The only people who pay attention to intraday volatility, momentum, sharpe ratios, beta coefficient, breaking news and equate their emotions to investing are day traders.

Every other logical, long term realistic investor is in it for the long term saving money, headaches, time and not paying attention to specific trades.

Now don’t get me wrong, investing isn’t as simple as buying, holding, waiting and selling. If it was that easy, none of us would bother checking in with the markets for 8 hours a day or paying brokers thousands in management fees to control our portfolio.

But as historical data presents, passive investing (long term researching, buying stocks in an index in order to reach market returns) vs active investing (attempting to beat the market in order to get above average returns) always wins short and long term hence the name-long term.

The safest and easiest way to grow wealth is by staying in the market for long.

It’s not about timing it-rather time in the market.

You don’t have to pay attention to all the daily moves, headlines and transform into a day trader because that requires a lot of time, labor, headaches, bets and tracking a lot of unknowns for no immediate result.

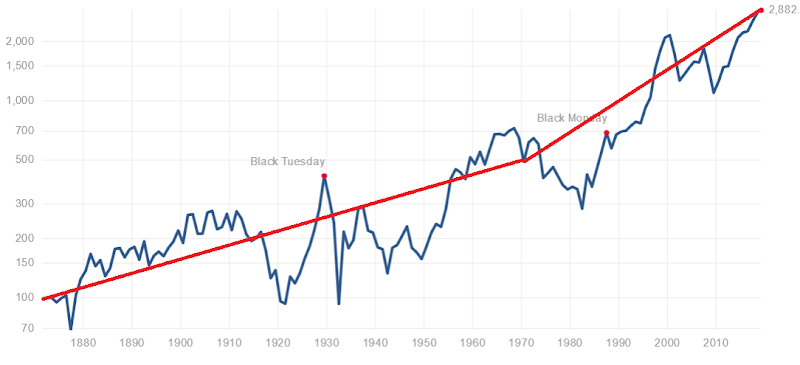

You’re always better off starting to invest early in low-cost index funds that track the market as a whole because the S&P500 or Dow, whichever index you choose to monitor will always goes up over time.

Yes and especially during a recession.

Triggers

Social media is the hot spot these days for traders because they’ve built a tribe around amateur investors who have no clue what they’re doing. The problem with these retail trading platforms is that there is no barrier to entry.

In order to prevent these traders, mostly teens from going into debt and treating the market like a casino instead of a goal strategy, a quiz of some sorts would be best for them to complete, even though they will find a way to get around it.

This quiz can involve asking for their risk tolerance, short/long term goals, intention for using the app just to get users thinking about their purpose on Robinhood or WeBull because most of them have none.

They join because they see some hype spurring amongst Redditors(reddit traders) they want to be a part of and end up wasting a lot of money in the process. Obviously the retail trading platform behemoths that are worth billions want to make the registration process as smooth as possible especially since news outlets are helping promote them themselves these past few months during the trading frenzy.

They have no intention to make it harder for a user to start trading because it comes at the expense of the users and they get a high.

It’s a problem when a retail trading platform loves when their users loose money.

This is called an adrenaline rush a.k.a an addiction-the same feeling you get in Vegas.

When I frist started as an investor, I used to tie my emotions directly to the big drops and swings. I had no plan besides learning how to buy and sell and never thought about retirement or long-term investments because who would at 15 yrs old anyway!

Due to my foolishness, when my portfolio dropped roughly 40% I panicked and knew it was time to sell off my positions. Long story short my timing was horrible and it was at the peak of a massive recovery.

The easiest way to determine if a correction, sell off or downturn will happen is by looking at the percentage drop. Rising interest rates, Federal Funds Rate (FFR determined by the Fed who dictates inflation and fiscal policy measures), inflation, and frothy valuations are signals that a selloff is arising yet even with these predictions, it is still difficult to determine.

Cut Some Slack

Sure you can stock pick all day every day and try to predict the next winner but it’s never guaranteed.

The reason why I welcome selloffs these days is because my portfolio isn’t affected by them anymore.

Most people forget this basic principle:

-You lose money in the stock market when you close out of a position at a loss but if you hold onto a stock and it still goes down, it’s not a loss.

If you are patient enough, that stock can easily go in the green and most likely will if it’s a realistic company that you think will prosper in the future.

When you can deal with anything going on in the market and not feel the need to tinker with your portfolio, this is true financial independence.

The easiest ways to not feel the need to pay attention to the market and stay in there no matter what is by:

-Know your income covers expenses

-Don’t need any porolfio money in foreseeable future

-Have a cash cushion and emergency savings account to back you up

-Can wait multiple years for gains or to esll when ready

-Have a back up plan such as diverse allocation and appropriate risk tolerance for age

Being financially free and not relying on 1 income source is extremely liberating. The stock market is a market for a reason. It’s there for extra support and for you to take advantage of companies that you believe will prosper in the future.

As with everything, moderation is key and drilling down into the tactics of working smarter not harder especially in the market where you can go ballistic with all the noise around you is a strength.

How Difficult Is Day Trading Anyway?

Successfully timing the market takes a lot of diligence, practice, metrics to screen and meticulously track trades all day every day. It’s a pain and why only a few seriously do it and a hand-full get real lucky.

But regardless of how much experience you have, it partially comes down to luck and timing. In order to time successful you need to be on top of:

-When to pull you money out of the market

-When to put you money back into the market

If you’re off on one of both, then you will loose money.

Why I Don’t Care

I know if the stock market crashes it won’t impact my life in any significant way because I’m already financially afloat. Even if I loose several of my income streams I know I can bounce back with relying on my tenant. Eventually the market will bounce back and continue to grow as it always does and I never tie emotion to it. It’s not a game. It’s serious- letting my money work for me.

So if you find yourself panicking now due to the rising 10-year bond yield indicating that safe-haven assets such as bonds are becoming less attractive moving into equities as the economy is slowly getting back to normal, here are a few things to consider before selling:

#1 The Stock Market Always Goes Up

There’s no doubt that daily the stock market has it’s highs and lows but what’s constant is that it’s always charging in a bull run overtime. Despite corrections, crashes, recessions and missteps, clearly as we’ve witnessed at the end of 2020, one of the worst years for the stock market, the overall markets were still up by nearly 34%.

Especially the S&P 500 which houses majority information technology stocks, they have had a massive bull run as interest rates were at all time lows and have almost doubled since 2016.

A paper in The National Bureau Of Economic Research titled “Negative bubbles: what happens after a crash?” illustrates that researchers studied stock market crashes from over 100 global stock markets from the years 1692–2015. In this dataset, the researchers observed more than 1,000 “stock market crashes” where a market experienced at least a 50% decline in one year:

-During these stock market crashes, they found two clear patterns.

-Stock prices tended to increase dramatically following crashes.

-Investors reduced their allocation to stocks and missed out on those increased returns.

Every investment carries its own risk but having a passive vs active split should keep you covered and afloat so there’s no fear in needing to pull anything out when dust hits the fan.

#2 Keep Emotions At Bay

You should act like a true robot when it comes to your money. If you think this is a game, then get out ASAP because it will only go downhill from there. The minute you experience pleasure loosing most and gaining only a few bucks, will propel you to take riskier bets and end up buying on margin-taking out debt to cover out losses and make positions.

In order to not associate yourself with the market make sure you:

-Have several sources of income and job security as much as possible

-Know that you have a backup and don’t need cash right away

-Invest in broader index not individual stocks that take a hit almost daily

-Understand that companies will bounce back and won’t change even after a single loss/correction

-Have a diversified portfolio

Becoming emotionless will allow you to make rational logical decisions. If you can stomach a 60% decline in your investment portfolio and keep your holdings, you are in the best spot.

#3 You Shouldn’t Need The Money ASAP Or Be Soley Reliant On The Stock Market

If you need to sell your stocks each month to cover your expenses that is a dangerous way to live. If you are in this desperate need to do so, I would first get out ASAP and secondly focus on dividend and undervalued stocks.

Ultimately you don’t want a stock market crash to hurt you financially. If your holdings do go down and so does your income, then that’s unfortunate but it still shouldn’t initiate the pressure to sell.

Making sure you have a non-related job to the market is important to consider as well. Let’s say if you lost two out of your three income sources, would you still be fine paying the bills?

Job security is huge and although every job is replaceable, having a job not correlated to the financial industry will keep you more grounded.

Wrap Up

The stock market is a scary place if you make it one. If you treat it with a long term game plan and know when you need to withdraw the funds with a purpose and no heightened emotion, then you should do less work.

What to do when facing fear with the market:

-Invest in index funds that simply track the stock market and know investments will bounce back

-Exposure to sectors is safer and broader indexes

-Ask yourself, ‘what if the top companies in my portfolio went bankrupt tomorrow, would I be fine?

Chill, hold and look away.

Happy volatility.