Relying on someone for your income is a dangerous move that more often than not can lead to bankruptcy. Most divorces cause one partner to profit immensely off of the other since prenups aren’t widely considered.

Nothing lasts forever and nor should the expectation that your spouse or parent can provide for you. It’s the same deal with your job.

Whether you kept a steady career as a surgeon for the past 15 years or are a newly minted engineer at a hot overvalued startup, you are relying on someone at all times to provide you a living. Even your investments can’t keep you fully sane without a backup plan.

You may believe the CEO of a prime company has more income security and protection with no chance of a layoff during their best years than a janitor at a top school district.

Image and expectations are what haunt people.

Which industry do you really think is more stable?

A decently sized listed company that trades 20x PE like the S&P 500 swayed by any talk in the market or a long-standing institution with a $10b endowment, top-rated legacy donation alumni program and cash cushion that was established in the 19th century?

Compared to Pelotons and Oat Milk, the education sector will always be in demand. People, especially foreigners will pay top-dollar no matter if the classroom is remote or not to receive that degree to boost their chances of success and that translates into secure compensation for those inside.

Whether a company is part of the cyclical, defensive or growth industry, there is no guarantee it will stay afloat, including educational providers such as Chegg, my go-to source for all hw troubles but there are ways to identify if something will last.

Ride the Waves

Believe it or not, the positions that pay less can be seen as more stable since at the end of the day, it’s all based on how much you keep and according to those at the top, majority don’t want to live basic with an enticing salary. The more we earn, the more we want to spend which is very difficult to stop yet if you earn less, you are expected to keep a tighter budget and may enjoy life more knowing your limits.

Stability could also mean having less pressure on yourself to compete with your co-workers and work your way up the corporate latter for admiration.

If your employer offers benefits such as health insurance and an employer qualified retirement plan like a 401 (k) along with vacation days/parental leave, possibly free college tuition for your child, casual or half-day Fridays and humane working hours, that job seems to be more stable than a prestigious brand name employer who won’t bother with those incentives treating you like a slave.

The reason being isn’t because large corporations don’t want to spend more on recruiting and incentives for hirers due to budget constraints, rather they know perspective applicants look past the importance of hidden benefits and instead solely focus on the company logo/name/image that slowly ends up meaning less to them overtime as they find out what they are missing out on to build exponential wealth.

There are a lot of hidden benefits in the most unexpected places if you want to have a piece of mind and enjoy your work. Although CEOs salary is predominately composed of stock options/grants through equity compensation and then performance pay + bonuses, it still isn’t guaranteed happiness or long-lasting.

Ultimately you need to weigh the hidden added benefits + your life > base salary + half of it taken away by taxes and your time.

There’s no such thing as working solely for yourself. It never existed. You can be self-employed but you still need to rely on your audience, following, connections, brand, reputation, and sadly the government at times to keep you afloat.

All in all, never make assumptions based on title or position. Just because so and so works at X doesn’t mean they are making the use out of their time and effort. It is extremely misleading considering many jobs outside of Silicon Valley or Wall Street offer incredible perks you don’t know about until you dig deep.

Also, you’ll be better off if you don’t depend on someone or something for financial freedom which starts with setting up uncorrelated passive income streams.

Covid Revenge

We’ve learned countless lessons during this pandemic and many of them were found through the poorly organized structure of the country and the divisiveness on issues such as politicizing masks. Cleary people have too much times on their hands, want to argue about everything and anything they can and even with an effective vaccine, they still refuse.

Anyway, we’ve also learned about how the hardest hit industries such as the hospitality, tourism, leisure, entertainment and travel space are cooping as they thrive on discretionary income, something we stash and don’t spend during a deadly pandemic or recession due to fear and uncertainty.

This leads consumers to spend less, save more, and pay off their dues until things get back to normal and then eventually revenge spend on the luxuries of life. Working in the hospitality to entertainment space is grueling not only because you rely on people to be in good spirits to visit you, but your reputation is based on how others perceive you which constantly shifts.

My family enjoys heading down to the Caribbean every year and the moment we step off the plane, the residents and guides on the island are 10x nicer than in the states. It feels abnormal and fake as we as tourists are their main attraction to promote business. Without us, they would have no reputation. Word of mouth marketing is the main way they grab attention from us and the people we know.

This over the top behavior is out of a necessity since they depend on tourists and travelers to keep them afloat to boost GDP. Tourism takes up a majority of tourist destinations’ GDP, the production of goods and services for the country. It is their obligation to keep and want us to come back and in order to do so we must feel pampered and overly special.

Similarly to the entertainment industry of sports to Broadway, they rely on their reputation and hope that people would still be enticed by their performance every time. If some bad news leaks, everything goes downhill.

If you work in an industry that relies on people to come on their own time out of free will not because they need to such as with Walmart for groceries or Slack to communicate with teammates, you run the risk of uncertainty much more often. Several of my colleagues in arts school often discuss how daunting it feels to be in the space. They describe it as walking on egg shells everyday, not knowing if the audience will want to see them anymore for no reason.

Although every business wants fresh graduates and engage in layoffs to attract the best in the business, the entertainment and sports industry are the most grueling. Not only are they extremely selective and can only choose a handful not a few thousand on the team, most performers to actors and athletes only get to enjoy their run for a few years and within those few years they have to pay off all the debt they accumulated from their first-time salary they blew and work 10x harder once in that position.

It is a grueling business with a high payout if you make it but a place most don’t want to enter as salary doesn’t weigh out the cost of taking out student loans and wasted time.

As the population grows, every market is overwhelmed and competitive. Ironically today it is easier than ever to go work for yourself which is perpetuating the labor shortage making it more difficult for companies to incentivize workers. Although a labor shortage doesn’t sound ideal, it’s better than at the start of the pandemic when unemployment was at unforeseen levels.

If you want to jump into an industry with no reliable stable pay, crazy hours and always in front of the press and limelight, it is suggested to have multiple side hustles to generate scalable passive income on the side.

I would suggest stashing your capital into inflationary proof investments such as art or real estate, one of the few investments that you can depreciate as it appreciates. That will allow you to really enjoy your job when your passive income exceeds your active income.

Many struggling actors or young athletes who quit school to pursue their dreams or rely on the bank of mom and dad are earning more from their passive side-streams than what they are working towards.

Either way, know what you are getting into beforehand and remember, everything takes longer than it seems. What you plan on doing, expect it to take longer and be more difficult and expensive down the road.

Gateway?

One tactic I’ve learned from my economics teacher about income stability that I’ve told my closest friends and family and now will tell you all about that will truly save you and boost your investment returns is by never having your primary job correlated to your investment picks.

Lets say you work in a bank. If you got lucky and timing worked in your favor to grab a high position majority of your income comes from stock options/grants, than performance based pay along with bonuses and client referrals . Since you have equity compensation, you already have a majority stake in your company which is certainly beneficial once you cash out but on the sidelines in your personal portfolio, I would never suggest investing more into that company or the industry in general since if the financial sector tanks, so will your income.

From finance to tech, although they are known to be defensible bullet proof industries, they are volatile and anything can happen anytime anywhere and unfortunately profits come before people. If the company isn’t doing well, people are let go so holding cash in your investment portfolio and for emergencies along with managing several passive income sources that can come from alternative investments from farmland and other holdings will keep you afloat the best.

News can break overnight that the CEO got in an affair or the accountants were smudging the numbers to indicate higher profits than expected which has led numerous companies in the past, most notably Enron to go bankrupt. We see this all the time. Most recently Lucid Motors’s CEO Peter Rawlinson faced allegations around harassment and “production hell” at his facilities which led the stock of Lucid Group Inc to tumble the last few months.

Be greedy when others are fearful and fearful when others are greedy. There’s a lot of shady business that comes around. A lot of criminals are right around the corner since money is enticing and addictive which alters motives and beliefs that can have a big unintended influence on your salary and livelihood.

Is It It?

Is it possible to work in a non-defensible bullet proof industry that you can be locked in for for the rest of your life?

Well first off, that’s rare because people like change and want to explore. We aren’t made to stay in the same home for 10 years, let alone a company for 50+ years anymore. The times are changing and so are industries which are leading people to reconsider their career choices every few years.

If so, what does it take to at least stay in a company for a good 10+ years? An Ivy league undergrad, graduate degree, Summa Cum Laude with 10 years of work experience prior to age 23, 4.5 unweighted GPA, 30 referrals, a noble price and a Peter Thiel scholarship?

Despite tech’s takeover across the economy, the positions that are known to have the most income stability have always been considered stable as they are selective amongst certain sectors that are always in-demand.

Can you think of the countless small businesses you’ve seen plastered across Facebook ads or walking down the street in your town to notice shops that sell nonsense? That ear wax machine or pretty kitty napkins that no one needs but the algorithm convinces you once you buy them they will make your life better?

Many of these businesses exist and are growing at rapid rates as Shopify, Etsy and other marketplaces online entice sellers to create their own brand not taking a pragmatic view on what is actually necessary in people’s lives.

There are only so many things people really need or want to buy and they usually stick with them forever.

These necessities cater to the things people always need and cannot live without.

These include:

-Food

-Shelter

-Insurance

-Health

-Comfort/Safety

-Stability

-Education

Out of these, even if a tsunami or the CEO resigns unexpectedly, won’t do damage long term as opposed to Etsy taking over a small business.

So lets dive into the jobs that are most likely to always stay and offer a stable living:

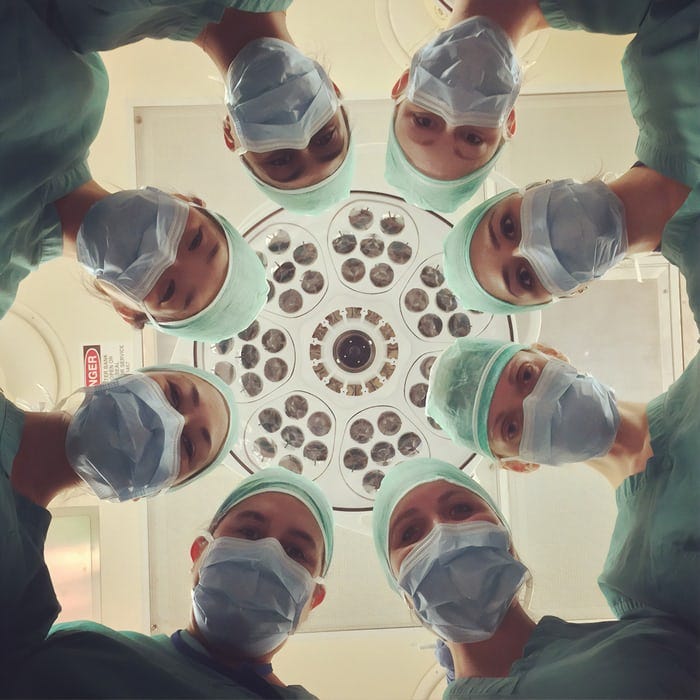

#1 Physicans + Their assistants

Median Salary: $112,260

Prior to the pandemic, there had been a shortage of medical workers. Although there is a dispersion to tele-health and 50% of Americans reportedly haven’t gone to a physical doctor’s office in over a year, help will always need to be there. You can only do so much online. Medical assistants need advanced training but not a medical degree as for a doctor.

#2 Software and Engineer Developer

Median Salary: $107,510

With only a bachelors degree or if you want to be the next Zuckerberg and ditch school all together and drop out (not recommended unless certain it’ll work), computer science roles rank as the top careers in the country according to the Best Job rankings site. The pandemic only filed the need for health and technology as we all went digital to frankly stay alive. Tech is booming by the minute if you’re in a reliable field within it not a fancy startup that has been public for decades with no reputation or profitable quarter since pre-pandemic.

#3 Physician

Median Salary: $206,500

The healthcare space is always in demand and never fails because our health is priceless. This requires a lot of time and effort on the professional side. Those who work in this industry must be certified, trained and reenact their license every few years since new findings are constantly discovered and our bodies are changing. Similarly to assistants and physicians, the number of primary care physicians and specialists are declining as well. For this position, you need to put a hefty investment into college and medical school but if you are lucky to get into NYU’s Langone School of Medicine, you get a full ride and that investment should pay off eventually if you work in a mid-size reputable hospital on urgent needs.

#4 Anesthesiologist

Median Salary: $208,000

Who would think putting patients to sleep by injecting a fluid into their bodies to ensure they don’t feel pain during surgery would be so stable?

There is practically no unemployment within the profession and is ranked as one of the top career choices for work life balance in the medical field.

Just make sure to not fall asleep on the job.

#5 Veterinarian

Median Salary: $95,460

Just like family, we love our pets and pamper them to the fullest. The covid pandemic has affected pet ownership by incredible rates as roughly 66% of pet owners added another member to the family and 13% became first-time pet owners.

Time will only tell if incoming office-workers will regret their pet purchases but for as long as we know it, pets will still need care no matter who the owner is. As pet adoptions were up 15% in 2020, people are splurging on pets and they will continue to need regular care throughout their lives. It isn’t cheap, especially the teeth clean and grooming.

#6 IT Manager

Median Salary: $146,360

Regarding the stock market, the NASDAQ and S&P 500 which track tech stocks are one of the most volatile major indexes yet when it comes to jobs inside tech, they are only growing and expanding as FinTech to AI, focus on fraud and security, WFH and our digital lives are needed more than ever.

IT managers can easily earn six figure salaries with a bachelor’s degree or bypass without one, within a few years. Tech companies in the U.S. recruit thousands from overseas without degrees which provide them the opportunity to start their own tech venture in the future.

#7 Substance Abuse and Behavioral Disorder Counselor/Therapist

Median Salary: $46240

Not terrific pay considering you need a bachelor’s degree, extensive training and a recommended graduate/medical degree, yet substance abuse counselors will always be in demand and needed more than ever these days as isolation, quarantine and loneliness fueled mental illness across ages.

#8 Physical Therapist

Median Salary: $89,440

It’s no surprise anyone offering medical help or assistance requires extensive specialist on the job training and several degrees. Although medical school isn’t cheap, it does pay off eventually if you are diligent in the field and build a good track record with patients and the company. PT to therapists are all necessities in good and bad times.

#9 Mechanical Engineer

Median Salary: $88, 430

Unlike a programmer or chemical engineer, mechanical engineers practice on the field. This is a low unemployment space where engineers handle high-tech equipment, work with robotics, automotive research, energy and other specialities to deliver top quality results to companies and billionaires who prefer space.

#10 Surgeon

Median Salary: $208,000

Don’t be enticed by the base pay. Not everyone can be a surgeon. Medical workers must get a professional medical degree, certifications, expensive training and doctorate degree before they complete any invasive procedures to treat disability, illness, etc. By the time a surgeon gets to work on a patient, they are already half-way through their career and never done studying.

Higher pay doesn’t always mean more stability, especially mentally and physically. Sure it can provide a good living if you can handle the pressure for a few years but to last for longer, you must have a mental strategy, a game plan to succeed to be the top of your field.

When you enjoy your work, nothing can stop you and in order to do so you must adopt personalized tactics even if you don’t work in any of these fields which are competitive and costly to get into.

Here are quick, easy ways to add more stability into any job:

-Always ask to do the work no one else wants to do to always be an invaluable resource!

-Work on the outside! Establish those passive income streams-the sky’s the limit when it comes to earning beyond your salary

-Always keep a network. Don’t network when you need to. Network continuously so you have someone as a backup at all times. It takes little to no investment to keep in touch with someone.

-Invest in yourself, it pays dividends for a lifetime

-Attain a degree or online certification (Many Silicon Valley companies don’t require college degrees anymore) -it already boosts your chances for a higher salary

-Hold off on any major life events such as marriage or kids until you have a job yourself-never depend on your spouse there’s no guarantee he/she will keep their job forever either

-Negotiate your pay and ask for more flexibility in your work to save money on commuting and possibly to spend more time on other money-making projects

-Ask for equity based compensation or a promotion

If there’s a will, there’s always a way. Know what you deserve and realize you are in control of your actions.

It’s all a balancing act. No one is completely 100% safe.