition has historically risen about 3% each year according to College Board.

What is even more shocking is that during the Great Recession of ’08 and the March 2020 downturn, the declining in public funds towards colleges as they closed, caused tuition to skyrocket.

Zoom University requires some schools to even charge more since they are deeply indebted due to a lack of students on campus utilizing facilities and participating in sports events that bring in millions in revenue each quarter.

Tuition accounts for about half of college revenue, while state and local governments provide the other half.

In 1979, the annual undergraduate tuition at Cornell was only $3,368 around $13k adjusted for inflation. Now it is worth roughly $50k.

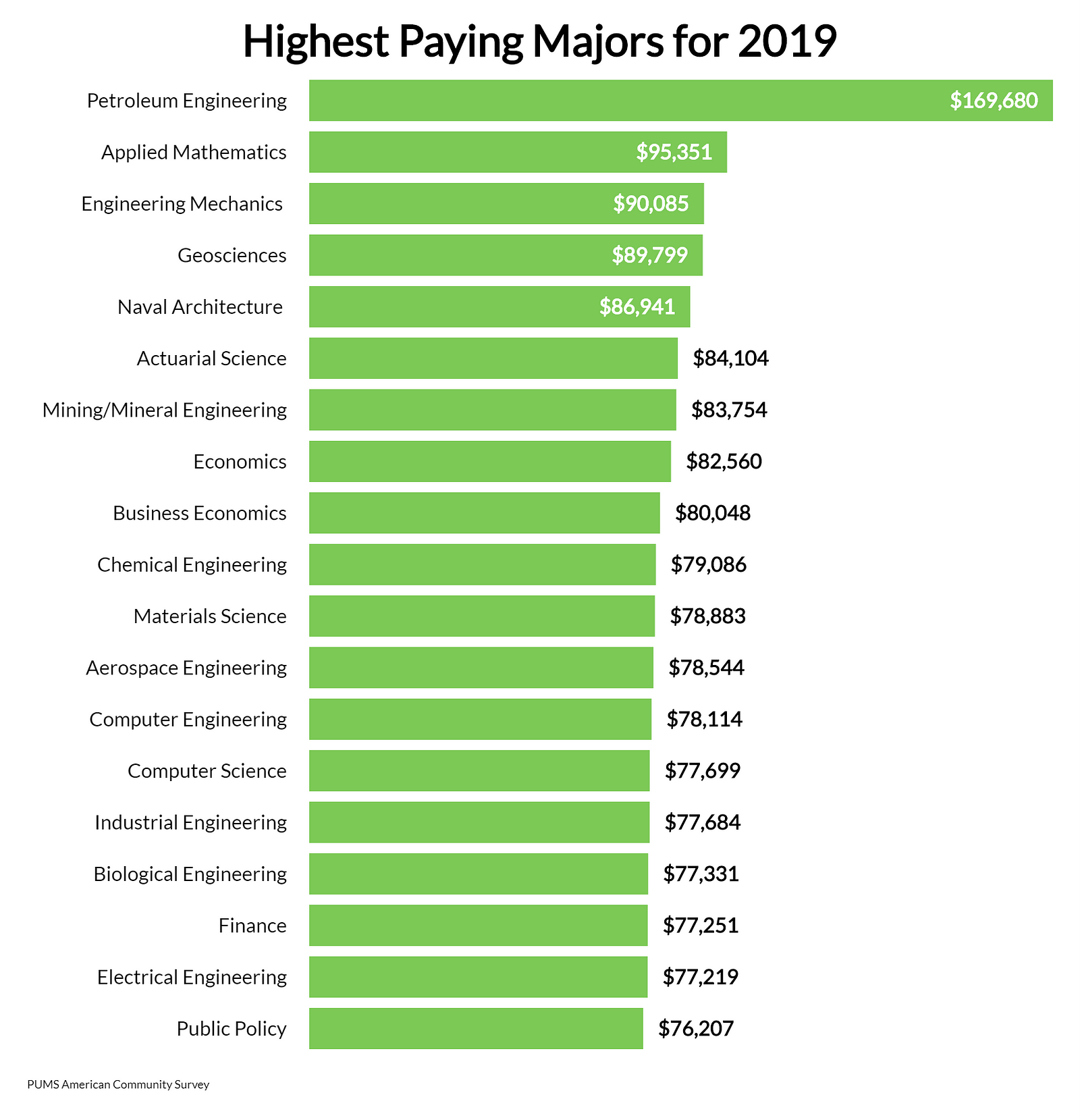

With these exorbitant fees for many majors that offer little to no return specifically those not in the high demand areas such as finance and tech, colleges can still get away with it.

Yet if a clothing to automobile company dramatically raised their costs by a few thousand each year, customers wouldn’t shop there anymore but college is something people believe is guaranteed to come back and make as a return on investment.

It is the best opportunity to get ahead wealthier households believe.

Yet the problem is that the government grants an easy line of credit to anyone.

This is partly the government’s fault not regulating tuition increases and not caring about student’s financial futures.

Reasons For The Education Increase:

-Deep cuts in state funding of rigger education

-More than half of families borrow or take out loans making education more attractive-pushing it to $1.6 trillion

-More people are going to college, and more of those who go are from low-and middle-income families

-Declining public funds

-It’s become more expensive to live in the states

As someone who was fortunate enough to get a full ride to NYU, debt is a burden that most of my colleagues, 90%+ have to deal with. Along with a lack of financial literacy, I cannot imagine how difficult it will be for them once they graduate to handle being vigilant with paying off debt while trying to live their life, get a job and stay responsible with no understanding of what debt means throughout college.

Solution

Although the easiest way to pay off student loans is to decrease expenses, it isn’t so easy for most who are already living pay check to paycheck, especially lower income families who want to put their children through a good education system in hopes of it paying it off quick.

The problem with draining students into insurmountable amounts of debt is that they cannot solely rely on education anymore.

Unfortunately, no job is 100% stable. From a doctor to lawyer, if the company has a budget deficit or wants fresh blood in the office, you are kicked out for no reason besides what your employers comes up with.

That’s why I strongly suggest everyone, as young as in college, to start building up several income stream. Time is on your side and whatever losses you make, can be reversed due to your long time horizon.

It never hurts and this will allow you to stay more financial afloat and not dependent on one solo income. By regularly contributing daily, cost averaging, instead of a lump sump every few years into your Roth IRA, you can easily become a millionaire by 50 if you start at my age of 20 with barely any effort.

Automatic transfers are best for those that are lazy. A portion of your income will automatically transfer into your investment and retirement account. Yes, at 20 I think about retirement.

Being financially independent means your investments can replace your living expenses. If that’s possible after all debt is paid, then you know you are on the best track.

Quick Tips

Here’s how to pay off 100k in student loans in under 2 years:

1) Refinance your student loans. During a low interest rate environment, this is the best time to refinance your mortgage. As the 10 year bond and treasury yield are creeping up to 2%, this is making bonds less attractive as they are more expensive.

Lower yields = cheaper loans.

As yields go up, so do interest rates and inflation so get in before it’s too late!

2) Pay off the loan with the highest interest rate first. Get the hardest biggest chunk out of the way.

3) See if you’re eligible for an income-driven repayment plan or any further scholarship

4) Joe Biden’s proposal is to cancel $10k in student debt per borrower. Student loans affect the economy more than one thinks as it diminishes spending and savings for the young as it is the prime-earnings age along with boosting anxieties about debilitating debt pressures the economy.

Shocking Breakdown

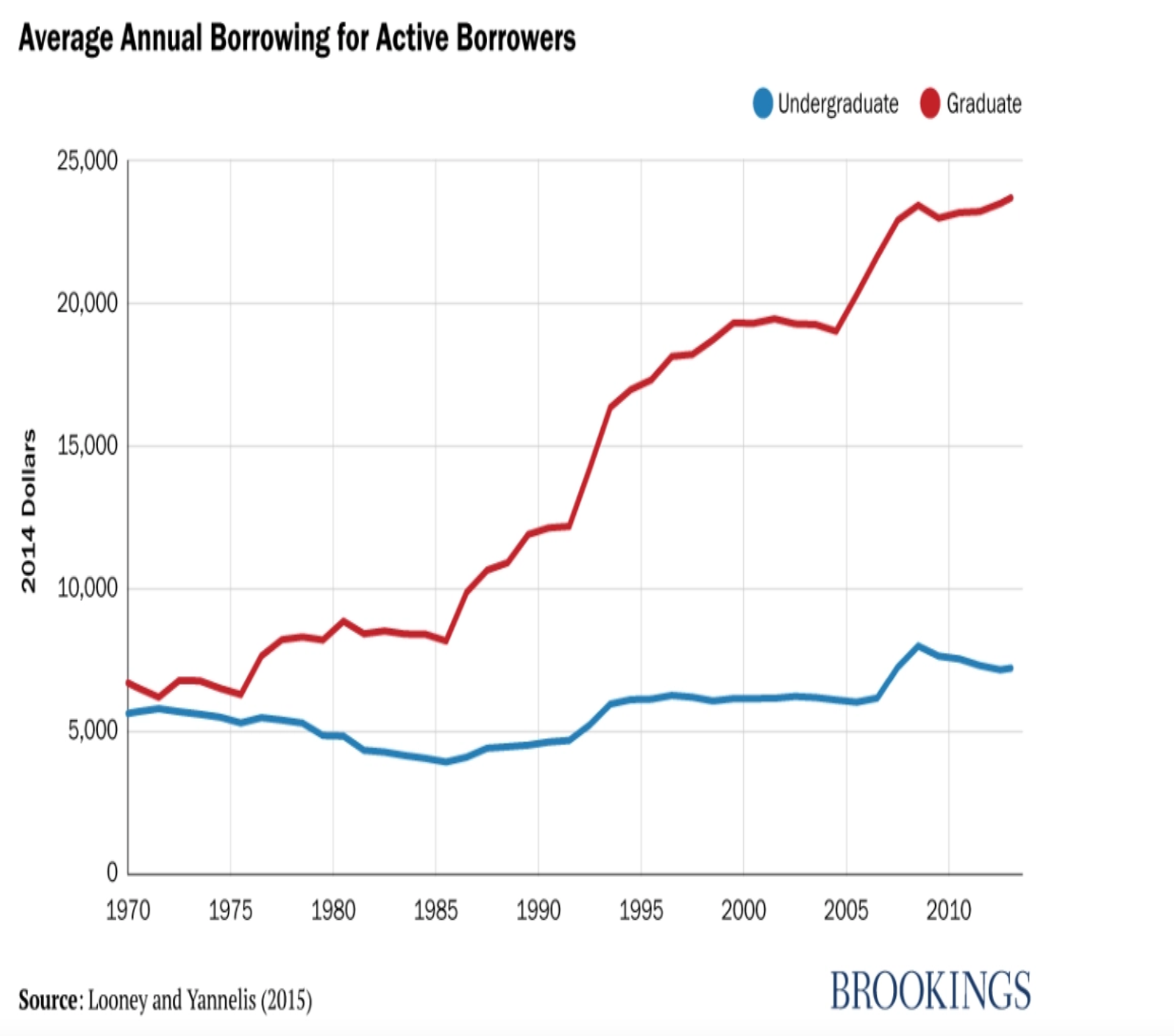

About 75% of student loan borrowers took loans to go to two- or four-year colleges; they account for about half of all student loan debt outstanding.

The remaining 25% of borrowers went to graduate school; they account for the other half of the debt outstanding.

The more education you receive, the higher chance you will earn more, roughly about $30k — infinity more but it is also crucial what field you get into so that raises the question, how rich are the wealthy if they cannot even afford school?

Thankfully with the average amount north of $30k, most undergrads finish college with little to modest debt.

About 30% of undergrads graduate with no debt and about 25% with less than $20,000. Despite horror stories about college grads with six-figure debt loads, only 6% of borrowers owe more than $100,000 — and they owe about one-third of all the student debt.

Your Role

Whether or not you have trailing debt from school, late credit card payments or a pesky mortgage that is set to be paid in 20 years, make sure you understand what you can control which includes being vigilant about your spending and savings.

Debt is something that accumulates quick due to interest. The higher interest rate, the higher your overall amount will be, expect for a FIXED mortgage.

Stay aware, be proactive and make the most out of your debt while it lasts kids, especially at school!